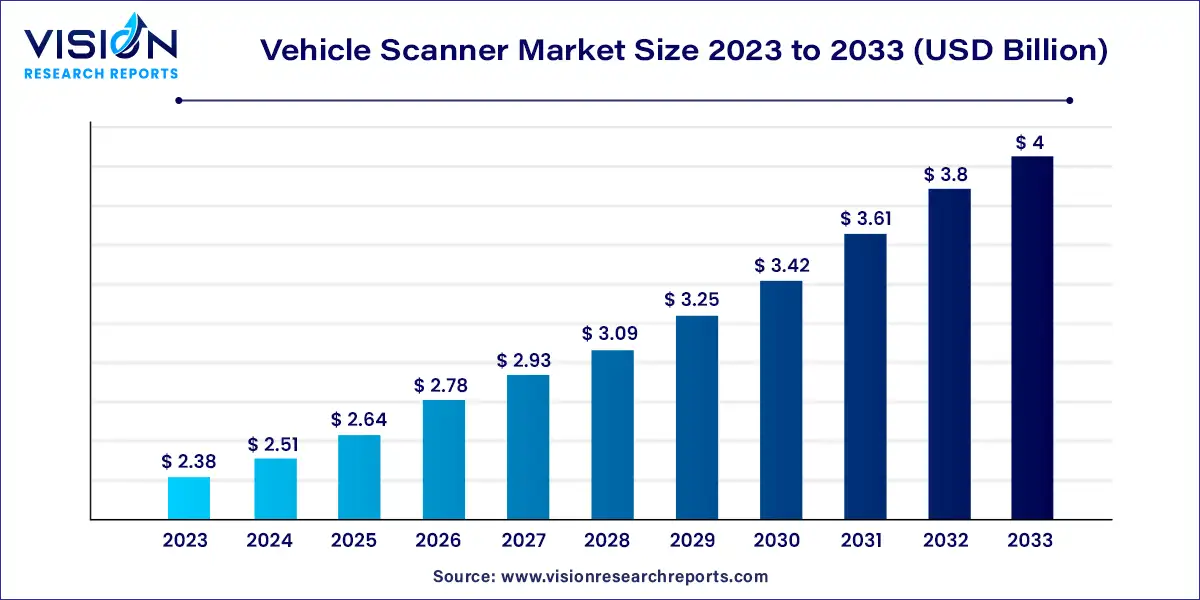

The global vehicle scanner market size was valued at USD 2.38 billion in 2023 and it is predicted to surpass around USD 4 billion by 2033 with a CAGR of 5.33% from 2024 to 2033.

The vehicle scanner market has witnessed significant growth over recent years, driven by the increasing demand for vehicle safety and security. Vehicle scanners are advanced systems used to detect and analyze various vehicle attributes, including dimensions, weight, and compliance with regulatory standards. These scanners play a crucial role in enhancing traffic management, improving road safety, and ensuring vehicle compliance with environmental regulations.

The vehicle scanner market is experiencing robust growth due to an increasing emphasis on road safety and vehicle security is a significant driver, with governments and transport authorities investing heavily in advanced scanning technologies to enhance vehicle inspections and prevent road accidents. Technological advancements play a crucial role, as innovations such as artificial intelligence and machine learning are integrated into scanning systems, improving their accuracy and operational efficiency. Additionally, stringent regulatory requirements concerning vehicle emissions, weight, and safety standards are compelling vehicle owners and operators to adopt scanning solutions to ensure compliance. The expanding vehicle fleet globally further fuels the demand for these systems, as managing a growing number of vehicles necessitates more sophisticated and reliable scanning technologies.

