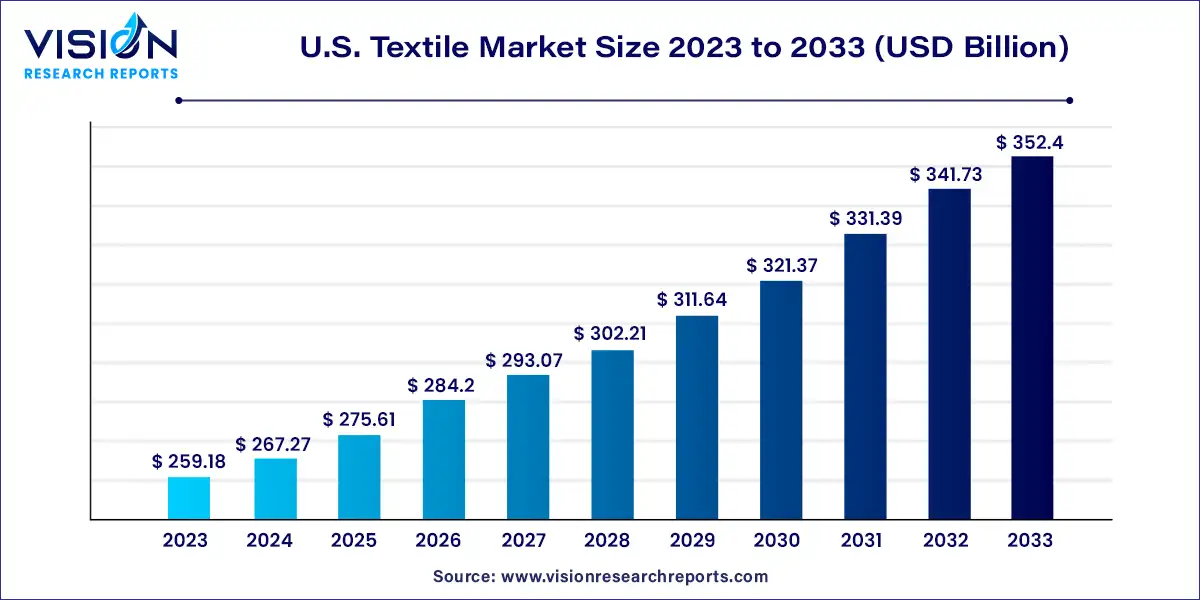

The U.S. textile market size was surpassed at USD 259.18 billion in 2023 and is expected to hit around USD 352.4 billion by 2033, growing at a CAGR of 3.12% from 2024 to 2033.

The U.S. textile market is experiencing robust growth due to the increasing consumer demand for diverse and high-quality textile products, driven by fashion trends and home decor preferences, is fueling market expansion. Secondly, advancements in textile technology, such as smart fabrics and sustainable production methods, are enhancing product offerings and attracting eco-conscious consumers. Additionally, the rise of e-commerce platforms has broadened market access and convenience, enabling consumers to explore a wide range of textile options. Moreover, investments in research and development are driving innovation, leading to the introduction of novel materials and applications. These elements collectively contribute to the dynamic growth trajectory of the U.S. textile industry.

Based on product, the U.S. textile industry is categorized into natural fibers, polyester, nylon, and others. The natural fiber segment led with the highest revenue share of 40% in 2023. Good drape, excellent luster, and increased softness offered by natural fibers are expected to play a key role in their increasing usage in manufacturing fabric worldwide. However, these fibers are costlier than synthetic fibers. This can act as an obstacle to the growth of the natural fibers segment.

Natural fibers are derived from animals, vegetables, and minerals and are knitted, woven, or bonded to form fabrics. As such, they are not harmful to the environment and are not dependent on petroleum and fossil fuels for their development, which is expected to increase the demand for natural fibers over the coming period.

The nylon segment is expected to grow at the highest CAGR of 3.56% over the forecast period. It has high resilience, superior elasticity, excellent luster, and low moisture absorbency. As such, it is used in apparel, home furnishing, and many other applications. Surging demand for synthetic fibers from the textiles industry is expected to be one of the major factors driving the growth of the nylon segment in the U.S. market.

