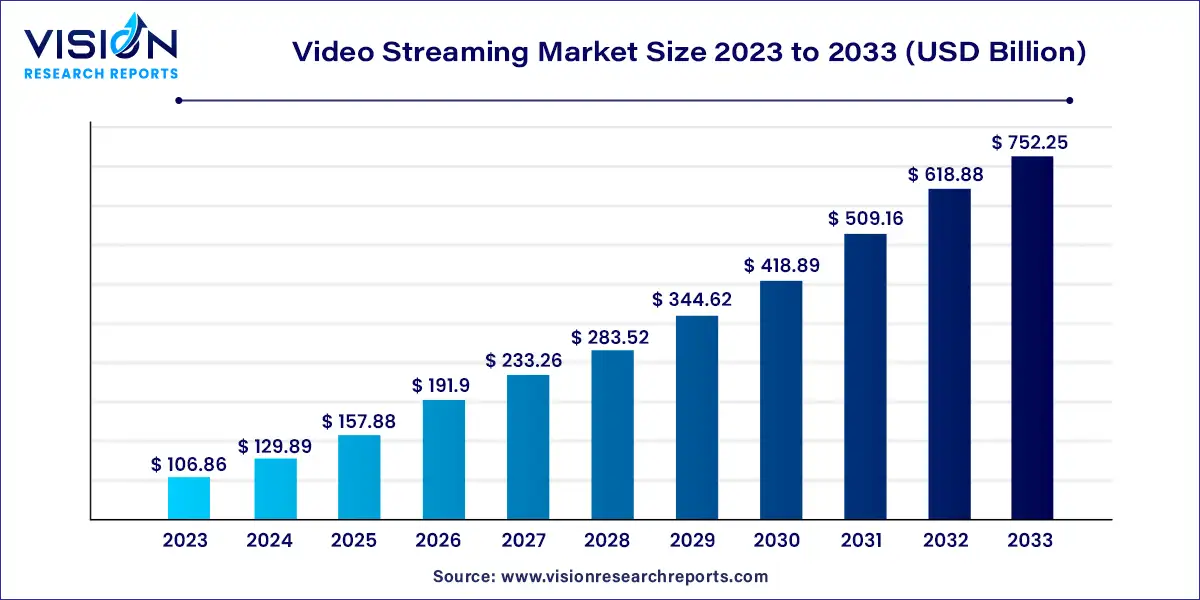

The global video streaming market size was estimated at USD 106.86 billion in 2023, which is expected to grow with a CAGR of 21.55% to reach USD 752.25 billion by 2033.

The video streaming market has witnessed exponential growth driven by technological advancements, increasing internet penetration, and evolving consumer preferences. Video streaming refers to the delivery of video content over the internet in real-time, allowing users to access and watch their favorite movies, TV shows, live events, and more on various devices, including smartphones, tablets, smart TVs, and computers.

The growth of the video streaming market propelled by an advancements in technology, particularly in internet infrastructure and streaming protocols, have facilitated seamless delivery of high-quality video content to consumers worldwide. Additionally, the widespread availability of affordable high-speed internet connections has made streaming accessible to a larger audience, driving adoption rates. Furthermore, the proliferation of smartphones, smart TVs, and other connected devices has provided multiple channels through which consumers can access streaming services, further fueling market growth. Moreover, the shift in consumer preferences towards on-demand content consumption and the convenience of anytime, anywhere access has spurred the demand for video streaming services. Lastly, the global COVID-19 pandemic has accelerated the trend towards digital entertainment as lockdowns and social distancing measures led to increased screen time and a greater reliance on streaming platforms for entertainment. These factors collectively contribute to the continued expansion of the video streaming market.

