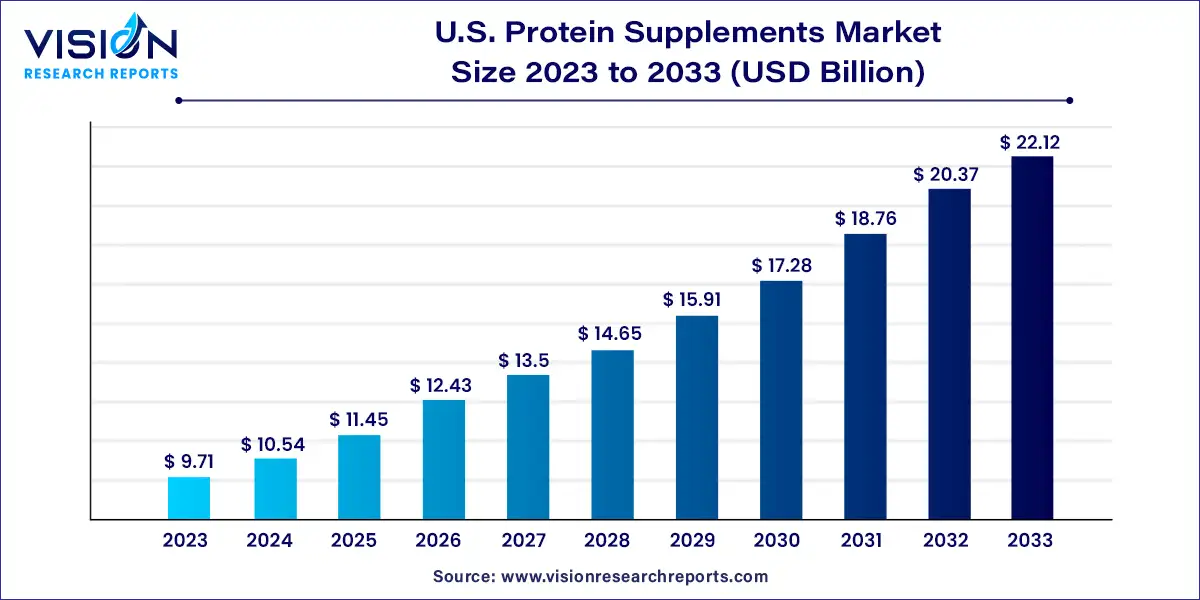

The U.S. protein supplements market size was estimated at USD 9.71 billion in 2023 and it is expected to surpass around USD 22.12 billion by 2033, poised to grow at a CAGR of 8.58% from 2024 to 2033. The U.S. protein supplements market has experienced significant growth over the past decade, driven by increasing health consciousness, a surge in fitness activities, and rising demand for dietary supplements. This overview provides insights into the market dynamics, key trends, and future prospects of protein supplements in the United States.

The U.S. protein supplements market is experiencing significant growth due to the rising health and fitness awareness is driving demand as consumers seek to enhance muscle growth, recovery, and overall well-being. The expanding fitness industry and increasing popularity of personalized nutrition further fuel this trend by offering tailored protein solutions. Additionally, the aging population is turning to protein supplements to maintain muscle mass and strength, while innovations in product formulations and the availability of convenient, on-the-go options are attracting a broader audience. The growing preference for plant-based proteins and the expansion of e-commerce platforms also contribute to the market’s robust expansion.

| Report Coverage | Details |

| Market Size in 2023 | USD 9.71 billion |

| Revenue Forecast by 2033 | USD 22.12 billion |

| Growth rate from 2024 to 2033 | CAGR of 7.86% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

In 2023, the animal-based segment commanded the largest market share at 61%. Proteins are essential for health, balancing acid-base fluids and aiding metabolism by regulating antibody synthesis. These supplements are primarily marketed to athletes and active individuals for muscle growth and energy management. Additionally, they are promoted for weight loss due to their high-protein, low-carbohydrate content.

Animal proteins are regarded as the highest quality sources, providing all essential amino acids. Consequently, animal-based protein supplements dominate the U.S. market, accounting for 65.09% of revenue. U.S. consumers focus on fat loss, muscle growth, and endurance, leading to increased popularity of animal-based protein supplements like whey, fish, and egg proteins. This growing demand from fitness enthusiasts is expected to drive further growth in this segment.

