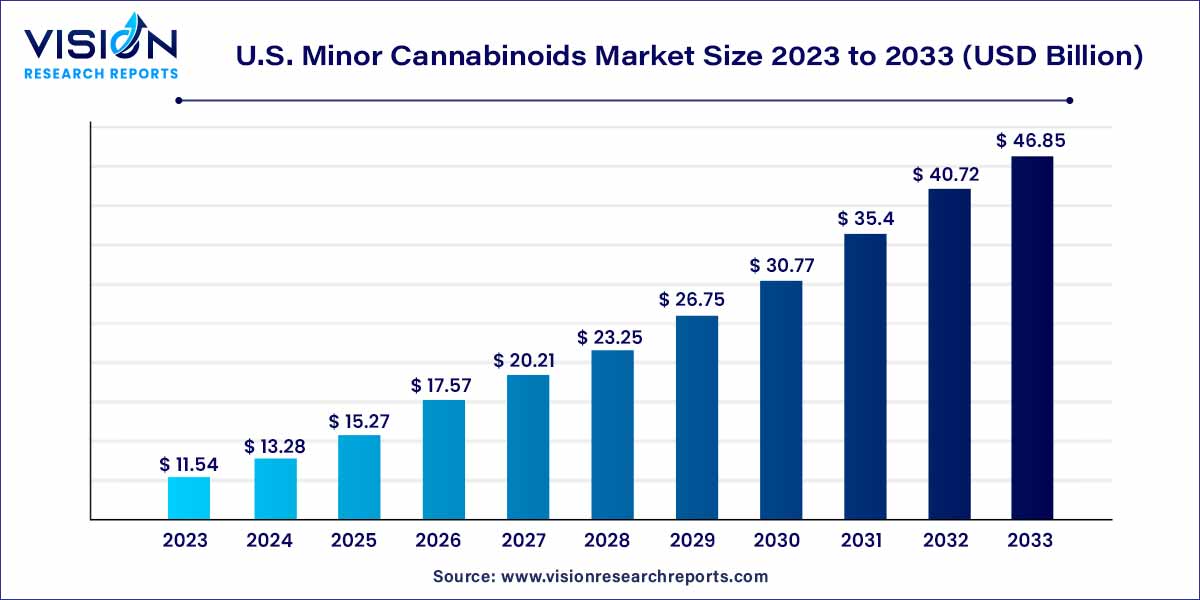

The U.S. minor cannabinoids market size was estimated at around USD 11.54 billion in 2023 and it is projected to hit around USD 46.85 billion by 2033, growing at a CAGR of 15.04% from 2024 to 2033. Customers can choose from a variety of products that meet their individual health demands and contain small amounts of cannabinoids. The industry is being driven by the rising legalization of cannabis-based products and the growing need for alternative medicinal choices.

The U.S. cannabinoid market has experienced a transformative shift, with an increasing spotlight on minor cannabinoids. This burgeoning sector within the broader cannabis industry is reshaping perspectives and garnering attention for its potential therapeutic benefits. This article delves into the overview of the U.S. Minor Cannabinoids Market, exploring the current landscape, trends, and factors influencing its growth.

The growth of the U.S. minor cannabinoids market is underpinned by several key factors. Firstly, changing consumer preferences and an increased focus on holistic wellness have driven the demand for products featuring minor cannabinoids such as CBG, CBC, and CBN. The market is witnessing a surge in innovation, with companies exploring novel cultivation and extraction methods to meet this rising demand. Furthermore, ongoing research into the therapeutic properties of minor cannabinoids contributes to the market's expansion, fostering the development of new, effective products. The evolving regulatory environment, as both federal and state entities provide clearer guidelines, is also a significant growth factor. As industry stakeholders address challenges related to standardization and quality control, the market is poised to capitalize on the opportunities presented by the growing recognition of minor cannabinoids' potential in the United States.

Holistic Wellness Integration:

Innovative Product Formulations:

Scientific Research and Development:

Regulatory Advancements:

Consumer Education and Transparency:

Market Expansion Through Collaboration:

The tetrahydrocannabivarin (THCV) segment claimed the market leadership in 2023, securing a substantial revenue share of 25.05%. This dominance is attributed to the increasing utilization of THCV in addressing various health conditions, including metabolic disorders, arthritis, diabetes, epilepsy, Alzheimer’s disease, neurological disorders, and pain management.

