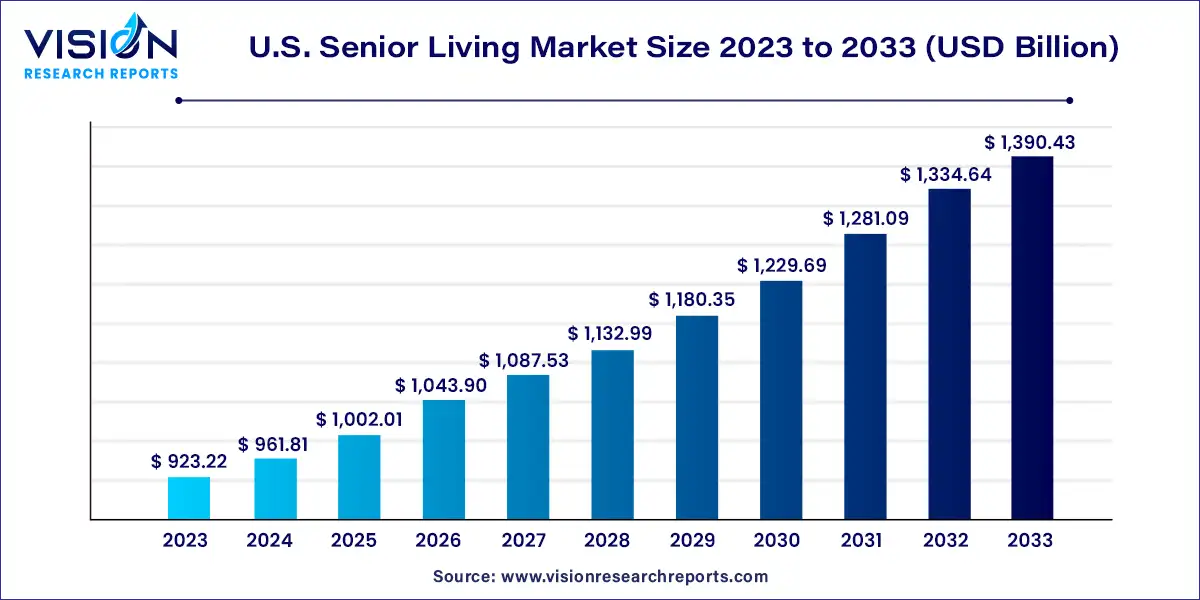

The U.S. senior living market size was estimated at around USD 923.22 billion in 2023 and it is projected to hit around USD 1,390.43 billion by 2033, growing at a CAGR of 4.18% from 2024 to 2033. The U.S. senior living market encompasses a diverse range of housing, healthcare, and personal care services tailored to meet the needs of older adults. As the baby boomer generation ages, this market segment has witnessed significant growth and transformation, driven by evolving consumer preferences and healthcare advancements.

The growth of the U.S. senior living market is propelled by the aging demographic, particularly the significant increase in adults aged 65 and older, drives demand for senior housing and care services. This demographic shift creates a robust market for various types of senior living options, from independent living to skilled nursing facilities, tailored to meet diverse healthcare and lifestyle needs. Secondly, advancements in healthcare and technology enhance the quality of care and enable aging individuals to maintain independence longer, supporting the expansion of senior living communities. Additionally, evolving consumer preferences towards integrated wellness programs, personalized care services, and community-based living foster innovation and investment in the sector.

The active adult (55+) communities/independent living segment dominated with a substantial 67% share in 2023. This growth is fueled by a rising number of baby boomers opting for vibrant, maintenance-free lifestyles in age-restricted communities. Key drivers include the desire for social engagement, access to recreational amenities, and the appeal of downsizing to more manageable living spaces. Additionally, the increasing availability of health and wellness programs tailored to active seniors continues to drive demand in this market segment. For example, Del Webb, a leading builder of active adult communities, recently announced the upcoming launch of its newest community, Del Webb at Legacy Hills in the Dallas area, set to open later this summer.

