U.S. Spatial Genomics & Transcriptomics Market Size and Growth

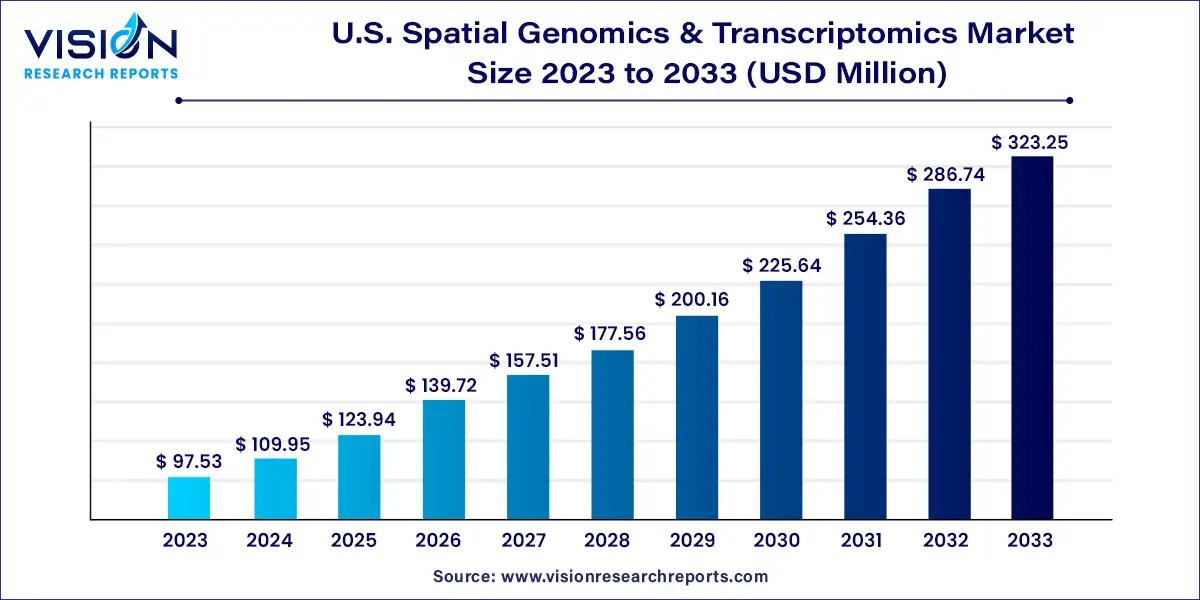

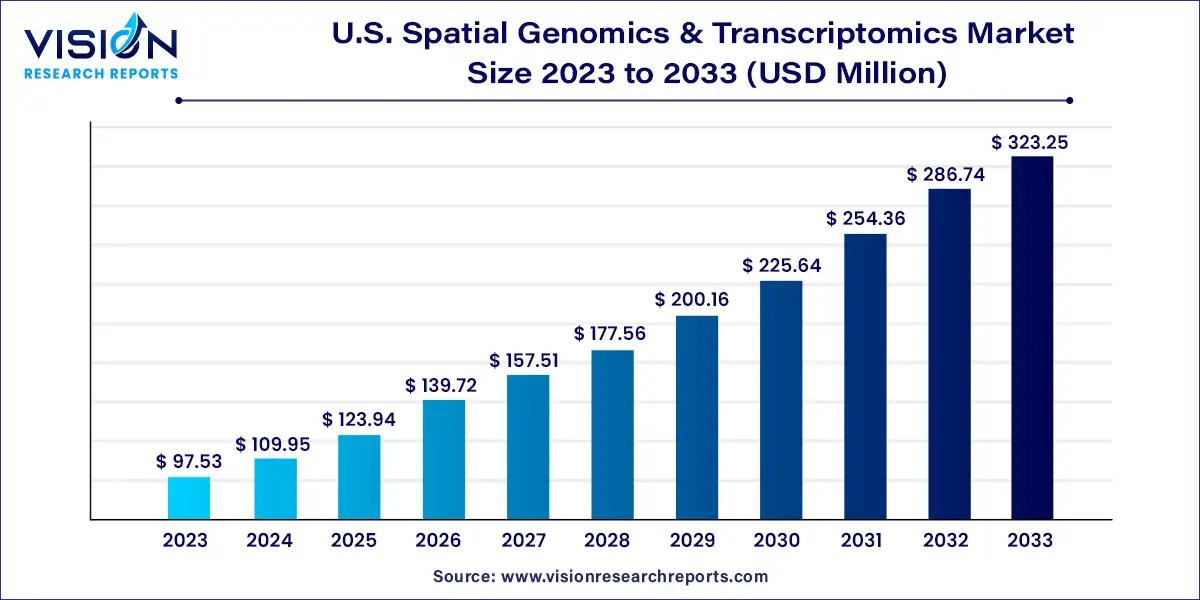

The U.S. spatial genomics & transcriptomics market size was estimated at USD 97.53 million in 2023 and it is expected to surpass around USD 323.25 million by 2033, poised to grow at a CAGR of 12.73% from 2024 to 2033.