The others segment is further categorized into spandex, acrylic fibers, and microfibers, as well as polyethylene (PE)-, polypropylene (PP)-, aramid-, and polyamide-based fibers. These fibers are processed to produce fabrics that are further used to develop different types of clothes and apparel. They exhibit superior strength, excellent smoothness and softness, and increased elasticity.

Based on application, the fashion segment led the market with the largest revenue share of 77% in 2023. This segment is further categorized into purses, ties & clothing accessories, and clothes. In the upcoming years, the rise of the fashion section of the U.S. textile market is anticipated to be driven by customers' rising desire for crease-free suits and shirts as well as high-quality dyed and printed materials.

Apparel was the leading segment in the fashion textile industry in the U.S. in 2023. The growth of this segment of the market can be attributed to the constantly increasing adoption of casual wear, formal wear, and fashionable clothes by consumers of all age groups across the country. Denim, lycra, cotton, silk, and polyester fabrics are highly increasingly for manufacturing fashion textiles and clothing.

Textiles are used to manufacture a wide array of ties & clothing accessories such as belts, scarves, mufflers, handkerchiefs, hats, caps, gloves, and cufflinks. The segment is mainly divided into hosiery, socks, sportswear, underwear, handbags, and others. The change in consumer preferences, especially in the men’s fashion industry, regarding the use of thin and printed ties and low-cost accessories is expected to positively influence the growth of this segment over the forecast period.

The technical application segment is expected to grow at the fastest CAGR of 3.95% from 2024 to 2033. The demand for technical textiles in the U.S. is driven by the rising need for high-performance and energy-efficient textiles and strict government restrictions regulating performance in various applications. Numerous end-use industries, such as automotive, aerospace, marine, protective gear, medical, and construction, are seeing a growing uptake of technical textiles. Because these businesses demand a number of technical benefits in textiles that standard textiles may not provide.

Based on raw material, the U.S. textile market is segmented into cotton, chemical, wool, silk, and others. The chemical segment led with the largest revenue share of 46% in 2023 and is anticipated to grow at a significant CAGR in the forthcoming years.

Chemicals play an important role in the fabric industry. Notably, fabrics made with 100% natural fibers contain around 27% chemicals by weight. Acetic acid, oxalic acid, sulfuric acid, and soda ash are some of the chemicals used in the textile industry. These chemicals are categorized as pretreatment chemicals, textile dyeing chemicals, printing chemicals, finishing chemicals, and antistatic agents. They can be used on both, natural as well as synthetic fibers, as dyeing and finishing agents to improve their appearance. The growing importance of the aesthetic appeal of clothes is expected to drive this segment.

The silk segment is projected to grow at the highest CAGR of 5.15% over the forecast period. Silk is considered to be the most luxurious fabric exhibiting high luster. Besides, properties such as high strength, elasticity, and absorbency have made silk one of the widely used materials in the textile market. According to the International Sericultural Commission, China, India, Uzbekistan, and Brazil were the major producers of silk, while the U.S., Italy, and Japan were the major consumers of silk.

By Product

By Raw Material

By Application

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Product Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Textile Market

5.1. COVID-19 Landscape: U.S. Textile Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Textile Market, By Product

8.1. U.S. Textile Market, by Product, 2024-2033

8.1.1 Natural Fibers

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Polyester

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Nylon

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Others

8.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 9. U.S. Textile Market, By Raw Material

9.1. U.S. Textile Market, by Raw Material, 2024-2033

9.1.1. Cotton

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Chemical

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Wool

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Silk

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Others

9.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 10. U.S. Textile Market, By Application

10.1. U.S. Textile Market, by Application, 2024-2033

10.1.1. Household

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Technical

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Fashion

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Others

10.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 11. U.S. Textile Market, Regional Estimates and Trend Forecast

11.1. U.S.

11.1.1. Market Revenue and Forecast, by Product (2021-2033)

11.1.2. Market Revenue and Forecast, by Raw Material (2021-2033)

11.1.3. Market Revenue and Forecast, by Application (2021-2033)

Chapter 12. Company Profiles

12.1. INVISTA S.R.L.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. IBENA Inc.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Belton Industries, Inc.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Dewitt.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. TenCate.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Mogul Co., Ltd.

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Siang May Pte Ltd.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. terrafix Geosynthetics

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. HUESKER International.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Morenot

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others