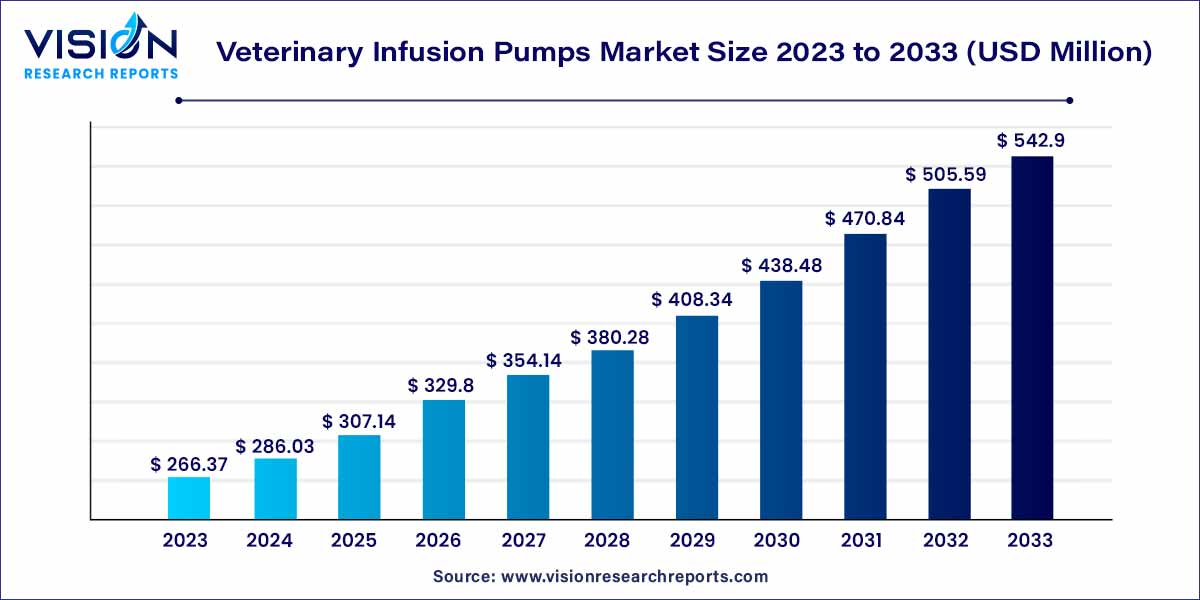

The global veterinary infusion pumps market size was estimated at around USD 266.37 million in 2023 and it is projected to hit around USD 542.9 million by 2033, growing at a CAGR of 7.38% from 2024 to 2033. The primary factors propelling the market's expansion are an increase in surgical hospital admissions combined with advantageous insurance plans, which should increase demand for the products.

The veterinary infusion pumps market is witnessing robust growth globally, propelled by the escalating demand for advanced medical equipment in veterinary care. Infusion pumps, a critical component in the delivery of fluids and medications to animals, are becoming increasingly indispensable in various veterinary settings. This overview provides insights into the key aspects influencing the dynamics of the veterinary infusion pumps market.

The growth of the veterinary infusion pumps market is underpinned by several key factors. Firstly, there is a discernible surge in the demand for specialized veterinary care, prompting an increased adoption of advanced medical equipment. Veterinary infusion pumps, playing a pivotal role in delivering precise medications and fluids to animals, are witnessing heightened utilization in both companion and livestock healthcare. Furthermore, ongoing technological advancements contribute to the market's expansion, with the development of smart infusion pumps featuring programmable rates and remote monitoring capabilities. The prevalence of chronic diseases in animals is another significant growth factor, necessitating the continuous and controlled administration of medications facilitated by these infusion pumps. Additionally, the growing financial commitment from pet owners and livestock farmers to invest in advanced veterinary healthcare significantly contributes to the overall market growth. The availability of diverse infusion pump options tailored to different animal sizes and medical requirements further propels the market forward. In essence, the convergence of increased demand for specialized care, technological innovation, and a willingness to invest in animal health collectively propels the veterinary infusion pumps market towards sustained growth.

| Report Coverage | Details |

| Market Revenue by 2033 | USD 542.9 million |

| Growth Rate from 2024 to 2033 | CAGR of 7.38% |

| Revenue Share of North America in 2023 | 32% |

| CAGR of Asia Pacific from 2024 to 2033 | 8.08% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

