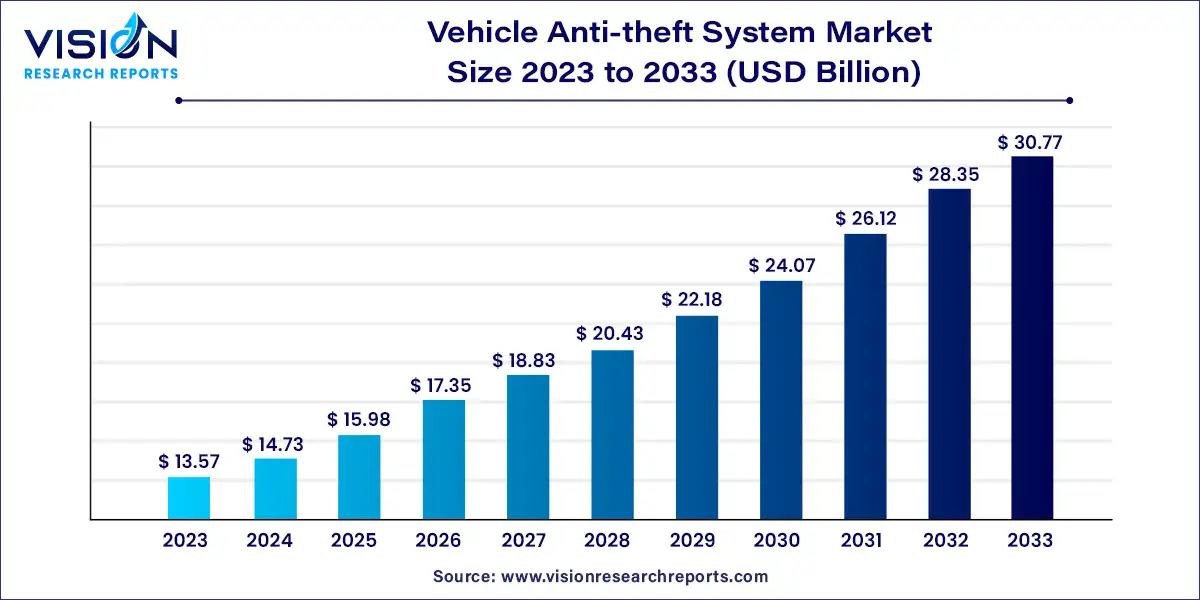

The global vehicle anti-theft system market size was estimated at around USD 13.57 billion in 2023 and it is projected to hit around USD 30.77 billion by 2033, growing at a CAGR of 8.53% from 2024 to 2033.

The global vehicle anti-theft system market is experiencing significant growth due to heightened security concerns and technological advancements. With increasing vehicle theft rates worldwide, both consumers and automotive manufacturers are investing in sophisticated anti-theft technologies to protect vehicles from unauthorized access and theft.

The vehicle anti-theft system market is experiencing robust growth driven the rising global incidence of vehicle theft, which has heightened the need for advanced security solutions. As vehicle theft techniques become more sophisticated, both consumers and manufacturers are increasingly investing in cutting-edge anti-theft technologies. Additionally, the integration of smart technologies, such as GPS tracking and biometric authentication, has significantly enhanced the effectiveness of anti-theft systems, making them more appealing to vehicle owners. Regulatory pressures and stringent safety standards also play a crucial role, as governments around the world mandate higher security measures for vehicles. Furthermore, the increasing adoption of connected vehicles and the Internet of Things (IoT) is driving the development of more advanced and integrated anti-theft solutions, which are anticipated to boost market growth in the coming years.

