U.S. Oncology Information Systems Market Size and Trends

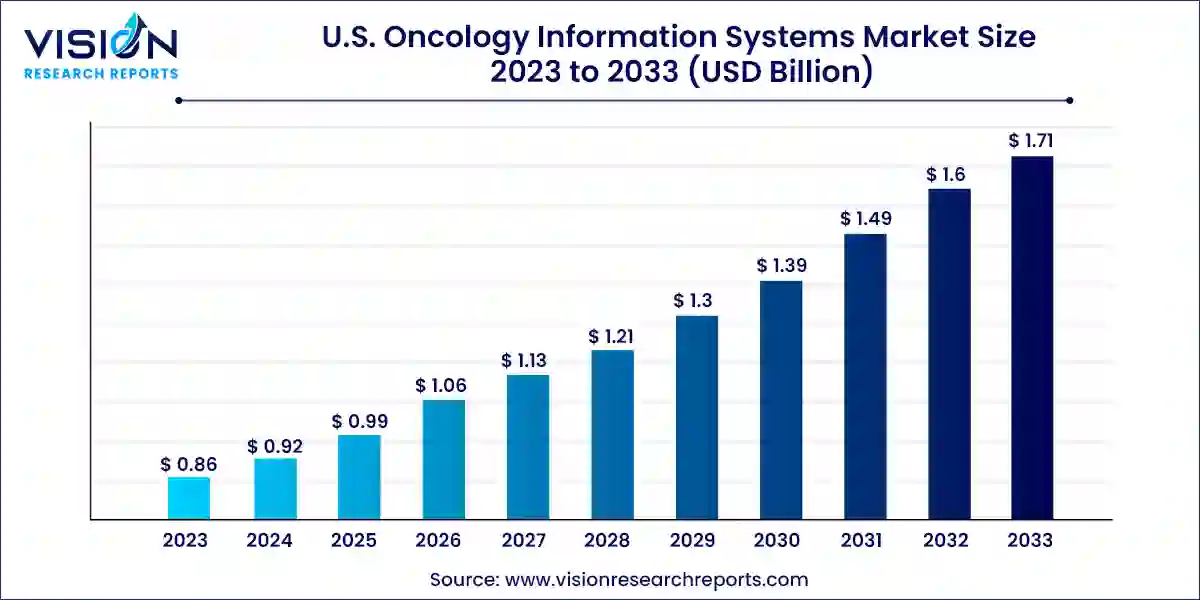

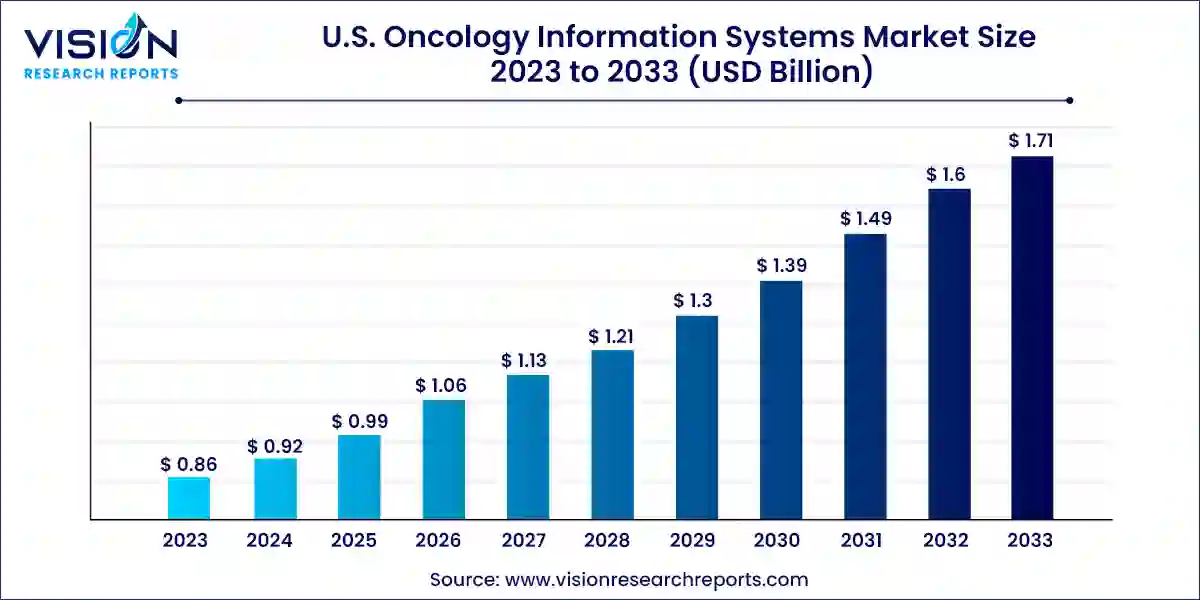

The U.S. oncology information systems market size was estimated at USD 0.86 billion in 2023 and it is expected to surpass around USD 1.71 billion by 2033, poised to grow at a CAGR of 7.13% from 2024 to 2033.

Key Pointers

- By Applications, the medical oncology segment generated the maximum market share of 61% in 2023.

- By Applications, the surgical oncology segment is estimated to expand the fastest CAGR during the forecast period.

- By Products and Services, the software segment contributed the largest market share of 74% in 2023.

- By Products and Services, the professional services segment is estimated to expand the fastest CAGR from 2024 to 2033.

U.S. Oncology Information Systems Market Overview

The U.S. oncology information systems (OIS) market presents a dynamic landscape driven by technological advancements and the evolving needs of healthcare providers and patients. As the demand for comprehensive oncology care continues to rise, the role of information systems in streamlining processes, enhancing clinical decision-making, and improving patient outcomes becomes increasingly crucial.

At its core, the U.S. Oncology Information Systems market encompasses a wide array of software solutions designed to support various aspects of cancer care delivery, including electronic health records (EHRs), clinical decision support systems, practice management tools, and telemedicine platforms. These systems play a pivotal role in consolidating patient data, facilitating communication among multidisciplinary care teams, and optimizing treatment planning and delivery.

U.S. Oncology Information Systems Market Growth Factors

The growth of the U.S. oncology information systems market is fueled by an advancements in precision medicine drive the demand for systems capable of integrating genomic data and predictive analytics. Regulatory compliance mandates, such as MACRA and QPP, necessitate solutions for quality reporting. Rising cancer incidence requires efficient systems to manage patient volumes and track disease trajectories. The COVID-19 pandemic accelerates telehealth integration into OIS platforms, facilitating virtual consultations and remote monitoring. Emphasis on value-based care models drives the development of solutions supporting reimbursement models and care coordination. These factors collectively propel the expansion of the U.S. Oncology Information Systems market, enhancing clinical workflows and patient outcomes.

