U.S. Organoids and Spheroids Market Size and Trends

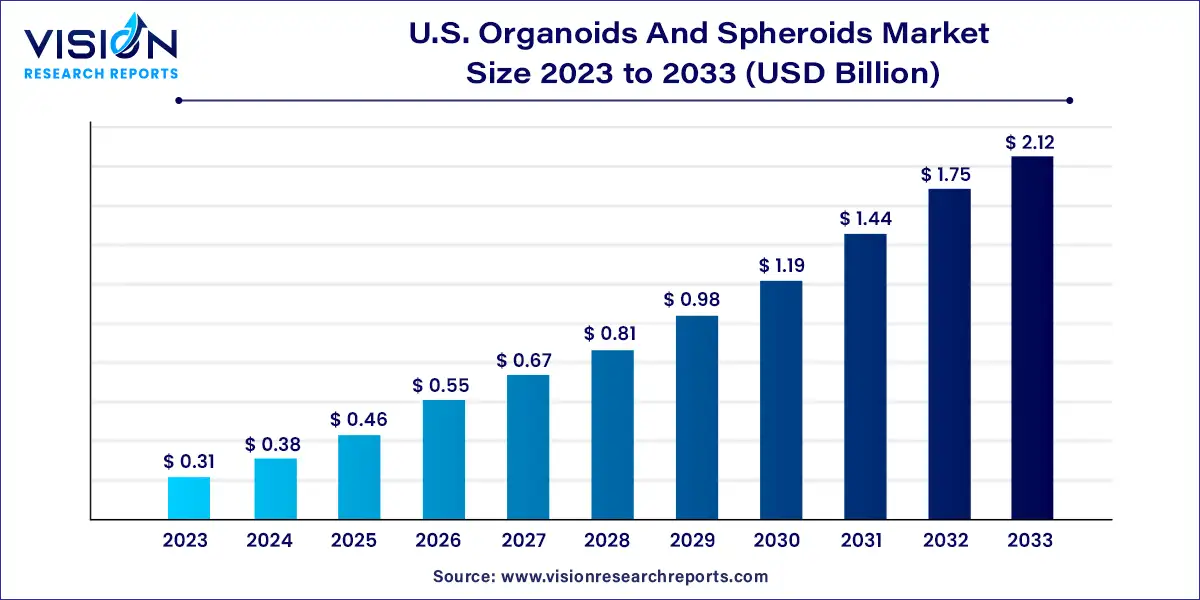

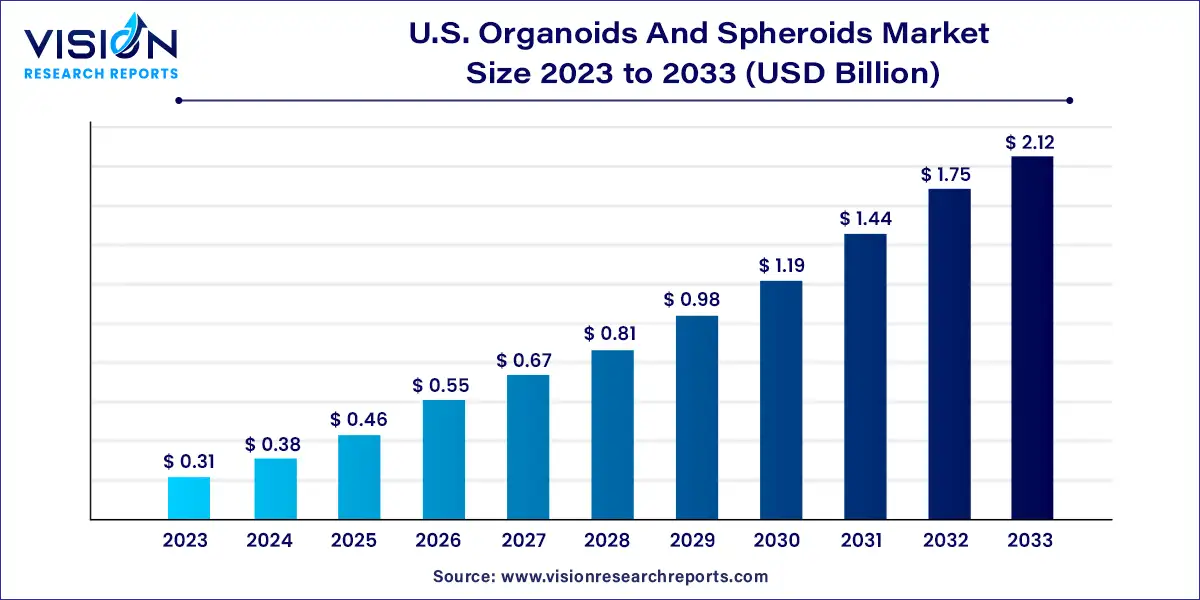

The U.S. organoids and spheroids market size was estimated at around USD 0.31 billion in 2023 and it is projected to hit around USD 2.12 billion by 2033, growing at a CAGR of 21.17% from 2024 to 2033.

