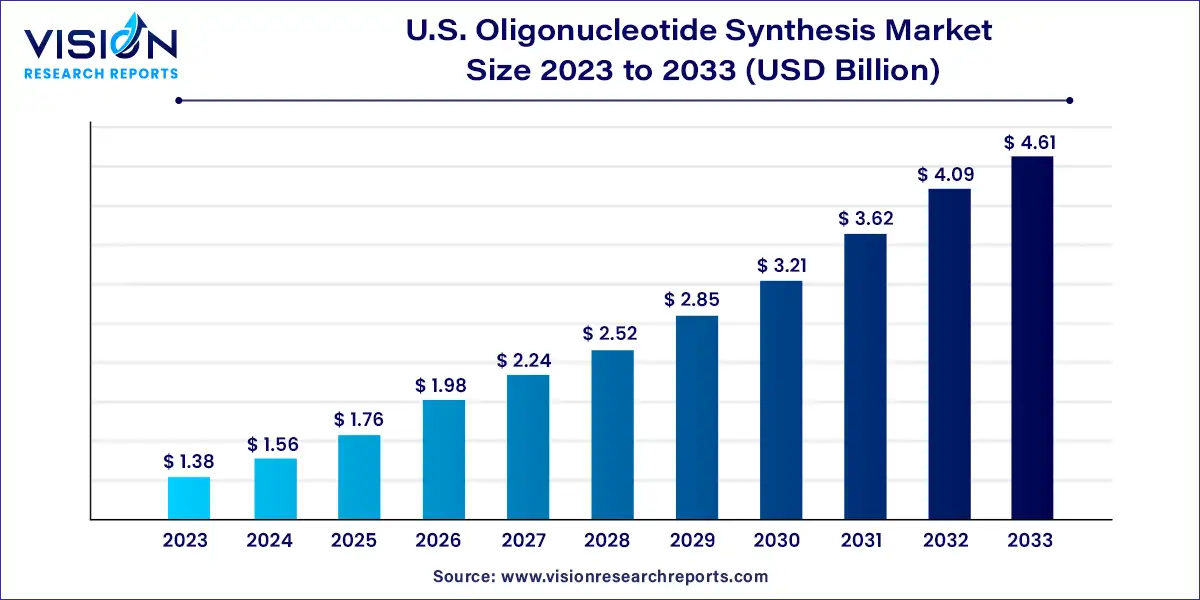

The U.S. oligonucleotide synthesis market size was estimated at around USD 1.38 billion in 2023 and it is projected to hit around USD 4.61 billion by 2033, growing at a CAGR of 12.83% from 2024 to 2033.

The U.S. oligonucleotide synthesis market has experienced significant growth is driven by advancements in biotechnology, increased demand for personalized medicine, and the expanding applications of oligonucleotides in research and therapeutic development. Oligonucleotides, short sequences of nucleotides, are essential tools in genetic testing, research, and the development of novel therapeutics.

The U.S. oligonucleotide synthesis market is experiencing robust growth driven by an advances in biotechnology, particularly in genomic and proteomic research, have significantly increased the demand for oligonucleotides. Personalized medicine is another major driver, as the need for tailored therapies continues to rise, necessitating custom oligonucleotide sequences. Additionally, increased investment in research and development by pharmaceutical and biotech companies is propelling market growth, as these investments are crucial for discovering new drug targets and developing innovative treatments. The expanding application of oligonucleotides in areas such as diagnostics, therapeutics, and genetic testing further fuels this market's expansion.

In 2023, the services segment dominated the U.S. oligonucleotide synthesis market, capturing the largest share of 38%. It is also expected to experience the fastest compound annual growth rate (CAGR) during the forecast period. As the complexity of genomic research and therapeutic applications grows, researchers and companies are increasingly outsourcing the synthesis, purification, and customization of oligonucleotide sequences. This trend is driven by the intricate design requirements of therapeutic oligonucleotides, the expanding scope of personalized medicine, and the need for cost-effective and scalable solutions. Outsourcing these services not only provides access to advanced technologies and expertise but also accelerates research and development timelines. For instance, in November 2023, Twist Bioscience launched Express Genes, an innovative gene synthesis service with a rapid turnaround time of 5 to 7 business days, facilitated by their manufacturing facility in Wilsonville, Oregon.

