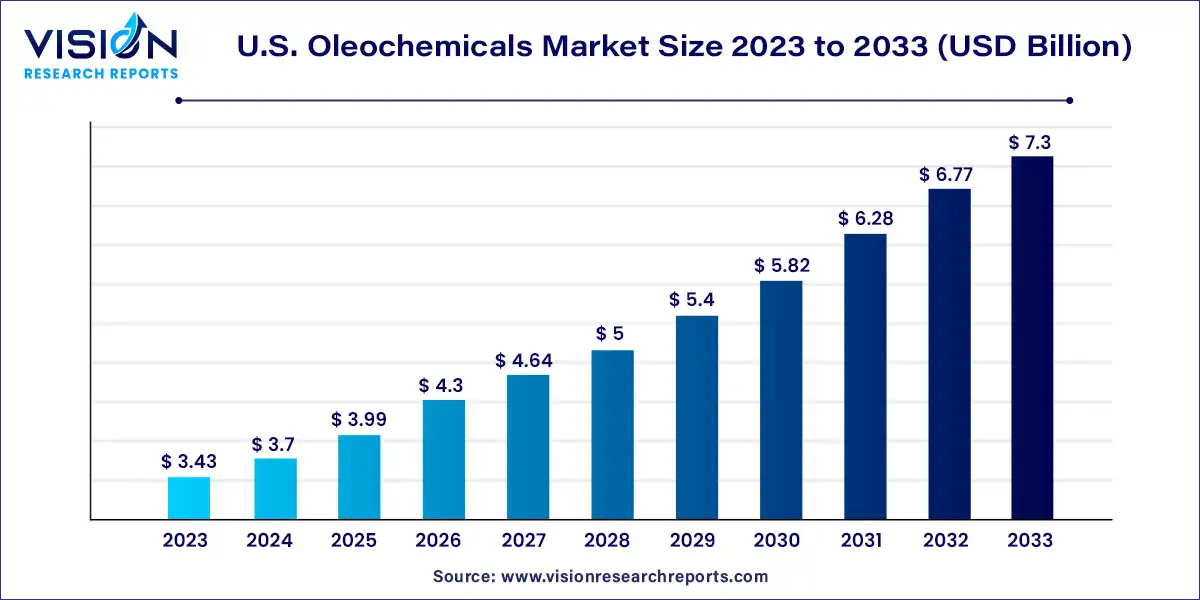

The U.S. oleochemicals market size was surpassed at USD 3.43 billion in 2023 and is expected to hit around USD 7.3 billion by 2033, growing at a CAGR of 7.85% from 2024 to 2033.

The U.S. oleochemicals market holds a pivotal position within the global landscape, driven by diverse applications spanning industrial, pharmaceutical, and personal care sectors. Derived from natural sources such as plant and animal fats, oleochemicals are gaining prominence as sustainable alternatives to petroleum-based products.

The growth of the U.S. oleochemicals market is underpinned by an increasing consumer preference for sustainable and eco-friendly products is driving demand, as oleochemicals are derived from renewable sources like plant and animal fats. Secondly, their versatile applications across industries such as pharmaceuticals, personal care, and industrial sectors contribute significantly to market expansion. Moreover, stringent environmental regulations favor the adoption of oleochemicals due to their biodegradability and lower ecological footprint compared to petroleum-based alternatives.

The glycerol esters segment emerged as the market leader, capturing the largest revenue share of 37% in 2023. This dominance is primarily driven by the escalating consumption of food products, where food-grade glycerol serves as a pivotal ingredient in manufacturing. Applications range from flavored beverages to ice creams and chewing gum. Glycerol monostearate (GMS), a key derivative used in the food & beverage industry and cosmetics, acts as an essential emulsifier in confectionery and exotic foods.

The fatty acid methyl ester (FAME) segment is poised for robust growth, projected to achieve a CAGR of 10.23% from 2024 to 2033. FAME, derived through the transesterification of fats like vegetable oils and animal fats with methanol and catalysts such as sodium hydroxide or sodium methoxide, finds extensive use in biodiesel production. In 2023, U.S. biodiesel production reached 1.7 billion gallons, underscoring the expanding demand for FAME in sustainable fuel solutions.

The personal care & cosmetics segment led with a significant revenue share of 22% in 2023. Growth in this segment is driven by the increasing integration of oleochemicals in the formulation and production of personal care and cosmetic products. Oleochemicals impart moisturizing properties and enhance the sensory attributes of these products, aligning with rising consumer preferences for effective and sustainable skincare solutions.

The industrial applications segment is anticipated to grow at a robust CAGR of 8.43% from 2024 to 2033. This segment encompasses diverse industries such as oilfield chemicals, pulp & paper chemicals, construction chemicals, lubricant additives, and agrochemicals. Recent trends highlight the adoption of versatile products like alcohol sulfates, ether sulfates, fatty amines, and others, reflecting increased demand across multiple industrial sectors for oleochemical-based solutions.

By Product

By Application

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others