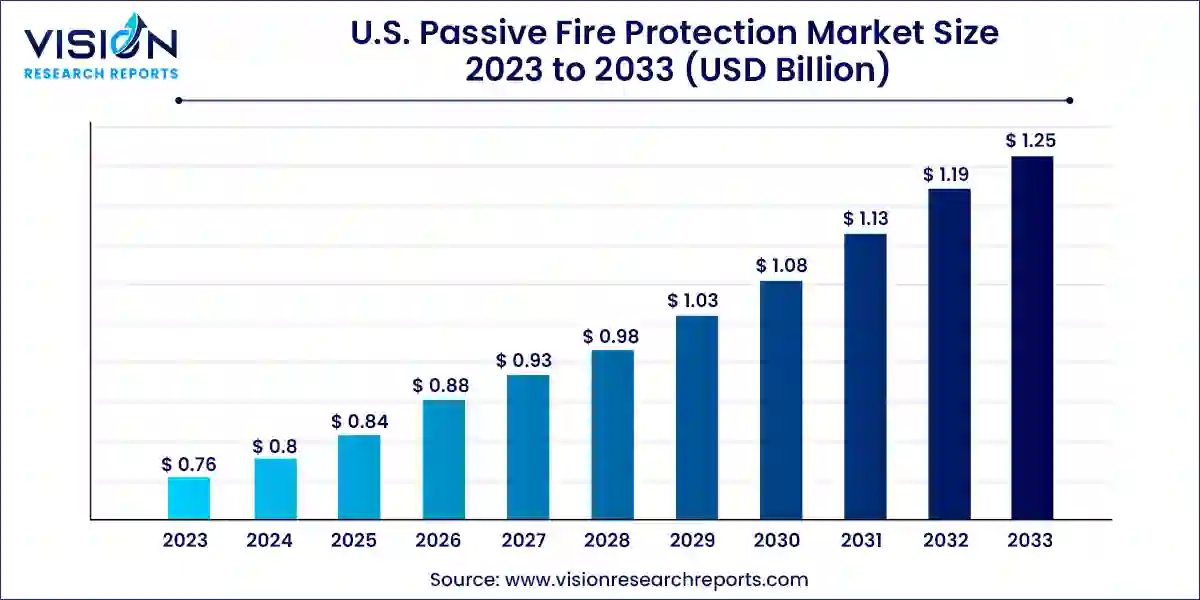

The U.S. passive fire protection market size was estimated at around USD 0.76 billion in 2023 and it is projected to hit around USD 1.25 billion by 2033, growing at a CAGR of 5.13% from 2024 to 2033.

The U.S. passive fire protection market plays a critical role in safeguarding buildings and structures against the devastating impact of fire incidents. Passive fire protection encompasses various materials, systems, and techniques designed to delay the spread of fire, smoke, and heat, thereby providing valuable time for evacuation and minimizing property damage.

The growth of the U.S. passive fire protection market is influenced by the stringent building codes and regulations mandate the integration of effective fire safety measures in residential, commercial, and industrial structures. This regulatory environment drives demand for passive fire protection systems, including fire-rated walls, doors, and floors, as well as firestopping materials and intumescent coatings. Secondly, increasing awareness among property owners, developers, and insurers about the importance of fire safety contributes to market expansion. The rising incidence of fire-related incidents underscores the necessity for robust fire protection solutions, further boosting market growth. Moreover, advancements in technology and materials continue to enhance the effectiveness and efficiency of passive fire protection systems, supporting innovation and adoption across the construction industry.

In 2023, the oil and gas sector dominated the market share and emerged as the fastest-growing application segment for passive fire protection. Given the sector's use of highly flammable materials, robust passive fire protection measures are essential to mitigate the risk of severe fires. Intumescent coatings are pivotal in providing fireproof coatings, fire-resistant barriers, and structural fireproofing, ensuring the safety of equipment, structures, and personnel. The critical role of passive fire protection in this sector is underscored by stringent safety regulations and the substantial value of assets at stake. Globally, increased exploration and production activities in oil and gas create significant opportunities for the application of intumescent coatings, driven by expansions in refineries, petrochemical projects, and related activities.

The construction segment is poised for substantial growth throughout the forecast period. The escalating complexity and scale of construction projects in the U.S. amplify the demand for passive fire protection solutions. Recognizing the importance of fire safety, construction firms are increasingly integrating passive fire protection systems during the early stages of project design and planning. This proactive approach not only mitigates fire risks but also enhances building resilience across residential, commercial, industrial, and institutional constructions.

In 2023, cementitious materials held the largest market share at 42% within the product segment. These materials are crucial in construction for containing and limiting fire spread. Applied through spraying or coating onto structural elements such as walls, columns, and steel beams, cementitious materials form a robust, insulating layer when exposed to high temperatures. They are particularly valued for their high-temperature resistance and durability, making them a preferred choice in both new construction and retrofit projects.

Intumescent coatings are projected to exhibit the fastest compound annual growth rate (CAGR) during the forecast period within the product segment. This type of fire-resistant material is gaining traction due to its exceptional performance characteristics. Intumescent coatings react to heat by swelling and forming a protective char layer, which effectively insulates and slows the temperature rise of underlying steel substrates. Compared to cementitious coatings, intumescent coatings offer superior fire protection properties while being thinner and significantly reducing structural and substrate weight. The building and construction industry represents the largest application area for intumescent coatings within the fire-resistant coatings market.

By Product

By Application

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Passive Fire Protection Market

5.1. COVID-19 Landscape: U.S. Passive Fire Protection Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Passive Fire Protection Market, By Product

8.1. U.S. Passive Fire Protection Market, by Product, 2024-2033

8.1.1. Cementitious Materials

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Intumescent Coatings

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Fireproofing Cladding

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Others

8.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 9. U.S. Passive Fire Protection Market, By Application

9.1. U.S. Passive Fire Protection Market, by Application, 2024-2033

9.1.1. Oil & Gas

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Construction

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Industrial Plants

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Warehousing

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Others

9.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 10.U.S. Passive Fire Protection Market, Regional Estimates and Trend Forecast

10.1. U.S.

10.1.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.2. Market Revenue and Forecast, by Application (2021-2033)

Chapter 11. Company Profiles

11.1. 3M

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Hilti Corporation

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Isolatek International

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Nullifire

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Roxul Inc.

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Sherwin-Williams

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. STI Firestop

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. TENMAT Inc.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Tremco Incorporated

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. USG Corporation

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others