U.S. Oncology Information Systems Market Trends:

- Integration of Artificial Intelligence (AI): Increasing integration of AI algorithms and machine learning capabilities into oncology information systems to support clinical decision-making, predictive analytics, and treatment planning, thereby enhancing efficiency and accuracy.

- Focus on Interoperability: Growing emphasis on interoperability standards to facilitate seamless exchange of patient data between different healthcare systems, enabling better care coordination, and improving patient outcomes.

- Expansion of Teleoncology Services: Rapid expansion of teleoncology services, driven by the COVID-19 pandemic and the need to provide remote consultations, follow-ups, and monitoring, leading to the integration of telehealth functionalities into oncology information systems.

- Patient-Centric Solutions: Shift towards patient-centric oncology information systems that empower patients to actively participate in their care process, access their health records, communicate with healthcare providers, and make informed decisions about their treatment.

- Remote Patient Monitoring: Increasing adoption of remote patient monitoring solutions within oncology information systems to track patient symptoms, treatment adherence, and outcomes outside of traditional clinical settings, enabling proactive intervention and personalized care.

- Genomic Data Integration: Growing integration of genomic data and molecular profiling into oncology information systems to support precision medicine approaches, enabling oncologists to personalize treatment strategies based on a patient's genetic profile and tumor characteristics.

U.S. Oncology Information Systems Market Restraints:

- High Implementation Costs: The initial investment required for implementing oncology information systems, including software customization, staff training, and infrastructure upgrades, can be prohibitive for smaller healthcare providers, posing a barrier to adoption.

- Data Quality and Standardization: Ensuring the accuracy, completeness, and standardization of oncology data within information systems can be challenging, especially with the diverse sources and formats of data inputs, potentially impacting the reliability and usability of clinical decision support tools.