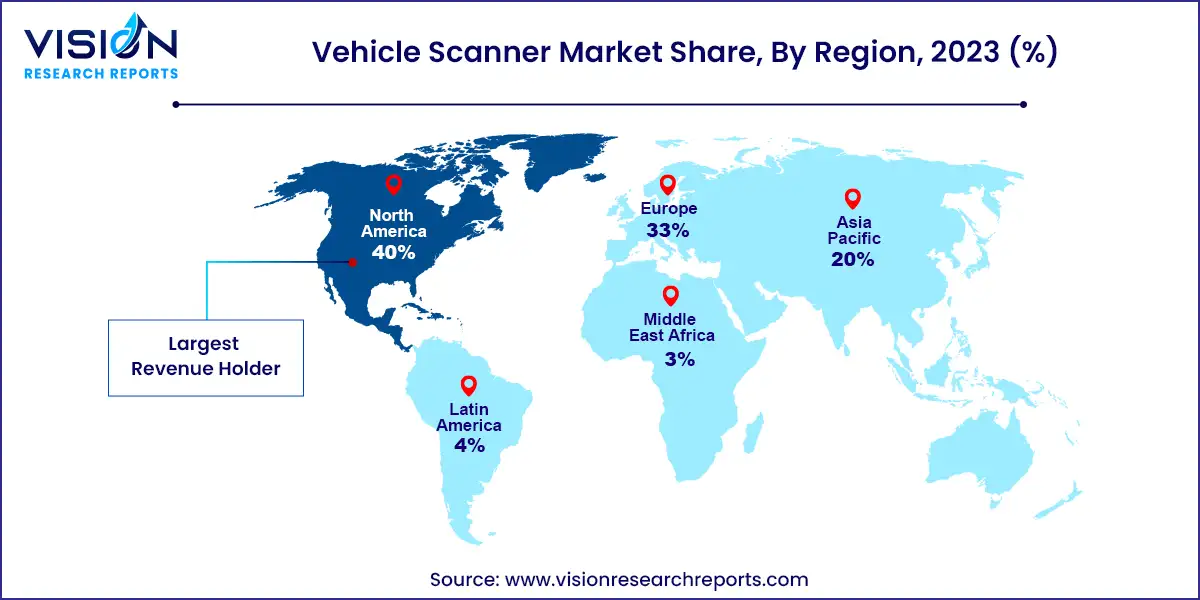

In 2023, North America held the largest global revenue share of 40% in the vehicle scanner market. The region's growth is driven by the increasing adoption of advanced security technologies across both public and private sectors. North America's robust automotive industry is also contributing to market expansion, as there is a need for efficient inspection and quality control processes in manufacturing facilities. Government initiatives aimed at enhancing homeland security and public safety further support the demand for vehicle scanners in the region.

| Attribute | North America |

| Market Value | USD 0.95 Billion |

| Growth Rate | 5.35% CAGR |

| Projected Value | USD 1.6 Billion |

The U.S. vehicle scanner market size was estimated at around USD 5.14 billion in 2023 and it is projected to hit around USD 19.81 billion by 2033, growing at a CAGR of 14.43% from 2024 to 2033.

The U.S. vehicle scanner market is experiencing significant growth due to heightened security concerns and stringent regulatory requirements. The U.S. government's focus on strengthening national security and preventing terrorist activities has led to increased investments in advanced vehicle scanning technologies. The expanding logistics and transportation sector, combined with the need for efficient cargo inspection, is also driving demand.

Asia Pacific Vehicle Scanner Market Trends

The Asia Pacific vehicle scanner market is expected to grow significantly during the forecast period. This growth is fueled by the expanding automotive industry and rising infrastructure development projects in the region. Countries like China, India, and Japan are investing heavily in smart city initiatives and modernizing their transportation networks, which boosts the demand for vehicle scanning systems. The increasing focus on public safety and security, particularly in high-traffic areas such as airports, seaports, and border crossings, is also driving market growth. Additionally, the adoption of automated and digital technologies in vehicle inspection processes is contributing to the market's expansion in Asia Pacific.

Europe Vehicle Scanner Market Trends

The vehicle scanner market in Europe is experiencing notable growth, driven by a stringent regulatory environment and a strong focus on safety and security. European countries are adopting advanced vehicle scanning technologies to address rising threats such as terrorism, smuggling, and illegal immigration. The well-established automotive industry in the region also plays a critical role, with manufacturers increasingly using vehicle scanners for quality control and compliance. Furthermore, the implementation of smart transportation systems and the development of modern infrastructure projects are fueling the demand for vehicle scanning solutions across Europe.

In 2023, the fixed vehicle scanner segment dominated the market with a substantial share of 66%. Fixed vehicle scanners are widely adopted at critical infrastructure points such as border crossings, military bases, and high-security facilities due to their reliability and continuous inspection capabilities. These scanners are essential for thorough screening of vehicles to detect contraband, explosives, and other potential security threats. Their advanced technology and integration with sophisticated software enable detailed analysis and prompt decision-making. Additionally, the durability and robustness of fixed scanners make them ideal for high-traffic areas requiring constant use. As global security concerns persist, the demand for fixed vehicle scanners is expected to remain strong, sustaining their significant market share.

The portable vehicle scanner segment is experiencing notable growth driven by the increasing need for flexible and mobile security solutions. Portable scanners offer mobility, allowing security personnel to perform inspections at various locations without permanent installations. Their ease of deployment and user-friendly interfaces make them suitable for temporary events, random checkpoints, and areas with limited infrastructure. Technological advancements have also improved the accuracy and efficiency of portable scanners, making them a viable alternative to fixed systems. As organizations and governments seek adaptable security solutions to address evolving threats, the portable vehicle scanner market is anticipated to expand further.

In 2023, the drive-through vehicle scanner segment held the largest market share, owing to its efficiency and effectiveness in high-traffic environments. Drive-through scanners are designed for rapid and accurate vehicle inspections as they pass through, making them ideal for use at border crossings, ports, and high-security facilities. Their ability to process a large volume of vehicles without causing significant delays has made them a preferred choice. Technological advancements have enhanced their imaging capabilities, improving the detection of contraband and security threats. The combination of speed, reliability, and improved detection capabilities has driven the widespread adoption of drive-through vehicle scanners.