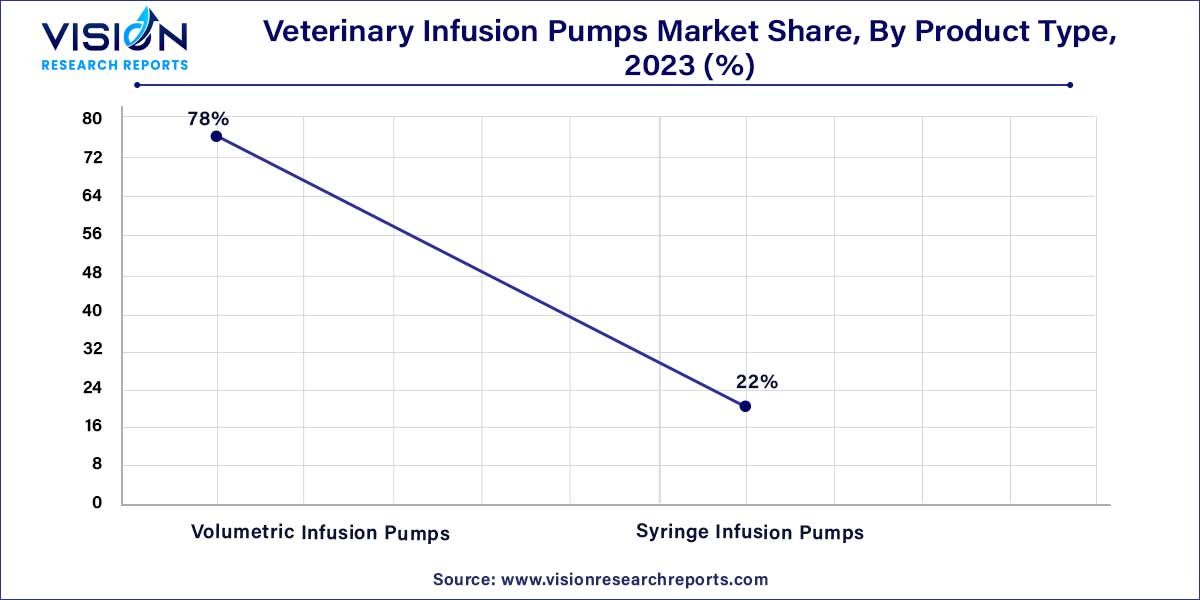

Based on product type, the market is categorized into syringe infusion pumps and volumetric infusion pump segments. The volumetric infusion pumps segment dominated the market with a share of 78% in 2023. This dominance can be attributed to the growing usage of large-volume infusion pumps for numerous benefits, including delivering fluids during animal blood transfusions, parenteral nutrition administration, and emergency conditions. In addition, continuous technological advancements and integration of advanced features for long-term treatments are expected to stimulate segmental growth. Moreover, volumetric infusion pumps offer ergonomic and compact design as well as they are integrated with wireless connectivity for real-time monitoring for effective treatment with better animal care are a few aspects driving segmental demand over the forecast period.

The syringe infusion pumps segment is projected to witness substantial growth in the foreseeable future. The segment demand is primarily attributed to the growing usage of syringe infusion pumps for precise anesthesia administration and drug administration with narrow therapeutic ranges.

Based on animal type, the companion animals segment held the largest market share of over 91% in 2023. The segment growth is due to the significant rise in pet adoption brought on by changing lifestyles, favorable reimbursement coverage, increasing awareness and adoption of advanced veterinary care, and out-of-pocket expenditure among developing economies. For instance, the APPA National Pet Owners Survey estimated that in 2023, around 66% of households own a pet in the U.S. and over 53% in the UK. Thus, increasing pet population in developed regions leads to a risk of several diseases among companion animals, thereby accelerating market demand. Furthermore, an upsurge in pet care spending and heightened awareness among pet owners and veterinarians regarding infusion therapy for critical care are other factors driving segmental demand.

The livestock animals segment held a considerable revenue share in 2023 and is estimated to witness a similar trend over the forecast timeline. The high segment growth potential is owing to increasing awareness regarding infusion therapy for better animal care. Further, the growing adoption of infusion pumps among homecare settings for long-term care broadens overall segmental revenue growth potential over the forecast period.

