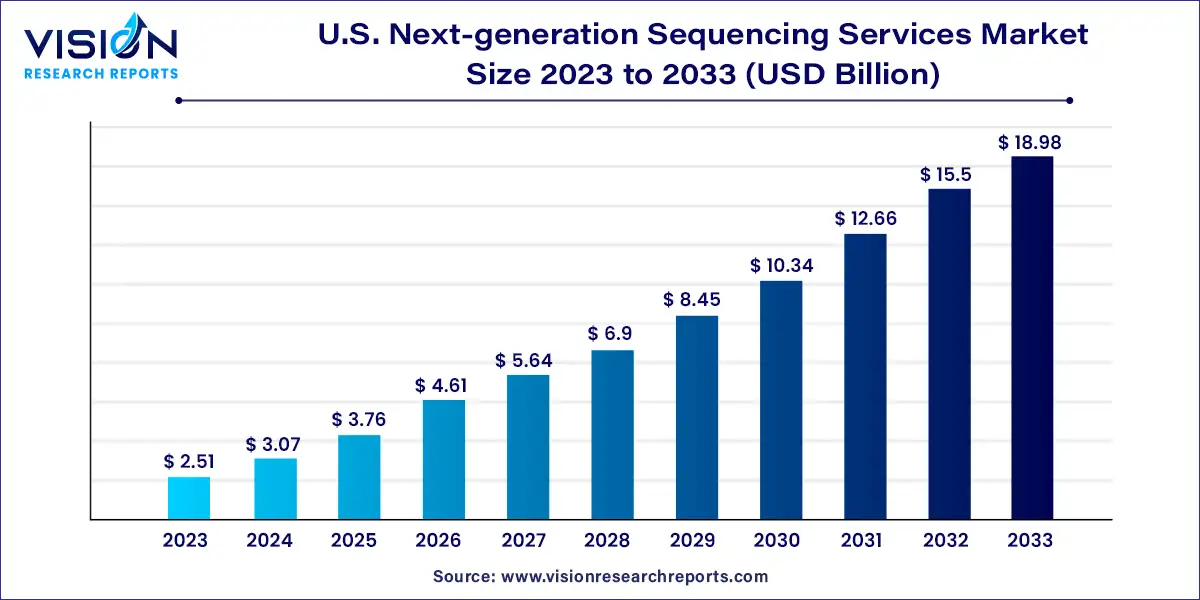

The U.S. next-generation sequencing services market size was estimated at around USD 2.51 billion in 2023 and it is projected to hit around USD 18.98 billion by 2033, growing at a CAGR of 22.42% from 2024 to 2033.

The U.S. next-generation sequencing (NGS) services market stands at the forefront of innovation in genomic research and clinical diagnostics. As a pivotal component of precision medicine and biomedical research, NGS services offer unparalleled insights into genetic variation, disease mechanisms, and therapeutic targets.

The growth of the U.S. next-generation sequencing (NGS) services market is propelled by the technological advancements continue to drive innovation in sequencing platforms, making NGS more efficient, accurate, and cost-effective. The increasing demand for personalized medicine is another significant growth factor, as NGS enables tailored treatment strategies based on individual genetic profiles. Expanded clinical utility, particularly in areas such as oncology, reproductive health, and infectious diseases, is driving the adoption of NGS services in clinical practice. Additionally, efforts to reduce sequencing costs and improve accessibility through cloud-based analysis platforms are democratizing genomic data analysis.

In 2023, human genome sequencing services emerged as the dominant force in the market, accounting for nearly 33% of the total revenue share. These services are pivotal in uncovering the origins of monogenic disorders like sickle-cell anemia, retinoblastoma, and cystic fibrosis, while also shedding light on complex diseases such as diabetes and cancer. By delving into human genetic information, these services facilitate personalized medicine, biomarker discovery, identification of cancer-associated genes, and exploration of how genes influence drug responses (pharmacogenomics).

Moreover, advancements in precision medicine and related fields, which gather human genome data, have significantly contributed to the development of suitable human reference genomes for tailored medication design. Consequently, these factors, coupled with cost reductions and the growing adoption of genome mapping projects, are poised to propel market growth throughout the projected period.

Gene regulation services are projected to exhibit the fastest compound annual growth rate (CAGR) during the forecast period. Next-generation sequencing (NGS) provides an advanced platform for gene regulation studies, enabling the comprehensive examination and analysis of transcriptional complexity within samples. These services play a critical role in identifying cardiovascular disorders and offer insights into actively expressed genes and transcripts across diverse medical conditions.

In 2023, sequencing services emerged as the dominant force in the market, capturing 56% of the total revenue share. Furthermore, this segment is projected to maintain the highest compound annual growth rate (CAGR) throughout the forecast period. This substantial growth can be attributed to the pivotal role sequencing services play in the entire workflow. The prevalence of numerous sequencers in the market, which are the primary platforms utilized in sequencing workflows, further reinforces this dominance. Moreover, the competitive landscape within the market is expected to intensify as companies innovate and introduce benchtop or portable sequencing platforms. This development is poised to drive growth within the segment over the forecast period.

Pre-sequencing services are forecasted to witness lucrative growth from 2024 to 2033. These services encompass library preparation and clonal amplification services, tailored to individual barcoded libraries and/or pooled libraries based on customer preference. Advancements and the introduction of new products in library preparation solutions have broadened the application scope of sequencing technologies in epigenetics and transcriptomics. Additionally, the development of advanced library preparation kits by key companies enhances the reproducibility and consistency of standard molecular biology reactions, while also offering access to innovative preparation strategies

In 2023, universities and other research entities secured the largest market share, comprising nearly 54% of the total revenue. Next-generation sequencing (NGS) services find extensive use among researchers spanning various sectors, including universities and research entities, hospitals and clinics, pharmaceutical and biotechnology entities, and other end-users, for a wide array of research endeavors.

The adoption of NGS services by universities and research entities is driven by key factors such as increased R&D funding, rising demand for NGS technology, and the expansion of genomic studies. This growth presents numerous opportunities for NGS providers focusing on the development of NGS-based solutions. Notably, in October 2022, the American Society for Microbiology received funding from the CDC to bolster pathogen genomic sequencing for pandemic preparedness.

Hospitals and clinics are projected to experience the fastest growth rate over the forecast period, primarily propelled by the extensive applications of NGS in clinical studies related to cancer prognosis. Advanced NGS tools play a pivotal role in pathogen detection, molecular diagnostics, personalized medicine research, and identification of genetic mutations. Consequently, NGS services support clinical studies on infectious diseases, cancer detection, infection control, and antimicrobial resistance testing, thereby aiding clinicians in making informed treatment decisions. Furthermore, strategic collaborations among hospitals, clinics, and service providers contribute to market growth in this sector.

By Service Type

By Workflow

By End-use

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others