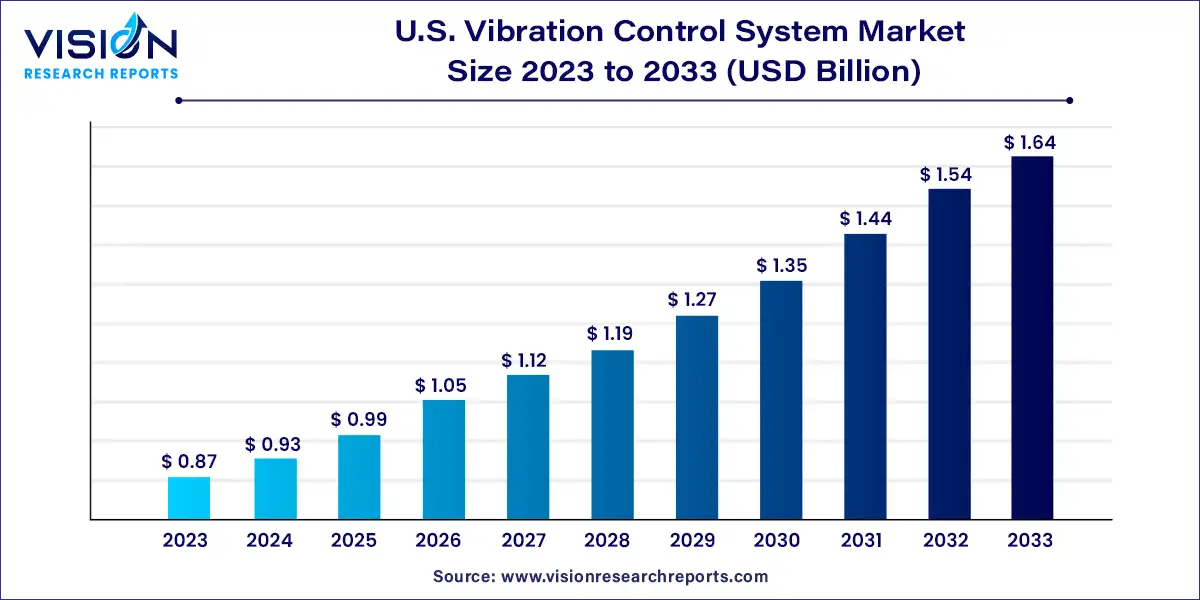

The U.S. vibration control system market size was estimated at around USD 0.87 billion in 2023 and it is projected to hit around USD 1.64 billion by 2033, growing at a CAGR of 6.53% from 2024 to 2033. The U.S. vibration control system market has witnessed significant growth driven by increasing awareness about the detrimental effects of vibrations across various industries.

The growth of the U.S. vibration control system market is propelled by the technological advancements, particularly in active vibration control systems, are enhancing the effectiveness of vibration management across industries. Stringent regulatory standards regarding noise and vibration levels in industrial environments are driving adoption, while increasing infrastructure projects necessitate robust vibration control solutions for structural integrity and safety. Retrofitting existing machinery with advanced systems also contributes to market growth, improving operational efficiency and extending equipment lifespan amidst competitive pressures and evolving industry demands.

In 2023, the manufacturing sector led the market with approximately 26% revenue share. This segment dominates due to its extensive use of machinery prone to vibration, which can impair accuracy, increase wear, generate noise, and pose safety risks. Vibration control systems (VCS) are crucial in manufacturing to mitigate these issues, enhancing operational efficiency, product quality, and equipment lifespan.

The automotive segment is poised to achieve the fastest CAGR of 8.33% through increased adoption of electric vehicles. This shift drives demand for vibration control components like dampers and isolators, crucial for improving vehicle efficiency by reducing vibrations, friction, and enhancing part durability.

In the electrical & electronics sector, growth opportunities are driven by expanding industrial machinery manufacturing globally. Vibration control systems in this industry utilize electronics, sensors, and actuators to safeguard structures and equipment from impact forces, fostering market expansion.

The vibration control segment is expected to grow rapidly at a CAGR of 6.53% owing to rising demand in oil & gas and power plant industries. These systems employ various anti-vibration devices such as absorbers and dampers to isolate and mitigate trembling and shock, crucial for operational stability in power plants.

Following closely, the VCS with motion control segment is set for significant growth by 2033, driven by automotive and aerospace applications. Motion control systems effectively manage unwanted vibrations in mechanical systems, enhancing passenger comfort in aircraft and operational efficiency across industries.

By System Type

By Application

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Vibration Control System Market

5.1. COVID-19 Landscape: U.S. Vibration Control System Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Vibration Control System Market, By System Type

8.1. U.S. Vibration Control System Market, by System Type, 2024-2033

8.1.1. Motion Control

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Vibration Control

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. U.S. Vibration Control System Market, By Application

9.1. U.S. Vibration Control System Market, by Application, 2024-2033

9.1.1. Automotive

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Aerospace & Defense

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Manufacturing

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Electrical & Electronics

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Healthcare

9.1.5.1. Market Revenue and Forecast (2021-2033)

9.1.6. Oil & Gas

9.1.6.1. Market Revenue and Forecast (2021-2033)

9.1.7. Others

9.1.7.1. Market Revenue and Forecast (2021-2033)

Chapter 10. U.S. Vibration Control System Market, Regional Estimates and Trend Forecast

10.1. U.S.

10.1.1. Market Revenue and Forecast, by System Type (2021-2033)

10.1.2. Market Revenue and Forecast, by Application (2021-2033)

Chapter 11. Company Profiles

11.1. Fabreeka

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Isolation Technology

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Kinetics Noise Control, Inc

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. PARKER HANNIFIN CORP

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Sentek Dynamics Inc.

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. VMC Group

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. LMCURBSMason Industries Inc.

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. MicroMetl Corporation

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Hutchinson

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. abbot

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others