In terms of route of administration, the intravenous segment held the highest market share of approximately 91% in 2023. The subcutaneous segment is anticipated to grow at the fastest CAGR of 8.82% over the forecast period. The intravenous route offers several advantages, such as direct delivery to the bloodstream, dosage control, and better immune response, making it a widely adopted route of administration in the veterinary infusion pump sector. Moreover, advancements in infusion technology and the integration of several features, including precise drug dosing, wireless connectivity, and relay mode for continuous infusion, among others, propel segmental growth.

The subcutaneous route segment has gained popularity in recent years due to applications such as drug delivery precision and enhanced patient comfort. The rise in awareness regarding advanced infusion pumps and alternative routes of administration, such as subcutaneous routes among healthcare professionals is anticipated to bolster segmental demand in the foreseeable future.

In terms of end-use, the veterinary hospitals & clinics segment 49% in 2023. Expanding veterinary hospitals and clinics coupled with an increasing number of veterinarians across the globe is anticipated to spur the market demand. The growing advancements in veterinary healthcare infrastructure and integration of advanced equipment, including infusion pumps among clinical settings, will positively influence the market demand. The rising preference for advanced infusion pumps among veterinarians is owing to several benefits such as precise drug dosing, multi-channel dosing, and integration of several modes to enhance effectiveness and patient outcomes.

The home care segment is predicted to witness unprecedented growth over the projected period. This high growth potential is primarily attributed to the upsurge in long-term care, along with increasing awareness regarding infusion therapy for effective nutrition and fluid management for better results. In addition, increasing pet care spending, especially on pet insurance in high-income countries will spur market growth. For instance, the APPA National Pet Owners Survey stated that U.S. pet owners spent more than USD 136.8 million on pet care in 2022. Thus, rising pet care spending coupled with high product awareness is expected to drive market revenue growth in the forthcoming years.

In terms of application, the fluid therapy segment led the global market with the largest market share of 35% in 2023. The growing adoption of infusion pumps for fluid therapy in veterinary medicine to provide precise control over the administration of fluids and medications is enhancing patient care and thereby driving segmental demand. The rising demand for multi-channel infusion pumps that allow for the simultaneous administration of multiple fluids or medications in complex treatment conditions strengthen the market demand. Furthermore, numerous pharmaceutical and biotech companies are proactively involved in R&D activities and clinical trials for novel drug innovations that require continuous fluid therapy to animals for checking effectivity and bioavailability, which can positively influence segment growth potential.

The nutrition segment is projected to grow at the fastest CAGR of 7.82% over the forecast period. The segment growth is attributed to the growing preference for enteral nutrition in pet care, where nutrients are directly delivered into the gastrointestinal tract through infusion pumps. Moreover, nutrition plays a significant role in preventive veterinary care, and veterinary infusion pumps can be used to administer nutritional solutions that assist in maintaining optimal health and prevent certain diseases. Thus, the aforementioned factors propel segment growth.