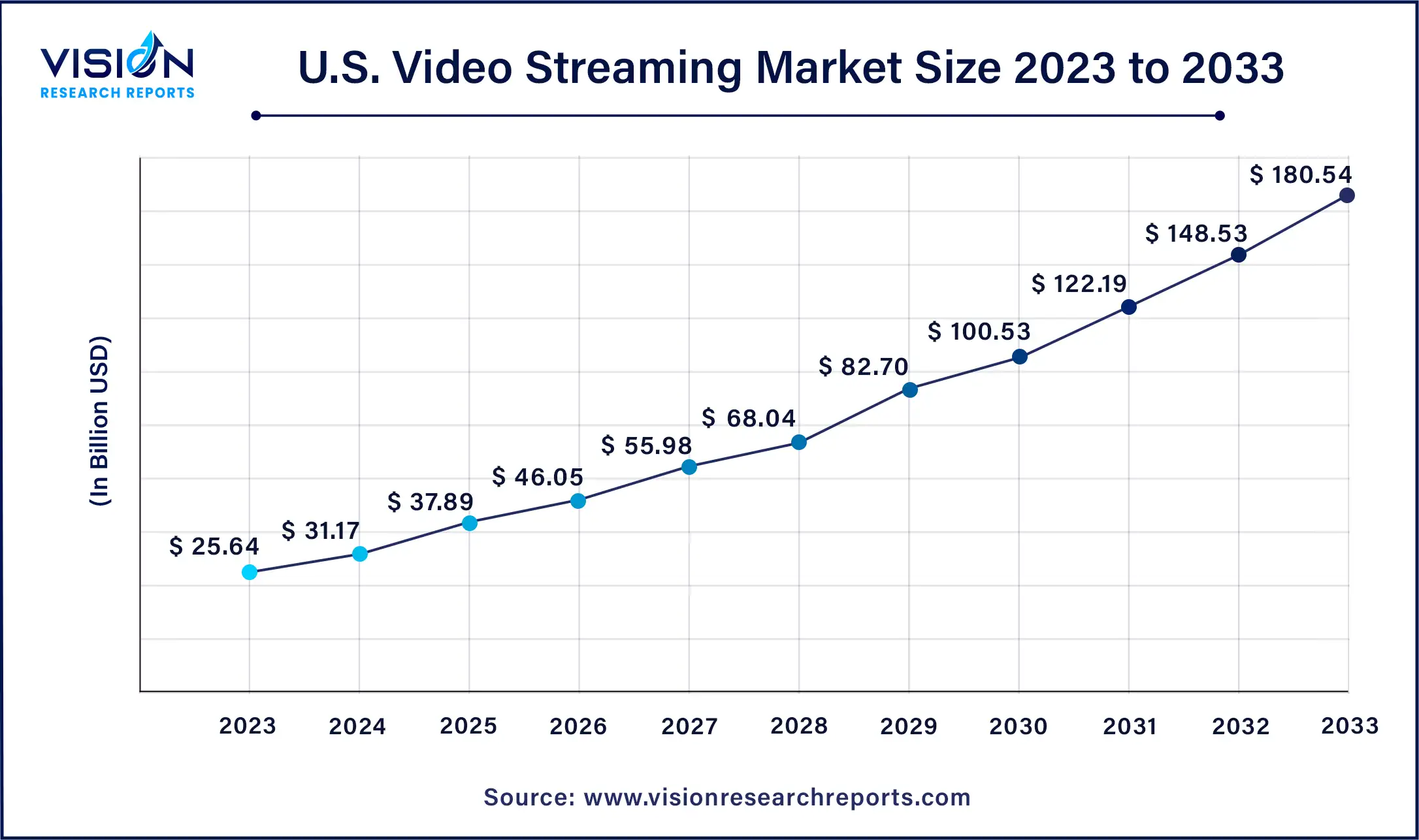

In 2023, the North America video streaming market seized the largest revenue share, accounting for 32% of the total market. This growth was primarily driven by the rapid expansion of cloud-based streaming services. Streaming giants such as Netflix, Disney+, and Amazon Prime Video fiercely compete for subscribers in North America by offering original content and diverse libraries.

Meanwhile, the video streaming market in Asia Pacific is projected to exhibit the highest compound annual growth rate (CAGR) from 2024 to 2033. This growth trajectory is attributed to rapid technological advancements, increased usage of mobile devices and tablets, and the surging popularity of online streaming. Additionally, Asia Pacific has expanded monetization opportunities by providing multichannel video streaming services alongside fixed-mobile packages, particularly benefiting from the rapid growth of broadband internet users in Southeast Asia.

In 2023, the live streaming segment dominated, capturing the largest share of revenue at 63%. This growth is attributed to increased demand for digital media devices and improved internet accessibility, facilitating remote viewing of media content. Key factors contributing to the popularity of live video streaming include diverse content offerings, ad-free experiences, mobile compatibility, robust analytics, and a vast potential audience.

Live streaming remains particularly relevant for events such as sports and music performances, maintaining its significance in the market. However, non-linear streaming, or video on demand (VOD), is poised for substantial growth in the foreseeable future due to its convenience and seamless content linkage. Driving this growth are factors like flexible watch-time options, uninterrupted viewing experiences, expansive content libraries, and the ability to pause live streams. Additionally, VOD is expected to gain widespread adoption across all age demographics, solidifying its position alongside live streaming as a mainstream content consumption method.

