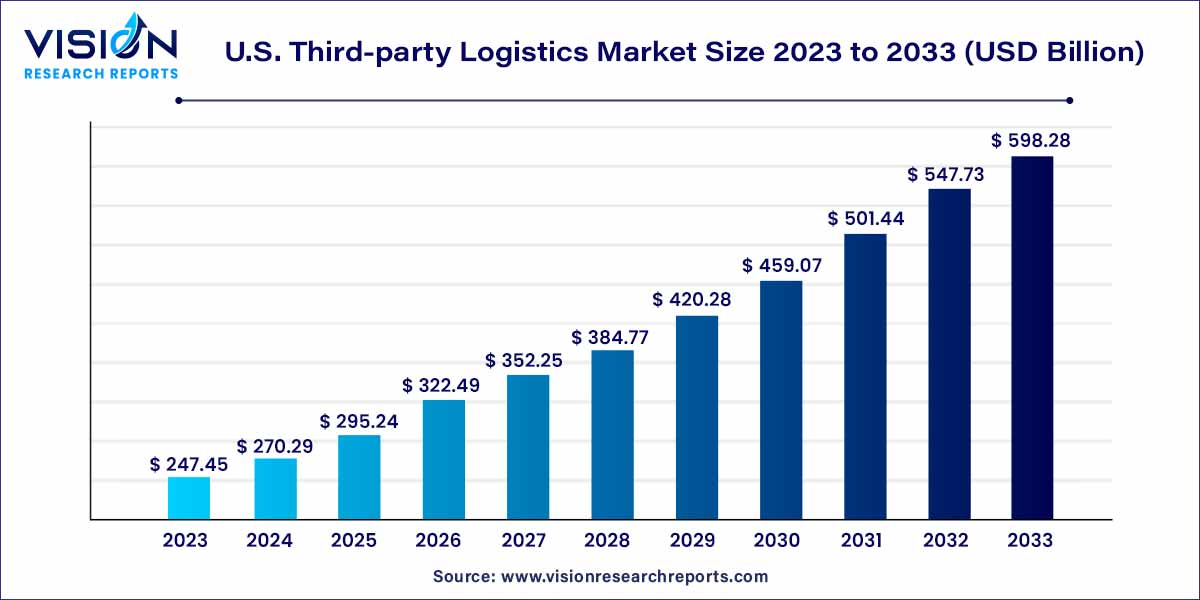

The U.S. third-party logistics market was surpassed at USD 247.45 billion in 2023 and is expected to hit around USD 598.28 billion by 2033, growing at a CAGR of 9.23% from 2024 to 2033.

The U.S. third-party logistics (3PL) market plays a pivotal role in the country's supply chain ecosystem, facilitating efficient movement and management of goods. This overview delves into the key aspects of the U.S. 3PL market, shedding light on its growth drivers, market trends, and the evolving landscape.

The robust growth of the U.S. third-party logistics (3PL) market is underpinned by several key factors. Firstly, the ongoing globalization of supply chains has fueled a heightened demand for 3PL services, as businesses seek partners capable of navigating the intricacies of international trade. Secondly, the flourishing e-commerce sector has significantly influenced the market dynamics, with 3PL providers playing a pivotal role in managing the complexities of order fulfillment, inventory control, and last-mile delivery. Furthermore, the trend of outsourcing logistics functions continues to gain momentum, as companies recognize the strategic advantages of focusing on core competencies while entrusting specialized logistics expertise to 3PL partners. These growth factors collectively contribute to a dynamic and expanding U.S. 3PL market, positioned at the forefront of modern supply chain solutions.

In terms of services, the market is categorized into various segments, including domestic transportation management (DTM), dedicated contract carriage (DCC)/freight forwarding, warehousing & distribution (W&D), international transportation management (ITM), and value-added logistics services (VALs). The DTM segment held the largest market share at 38% in 2023, primarily driven by the continuous rise in carrier rates. Businesses, in response to escalating costs, are increasingly turning to third-party logistics (3PL) providers to streamline transportation expenses and enhance overall operational efficiency. Outsourcing DTM to a 3PL provider proves beneficial in cost reduction, as these providers leverage their purchasing power and expansive transportation networks to negotiate more favorable rates with carriers, ultimately lowering transportation costs for clients. Furthermore, 3PL providers play a crucial role in optimizing the transportation process, reducing transportation time, and improving delivery reliability.

The VALs segment is anticipated to achieve the highest CAGR over the forecast period. VALs encompass services that go beyond conventional logistics and transportation offerings provided by 3PL providers. These services add significant value to customers by enhancing the functionality and efficiency of the supply chain. As businesses increasingly seek specialized logistics services to meet unique requirements, the demand for value-added logistics services, including inventory management, packaging, labeling, kitting, customization, and reverse logistics, is on the rise. This trend aligns with companies' focus on improving customer satisfaction and optimizing supply chain operations, indicating a growing demand for value-added logistics services in the market.