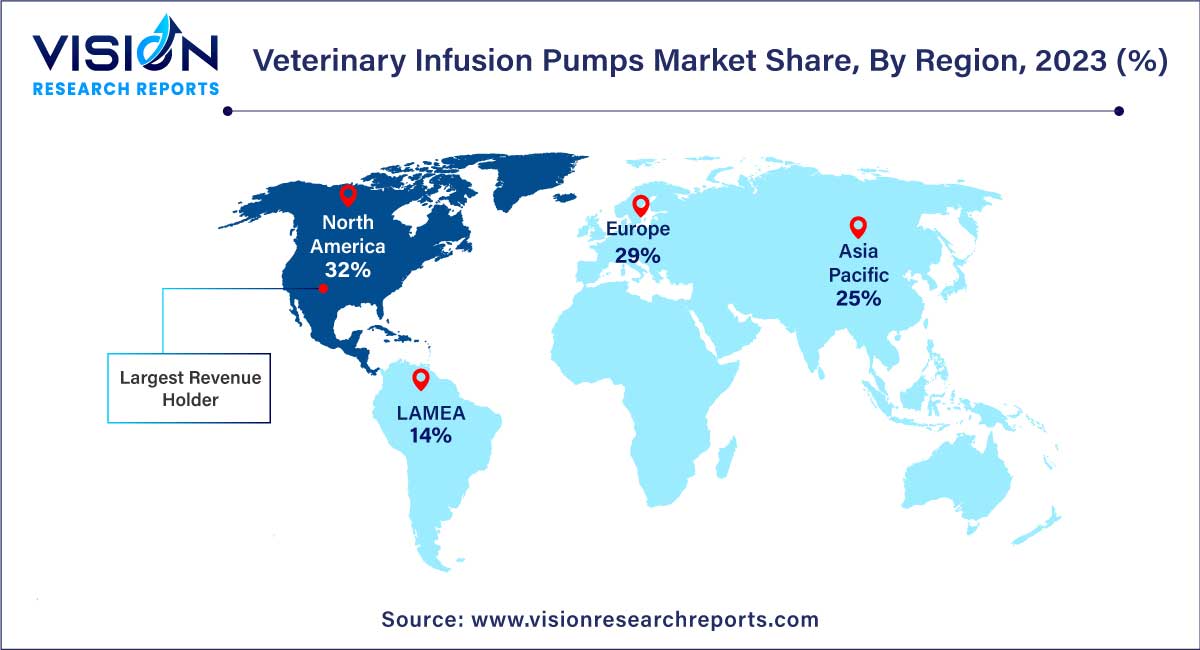

Based on region, North America dominated the market with a share of more than 32% in 2023. The regional growth is owing to factors such as the strong presence of major industry players, increasing prevalence of several chronic diseases, and technological advancements. Key companies, including HESKA Corporation, Grady Medical Systems, and Avante Health Solutions, are headquartered in the U.S., thus contributing to the regional share. Moreover, a strong foothold in R&D activities and clinical trials in the region by several life science companies and research institutes is projected to accelerate product demand in the region. Further, heightened product awareness and high pet care spending are a few other factors propelling the North America market over the forecast period.

Asia Pacific region is expected to grow the fastest at over 8.08% over the forecast period. The regional growth is attributed to the evolving healthcare infrastructure, strong presence of local players, and awareness of animal health and fluid management.

By Product Type

By Animal Type

By Route of Administration

By Application

By End-use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Veterinary Infusion Pumps Market

5.1. COVID-19 Landscape: Veterinary Infusion Pumps Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Veterinary Infusion Pumps Market, By Product Type

8.1. Veterinary Infusion Pumps Market, by Product Type, 2024-2033

8.1.1. Volumetric Infusion Pumps

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Syringe Infusion Pumps

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Veterinary Infusion Pumps Market, By Animal Type

9.1. Veterinary Infusion Pumps Market, by Animal Type, 2024-2033

9.1.1. Companion Animals

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Livestock Animals

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Veterinary Infusion Pumps Market, By Route of Administration

10.1. Veterinary Infusion Pumps Market, by Route of Administration, 2024-2033

10.1.1. Intravenous (IV)

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Subcutaneous

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Epidural Infusion

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Other Route of Administration

10.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Veterinary Infusion Pumps Market, By Application

11.1. Veterinary Infusion Pumps Market, by Application, 2024-2033

11.1.1. Fluid Therapy

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Anesthesia

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. Pain Management

11.1.3.1. Market Revenue and Forecast (2021-2033)

11.1.4. Nutrition

11.1.4.1. Market Revenue and Forecast (2021-2033)

11.1.5. Other Application

11.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Global Veterinary Infusion Pumps Market, By End-use

12.1. Veterinary Infusion Pumps Market, by End-use, 2024-2033

12.1.1. Veterinary Hospitals & Clinics

12.1.1.1. Market Revenue and Forecast (2021-2033)

12.1.2. Home Care

12.1.2.1. Market Revenue and Forecast (2021-2033)

12.1.3. Research & Academic Institutions

12.1.3.1. Market Revenue and Forecast (2021-2033)

12.1.4. Other End-use

12.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 13. Global Veterinary Infusion Pumps Market, Regional Estimates and Trend Forecast

