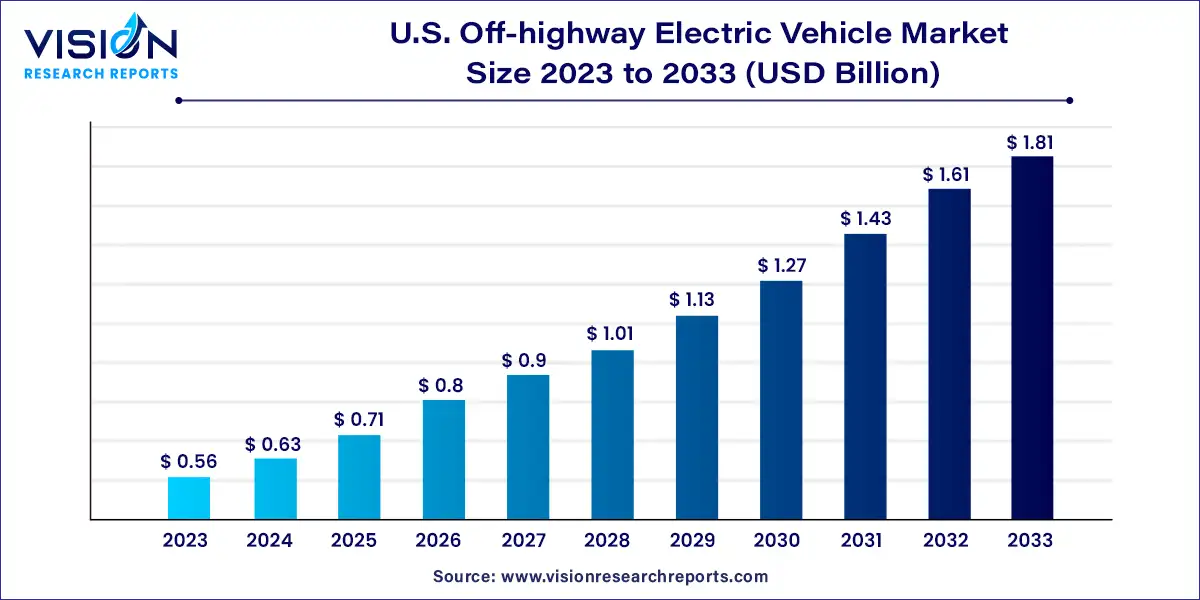

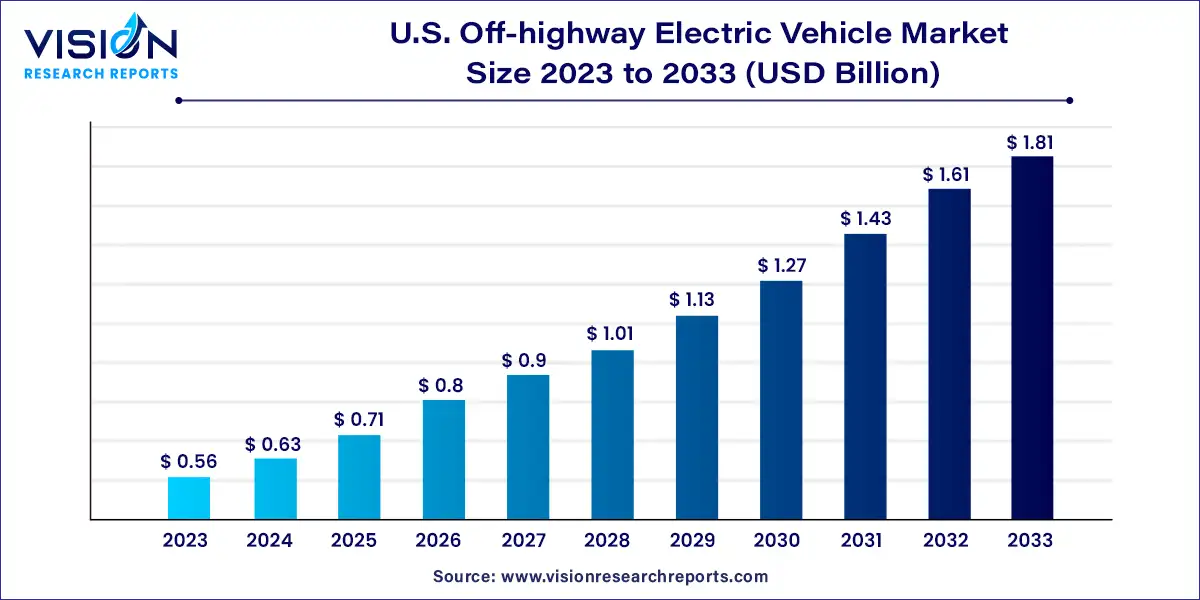

U.S. Off-highway Electric Vehicle Market Size and Trends

The U.S. Off-highway electric vehicle market size was valued at USD 0.56 billion in 2023 and is predicted to surpass around USD 1.81 billion by 2033 with a CAGR of 12.45% from 2024 to 2033.