The UVSS (Under Vehicle Surveillance System) segment is gaining traction due to the growing need for enhanced security measures. UVSS technology provides a critical layer of security by inspecting the underside of vehicles, a common area for hidden threats. This segment's growth is particularly notable in high-risk areas such as government facilities, military bases, and critical infrastructure sites. The increasing focus on counter-terrorism and prevention of illegal activities has led many organizations to invest in UVSS systems. Moreover, advancements in imaging and detection technologies have improved the accuracy and efficiency of these systems, making them increasingly attractive to buyers. Consequently, the UVSS vehicle scanner segment is projected to continue its upward trend in the coming years.

The government and critical infrastructure protection segment led the market with a share of 67% in 2023. This dominance is due to the heightened emphasis on national security and public safety. Governments globally are investing heavily in advanced scanning technologies to protect critical infrastructures such as airports, seaports, military bases, and government buildings. These scanners are vital for detecting potential threats like explosives, contraband, and unauthorized items. The integration of cutting-edge technologies, including artificial intelligence, machine learning, and real-time data analytics, enhances the efficiency and accuracy of these scanners, making them indispensable for security agencies.

The private vehicle scanner segment is expected to experience significant growth from 2024 to 2033, driven by the increasing demand for enhanced security measures in commercial and private facilities. With rising incidents of theft, smuggling, and terrorism, private enterprises are recognizing the importance of vehicle scanners in protecting their assets and personnel. Sectors such as logistics, hospitality, entertainment, and corporate facilities are increasingly adopting vehicle scanners to bolster their security protocols. The availability of cost-effective and user-friendly scanning solutions has accelerated their adoption in the private sector. Furthermore, advancements in technology that offer high-speed scanning, minimal human intervention, and integration with existing security systems are making vehicle scanners a preferred choice for private entities, fueling robust market growth.

By Structure Type

By Type

By Application

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Structure Type Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Vehicle Scanner Market

5.1. COVID-19 Landscape: Vehicle Scanner Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Vehicle Scanner Market, By Structure Type

8.1. Vehicle Scanner Market, by Structure Type, 2024-2033

8.1.1 Drive Through

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. UVSS

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Vehicle Scanner Market, By Type

9.1. Vehicle Scanner Market, by Type, 2024-2033

9.1.1. Fixed

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Portable

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Vehicle Scanner Market, By Application

10.1. Vehicle Scanner Market, by Application, 2024-2033

10.1.1. Government/ Critical Infrastructure Protection

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Private

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Vehicle Scanner Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Structure Type (2021-2033)

11.1.2. Market Revenue and Forecast, by Type (2021-2033)

11.1.3. Market Revenue and Forecast, by Application (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Structure Type (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Type (2021-2033)

11.1.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Structure Type (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Type (2021-2033)

11.1.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Structure Type (2021-2033)

11.2.2. Market Revenue and Forecast, by Type (2021-2033)

11.2.3. Market Revenue and Forecast, by Application (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Structure Type (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Type (2021-2033)

11.2.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Structure Type (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Type (2021-2033)

11.2.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Structure Type (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Type (2021-2033)

11.2.6.3. Market Revenue and Forecast, by Application (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Structure Type (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Type (2021-2033)

11.2.7.3. Market Revenue and Forecast, by Application (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Structure Type (2021-2033)

11.3.2. Market Revenue and Forecast, by Type (2021-2033)

11.3.3. Market Revenue and Forecast, by Application (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Structure Type (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Type (2021-2033)

11.3.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Structure Type (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Type (2021-2033)

11.3.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Structure Type (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Type (2021-2033)

11.3.6.3. Market Revenue and Forecast, by Application (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Structure Type (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Type (2021-2033)

11.3.7.3. Market Revenue and Forecast, by Application (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Structure Type (2021-2033)

11.4.2. Market Revenue and Forecast, by Type (2021-2033)

11.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Structure Type (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Type (2021-2033)

11.4.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Structure Type (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Type (2021-2033)

11.4.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Structure Type (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Type (2021-2033)

11.4.6.3. Market Revenue and Forecast, by Application (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Structure Type (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Type (2021-2033)

11.4.7.3. Market Revenue and Forecast, by Application (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Structure Type (2021-2033)

11.5.2. Market Revenue and Forecast, by Type (2021-2033)

11.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Structure Type (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Type (2021-2033)

11.5.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Structure Type (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Type (2021-2033)

11.5.5.3. Market Revenue and Forecast, by Application (2021-2033)

Chapter 12. Company Profiles

12.1. SecureOne (Uniscan).

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Omnitec Security Systems LLC.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. SecuScan.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Tescon Sicherheitssysteme Schweiz GmbH.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Gatekeep Security Inc.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. SCANLAB

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Leidos.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. UVeye Inc.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Infinite technologies..

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others