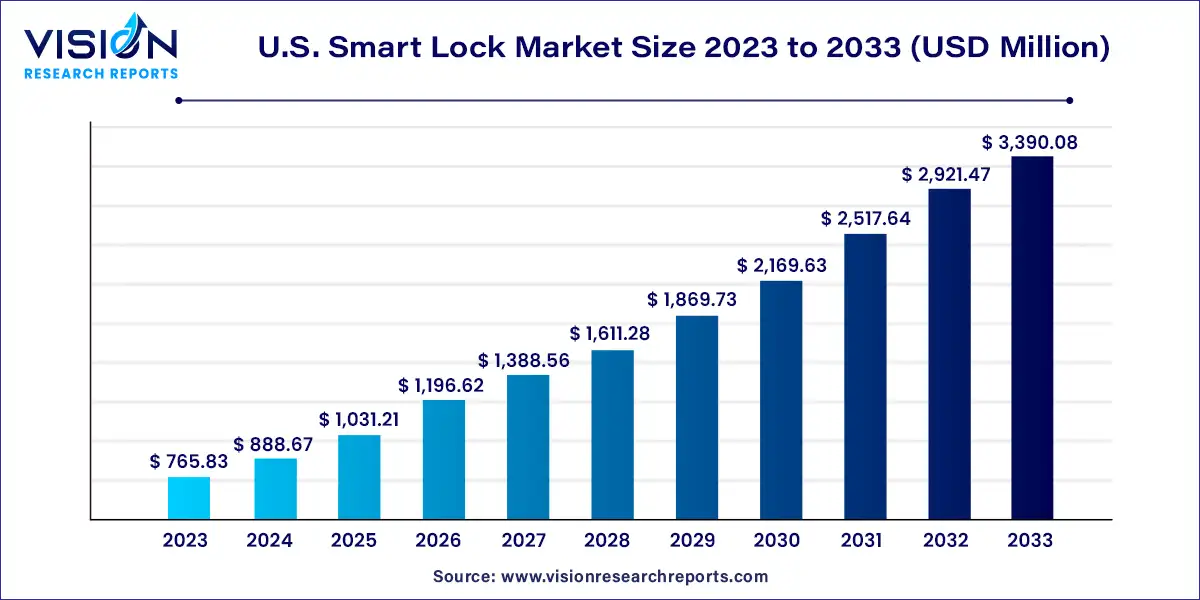

The U.S. smart lock market size was estimated at USD 765.83 million in 2023 and it is expected to surpass around USD 3,390.08 million by 2033, poised to grow at a CAGR of 16.04% from 2024 to 2033. The smart lock market in the United States has seen substantial growth driven by advancements in technology, increasing adoption of smart home devices, and a rising demand for enhanced security solutions.

The U.S. smart lock market is witnessing robust growth due to the technological advancements in wireless communication, such as Bluetooth and Wi-Fi, have made smart locks more reliable and user-friendly. Increasing security concerns, driven by the rise in burglary rates, are prompting consumers to seek advanced security solutions, further propelling market demand. The proliferation of smart home devices and ecosystems is another significant driver, as smart locks seamlessly integrate with other smart home technologies, offering enhanced convenience and security. Additionally, the growing awareness and adoption of IoT devices in residential and commercial settings are contributing to the market's expansion.

In 2023, the residential segment held a dominant revenue share of 62%. This dominance is attributed to the increasing adoption of smart home technologies and the surge in restoration and new construction projects across various sectors. The growing affordability of advanced security solutions, including smart doors, motion detectors, and remote locking/unlocking systems, is expected to further drive market expansion.

The hospitality segment is projected to experience significant growth, with a CAGR of 20.13% from 2024 to 2033. This growth is driven by innovative solutions offered by leading market players tailored to the hospitality industry, enhancing security and convenience for guests and staff alike.

The deadbolt segment commanded the largest revenue share of 45% in 2023. This can be attributed to the widespread adoption of smart home technology, which favors deadbolts for their robust and user-friendly locking mechanisms. Their high durability, low installation costs, and strong resistance to forced entry contribute to their popularity.

The lever handles segment is expected to grow at a CAGR of 18.83% from 2024 to 2033. The ongoing modernization efforts in the hospitality sector, aimed at enhancing security for tourists, are set to drive this growth. Smart lever handles are increasingly being used in commercial settings on interior doors. The push-down style handle, which simplifies the locking/unlocking process compared to traditional knobs that require holding and turning, is anticipated to further boost the segment's growth.

By Type

By Application

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Smart Lock Market

5.1. COVID-19 Landscape: U.S. Smart Lock Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Smart Lock Market, By Type

8.1. U.S. Smart Lock Market, by Type, 2024-2033

8.1.1. Deadbolt

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Level Handlers

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Padlock

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Others

8.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 9. U.S. Smart Lock Market, By Application

9.1. U.S. Smart Lock Market, by Application, 2024-2033

9.1.1. Residential

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Hospitality

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Enterprise

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Critical Infrastructure

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Others

9.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 10. U.S. Smart Lock Market, Regional Estimates and Trend Forecast

10.1. U.S.

10.1.1. Market Revenue and Forecast, by Type (2021-2033)

10.1.2. Market Revenue and Forecast, by Application (2021-2033)

Chapter 11. Company Profiles

11.1. August Home, Inc. (ASSA ABLOY)

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. HavenLock, Inc.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Kwikset (Spectrum Brands Holdings, Inc.)

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Schlage (Allegion Plc

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Sentrilock, LLC

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. UniKey Technologies, Inc.

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Yale Locks (ASSA ABLOY)

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Goji

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Onity Inc. (Carrier Global Corporation)

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Honeywell International Inc.

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others