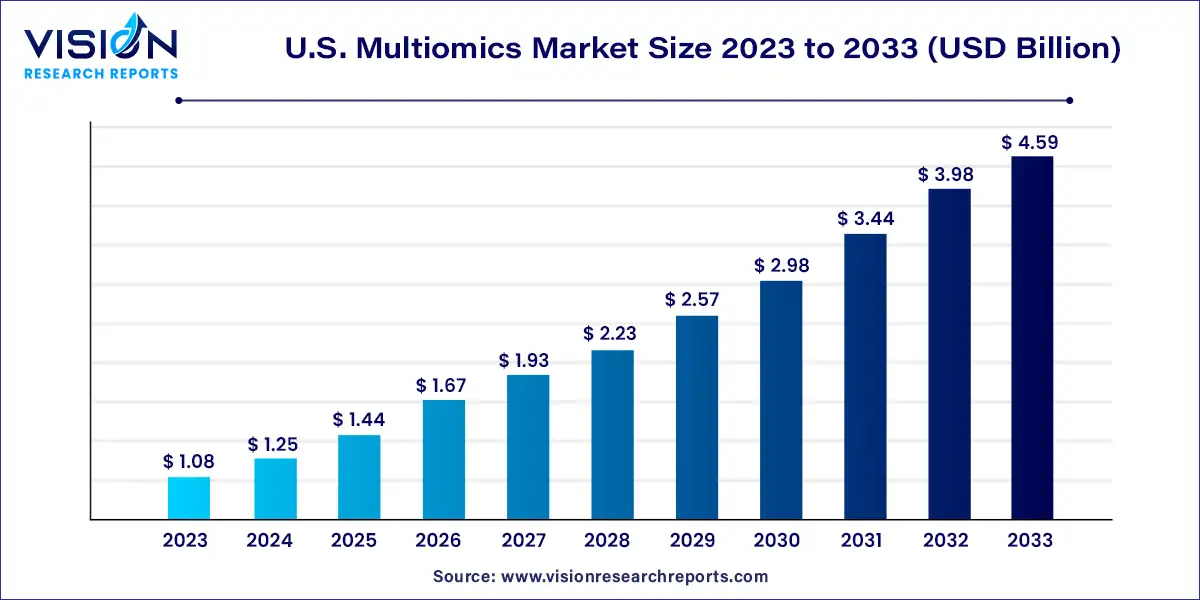

The U.S. multiomics market size was estimated at around USD 1.08 billion in 2023 and is projected to hit around USD 4.59 billion by 2033, growing at a CAGR of 15.58% from 2024 to 2033.

The multiomics market in the United States is experiencing significant growth, driven by advancements in technology, increased funding for research, and a rising demand for personalized medicine. The convergence of high-throughput sequencing technologies, bioinformatics, and machine learning is enabling researchers and clinicians to analyze complex biological data sets with greater precision and efficiency.

The growth of the U.S. multiomics market is driven by the technological advancements, increased funding for research, and the rising demand for personalized medicine. Cutting-edge technologies such as next-generation sequencing and mass spectrometry have significantly lowered the costs and enhanced the efficiency of multiomics analyses, making them more accessible. Additionally, substantial investments from government bodies and private organizations are supporting large-scale multiomics projects aimed at understanding complex diseases. The shift towards personalized medicine is also a major driver, as multiomics provides the comprehensive molecular insights needed to develop tailored treatments and improve patient outcomes.

Based on products and services, the product segment held the largest revenue share in the market in 2023. This segment is further divided into instruments, consumables, and software. The growth in this segment is driven by ongoing developments and an increasing number of product launches. Research highlights the efficiency of genomics in predicting and identifying novel compounds, which significantly contributes to drug development and synthetic biology. For instance, in March 2023, Mission Bio partnered with CMaT to enhance cell therapy development using the Tapestri Platform, addressing manufacturing challenges to ensure the safe and rapid delivery of potentially life-saving therapies.

The service segment is expected to register the fastest compound annual growth rate (CAGR) of 17.65% over the forecast period. This segment is experiencing significant growth due to the rising demand for specialized expertise and comprehensive solutions. Services in this segment include experimental design, sample preparation, data generation, and in-depth bioinformatics analysis, all of which are crucial for helping researchers and organizations navigate multiomics workflows and achieve accurate results.