13.1. North America

13.1.1. Market Revenue and Forecast, by Product Type (2021-2033)

13.1.2. Market Revenue and Forecast, by Animal Type (2021-2033)

13.1.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

13.1.4. Market Revenue and Forecast, by Application (2021-2033)

13.1.5. Market Revenue and Forecast, by End-use (2021-2033)

13.1.6. U.S.

13.1.6.1. Market Revenue and Forecast, by Product Type (2021-2033)

13.1.6.2. Market Revenue and Forecast, by Animal Type (2021-2033)

13.1.6.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

13.1.6.4. Market Revenue and Forecast, by Application (2021-2033)

13.1.7. Market Revenue and Forecast, by End-use (2021-2033)

13.1.8. Rest of North America

13.1.8.1. Market Revenue and Forecast, by Product Type (2021-2033)

13.1.8.2. Market Revenue and Forecast, by Animal Type (2021-2033)

13.1.8.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

13.1.8.4. Market Revenue and Forecast, by Application (2021-2033)

13.1.8.5. Market Revenue and Forecast, by End-use (2021-2033)

13.2. Europe

13.2.1. Market Revenue and Forecast, by Product Type (2021-2033)

13.2.2. Market Revenue and Forecast, by Animal Type (2021-2033)

13.2.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

13.2.4. Market Revenue and Forecast, by Application (2021-2033)

13.2.5. Market Revenue and Forecast, by End-use (2021-2033)

13.2.6. UK

13.2.6.1. Market Revenue and Forecast, by Product Type (2021-2033)

13.2.6.2. Market Revenue and Forecast, by Animal Type (2021-2033)

13.2.6.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

13.2.7. Market Revenue and Forecast, by Application (2021-2033)

13.2.8. Market Revenue and Forecast, by End-use (2021-2033)

13.2.9. Germany

13.2.9.1. Market Revenue and Forecast, by Product Type (2021-2033)

13.2.9.2. Market Revenue and Forecast, by Animal Type (2021-2033)

13.2.9.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

13.2.10. Market Revenue and Forecast, by Application (2021-2033)

13.2.11. Market Revenue and Forecast, by End-use (2021-2033)

13.2.12. France

13.2.12.1. Market Revenue and Forecast, by Product Type (2021-2033)

13.2.12.2. Market Revenue and Forecast, by Animal Type (2021-2033)

13.2.12.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

13.2.12.4. Market Revenue and Forecast, by Application (2021-2033)

13.2.13. Market Revenue and Forecast, by End-use (2021-2033)

13.2.14. Rest of Europe

13.2.14.1. Market Revenue and Forecast, by Product Type (2021-2033)

13.2.14.2. Market Revenue and Forecast, by Animal Type (2021-2033)

13.2.14.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

13.2.14.4. Market Revenue and Forecast, by Application (2021-2033)

13.2.15. Market Revenue and Forecast, by End-use (2021-2033)

13.3. APAC

13.3.1. Market Revenue and Forecast, by Product Type (2021-2033)

13.3.2. Market Revenue and Forecast, by Animal Type (2021-2033)

13.3.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

13.3.4. Market Revenue and Forecast, by Application (2021-2033)

13.3.5. Market Revenue and Forecast, by End-use (2021-2033)

13.3.6. India

13.3.6.1. Market Revenue and Forecast, by Product Type (2021-2033)

13.3.6.2. Market Revenue and Forecast, by Animal Type (2021-2033)

13.3.6.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

13.3.6.4. Market Revenue and Forecast, by Application (2021-2033)

13.3.7. Market Revenue and Forecast, by End-use (2021-2033)

13.3.8. China

13.3.8.1. Market Revenue and Forecast, by Product Type (2021-2033)

13.3.8.2. Market Revenue and Forecast, by Animal Type (2021-2033)

13.3.8.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

13.3.8.4. Market Revenue and Forecast, by Application (2021-2033)

13.3.9. Market Revenue and Forecast, by End-use (2021-2033)

13.3.10. Japan

13.3.10.1. Market Revenue and Forecast, by Product Type (2021-2033)

13.3.10.2. Market Revenue and Forecast, by Animal Type (2021-2033)

13.3.10.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

13.3.10.4. Market Revenue and Forecast, by Application (2021-2033)

13.3.10.5. Market Revenue and Forecast, by End-use (2021-2033)

13.3.11. Rest of APAC

13.3.11.1. Market Revenue and Forecast, by Product Type (2021-2033)

13.3.11.2. Market Revenue and Forecast, by Animal Type (2021-2033)

13.3.11.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

13.3.11.4. Market Revenue and Forecast, by Application (2021-2033)

13.3.11.5. Market Revenue and Forecast, by End-use (2021-2033)