In 2023, the roadways segment dominated the market, holding an impressive 82% market share. This segment's strength lies in its adaptability to changing demands and requirements, offering a crucial advantage. Third-party logistics (3PL) providers within the road transport segment can tailor their services by utilizing vehicles of various types and sizes, aligning precisely with the unique needs of each customer. This customization not only enhances efficiency but also contributes to cost savings. Additionally, road transport ensures a high level of visibility and control across the entire supply chain, further bolstering its position as a preferred mode of transportation.

Looking ahead, the waterways segment is poised to exhibit the fastest Compound Annual Growth Rate (CAGR) from 2024 to 2033. Waterways offer an efficient and cost-effective solution for transporting goods in large volumes over extended distances, making them particularly favorable for bulky and heavy items. 3PL companies play a pivotal role in optimizing supply chain operations and reducing transportation costs by facilitating the movement of goods via waterways. A key advantage of waterway transportation is its high energy efficiency, involving significantly lower fuel consumption per ton-mile compared to alternative modes of transportation. This positions waterways as a sustainable and economically viable choice for the future of logistics.

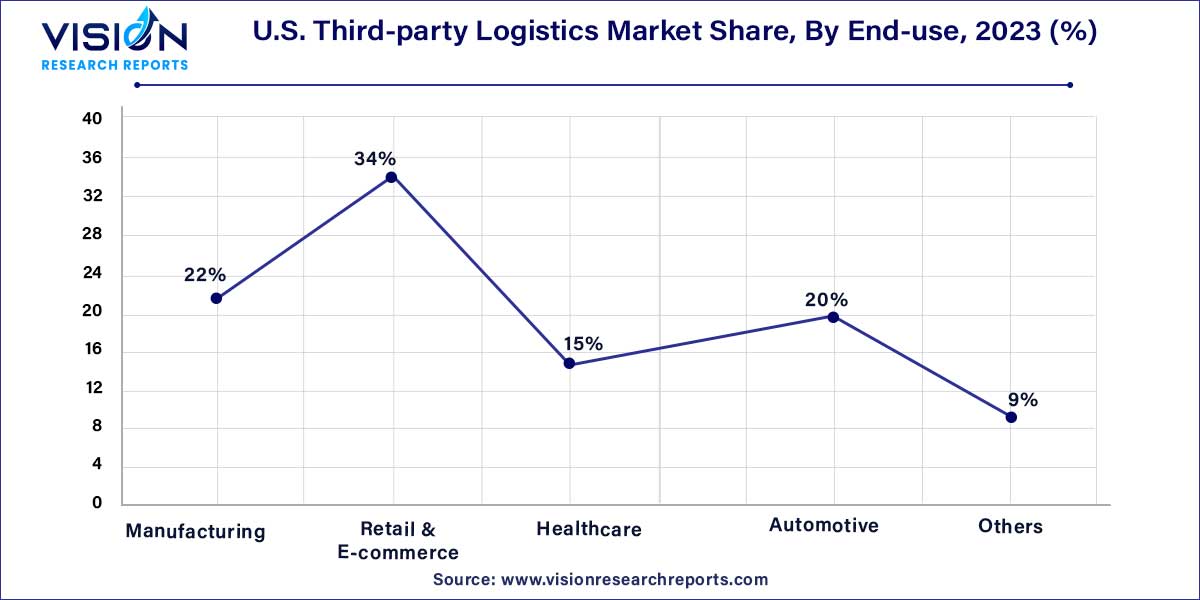

In 2023, the retail & e-commerce segment secured the largest market share at 34%. This dominance is attributed to the rapid growth experienced by e-commerce businesses, particularly during peak shopping periods like Black Friday and Cyber Monday. Third-party logistics (3PL) providers play a crucial role in supporting this growth by offering flexible scaling capabilities. This eliminates the need for e-commerce businesses to invest in dedicated infrastructure or personnel. The adoption of 3PL services is driven by the imperative for efficient and cost-effective order fulfillment, international shipping expertise, and the essential elements of flexibility and scalability. 3PL companies further aid retailers by providing a suite of services, including transportation management, inventory management, warehousing and distribution, and e-commerce fulfillment. Outsourcing these functions allows retailers to concentrate on their core competencies, such as merchandising and marketing.

Looking ahead, the manufacturing segment is anticipated to achieve the fastest CAGR from 2024 to 2033. The growth in this sector is propelled by intricate supply chains, global operations, a focus on efficiency and cost optimization, strategic emphasis on core competencies, the need for customized solutions, scalability requirements, technology integration, regulatory compliance, and adherence to Just-in-Time inventory practices. Many manufacturing companies operate on a global scale, engaging in the sourcing of materials from diverse locations and the international distribution of finished goods. 3PL providers play a pivotal role in facilitating seamless global trade by optimizing transportation, ensuring compliance with customs regulations, and fostering the efficient flow of goods across international borders.

By Services

By Transport

By End-use

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others