The memory care segment is poised for rapid growth in the coming years, driven by the escalating prevalence of Alzheimer’s disease and related dementias among older adults. As of 2024, nearly 7 million Americans have Alzheimer's, with the majority aged 65 and older. Key growth factors include heightened awareness and diagnosis of memory-related conditions, advancements in specialized care techniques, and an increasing emphasis on creating secure and supportive environments for residents. Families seeking specialized care options and ongoing improvements in facility design and technology tailored to memory care are also contributing to the rising demand for these specialized services.

The Southeast U.S. senior living market led the overall industry, capturing a significant 28% revenue share in 2023, driven by an aging population and heightened demand for specialized healthcare services. There's a growing trend of integrating senior living options into healthcare facilities to offer comprehensive care solutions. For instance, Selectis Health, Inc. recently announced agreements to sell four skilled nursing facilities in Georgia, enhancing their service offerings through strategic partnerships. This collaborative approach aims to meet diverse senior care needs while ensuring access to quality healthcare and supportive living environments.

Meanwhile, the Southwest U.S. is experiencing the fastest market growth, fueled by a rapidly aging population and increasing demand for specialized care services. The region's favorable climate and lifestyle amenities attract retirees, leading to a burgeoning market for retirement communities and assisted living facilities. Significant investments in healthcare infrastructure and robust support for senior care initiatives further enhance service quality and accessibility, creating a dynamic market landscape focused on meeting the diverse needs of aging residents.

By Facility

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Senior Living Market

5.1. COVID-19 Landscape: U.S. Senior Living Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Senior Living Market, By Facility

8.1.U.S. Senior Living Market, by Facility Type, 2024-2033

8.1.1. Skilled Nursing Facility

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Assisted Living Facility

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Active Adult (55+) Communities/Independent Living

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Memory Care

8.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 9. U.S. Senior Living Market, Regional Estimates and Trend Forecast

9.1. U.S.

9.1.1. Market Revenue and Forecast, by Facility (2021-2033)

Chapter 10. Company Profiles

10.1. Genesis Healthcare

10.1.1. Company Overview

10.1.2. Product Offerings

10.1.3. Financial Performance

10.1.4. Recent Initiatives

10.2. Brookdale Senior Living Solutions

10.2.1. Company Overview

10.2.2. Product Offerings

10.2.3. Financial Performance

10.2.4. Recent Initiatives

10.3. Lincare, Inc.

10.3.1. Company Overview

10.3.2. Product Offerings

10.3.3. Financial Performance

10.3.4. Recent Initiatives

10.4. The Ensign Group, Inc

10.4.1. Company Overview

10.4.2. Product Offerings

10.4.3. Financial Performance

10.4.4. Recent Initiatives

10.5. Extendicare

10.5.1. Company Overview

10.5.2. Product Offerings

10.5.3. Financial Performance

10.5.4. Recent Initiatives

10.6. Sunrise Senior Living, LLC

10.6.1. Company Overview

10.6.2. Product Offerings

10.6.3. Financial Performance

10.6.4. Recent Initiatives

10.7. Life Senior Living Facilities

10.7.1. Company Overview

10.7.2. Product Offerings

10.7.3. Financial Performance

10.7.4. Recent Initiatives

10.8. Golden Living Centers

10.8.1. Company Overview

10.8.2. Product Offerings

10.8.3. Financial Performance

10.8.4. Recent Initiatives

10.9. LifeCare Centers of America Corporate

10.9.1. Company Overview

10.9.2. Product Offerings

10.9.3. Financial Performance

10.9.4. Recent Initiatives

10.10. Peninsula behavioral health

10.10.1. Company Overview

10.10.2. Product Offerings

10.10.3. Financial Performance

10.10.4. Recent Initiatives

Chapter 11. Research Methodology

11.1. Primary Research

11.2. Secondary Research

11.3. Assumptions

Chapter 12. Appendix

12.1. About Us

12.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others