Key Pointers

- By Technology, the consumables product segment held the largest revenue share of 54% in 2023.

- By Technology, the software segment is expected to expand at the highest CAGR from 2024 to 2033.

- By Product, the spatial transcriptomics segment generated the maximum market share of 80% in 2023.

- By End-use, the translational research segment captured the maximum market share of 61% in 2023.

- By End-use, the academic customer segment is estimated to expand the fastest CAGR of 12.04% from 2024 to 2033.

U.S. Spatial Genomics & Transcriptomics Market Overview

The U.S. spatial genomics and transcriptomics market is experiencing significant growth and innovation, fueled by advancements in technology and a growing demand for precise spatial information in biological research and clinical applications.

U.S. Spatial Genomics & Transcriptomics Market Growth Factors

The growth of the U.S. spatial genomics and transcriptomics market is propelled by an advancement in technology, including spatial transcriptomics and spatially resolved transcriptomics, are driving innovation and expanding the capabilities of spatial analysis techniques. Secondly, increasing investments in genomic research, both in academia and industry, are fueling the adoption of spatial omics technologies for studying complex biological systems. Thirdly, the integration of spatial genomics and transcriptomics into clinical applications, such as cancer research and personalized medicine, is creating new avenues for market expansion. Moreover, strategic collaborations between biotechnology companies, research institutions, and healthcare organizations are fostering innovation and accelerating market penetration. Finally, evolving regulatory frameworks and guidelines are shaping industry practices and ensuring compliance with standards in genomic data privacy and sample handling.

U.S. Spatial Genomics & Transcriptomics Market Trends:

- Convergence with Artificial Intelligence (AI) and Machine Learning: The integration of spatial omics with AI and machine learning algorithms is enhancing data analysis capabilities, enabling deeper insights into spatial gene expression patterns and cellular interactions.

- Standardization of Protocols and Workflows: Efforts to establish standardized protocols and workflows for spatial genomics and transcriptomics are increasing, facilitating reproducibility and comparability of results across different platforms and studies.

- Emergence of Novel Spatial Analysis Techniques: Ongoing research and development efforts are leading to the emergence of novel spatial analysis techniques, such as spatial proteomics and spatial metabolomics, expanding the scope of spatial omics applications beyond gene expression analysis.

- Advancements in Imaging Technologies: Technological advancements in imaging modalities, such as multiplexed imaging and super-resolution microscopy, are improving spatial resolution and sensitivity, enabling more precise visualization and quantification of spatially resolved biomolecules.

- Application Diversity Across Disease Areas: Spatial genomics and transcriptomics are finding applications across diverse disease areas, including cancer, neurodegenerative disorders, and infectious diseases, driving demand for spatial analysis solutions tailored to specific research and clinical needs.

- Rise of Spatially Resolved Multi-Omics Approaches: The integration of spatially resolved multi-omics approaches, combining genomic, transcriptomic, proteomic, and metabolomic data at the spatial level, is enabling comprehensive characterization of complex biological systems and disease mechanisms.

U.S. Spatial Genomics & Transcriptomics Market Restraints:

- Complex Data Analysis and Interpretation: The analysis and interpretation of spatial omics data can be complex and computationally intensive, posing challenges for researchers without specialized bioinformatics expertise and access to advanced computational resources.

- High Cost of Technology: The high cost associated with acquiring and operating spatial genomics and transcriptomics platforms, including instrumentation, reagents, and maintenance, can be a significant barrier to adoption, particularly for small research laboratories and academic institutions with limited funding.

- Limited Standardization and Validation: The lack of standardized protocols and validation procedures for spatial omics technologies can lead to variability in results and hinder cross-study comparability, impacting the reliability and reproducibility of spatial analysis findings.

- Sample Heterogeneity and Spatial Variability: Biological samples, especially tissues, exhibit inherent heterogeneity and spatial variability, which can introduce challenges in accurately capturing and interpreting spatial gene expression patterns and cellular interactions.

- Data Privacy and Security Concerns: Spatial omics data, which may include sensitive genomic and phenotypic information, raise concerns related to data privacy and security, necessitating robust measures for data anonymization, encryption, and compliance with regulatory requirements.

Technology Insights

In 2023, the consumables product segment took the lead with a substantial 54% share. This dominance stems from widespread product adoption, heightened use of reagents and kits, easy accessibility to a variety of products, and regular procurement of consumables crucial for the operation of various analyzers. Additionally, the introduction of new instruments necessitates the development of compatible consumables, further propelling market growth. Such trends are poised to sustain market expansion throughout the forecast period.