In 2023, the OTT segment claimed the largest revenue share, accounting for 44% of the market. This dominance can be attributed to the convenience offered by OTT-based solutions, which provide access to film and TV content over the internet without requiring users to subscribe to traditional cable or pay-TV services. Over the forecast period, this segment is expected to experience significant growth driven by the increasing demand for streamlined business automation and the widespread availability of broadband infrastructure. Emerging features such as hybrid monetization models, original digital content, and intensified competition leading to content fragmentation are anticipated to further fuel the expansion of OTT streaming solutions.

Meanwhile, the pay-TV segment also captured a noteworthy revenue share in 2023, largely due to a surge in demand for pay-TV services in regions like China, India, Mexico, and Brazil. However, the rise in programming costs for pay-TV and IPTV services has prompted customers to turn to OTT alternatives. Moreover, the proliferation of unlimited wireless data plans and the availability of public Wi-Fi have facilitated the growth of OTT service providers. For instance, Home Box Office, Inc. introduced HBO Now, an online streaming platform, enabling viewers to access HBO shows online without a cable subscription.

In 2023, the smartphones and tablets segment captured the largest revenue share, accounting for 32% of the market. This significant share can be attributed to factors such as the widespread availability of internet access, rising disposable incomes, improved standards of living, and evolving lifestyles. Conversely, the smart TV segment is poised for notable growth over the forecast period, driven by its comprehensive offering of TV channels and integrated video streaming services like Netflix.

Smartphones and tablets have become preferred devices for streaming content due to their seamless access to reliable internet services. Their portability and remote accessibility make them convenient choices for online content consumption. However, the smart TV segment is gaining traction, fueled by the availability of diverse video streaming applications such as Hulu, PlayStation Vue, DirecTV Now, YouTube TV, and Sling TV. Furthermore, applications like PLEX, which organize TV content, are expected to boost the growth of this segment by providing the capability to play various media content on smart TVs.

In 2023, the training and support segment held the largest revenue share, accounting for over 39% of the market. Meanwhile, the managed services segment is estimated to have a substantial market share, representing approximately 31% of the total market in 2023. Managed services offer the integration of broadcast and OTT solutions within a single online video management platform, providing viewers with a personalized experience. This advantage is expected to drive growth within the segment.

Video managed services deliver advanced media solutions to viewers, enhancing content quality and increasing monetization opportunities. These services encompass localization and access solutions, digital packaging and fulfillment, creative video services, compliance, and metadata services, among others. Additionally, managed services incorporate intelligent content distribution capabilities for third-party and direct OTT streaming service providers. As managed services enable the management and monetization of comprehensive OTT platforms and streaming-related services, their growth is anticipated to remain significant throughout the forecast period

In 2023, the cloud segment held the largest revenue share, surpassing 60%. The evolution of cloud computing has revolutionized video streaming, paving the way for platforms like YouTube and Netflix. Notably, the cloud segment in the Asia Pacific region is projected to achieve the highest compound annual growth rate (CAGR) from 2024 to 2033. In the same year, it also secured the leading market share in North America, attributed to the expansion of cloud-based services in countries such as the U.S. and Canada.

Video streaming platforms have increasingly adopted cloud-based deployment to leverage its benefits, including robust bandwidth and accelerated speed. The scalability of cloud-based deployment allows for handling substantial data content, thereby enhancing the viewing experience. Consequently, many streaming service providers opt for cloud-based deployment over on-premises solutions. Moreover, cloud scaling assists in augmenting bandwidth and addressing buffering and latency issues.

In 2023, the consumer segment captured the largest revenue share, accounting for nearly 51% of the market. This surge is primarily driven by the growing viewership of video on demand and live streaming services within the media and entertainment sector. The consumer segment is poised for further expansion, fueled by the convenience of remote video viewing. The increasing adoption of connected devices, particularly smartphones, and mobile subscriptions is expected to bolster this growth.

Conversely, the enterprise segment is projected to grow at a compound annual growth rate (CAGR) of 22.15% over the forecast period. This growth is attributed to the rising utilization of video streaming services by enterprises for training and consultancy purposes. Technological advancements such as captioning, advanced video codecs, indexing, web-based real-time transcoding, aggregation, and communication are anticipated to drive demand for video streaming among enterprise users. Furthermore, these technologies enhance communication efficiency within organizations, facilitating measures such as on-demand video and flexibility in remote working conditions.

By Streaming Type

By Solution

By Platform

By Service

By Revenue Model

By Deployment Type

By User

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others