Key Pointers

- By Application, the mining sector held the largest revenue share in 2023.

- By Application, the construction sector is expected to expand at the highest CAGR from 2024 to 2033.

- By Storage Type, the lead-acid segment generated the maximum market share in 2023.

- By Propulsion, the hybrid electric vehicle (HEV) segment contributed the largest market share of 58% in 2023.

- By Propulsion, the battery electric vehicle (BEV) segment is estimated to expand the fastest CAGR from 2024 to 2033.

U.S. Off-highway Electric Vehicle Market Overview

The U.S. off-highway electric vehicle market is experiencing significant growth and transformation, driven by a confluence of factors including technological advancements, environmental regulations, and evolving consumer preferences.

U.S. Off-highway Electric Vehicle Market Growth Factors

The growth of the U.S. off-highway electric vehicle market is driven by an increasing environmental concerns and regulations regarding emissions are compelling industries to transition towards cleaner and greener alternatives. Electric vehicles offer a sustainable solution, reducing carbon emissions and environmental impact. Secondly, technological advancements in battery technology and electric drivetrains are enhancing the performance and viability of electric off-highway vehicles. Improved energy density, longer battery life, and faster charging capabilities are boosting adoption rates. Additionally, cost savings associated with lower operating expenses and improved efficiency are incentivizing fleet operators to invest in electric propulsion systems.

U.S. Off-highway Electric Vehicle Market Trends:

- Increasing Adoption of Electric Vehicles: There is a notable surge in the adoption of electric vehicles (EVs) across various off-highway applications. Factors such as environmental concerns, regulatory incentives, and technological advancements are driving this trend.

- Shift towards Sustainability: The off-highway electric vehicle market is experiencing a shift towards sustainability, with a growing emphasis on reducing carbon emissions and minimizing environmental impact. Electric vehicles offer a cleaner and greener alternative to traditional diesel-powered equipment.

- Expansion of Product Offerings: Manufacturers are expanding their product portfolios to include a wider range of off-highway electric vehicles tailored to specific applications and industries. This diversification is driven by evolving customer demands and market opportunities.

- Infrastructure Development: The development of charging infrastructure is crucial for the widespread adoption of off-highway electric vehicles. Efforts are underway to expand charging networks and infrastructure, particularly in remote or off-grid locations, to support the growing fleet of electric-powered equipment.

U.S. Off-highway Electric Vehicle Market Restraints:

- Infrastructure Limitations: The lack of charging infrastructure in remote or off-grid locations poses a significant challenge to the widespread adoption of off-highway electric vehicles. Limited access to charging stations and the need for substantial investments in charging infrastructure hinder the market growth, particularly in industries such as construction and mining.

- Initial Capital Costs: Despite the long-term cost savings associated with electric propulsion, the higher upfront purchase price of electric off-highway vehicles remains a barrier for many buyers. The initial capital investment required for electric propulsion systems, batteries, and specialized equipment can deter potential buyers, especially in price-sensitive markets.

- Range Anxiety: Concerns over range limitations and battery range anxiety may deter fleet operators from adopting off-highway electric vehicles, particularly in applications that require extended operating hours or continuous operation over large distances. Limited battery range and the need for frequent recharging can impact productivity and operational efficiency, especially in demanding work environments.

- Performance Limitations: While electric drivetrains offer superior performance and efficiency compared to internal combustion engines, off-highway electric vehicles may face performance limitations in certain applications or operating conditions. Factors such as terrain, load capacity, and extreme weather conditions can affect the performance and range of electric-powered equipment, limiting their suitability for certain use cases.

Application Insights

In 2023, the mining sector held the largest share of revenue in the market. The adoption of electric vehicles (EVs) within mining represents a notable shift towards sustainability, efficiency, and safety. This transition is attributed to both environmental regulations and operational improvements. EVs produce no exhaust emissions, thus markedly enhancing air quality within enclosed mining environments. Additionally, the decreased noise levels associated with EVs contribute to a safer and more comfortable working atmosphere.

Meanwhile, the construction sector is forecasted to exhibit the highest compound annual growth rate (CAGR) throughout the projection period. The construction industry is undergoing significant changes spurred by the emergence and integration of off-highway electric vehicles such as excavators and loaders. With an upsurge in construction projects, the electric vehicle market within this segment is expected to experience substantial growth.