Meanwhile, the software segment is forecasted to exhibit the highest compound annual growth rate (CAGR) from 2024 to 2033. This surge is driven by the growing number of ongoing genomic research studies, which demand robust software solutions for visualizing, interpreting, and managing data derived from spatial studies of DNA and RNA molecules. Furthermore, companies are enhancing their service offerings through strategic partnerships with other organizations, thereby expanding market reach. For instance, in October 2022, a collaboration between 10X Genomics and Oxford Nanopore Technologies was announced, aimed at enabling single-cell and spatial full-length isoform transcript sequencing. This collaboration seeks to streamline the sequencing process of full-length transcripts in single reads by leveraging Oxford Nanopore's PromethION devices and consumables alongside 10x Genomics' sample preparation methods.

Product Insights

In 2023, the spatial transcriptomics segment dominated the market, capturing an impressive 80% share, and is poised to maintain its lead with the fastest compound annual growth rate (CAGR) in the forecast period. This dominance is fueled by the escalating demand for nucleic acid sequencing of biological samples or single cells, serving as a primary driver for the segment's growth. Furthermore, the segment's wide-ranging applications, including the development of spatial maps of complex tissues, immune profiling, identification of drug targets, and optimization of computational biology, contribute to its robust demand, thus driving overall market growth.

On the other hand, the spatial genomics segment is expected to witness significant growth at a noteworthy CAGR from 2024 to 2033. This growth trajectory is propelled by advancements in genome editing tools, such as the CRISPR/Cas9 system, which have facilitated the adoption of spatial genomics, thereby driving market expansion. Additionally, the increasing potential of spatial genetics/transcriptomics analysis has spurred investments in the innovation of new products in the healthcare sector, further amplifying growth opportunities in the market.

End-use Insights

In 2023, the translational research segment commanded a significant 61% share of the revenue. This dominance is primarily attributed to the rising adoption of spatial genomics to translate real-time tissue responses to external agents. Spatial genomics plays a pivotal role in translational research, particularly in cell mapping and neuroscience. Furthermore, numerous companies are concentrating on sustainable product launches to meet the unmet needs of translational research, thereby fostering opportunities for segment growth.

Meanwhile, the academic customer segment is projected to experience a notable CAGR of 12.04% over the forecast period, driven by the growing preference for spatial genomic analysis among academic research institutions. This technology holds significant value for academic researchers investigating the morphological characteristics of cells in genetically linked diseases such as cancer, diabetes, Alzheimer's, and more. Such applications of spatial genomics and transcriptomics are anticipated to propel market growth.

U.S. Spatial Genomics & Transcriptomics Market Key Companies

- NanoString Technologies, Inc.

- S2 Genomics, Inc.

- Illumina, Inc.

- Dovetail Genomics

- 10x Genomics

- Seven Bridges Genomics

- Readcoor, Inc

- Bio-Techne

- Advanced Cell Diagnostics (ACD)

Recent Developments

- In March 2024, 10x Genomics, Inc. unveiled its groundbreaking Visium HD Spatial Gene Expression product, enabling researchers to analyze the entire transcriptome from FFPE tissue sections with single-cell resolution. This innovative assay offers a comprehensive understanding of gene expression patterns within tissues, providing researchers with a potent tool to investigate cellular biology with unprecedented detail.

- Around the same time, biomedical engineers at Johns Hopkins introduced an inventive computational technique named STalign. This method accurately aligns spatial transcriptomics (ST) data across different samples, resolutions, and technologies, empowering researchers to delve deeper into cellular biology. STalign enhances researchers' ability to effectively compare spatial single-cell data, facilitating comprehensive insights into cellular organization and function.

U.S. Spatial Genomics & Transcriptomics Market Segmentation:

By Technology

- Instruments

- By Mode

- Automated

- Semi-automated

- Manual

- By Type

- Sequencing Platforms

- IHC

- Microscopy

- Flow Cytometry

- Mass Spectrometry

- Others

- Consumables

- Software

- Bioinformatics Tools

- Imaging Tools

- Storage and Management Databases

By Product

- Spatial Transcriptomics

- Sequencing-Based Methods

- Laser Capture Microdissection (LCM)

- FFPE Tissue Samples

- Others

- Transcriptome In-Vivo Analysis (TIVA)

- In Situ Sequencing

- Microtomy Sequencing

- IHC

- Microscopy-based RNA Imaging Techniques

- Single Molecule RNA Fluorescence In-Situ Hybridization (smFISH)

- Padlock Probes/ Rolling Circle Amplification

- Branched DNA Probes

- Spatial Genomics

- FISH

- Microscopy-based Live DNA Imaging

- Genome Perturbation Tools

- Massively-Parallel Sequencing

- Biochemical Techniques

- Others

By End-use

- Translational Research

- Academic Customers

- Diagnostic Customers

- Pharmaceutical Manufacturer

Frequently Asked Questions

The U.S. spatial genomics & transcriptomics market size was reached at USD 97.53 million in 2023 and it is projected to hit around USD 323.25 million by 2033.

The U.S. spatial genomics & transcriptomics market is growing at a compound annual growth rate (CAGR) of 12.73% from 2024 to 2033.

Key factors that are driving the U.S. spatial genomics & transcriptomics market growth include rising need for solutions to reduce healthcare costs, increasing focus on patient-centric care, and strong government support.

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others