Conversely, the plant-based protein segment is projected to grow at the fastest CAGR of 8.74% from 2024 to 2033. Plant-based proteins support muscle and tissue health with fewer side effects and higher bioavailability compared to animal-based proteins. A 2020 study by Nutrition Business Journal highlighted that organic plant-based proteins are effective for weight loss and improving gut health. The rising lactose-intolerant population and increasing veganism in the U.S. are contributing to the growth of plant-based protein supplements.

Protein powder held a dominant 46% market share during the forecast period. Derived from sources like egg, whey, soy, pea, and casein, protein powders are enriched with vitamins, fats, thickeners, minerals, and fibers. They support muscle development, weight management, tissue repair, cholesterol levels, immune function, and enzyme production. According to the U.S. Department of Agriculture's Food and Nutrition Board, the average protein requirement is about 0.66 grams per kilogram of body weight daily.

Organic protein powders are gaining popularity due to the demand for clean-label products with fewer additives. For instance, Ancient Brands, LLC launched Plant Protein+ in June 2020, a USDA-certified organic protein powder made from seeds, botanicals, mushrooms, and adaptogens.

The RTD (Ready-to-Drink) segment is expected to grow at CAGR of 9.54% from 2024 to 2033. RTD protein beverages are convenient sources of protein, offering benefits like anti-aging properties and fat loss. The increased focus on healthy aging and the role of protein in diets are fueling this growth. The rising vegetarian population is also driving demand for plant-based RTD beverages, with companies like PepsiCo launching new products such as the EVOLVE protein shakes in March 2021.

In 2023, the functional food segment led the market with a 54% share. Growing consumer interest in health and diet has increased demand for functional foods that help manage health conditions like obesity, cardiovascular diseases, and diabetes. Advances in technologies such as enzyme technology, encapsulation, and vacuum impregnation are driving innovations in functional foods.

The sports nutrition segment is expected to grow at a CAGR of 9.44%. Bodybuilders and athletes are increasingly aware of the benefits of sports nutrition products, leading to market expansion. Retailers are enhancing the adoption of sports nutrition products, with brands like MusclePharm launching new whey protein drinks in summer 2023.

Online stores held the largest share of 62% in 2023. The COVID-19 pandemic accelerated the shift from offline to online purchases. Consumers, now more accustomed to online shopping, prefer exploring various e-commerce platforms for protein supplements. Online channels are popular among millennials and Gen X, making them crucial for market success.

Supermarkets are projected to grow at a CAGR of 9.86% during the forecast period. They conduct consumer sentiment analyses to align product offerings with customer preferences and offer a wide range of protein supplements. This convenience, along with the presence of reputable brands, builds customer trust and encourages repeat purchases.

By Source

By Product

By Application

By Distribution Channel

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Protein Supplements Market

5.1. COVID-19 Landscape: U.S. Protein Supplements Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Protein Supplements Market, By Source

8.1. U.S. Protein Supplements Market, by Source, 2024-2033

8.1.1. Animal-based

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Plant-based

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. U.S. Protein Supplements Market, By Product

9.1. U.S. Protein Supplements Market, by Product, 2024-2033

9.1.1. Protein Powders

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Protein Bars

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. RTD

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Others

9.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 10. U.S. Protein Supplements Market, By Application

10.1. U.S. Protein Supplements Market, by Application, 2024-2033

10.1.1. Sports Nutrition

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Functional Foods

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. U.S. Protein Supplements Market, By Distribution Channel

11.1. U.S. Protein Supplements Market, by Distribution Channel, 2024-2033

11.1.1. Supermarkets

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Online Stores

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. DTC

11.1.3.1. Market Revenue and Forecast (2021-2033)

11.1.4. Others

11.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 12. U.S. Protein Supplements Market, Regional Estimates and Trend Forecast

12.1. U.S.

12.1.1. Market Revenue and Forecast, by Source (2021-2033)

12.1.2. Market Revenue and Forecast, by Product (2021-2033)

12.1.3. Market Revenue and Forecast, by Application (2021-2033)

12.1.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

Chapter 13. Company Profiles

13.1. Glanbia Plc

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. MusclePharm

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Abbott

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. CytoSport Inc.

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. QuestNutrition LLC

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Iovate Health Sciences International Inc

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. The Bountiful Company

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. AMCO Proteins

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Now Foods

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Transparent Labs

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others