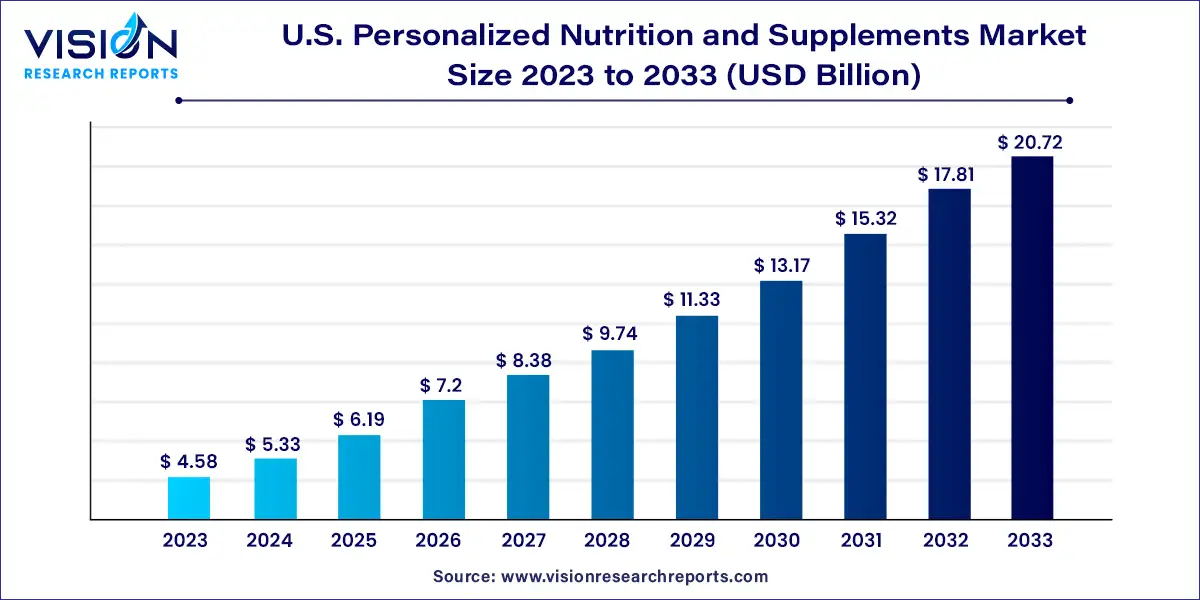

The U.S. personalized nutrition and supplements market size was estimated at around USD 4.58 billion in 2023 and it is projected to hit around USD 20.72 billion by 2033, growing at a CAGR of 16.29% from 2024 to 2033.

The U.S. personalized nutrition and supplements market is witnessing robust growth, driven by evolving consumer preferences towards health and wellness. Personalized nutrition caters to individualized dietary needs based on genetic makeup, lifestyle factors, and health goals.

The U.S. personalized nutrition and supplements market is experiencing significant growth due to the rising awareness among consumers about the importance of preventive healthcare and personalized wellness solutions. Advances in nutrigenomics have enabled the development of tailored nutritional supplements that align with individual genetic profiles, enhancing nutrient absorption and effectiveness. Integration of technology, such as digital health platforms and wearable devices, allows for personalized data insights, empowering consumers to make informed dietary choices. Favorable regulatory environments support innovation and ensure safety standards, driving product development in the market.

In 2023, the vitamins segment captured the largest market share at 27%, driven by widespread recognition of their essential role in maintaining overall health and preventing nutrient deficiencies. The accessibility, variety, and well-documented benefits of vitamins solidify their foundational position in personalized nutrition strategies within the U.S. market.

The herbal/botanic segment is poised to exhibit the highest compound annual growth rate (CAGR) of 17.18% during the forecast period. This surge is fueled by increasing consumer preferences for natural and plant-based ingredients. Heightened awareness of the health benefits associated with herbal and botanical supplements, coupled with a rising interest in holistic wellness approaches, continues to drive demand for products derived from herbs, roots, flowers, and other botanical sources.

