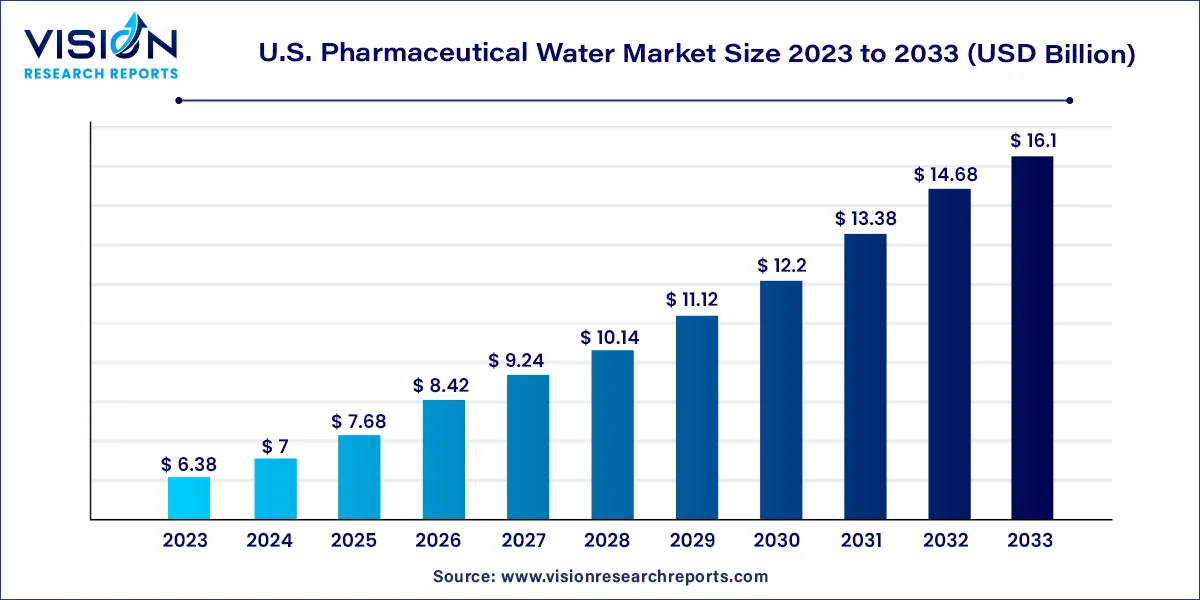

The U.S. pharmaceutical water market size was estimated at around USD 6.38 billion in 2023 and it is projected to hit around USD 16.1 billion by 2033, growing at a CAGR of 9.7% from 2024 to 2033.

The U.S. pharmaceutical water market is an essential component of the broader healthcare and pharmaceutical industry. Water is a critical raw material used in the production of pharmaceuticals, including oral medications, injectables, vaccines, and various topical products. The quality of water used in the production process is highly regulated, as it directly impacts the safety, efficacy, and purity of pharmaceutical products. As such, the market for pharmaceutical-grade water is characterized by stringent quality standards and evolving regulatory frameworks, ensuring the highest levels of safety and compliance.

The growth of the U.S. pharmaceutical water market is driven by several key factors that are closely tied to advancements in the healthcare and pharmaceutical sectors. One of the primary drivers is the increasing demand for high-quality pharmaceutical products, particularly injectables, vaccines, and biologics, which require ultrapure water for production. As the U.S. pharmaceutical industry continues to evolve, there is a growing emphasis on stringent regulatory standards for water quality, ensuring that manufacturers invest in advanced water purification technologies. Additionally, the rise of chronic diseases and the aging population have fueled the demand for injectable medications, further amplifying the need for Water for Injection (WFI). Moreover, the expansion of biotechnology and the development of personalized medicine also contribute to the market’s growth, as these innovative therapies often rely on high-purity water in their manufacturing processes.

Global Market Size

Largest Segment

Fastest Growth

Growth Rate

In 2023, the Water for Injection (WFI) segment emerged as the dominant category in the U.S. pharmaceutical water market. WFI is a critical solvent used in the formulation of pharmaceutical products, particularly for injectable medications. The segment's growth is primarily driven by increasing regulatory requirements, the rising demand for injectables, and the essential role WFI plays in ensuring product safety and efficacy. Additionally, the expanding production of vaccines and biologics to meet the rising demand for high-quality products has further accelerated the adoption of WFI in pharmaceutical manufacturing.

The High-Performance Liquid Chromatography (HPLC) segment, on the other hand, is recognized as the fastest-growing segment in the market. The growing demand for solutions to manage complex drug formulations and the need for stringent water quality control are expected to drive HPLC’s expansion during the forecast period. HPLC is particularly valuable in detecting contamination and quantifying impurities in pharmaceutical-grade water. Additionally, the increasing emphasis on meeting U.S. Pharmacopeia (USP) and FDA regulatory standards is driving the integration of HPLC systems into water purification processes within the pharmaceutical industry.

In terms of application, the pharmaceutical and biotechnology companies segment dominated the U.S. pharmaceutical water market. This is largely due to the growing need for large-scale production, adherence to strict water quality standards, and the rising demand for biologics, injectables, and vaccines. The increasing focus on sustainable water management solutions and efforts to enhance water conservation and efficiency in production processes are also contributing to the rising demand within pharmaceutical and biotechnology sectors. These trends are pushing companies to adopt advanced water purification systems to meet evolving regulatory requirements and ensure high-quality standards in their products.

By Type

By Application

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Pharmaceutical Water Market

5.1. COVID-19 Landscape: U.S. Pharmaceutical Water Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Pharmaceutical Water Market, By Type

8.1. U.S. Pharmaceutical Water Market, by Type, 2024-2033

8.1.1. Purified Water (PW)

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Water for Injection (WFI)

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Sterile Water for Injection (SWFI)

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Bacteriostatic Water for Injection

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Water for Hemodialysis

8.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 9. U.S. Pharmaceutical Water Market, By Application

9.1. U.S. Pharmaceutical Water Market, by Application, 2024-2033

9.1.1. Injectables

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Oral Medications

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Topical Products

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Biopharmaceuticals

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Vaccines and Blood Products

9.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 10. U.S. Pharmaceutical Water Market, Regional Estimates and Trend Forecast

10.1. U.S.

10.1.1. Market Revenue and Forecast, by Type (2021-2033)

10.1.2. Market Revenue and Forecast, by Application (2021-2033)

Chapter 11. Company Profiles

11.1. Baxter International, Inc.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Thermo Fisher Scientific, Inc

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Cytiva (Danaher)

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Pfizer, Inc.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Intermountain Life Sciences

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. CovaChem, LLC

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. General Electric

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Aqua Solutions

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Evoqua Water Technologies

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Nexus Pharmaceuticals

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others