Furthermore, the robust growth of this segment is fueled by a series of organic and inorganic initiatives undertaken by market participants. These initiatives include engaging in clinical trials, launching innovative products, expanding production capacities, and more. For example, in June 2022, InMed Pharmaceuticals Inc., a notable manufacturer of rare cannabinoids, entered the health and wellness sector by introducing B2B sales of the rare cannabinoid delta 9-dominant tetrahydrocannabivarin (d9-THCV) through its wholly owned subsidiary, BayMedica LLC.

On the other hand, the cannabigerolic acid (CBGA) segment is poised to experience the highest compound annual growth rate (CAGR) from 2024 to 2033. The growth of this segment is propelled by the comprehensive therapeutic applications of CBGA, increasing demand from pharmaceutical companies, and a growing number of players focusing on CBGA production. Notably, in January 2022, Hometown Hero CBD launched its innovative CBDA + CBGA Tincture, featuring CBGA, CBDA, CBG, and CBD at 600mg each in a 30ml tincture. The hemp-derived cannabinoids in the tincture comply with legal standards across all 50 states.

In 2023, the neurological disorders segment commanded a substantial portion of the revenue share. The growth of this segment is primarily driven by the escalating prevalence of neurological disorders and the recognized benefits of cannabinoids in their management. Notably, synthetic cannabinoid compounds like Nabiximols have demonstrated significant health benefits, particularly in alleviating spasticity-associated symptoms in multiple sclerosis patients. The continuous expansion of research activities focusing on both minor and synthetic cannabinoids contributes significantly to the overall market growth.

Concurrently, the "others" application segment emerged as the leading contributor to revenue in 2023. This diverse category encompasses medical conditions such as diabetes, arthritis, and cardiovascular diseases. Synthetic cannabinoid compounds and endocannabinoids, for instance, have exhibited notable health benefits in addressing cardiovascular disorders. CBGA, with its identified role in managing heart conditions and epilepsy, adds to the segment's growth. Ongoing research studies exploring the applications of minor cannabinoids across various disorders, coupled with substantial support from funding organizations, further propel the expansion of this segment.

The pain management segment is poised for substantial growth with an anticipated significant CAGR from 2024 to 2033. Cannabinoids like CBC, CBN, and CBG have exhibited promising outcomes in the realm of pain management, particularly in addressing chronic pain. The noteworthy efficacy of CBN and CBG in managing chronic pain has spurred market players to incorporate these derivatives in the formulation of pain management remedies. An exemplar of this trend is Precision Plant Molecules, which offers a range of Cannabigerol (CBG) cannabinoid products tailored for consumer-packaged goods companies, enabling the creation of distinctive and efficacious health and wellness products.

By Product Type

By Application

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Minor Cannabinoids Market

5.1. COVID-19 Landscape: U.S. Minor Cannabinoids Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Minor Cannabinoids Market, By Product Type

8.1. U.S. Minor Cannabinoids Market, by Product Type, 2024-2033

8.1.1. Cannabigerol (CBG)

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Cannabichromene (CBC)

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Cannabinol (CBN)

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Tetrahydrocannabivarin (THCV)

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Cannabigerolic Acid (CBGA)

8.1.5.1. Market Revenue and Forecast (2021-2033)

8.1.6. Others

8.1.6.1. Market Revenue and Forecast (2021-2033)

Chapter 9. U.S. Minor Cannabinoids Market, By Application

9.1. U.S. Minor Cannabinoids Market, by Application, 2024-2033

9.1.1. Inflammation

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Pain Management

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Neurological Disorders

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Cancer

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Others

9.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 10. U.S. Minor Cannabinoids Market, Regional Estimates and Trend Forecast

10.1. U.S.

10.1.1. Market Revenue and Forecast, by Product Type (2021-2033)

10.1.2. Market Revenue and Forecast, by Application (2021-2033)

Chapter 11. Company Profiles

11.1. Mile High Labs

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. GCM Holdings, LLC (Cannabinoids)

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. GenCanna.

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. CBD. INC.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Rhizo Sciences

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Laurelcrest

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Fresh Bros Hemp Company

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. BulKanna

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. High Purity Natural Products.

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. ZERO POINT EXTRACTION, LLC

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others