In 2023, supermarkets/hypermarkets dominated with a market share of 44%. The segment benefits from high consumer foot traffic, positioning supermarkets as convenient one-stop destinations for grocery and supplement purchases. Collaborations between key players and supermarkets are enhancing sales opportunities, supported by a significant increase in consumer visits to supermarkets in recent years.

The online pharmacies & e-commerce segment is expected to experience the fastest CAGR over the forecast period. Factors contributing to this growth include competitive pricing, doorstep delivery convenience, and the ability to compare products across multiple platforms. Increasing participation of companies and startups in online retail is anticipated to further boost demand for personalized nutrition and supplements through digital channels.

In 2023, tablets/capsules led the market with a revenue share of 65%. Known for their safety, cost-effectiveness, and efficient nutrient delivery, tablets and capsules offer versatility in shape and size, catering to diverse consumer preferences. Their relatively lower production costs contribute to affordability, while quick disintegration ensures rapid nutrient absorption and effectiveness.

The liquid segment is forecasted to grow at a rapid CAGR of 17.54%, driven by the flexibility to customize nutrient dosages and the ease of consumption, particularly appealing to children and older adults. Liquid supplements provide faster absorption into the bloodstream, addressing the needs of consumers seeking efficient nutrient uptake.

The adults segment dominated in 2023 with a market share of 50% and is expected to grow at a rapid pace during the forecast period. Increasing consumer focus on health, wellness, and preventive care drives demand for personalized nutrition solutions tailored to address specific health concerns such as cardiovascular health, weight management, and overall well-being. High supplement usage among adults underscores their proactive approach to health maintenance.

The geriatric segment is anticipated to grow significantly, supported by advancements in technology such as DNA analysis and AI-driven dietary recommendations. These innovations enable highly personalized nutrition plans that consider genetic predispositions and health conditions, enhancing overall well-being among older adults and driving demand for specialized supplements tailored to their unique needs.

By Ingredient

By Dosage Form

By Age Group

By Distribution Channel

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Personalized Nutrition and Supplements Market

5.1. COVID-19 Landscape: U.S. Personalized Nutrition and Supplements Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Personalized Nutrition and Supplements Market, By Ingredient

8.1. U.S. Personalized Nutrition and Supplements Market, by Ingredient, 2024-2033

8.1.1. Proteins & Amino Acid

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Vitamins

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Minerals

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Probiotics

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Herbal/Botanic

8.1.5.1. Market Revenue and Forecast (2021-2033)

8.1.6. Others

8.1.6.1. Market Revenue and Forecast (2021-2033)

Chapter 9. U.S. Personalized Nutrition and Supplements Market, By Dosage Form

9.1. U.S. Personalized Nutrition and Supplements Market, by Dosage Form, 2024-2033

9.1.1. Tablets/Capsules

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Liquids

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Powders

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Others

9.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 10. U.S. Personalized Nutrition and Supplements Market, By Age Group

10.1. U.S. Personalized Nutrition and Supplements Market, by Age Group, 2024-2033

10.1.1. Pediatric

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Adults

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Geriatric

10.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 11. U.S. Personalized Nutrition and Supplements Market, By Distribution Channel

11.1. U.S. Personalized Nutrition and Supplements Market, by Distribution Channel, 2024-2033

11.1.1. Supermarkets/Hypermarkets

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Specialty Stores

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. Retail Pharmacies

11.1.3.1. Market Revenue and Forecast (2021-2033)

11.1.4. Online Pharmacies & E-commerce Site

11.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 12. U.S. Personalized Nutrition and Supplements Market, Regional Estimates and Trend Forecast

12.1. U.S.

12.1.1. Market Revenue and Forecast, by Ingredient (2021-2033)

12.1.2. Market Revenue and Forecast, by Dosage Form (2021-2033)

12.1.3. Market Revenue and Forecast, by Age Group (2021-2033)

12.1.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

Chapter 13. Company Profiles

13.1. Viome Life Sciences, Inc.

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. DSM Nutritional Products AG

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Thorne

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. HUM Nutrition, Inc.

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. GenoPalate Inc

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Pharmavite

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. GNC Holdings, LLC

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. The Vitamin Shoppe

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Nestlé Health Science (Nestlé)

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Baze Labs

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others