13.4. MEA

13.4.1. Market Revenue and Forecast, by Product Type (2021-2033)

13.4.2. Market Revenue and Forecast, by Animal Type (2021-2033)

13.4.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

13.4.4. Market Revenue and Forecast, by Application (2021-2033)

13.4.5. Market Revenue and Forecast, by End-use (2021-2033)

13.4.6. GCC

13.4.6.1. Market Revenue and Forecast, by Product Type (2021-2033)

13.4.6.2. Market Revenue and Forecast, by Animal Type (2021-2033)

13.4.6.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

13.4.6.4. Market Revenue and Forecast, by Application (2021-2033)

13.4.7. Market Revenue and Forecast, by End-use (2021-2033)

13.4.8. North Africa

13.4.8.1. Market Revenue and Forecast, by Product Type (2021-2033)

13.4.8.2. Market Revenue and Forecast, by Animal Type (2021-2033)

13.4.8.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

13.4.8.4. Market Revenue and Forecast, by Application (2021-2033)

13.4.9. Market Revenue and Forecast, by End-use (2021-2033)

13.4.10. South Africa

13.4.10.1. Market Revenue and Forecast, by Product Type (2021-2033)

13.4.10.2. Market Revenue and Forecast, by Animal Type (2021-2033)

13.4.10.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

13.4.10.4. Market Revenue and Forecast, by Application (2021-2033)

13.4.10.5. Market Revenue and Forecast, by End-use (2021-2033)

13.4.11. Rest of MEA

13.4.11.1. Market Revenue and Forecast, by Product Type (2021-2033)

13.4.11.2. Market Revenue and Forecast, by Animal Type (2021-2033)

13.4.11.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

13.4.11.4. Market Revenue and Forecast, by Application (2021-2033)

13.4.11.5. Market Revenue and Forecast, by End-use (2021-2033)

13.5. Latin America

13.5.1. Market Revenue and Forecast, by Product Type (2021-2033)

13.5.2. Market Revenue and Forecast, by Animal Type (2021-2033)

13.5.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

13.5.4. Market Revenue and Forecast, by Application (2021-2033)

13.5.5. Market Revenue and Forecast, by End-use (2021-2033)

13.5.6. Brazil

13.5.6.1. Market Revenue and Forecast, by Product Type (2021-2033)

13.5.6.2. Market Revenue and Forecast, by Animal Type (2021-2033)

13.5.6.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

13.5.6.4. Market Revenue and Forecast, by Application (2021-2033)

13.5.7. Market Revenue and Forecast, by End-use (2021-2033)

13.5.8. Rest of LATAM

13.5.8.1. Market Revenue and Forecast, by Product Type (2021-2033)

13.5.8.2. Market Revenue and Forecast, by Animal Type (2021-2033)

13.5.8.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

13.5.8.4. Market Revenue and Forecast, by Application (2021-2033)

13.5.8.5. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 14. Company Profiles

14.1. B. Braun Melsungen AG

14.1.1. Company Overview

14.1.2. Product Offerings

14.1.3. Financial Performance

14.1.4. Recent Initiatives

14.2. Shenzhen Mindray Animal Medical Technology Co., LTD.

14.2.1. Company Overview

14.2.2. Product Offerings

14.2.3. Financial Performance

14.2.4. Recent Initiatives

14.3. Avante Health Solutions

14.3.1. Company Overview

14.3.2. Product Offerings

14.3.3. Financial Performance

14.3.4. Recent Initiatives

14.4. Burtons Medical Equipment

14.4.1. Company Overview

14.4.2. Product Offerings

14.4.3. Financial Performance

14.4.4. Recent Initiatives

14.5. Digicare Biomedical Technology Inc.

14.5.1. Company Overview

14.5.2. Product Offerings

14.5.3. Financial Performance

14.5.4. Recent Initiatives

14.6. Eitan Medical Ltd.

14.6.1. Company Overview

14.6.2. Product Offerings

14.6.3. Financial Performance

14.6.4. Recent Initiatives

14.7. Grady Medical Systems

14.7.1. Company Overview

14.7.2. Product Offerings

14.7.3. Financial Performance

14.7.4. Recent Initiatives

14.8. HESKA Corporation

14.8.1. Company Overview

14.8.2. Product Offerings

14.8.3. Financial Performance

14.8.4. Recent Initiatives

14.9. Leading Edge Veterinary Equipment

14.9.1. Company Overview

14.9.2. Product Offerings

14.9.3. Financial Performance

14.9.4. Recent Initiatives

14.10. Millpledge Veterinary

14.10.1. Company Overview

14.10.2. Product Offerings

14.10.3. Financial Performance

14.10.4. Recent Initiatives

Chapter 15. Research Methodology

15.1. Primary Research

15.2. Secondary Research

15.3. Assumptions

Chapter 16. Appendix

16.1. About Us

16.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others