Key Pointers

- By Type, the spheroids segment held the largest revenue share of 53% in 2023.

- By Type, the organoids segment is expected to expand at the highest CAGR from 2024 to 2033.

- By Application, the developmental biology segment generated the maximum market share of 31% in 2023.

- By Application, the regenerative medicine segment is anticipated to grow at the noteworthy CAGR from 2024 to 2033.

- By End-use, the biotechnology and pharmaceutical industries segment captured the maximum market share of 48% in 2023.

U.S. Organoids and Spheroids Market Overview

The field of organoids and spheroids in the United States has witnessed significant growth and innovation in recent years. These advanced 3D cell culture models hold immense potential for various applications in biomedical research, drug discovery, and regenerative medicine.

U.S. Organoids and Spheroids Market Growth Factors

The growth of the U.S. organoids and spheroids market is propelled by the burgeoning demand for physiologically relevant models in biomedical research and drug discovery. Organoids and spheroids offer a closer mimicry of human tissue architecture and function compared to traditional 2D cell cultures, enhancing the predictive value of preclinical studies. Secondly, advancements in technology, including biomaterials, microfabrication techniques, and imaging modalities, enable the generation of complex multicellular structures with enhanced functionality. This fosters research in disease modeling, personalized medicine, and high-throughput screening assays. Lastly, the application of organoids and spheroids in drug development is driving their adoption by pharmaceutical companies for target validation, lead optimization, and toxicity testing. These growth factors underscore the potential of organoids and spheroids to revolutionize biomedical research and therapeutic development in the United States and beyond.

U.S. Organoids and Spheroids Market Trends:

- Increased Adoption in Biomedical Research: Organoids and spheroids are gaining popularity as advanced 3D cell culture models due to their ability to closely mimic the architecture and function of human tissues. This trend is driving their widespread adoption across various fields of biomedical research, including cancer biology, neurology, and developmental biology.

- Integration of Multi-Omics Technologies: There is a growing trend towards combining organoid and spheroid models with high-throughput omics technologies such as genomics, transcriptomics, and proteomics. This integration allows researchers to obtain comprehensive molecular insights into disease mechanisms, drug responses, and therapeutic targets, facilitating the development of precision medicine approaches.

- Rise of Disease-Specific Organoid Libraries: Research institutions and biotechnology companies are increasingly investing in the development of disease-specific organoid libraries. These collections of organoid models represent a wide range of human diseases, including cancer, genetic disorders, and infectious diseases, providing valuable tools for drug screening, disease modeling, and personalized medicine initiatives.

- Emphasis on Microfluidics and Automation: To address the challenges of scalability and reproducibility associated with organoid and spheroid cultures, there is a growing emphasis on microfluidics-based platforms and automated systems. These technologies enable precise control over culture conditions, improve throughput, and enhance experimental reproducibility, making them increasingly attractive for high-throughput drug screening and phenotypic profiling studies.

U.S. Organoids and Spheroids Market Restraints:

- Variability and Heterogeneity: One of the primary restraints facing the U.S. organoids and spheroids market is the inherent variability and heterogeneity of these 3D cell culture models. Differences in culture conditions, cellular composition, and maturation levels can result in inconsistencies in experimental outcomes, posing challenges to reproducibility and data interpretation.

- Standardization Challenges: The lack of standardized protocols for organoid and spheroid culture represents a significant barrier to widespread adoption and commercialization. Variations in culture methods, growth factors, and substrate materials make it difficult to compare results across different studies and laboratories, hindering progress in the field.

- Ethical and Regulatory Considerations: The use of human-derived cells in organoid cultures raises ethical concerns regarding consent, privacy, and equitable access to biological materials. Additionally, regulatory frameworks governing the use of human tissues and genetic information impose compliance challenges and may limit the accessibility of certain cell sources for research purposes.

- Limited Scalability: Scalability remains a challenge for organoid and spheroid cultures, particularly in the context of large-scale drug screening and production applications. Culturing large numbers of organoids or spheroids in a reproducible and cost-effective manner is technically demanding and may require specialized equipment and expertise, constraining their utility for high-throughput applications.

Type Insights

In 2023, the spheroids segment emerged as the market leader, commanding a substantial share of 53%. This dominance is attributed to the versatile applications of spheroids, particularly in cancer research and drug screening, which propel the segment's growth. Spheroids, characterized as 3D cell aggregates simulating tissues and microtumors, provide a more faithful depiction of tumor behavior compared to conventional 2D cell cultures. Their pivotal role in exploring tumor cell formation, tumor microenvironments, drug efficacy screening, and stem cell investigations underscores their significance in biomedical research. These distinctive features are poised to drive further expansion of the spheroids segment throughout the forecast period.