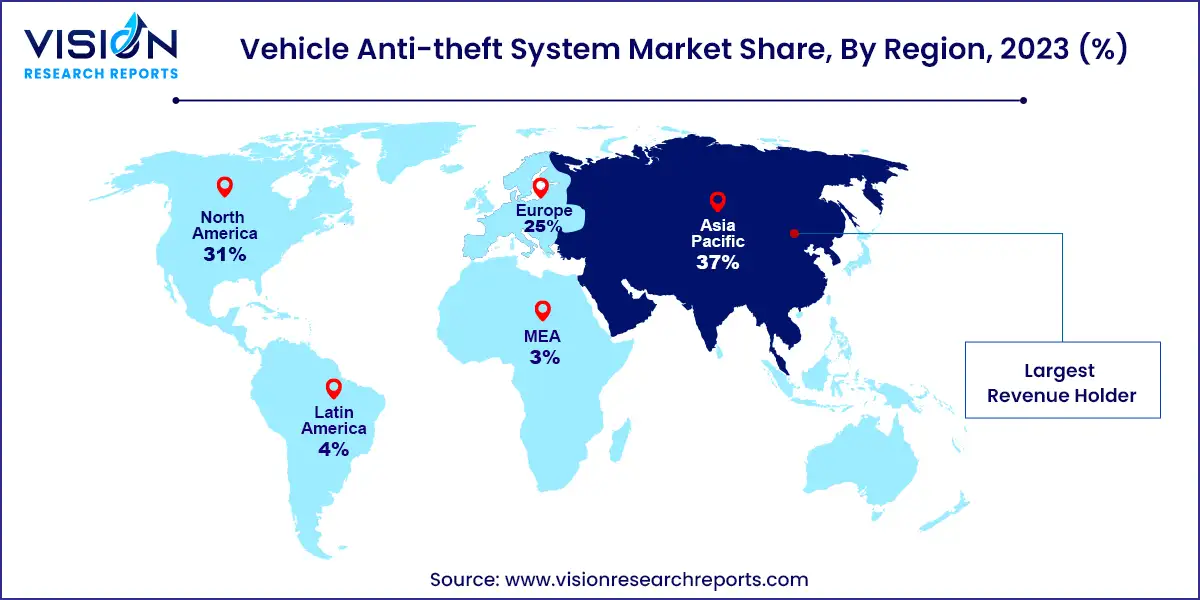

The Asia Pacific region led the vehicle anti-theft system market in 2023, holding a 37% share of global revenue. The growth in this region is attributed to the booming automotive sector in countries like China, Japan, and India, driven by increasing vehicle production and sales. Additionally, the electrification of vehicles and the rising popularity of autonomous vehicles are expected to further boost the demand for advanced anti-theft solutions in the region.

| Attribute | Asia Pacific |

| Market Value | USD 5.02 Billion |

| Growth Rate | 8.53% CAGR |

| Projected Value | USD 11.38 Billion |

North America Vehicle Anti-Theft System Market Trends

The vehicle anti-theft system market in North America is expected to grow steadily from 2024 to 2033. The region's growth is fueled by stringent government regulations mandating advanced vehicle security features, pushing manufacturers to prioritize compliance and consumer safety. Additionally, the presence of major automotive manufacturers and increased consumer awareness about vehicle security further support the market’s expansion in North America.

U.S. Vehicle Anti-Theft System Market Trends

In the U.S., the vehicle anti-theft system market is projected to grow significantly from 2024 to 2033. Rising vehicle theft incidents are driving both consumers and fleet operators to adopt advanced security solutions. For instance, data from NHTSA indicates that over one million vehicles were stolen in the U.S. in 2023, reflecting a 25% increase in theft compared to previous years.

Europe Vehicle Anti-Theft System Market Trends

The vehicle anti-theft system market in Europe is anticipated to grow at a moderate rate from 2024 to 2033. The market's expansion in Europe is supported by increasing consumer awareness of the benefits of anti-theft systems and the availability of integrated solutions. The integration of connected car technologies, such as telematics and remote monitoring, is enhancing the functionality of anti-theft systems, making them more appealing to vehicle owners in Europe.

In 2023, the alarms segment led the market, capturing a 29% share of global revenue. Alarms are fundamental components of vehicle anti-theft systems, typically equipped with sensors that trigger audible and sometimes visual alerts when unauthorized access or tampering is detected. These alarms act as deterrents to potential thieves and alert vehicle owners or bystanders of theft attempts. Upon detecting a breach, the system activates flashing lights, a loud alarm, and may also include a starter disable feature or vehicle shutdown to immobilize the vehicle. This broad array of benefits drives the growing demand and adoption of alarm systems in the market.