Storage Type Insights

In 2023, the lead-acid segment commanded the largest share of revenue in the market. Renowned for their reliability, cost-effectiveness, and established technology, lead-acid batteries have been a fundamental energy storage solution across diverse applications. Within the realm of off-highway electric vehicles (OHEVs), lead-acid batteries have played a pivotal role, especially during the initial phases of the industry's transition towards electrification. Their cost-efficiency and recyclability have positioned them as one of the primary storage options in this sector.

On the other hand, the Li-ion segment is poised to exhibit the highest compound annual growth rate (CAGR) during the forecast period. Characterized by their high energy density, Li-ion batteries can store more electricity within a smaller and lighter package, granting OHEVs a critical advantage in operational efficiency. Moreover, Li-ion batteries typically boast a longer lifespan compared to other battery technologies. The capability for rapid charging enables vehicles to swiftly return to operation, a crucial aspect for maintaining productivity across various industries.

Propulsion Insights

In 2023, the hybrid electric vehicle (HEV) segment dominated the market with the largest revenue share, accounting for 58%. HEVs combine an internal combustion engine (ICE) with one or more electric motors and a battery. The rising demand for HEVs stems from their notable fuel efficiency, lower emissions, and reduced reliance on fossil fuels. For instance, in January 2024, Volvo Construction Equipment (Volvo CE) introduced the EW240, a new electric material handler. This machine produces zero exhaust emissions and operates nearly silently, enabling continuous operation around the clock.

Conversely, the battery electric vehicle (BEV) segment is poised to exhibit the fastest compound annual growth rate (CAGR) throughout the forecast period. With the industry's focus shifting towards sustainable and efficient solutions to curb carbon emissions, the BEV segment is experiencing rapid momentum. These vehicles rely entirely on electricity stored in rechargeable battery packs, eliminating the need for combustion engines. In November 2022, Caterpillar Inc. unveiled its inaugural battery electric mining truck, marking a significant stride towards a more sustainable future.

U.S. Off-highway Electric Vehicle Market Key Companies

- AB Volvo

- Caterpillar

- CNH Industrial America LLC

- Deere & Company

- Doosan Bobcat

- J C Bamford Excavators Ltd.

- Kobelco Construction Machinery U.S.A Inc.

- Komatsu Ltd.

- Mitsubishi Heavy Industries Ltd.

- Sany America Inc.

- Terex Corporation

Recent Developments

- In November 2023, AB Volvo's subsidiary, Volvo Construction Equipment (Volvo CE), forged a partnership with CRH aimed at decarbonizing the construction industry. This collaboration primarily centers on electrification initiatives geared towards reducing carbon emissions. Both entities are resolute in their mission to advance sustainable and eco-friendly technologies within the construction sector.

- In April 2022, Sany Heavy Industry Co. Ltd. entered into a strategic partnership with Contemporary Amperex Technology Co. Ltd. (CATL) to drive electrification efforts across various industries, including construction, agriculture, and mining.

- In March 2022, J C Bamford Excavators Ltd. unveiled the HTD-5E electric dumpster, capable of carrying approximately 1,100 lbs of load. This tracked dumper is purpose-built for traversing diverse terrains, facilitating material movement. The introduction of this electric model underscores the company's dedication to developing environmentally friendly, zero-emission equipment suitable for a multitude of applications.

U.S. Off-highway Electric Vehicle Market Segmentation:

By Propulsion

By Storage Type

By Application

- Agriculture

- Construction

- Mining

Frequently Asked Questions

The U.S. Off-highway electric vehicle market size was reached at USD 0.56 billion in 2023 and it is projected to hit around USD 1.81 billion by 2033.

The U.S. Off-highway electric vehicle market is growing at a compound annual growth rate (CAGR) of 12.45% from 2024 to 2033.

Key factors that are driving the U.S. Off-highway electric vehicle market growth include rising need for solutions to reduce healthcare costs, increasing focus on patient-centric care, and strong government support.

The U.S. Off-highway electric vehicle market size was reached at USD 0.56 billion in 2023 and it is projected to hit around USD 1.81 billion by 2033.

The U.S. Off-highway electric vehicle market is growing at a compound annual growth rate (CAGR) of 12.45% from 2024 to 2033.

Key factors that are driving the U.S. Off-highway electric vehicle market growth include rising need for solutions to reduce healthcare costs, increasing focus on patient-centric care, and strong government support.

The U.S. Off-highway electric vehicle market size was reached at USD 0.56 billion in 2023 and it is projected to hit around USD 1.81 billion by 2033.

The U.S. Off-highway electric vehicle market is growing at a compound annual growth rate (CAGR) of 12.45% from 2024 to 2033.

Key factors that are driving the U.S. Off-highway electric vehicle market growth include rising need for solutions to reduce healthcare costs, increasing focus on patient-centric care, and strong government support.

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others