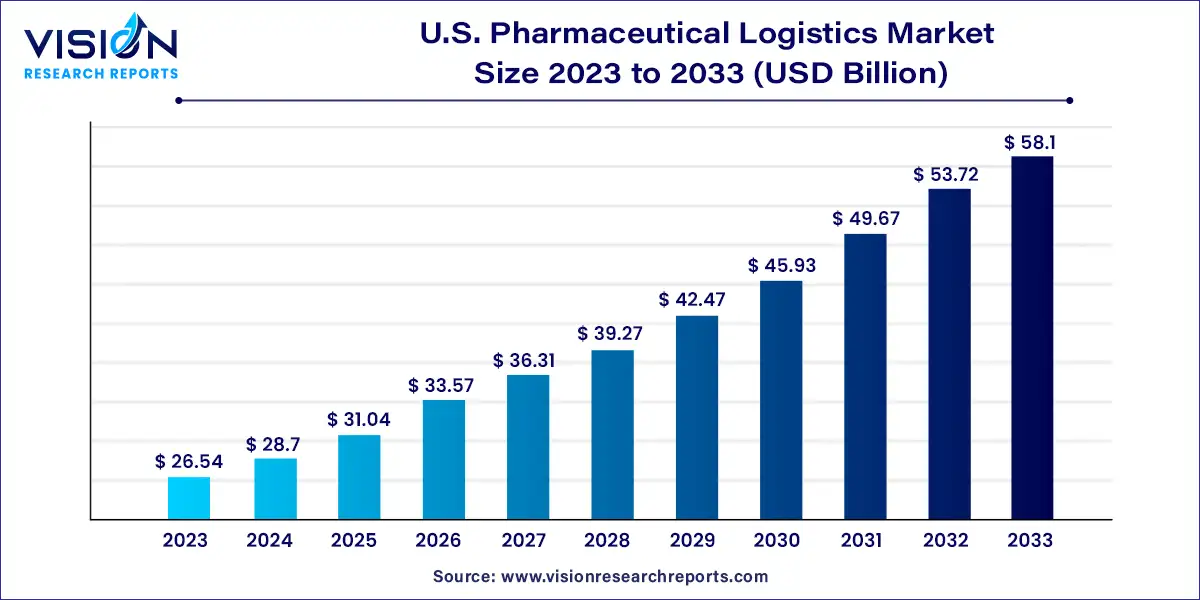

The U.S. pharmaceutical logistics market size was estimated at USD 26.54 billion in 2023 and it is expected to surpass around USD 58.1 billion by 2033, poised to grow at a CAGR of 8.15% from 2024 to 2033.

In the pharmaceutical logistics, the United States stands as a crucial hub, navigating the intricate pathways of supply chains to ensure the seamless distribution of essential medications and healthcare products. The landscape of pharmaceutical logistics in the U.S. is dynamic, shaped by technological advancements, regulatory frameworks, and evolving consumer demands.

The growth trajectory of the U.S. pharmaceutical logistics market is propelled by an advancements in technology, including the integration of IoT sensors, blockchain, and data analytics, enhance efficiency, visibility, and transparency across the supply chain, driving productivity and minimizing risks. Secondly, the increasing demand for pharmaceutical products, fueled by demographic trends such as aging populations and rising chronic diseases, amplifies the need for robust logistics infrastructure to ensure timely and reliable delivery. Furthermore, stringent regulatory requirements imposed by agencies like the FDA and DEA necessitate compliance-driven practices, driving investments in quality assurance, security, and adherence to safety standards. Additionally, the emergence of new healthcare delivery models, such as telemedicine and direct-to-patient services, reshapes distribution channels, prompting adaptations in logistics strategies to accommodate evolving consumer preferences.

The non-cold chain segment dominated the revenue share, accounting for 66% in 2023. This segment is expected to maintain its dominance in the forthcoming years, primarily driven by the growing demand for non-cold chain pharmaceutical medicines and other related products

The cold chain logistics segment is expected to experience the most rapid compound annual growth rate (CAGR) throughout the forecast period, driven by heightened demand for temperature-controlled products such as vaccines. These products necessitate precise temperature-controlled logistics services to uphold their effectiveness, thus fueling the segment's rapid expansion. Additionally, stringent regulations mandating accurate temperature maintenance for temperature-sensitive drugs and pharmaceutical products are poised to further bolster growth within this segment. The increasing adoption of telematics within cold chain pharmaceutical logistics is facilitating companies in enhancing connectivity, safety, and efficiency in transporting cargoes.

In 2023, the storage segment emerged as the dominant force in the market, commanding a notable revenue share of 61%. The surge in demand for both generic and branded pharmaceutical products has spurred the expansion of storage facilities. These facilities play a pivotal role in preserving the efficacy of products post-production and facilitating their distribution through various channels to distributors and retailers. Furthermore, the increasing need for temperature-sensitive storage facilities to house such drugs during logistics operations is propelling the growth of this segment. This trend is expected to continue driving segmental growth in the forthcoming years. Additionally, shifting consumer lifestyles and dietary patterns are contributing to the rising demand for temperature-sensitive protein and nutritional supplements, further fueling the demand for storage facilities throughout the forecast period.

Meanwhile, the monitoring components segment is poised to witness the fastest Compound Annual Growth Rate (CAGR) from 2024 to 2033. This accelerated growth is attributed to the growing necessity to ensure the efficiency, integrity, and safety of cold chain products. Within the monitoring components segment, there are two subsegments: hardware and software. The transportation segment is forecasted to experience significant momentum in growth during the forecast period. This segment encompasses three subsegments: sea freight logistics, air freight logistics, and overland logistics. The increasing adoption of sea-based pharmaceutical logistics is a key driver of market growth, as sea freight logistics services are adept at handling sensitive large molecule biologics and personalized medicines.

By Type

By Component

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others