- Physician Resistance to Technology: Some healthcare providers may exhibit resistance to adopting oncology information systems due to concerns about technology replacing traditional clinical judgment, workflow disruptions, or perceived loss of autonomy in decision-making.

- Regulatory Compliance Burdens: Compliance with regulatory requirements such as HIPAA, FDA regulations, and quality reporting standards adds additional administrative burdens and costs to healthcare organizations using oncology information systems, potentially impeding adoption.

- Limited Interoperability: Despite efforts to standardize interoperability protocols, interoperability challenges persist between different oncology information systems and healthcare IT platforms, hindering seamless data exchange and care coordination across healthcare settings.

Applications Insights

In 2023, the medical oncology segment took the lead with a substantial share of 61%. This mode of treatment presents a holistic and effective approach to combatting cancer. Moreover, the rising incidence of cancer is projected to fuel market expansion. The escalating utilization of chemotherapy, immunotherapy, targeted therapy, and hormonal therapy for more efficient cancer management is anticipated to further propel market growth.

The surgical oncology segment is poised to witness the most significant compound annual growth rate (CAGR) during the forecast period. While surgery alone is no longer the primary treatment for most solid tumors, the combination of surgical intervention with multi-modal therapies, predominantly involving radiotherapy, targeted molecular therapies, and chemotherapy, has emerged as the preferred course of action. Complex surgical procedures such as cytoreductive surgery, isolated limb perfusion, laparoscopic cancer surgery, and sarcoma surgery are predominantly conducted in specialized healthcare facilities. Consequently, the increasing intricacy in surgical interventions for solid tumors is anticipated to drive the expansion of the surgical oncology OIS market.

Products and Services Insights

In 2023, the software segment dominated the market landscape, accounting for a substantial share of 74%. These software solutions play a pivotal role in facilitating the seamless exchange of patient data across various healthcare entities, bridging the gap between healthcare practitioners and radiology centers. This integration significantly enhances the safety and efficiency of cancer treatment. Industry leaders such as Varian (Siemens Healthineers), Flatiron, and Elekta are at the forefront, developing innovative products by incorporating solutions like oncology-specific Electronic Medical Records (EMR). Consequently, the dominance of the software segment persists as it streamlines patient and data management processes, safeguarding data quality and participant safety.

The professional services segment is anticipated to experience significant growth in the foreseeable future. With hospitals and clinics often lacking the in-house expertise and resources necessary for OIS software deployment, outsourcing these services becomes imperative. Outsourcing arrangements may range from short-term projects to long-term contracts. Major players like Varian (Siemens Healthineers), Elekta, eviCore Healthcare, and Asclepius Consulting are among the key providers of professional services for cancer care on a global scale.

U.S. Oncology Information Systems Market Key Companies

- Elekta AB

- Accuray Incorporated

- Varian Medical Systems (Siemens Healthineers)

- RaySearch Laboratories

- Cerner Corporation (Oracle Corporation)

- BrainLab

- Philips Healthcare

- Prowess, Inc.

- DOSIsoft S.A.

- ViewRay Inc.

- MIM Software and Flatiron

Recent Developments

- In May 2022, RaySearch Laboratories and GE Healthcare announced a collaboration to jointly develop an advanced radiation therapy simulation. The collaboration aims to incorporate the latest technological advancements in treatment planning systems. As part of this partnership, RaySearch will integrate GE Healthcare’s multi-modality simulator into its RayStation treatment planning system.

- In June 2022, Accuray Incorporated partnered with Limbus AI Inc. in a strategic move to combine Limbus’ AI-powered auto-contouring algorithms with Accuray’s adaptive radiotherapy capabilities. The focus of this collaboration is to enhance software solutions for the treatment planning process.

U.S. Oncology Information Systems Market Segmentation:

By Products And Services

- Software

- Patient Information Systems

- Treatment Planning Systems

- Professional Services

By Application

- Medical Oncology

- Radiation Oncology

- Surgical Oncology

Frequently Asked Questions

The U.S. oncology information systems market size was reached at USD 0.86 billion in 2023 and it is projected to hit around USD 1.71 billion by 2033.

The U.S. oncology information systems market is growing at a compound annual growth rate (CAGR) of 7.13% from 2024 to 2033.

Key factors that are driving the U.S. oncology information systems market growth include rising need for solutions to reduce healthcare costs, increasing focus on patient-centric care, and strong government support.

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others