The immobilizers segment is expected to experience substantial growth from 2024 to 2033. The adoption of immobilizer systems across various vehicle types is on the rise. An immobilizer is an electronic device installed in vehicles to prevent engine start unless the correct key or key fob is present. This effective anti-theft technology has significantly reduced vehicle theft rates, offering vehicle owners enhanced security and contributing to lower insurance premiums. Consequently, automotive immobilizer technology has become a crucial component in vehicle security.

In 2023, passenger cars dominated the market. The growth of this segment is driven by the increasing production and sales of various passenger vehicles, including SUVs, luxury cars, and sedans. Owners of passenger cars are increasingly seeking vehicles equipped with advanced anti-theft systems, such as alarms, immobilizers, and tracking devices, to safeguard their investments and possessions. Consequently, vehicle manufacturers are continually innovating and integrating advanced technologies to meet the evolving security needs of passenger car owners, fueling the segment's expansion.

The commercial vehicles segment is projected to see significant growth from 2024 to 2033. This segment, encompassing trucks, buses, and other heavy-duty vehicles, faces unique security challenges due to the valuable cargo they often carry. This makes them attractive targets for theft, necessitating robust anti-theft measures. The increasing use of systems like immobilizers and alarms, which prevent the vehicle from starting without the correct key or code and protect valuable cargo, is contributing to the segment's growth.

The OEM segment led the market in 2023. As consumer preferences shift towards enhanced safety and security features, original equipment manufacturers (OEMs) are integrating advanced anti-theft systems into their vehicles. This trend allows OEMs to meet evolving regulatory standards and cater to the demands of modern car buyers. As a result, there is a consistent rise in demand, underscoring the pivotal role of OEMs in advancing vehicle security.

The aftermarket segment is anticipated to experience significant growth from 2024 to 2033. This growth is driven by the increasing sales of passenger cars and the rising demand for retrofitting existing vehicles with advanced security solutions. The aftermarket channel offers greater flexibility and customization options, allowing consumers to choose from a wide range of anti-theft systems tailored to their specific needs. This level of personalization is especially appealing to owners of older vehicles looking to enhance their security features, thereby driving segment growth.

By Product

By Vehicle Type

By Sales Channel

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Product Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Vehicle Anti-theft System Market

5.1. COVID-19 Landscape: Vehicle Anti-theft System Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Vehicle Anti-theft System Market, By Product

8.1. Vehicle Anti-theft System Market, by Product, 2024-2033

8.1.1 Steering Locks

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Alarms

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Biometric Capture Devices

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Immobilizers

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Remote Keyless Entry

8.1.5.1. Market Revenue and Forecast (2021-2033)

8.1.6. Central Locking

8.1.6.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Vehicle Anti-theft System Market, By Vehicle Type

9.1. Vehicle Anti-theft System Market, by Vehicle Type, 2024-2033

9.1.1. Passenger Cars

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Commercial Vehicles

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Vehicle Anti-theft System Market, By Sales Channel

10.1. Vehicle Anti-theft System Market, by Sales Channel, 2024-2033

10.1.1. OEM

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Aftermarket

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Vehicle Anti-theft System Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Product (2021-2033)

11.1.2. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.1.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.1.4.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.1.5.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.2. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.2.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.2.4.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.2.5.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.2.6.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.2.7.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.2. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.3.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.3.4.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.3.5.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.3.6.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.3.7.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.2. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.4.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.4.4.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.4.5.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.4.6.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.4.7.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.5.2. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.5.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.5.4.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.5.5.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

Chapter 12. Company Profiles

12.1. Continental AG.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Denso Corporation.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Robert Bosch GmbH.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Author LLC.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Viper.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. OnStar Corporation

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Pandora Car Alarm Systems Ltd.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Meta System S.p.A.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Valeo S.A.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. ZF Friedrichshafen AG

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others