Meanwhile, the organoids segment is forecasted to exhibit the highest compound annual growth rate (CAGR) from 2024 to 2033. Organoids represent more intricate structures designed to emulate the functionality of organs and tissues with greater fidelity. Their ability to mimic the physiological complexity of the tumor microenvironment makes them particularly valuable in personalized medicine, drug discovery, and tissue engineering endeavors. These emerging trends are expected to fuel market growth significantly in the years ahead.

Application Insights

In 2023, the developmental biology segment secured the largest market share, accounting for 31% of the total. This dominance is attributed to the increasing adoption of organoid and spheroid culture systems within the field of developmental biology. These advanced models offer valuable insights into tissue homeostasis, lineage specification, embryonic development, and organogenesis. They enable real-time observation and visualization of developmental processes, facilitating comparative studies between animal and human development. Such capabilities contribute significantly to the expansion of this segment.

On the other hand, the regenerative medicine segment is poised to experience the highest compound annual growth rate (CAGR) from 2024 to 2033. This growth is driven by the transplantation of organoids and spheroids derived from adult stem cells, which holds promise for replacing damaged or diseased tissues and organs. For example, Sugimoto et al. demonstrated successful transplantation of colonic epithelial organoids derived from human primary tissues to treat endogenous epithelial colon damage in mice. Such therapeutic applications are expected to propel the growth of this segment during the forecast period.

End-use Insights

In 2023, the biotechnology and pharmaceutical industries segment commanded a significant revenue share of 48%. These sectors focus on the development and commercialization of products related to organoids and spheroids, driven by their high demand in various applications. Additionally, many companies within these industries are implementing strategic initiatives such as collaborations and acquisitions, which are anticipated to further propel the growth of this segment.

Meanwhile, the academic and research institutes segment is expected to witness a robust compound annual growth rate (CAGR) of 24.05% during the forecast period. This growth is fueled by the increasing adoption of organoid models for research and development purposes within academic and research institutions. For example, according to an article published by PubMed, 3D tumor models, including spheroids derived from cervical cancer cell lines and patient-derived organoids, serve as valuable platforms for assessing novel therapies, particularly immunotherapies targeting tumor cells and modulating the tumor microenvironment. Such applications contribute to the expansion of this segment.

U.S. Organoids and Spheroids Market Key Companies

- Thermo Fisher Scientific, Inc

- Sigma-Aldrich Co. LLC

- 3D Biomatrix

- Corning Incorporated

- 3D Biotek LLC

- Perkin Elmer, Inc.

- Prellis Biologics

- Danaher

- Aragen Bioscience

- Cell Microsystems

Recent Developments

- In February 2024, Cell Microsystems forged a partnership with OMNI Life Science to introduce groundbreaking cellular analysis solutions to North America. This collaboration aims to unveil three pioneering products - CERO, CASY, and TIGR - in the United States and Canadian markets.

- Similarly, in February 2024, Danaher revealed a collaboration with Cincinnati Children's Hospital Medical Center with the goal of bolstering patient safety during early drug development stages. This joint effort focuses on developing innovative technologies centered around liver organoid technology for drug toxicity screening. The ultimate objective is to expedite the development of new therapies and potentially reduce substantial research costs.

U.S. Organoids and Spheroids Market Segmentation:

By Type

- By Type

- Organoids

- By Type

- Neural Organoids

- Hepatic Organoids

- Intestinal Organoids

- Other Organoids

- By Method

- General Submerged Method for Organoid Culture

- Crypt Organoid Culture Techniques

- Air Liquid Interface (ALI) Method for Organoid Culture

- Clonal Organoids from Lgr5+ Cells

- Brain and Retina Organoid Formation Protocol

- Other

- By Source

- Primary Tissues

- Stem Cells

- Spheroids

- By Type

- Multicellular tumor spheroids (MCTS)

- Neurospheres

- Mammospheres

- Hepatospheres

- Embryoid bodies

- By Method

- Micropatterned Plates

- Low Cell Attachment Plates

- Hanging Drop Method

- Others

- By Source

- Cell Line

- Primary Cell

- iPSCs Derived Cells

By Application

- Developmental Biology

- Personalized Medicine

- Regenerative Medicine

- Disease Pathology Studies

- Drug Toxicity & Efficacy Testing

By End-use

- Biotechnology and pharmaceutical industries

- Academic & Research Institutes

- Hospitals and Diagnostic centers

Frequently Asked Questions

The U.S. organoids and spheroids market size was reached at USD 0.31 billion in 2023 and it is projected to hit around USD 2.12 billion by 2033.

The U.S. organoids and spheroids market are growing at a compound annual growth rate (CAGR) of 21.17% from 2024 to 2033.

Key factors that are driving the U.S. organoids and spheroids market growth include rising need for solutions to reduce healthcare costs, increasing focus on patient-centric care, and strong government support.

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others