Based on type, the market is segmented into single-cell multiomics and bulk multiomics. The bulk multiomics segment dominated the market in 2023. This segment is essential for providing a comprehensive understanding of the pathogenesis of disorders and diverse phenotypes at the individual level. Its dominance is due to several advantages, including a straightforward experimental process and cost-effective analysis of large-scale samples. Additionally, the bulk multiomics method eliminates the need for living cells.

The single-cell multiomics segment is projected to grow at the fastest compound annual growth rate (CAGR) of 18.18% over the forecast period. An article published by Nature Reviews Molecular Cell Biology in April 2023 highlights recent progress in single-cell analyses and barcoding strategies, emphasizing innovative techniques that integrate genome, epigenome, and transcriptome profiling. These advancements provide better specificity, precision, and resolution, leading to a deeper understanding of cellular heterogeneity, differentiation, and epigenetic reprogramming, thereby driving the growth of this segment over the forecast period.

Based on platform, the market is segmented into genomics, transcriptomics, proteomics, metabolomics, and integrated omics platforms. The genomics segment dominated the market in 2023 with a revenue share of 40%. This dominance is driven by advancements such as CRISPR/Cas9 genome editing. Diverse data streams, including wearables and clinical data, are enabling a holistic approach to personalized medicine. Furthermore, in December 2023, the FDA approved the first CRISPR gene-editing treatment, exa-cel, for sickle cell disease. Developed by Vertex and CRISPR Therapeutics, this approval reinforces the integration of genomics into clinical practice, paving the way for increased adoption of gene-editing techniques in healthcare. These factors are anticipated to boost the growth of the genomics segment over the forecast period.

The metabolomics segment is expected to grow at the fastest compound annual growth rate (CAGR) over the forecast period. This platform is a promising technology integral to precision medicine, involving the comprehensive analysis of metabolites within a biological specimen. Modern metabolomic technologies surpass the scope of small-scale metabolite detection, enabling the precise analysis of hundreds to thousands of metabolites. This capability is expected to drive the growth of the metabolomics segment over the forecast period.

The market is segmented based on application into cell biology, oncology, neurology, and bulk immunology. The oncology segment dominated the market in 2023, holding a market share of 41%, and is projected to experience the fastest compound annual growth rate (CAGR) over the forecast period. This dominance is attributed to the increasing need to comprehend complex molecular interactions in cancer development. Moreover, strategic investments by key market players in cancer research are significant growth drivers. For example, in June 2023, collaborative efforts between Owkin, NanoString, and renowned cancer research institutions led to the launch of MOSAIC—a groundbreaking USD 50 million spatial omics project with the potential to redefine cancer research.

The neurology segment is expected to grow at a substantial CAGR over the forecast period. Multiomics technologies have profoundly impacted neurology, revolutionizing the understanding of complex neurological disorders. Next-generation sequencing, transcriptomics, proteomics, and metabolomics have become indispensable tools, facilitating the unbiased identification of disease-causing gene variants and biomarkers. These factors are anticipated to propel the growth of the neurology segment over the forecast period

The market is segmented by end-use into academic and research institutes, pharmaceutical and biotechnology companies, and others. Academic and research institutes dominated the segment, holding a market share of 50% in 2023. Numerous government organizations, such as the NIH, provide funding to specific multiomics sequencing and analysis centers dedicated to understanding the genomic bases of rare and common human diseases. The Centers for Common Disease Genomics, a division of the NIH, utilize genome sequencing to investigate and ascertain the influence of omics on prevalent diseases like autism, stroke, diabetes, and heart diseases. For example, in September 2023, the NIH granted USD 50.3 million for multiomics research on various human diseases and health.

The pharmaceutical and biotechnology companies segment is projected to achieve the fastest compound annual growth rate (CAGR) over the forecast period. Next-generation sequencing (NGS) is rapidly gaining importance in biopharmaceutical manufacturing processes. Advanced technology is enhancing the development of cell lines and quality assurance practices. Moreover, these sequencing techniques guide the development of medications for targeted therapy and precision medicine. For instance, NGS enables researchers to discover and characterize new molecular targets, including targets that could aid in the development of therapies for diseases previously deemed incurable. Therefore, the adoption of such advanced technology is expected to drive the growth of the segment from 2024 to 2033.

By Product & Services

By Type

By Platform

By Application

By End-use

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others