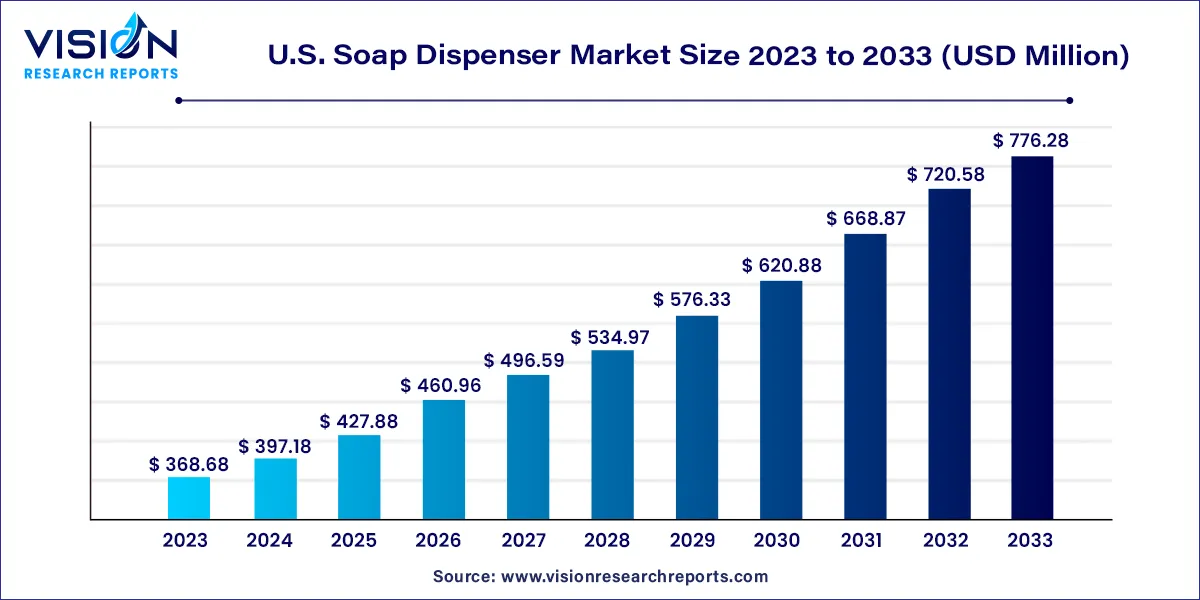

The U.S. soap dispenser market size was valued at USD 368.68 million in 2023 and it is predicted to surpass around USD 776.28 million by 2033 with a CAGR of 7.73% from 2024 to 2033. The U.S. soap dispenser market is a dynamic sector within the broader sanitary products industry, characterized by diverse applications across residential, commercial, and industrial environments. Soap dispensers are essential for maintaining hygiene standards and convenience, driving demand across various settings.

The U.S. soap dispenser market is experiencing robust growth driven by an increasing awareness of hygiene and the need to reduce the spread of infections have significantly boosted demand for soap dispensers in both public and private sectors. The shift towards touchless and automated soap dispensers, driven by technological advancements, is enhancing user convenience and reducing cross-contamination. Moreover, stringent health regulations and hygiene standards in commercial and healthcare settings are accelerating market growth. The rising adoption of smart dispensers with features such as real-time monitoring and refill alerts is also contributing to the market’s expansion. Additionally, the growth of the construction and hospitality industries, coupled with a heightened focus on maintaining sanitary conditions, further supports the upward trajectory of the soap dispenser market in the U.S.

In 2023, manual soap dispensers led the market, capturing over 57% of the revenue share. This dominance is attributed to growing consumer awareness about hygiene and safety. The affordability and wide range of options available for manual soap dispensers contribute to their popularity. Additionally, since manual dispensers do not require batteries, their maintenance costs are lower, enhancing their appeal to consumers. They are particularly popular in small-scale restaurants, pubs, commercial establishments, and corporate offices.

Conversely, automatic soap dispensers are expected to experience the highest growth rate, with a projected CAGR of approximately 8.44% from 2023 to 2033. Their integration in modern commercial restrooms is becoming standard due to their role in promoting health and hygiene. Automatic dispensers help minimize germ transfer, reducing the spread of viruses and illnesses in restrooms. Their ability to dispense a consistent amount of soap also aids in resource conservation by reducing waste.

In 2023, commercial soap dispensers accounted for over 26% of the market's revenue. The increased consumer spending and higher foot traffic in commercial spaces like malls, restaurants, and theaters drive the demand for well-equipped bathrooms, boosting the adoption of soap dispensers. For instance, U.S. Census Bureau data indicates that eating and drinking establishments achieved sales of USD 88.0 billion in May 2023, with a notable 8.0% increase in consumer spending at restaurants compared to the previous year.

The residential soap dispenser segment is anticipated to grow at the fastest rate, with a projected CAGR of 8.43% during the forecast period. This growth is driven by rising housing costs and mortgage rates, leading homeowners to invest in home remodeling and improvements. The 2023 U.S. Houzz Bathroom Trends report highlights a nearly 13% increase in median spending on primary bathroom projects, reaching USD 9,000, with the top 10% of projects seeing a 17% increase to USD 35,000 or more. Homeowners are increasingly investing in upgrades that enhance their living quality, driving demand for soap dispensers in the residential market.

By Product

By Application

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Soap Dispenser Market

5.1. COVID-19 Landscape: U.S. Soap Dispenser Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Soap Dispenser Market, By Product

8.1. U.S. Soap Dispenser Market, by Product, 2024-2033

8.1.1. Automatic

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Manual

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. U.S. Soap Dispenser Market, By Application

9.1. U.S. Soap Dispenser Market, by Application, 2024-2033

9.1.1. Residential

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Corporate Offices

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Commercials

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Educational Institutions

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Healthcare

9.1.5.1. Market Revenue and Forecast (2021-2033)

9.1.6. Public Places

9.1.6.1. Market Revenue and Forecast (2021-2033)

9.1.7. Transportation

9.1.7.1. Market Revenue and Forecast (2021-2033)

Chapter 10. U.S. Soap Dispenser Market, Regional Estimates and Trend Forecast

10.1. U.S.

10.1.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.2. Market Revenue and Forecast, by Application (2021-2033)

Chapter 11. Company Profiles

11.1. Kohler Co.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. ASI American Specialties, Inc.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. simplehuman

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Bobrick Washroom Equipment, Inc.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Bradley Corporation

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Georgia-Pacific LLC

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. GOJO Industries, Inc.

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Sloan Valve Company

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Safetec of America, Inc.

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. SC Johnson Professional

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others