The oligonucleotide segment is projected to grow at a significant CAGR of 13.26% from 2024 to 2033. Oligonucleotides are crucial tools in molecular biology research, genetic testing, and drug development. Advances in scientific research and a deeper understanding of genomics and personalized medicine are driving the demand for custom oligonucleotides for experimentation and analysis. Additionally, these molecules are increasingly used in diagnostics to detect genetic variations and mutations associated with diseases. Their therapeutic applications include gene therapy, antisense therapy, and RNA interference (RNAi). The expanding field of precision medicine and the development of nucleic acid-based therapies further contribute to the growing demand for custom oligonucleotides. For example, in October 2019, Boston Children's Hospital neurologists and researchers developed an Antisense Oligonucleotide (ASO) therapy tailored for CLN7 Batten disease, which resulted in halving daily seizure frequency and reducing the duration of each seizure by over 80%.

In 2023, the PCR primers segment held the largest revenue share of 23% in the U.S. oligonucleotide synthesis market. PCR technology, powered by specific primers, enables laboratories to detect minute amounts of pathogen DNA or RNA, aiding in the diagnosis of infectious diseases such as viral, bacterial, and parasitic infections. This technology facilitates rapid and accurate diagnoses, leading to quicker treatment interventions and improved patient outcomes. Additionally, PCR primers help identify specific genetic markers associated with various cancer types, enabling early detection and personalized treatment approaches. They are also instrumental in monitoring cancer progression and assessing treatment responses. According to the NIH, laboratories are increasingly adopting multiplex PCR assays that target multiple genes or pathogens simultaneously. This requires specialized primer sets with high multiplexity and specificity, creating opportunities for manufacturers to meet this growing demand.

The sequencing segment is expected to witness the fastest CAGR of 17.42% during the forecast period. Sequencing applications are crucial for researching various aspects of genomics and genetics by analyzing genetic material such as DNA and RNA. This analysis provides a deeper understanding of the genetic composition and functionality of organisms. Sequencing is particularly essential for identifying and monitoring pathogens, including emerging viruses and antibiotic-resistant bacteria, necessitating swift and precise detection methods that often rely on oligonucleotide-based assays. The U.S. market for oligonucleotide synthesis in sequencing has expanded due to advancements in sequencing technologies and bioinformatics tools, which have enhanced the efficiency and accuracy of genetic analysis.

In 2023, academic research institutes held the largest market share of 44% in the U.S. oligonucleotide synthesis market. These institutions are at the forefront of genomic research and innovation. Researchers in academia, driven by the pursuit of knowledge and scientific interest, explore diverse areas of genomics. The segment's growth is attributed to the increasing number of research studies conducted in these institutes and the availability of funding for research activities. For example, in January 2020, the U.S. Intelligence Advanced Research Projects Activity awarded USD 23.0 million to DNA Script and its partners, including Illumina, for DNA-based data storage. These organizations have collaborated for over four years to investigate the potential integration of enzymatic DNA synthesis technology and next-generation sequencing (NGS) into a unified instrument.

Pharmaceutical and biotechnology companies are expected to grow at the fastest CAGR of 14.68% from 2024 to 2033. These companies are increasingly adopting precision medicine approaches, targeting specific genetic mutations, biomarkers, or pathways implicated in disease pathology. Oligonucleotide-based therapies offer the potential for personalized treatment strategies tailored to individual patients' genetic profiles. Consequently, there is a growing demand for custom-designed oligonucleotides with specific sequences, modifications, and delivery strategies to enable precise targeting and therapeutic efficacy.

By Product & Service

By Application

By End-use

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others