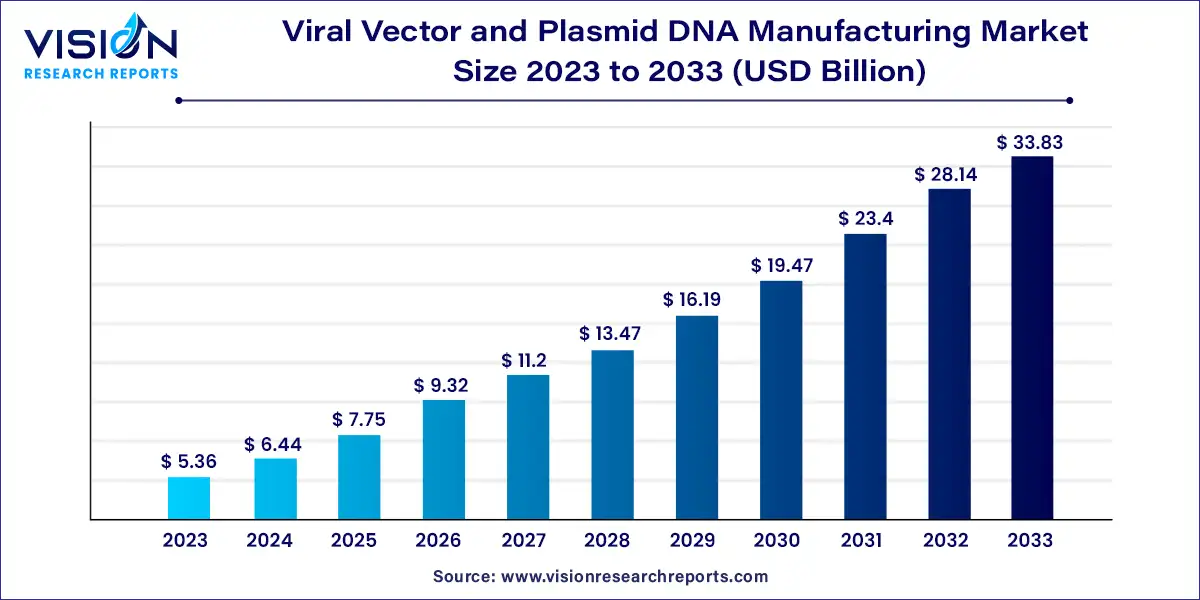

The global viral vector and plasmid DNA manufacturing market size was valued at USD 5.36 billion in 2023 and is anticipated to reach around USD 33.83 billion by 2033, growing at a CAGR of 20.23% from 2024 to 2033. The viral vector and plasmid DNA manufacturing market is a rapidly expanding sector within the biotechnology and pharmaceutical industries, driven by advancements in gene therapy, vaccine development, and personalized medicine. This market involves the production of viral vectors and plasmid DNA, crucial components for genetic modification, therapeutic interventions, and research applications.

The growth of the viral vector and plasmid DNA manufacturing market is significantly influenced by the escalating incidence of genetic disorders and chronic diseases has heightened the demand for advanced gene therapies and personalized medicine. This surge in need is driving innovation and investment in the development of viral vectors and plasmid DNA. Additionally, the rapid advancement in biotechnology and genetic engineering technologies, such as CRISPR and next-generation sequencing, has enhanced the efficiency and effectiveness of gene delivery systems. The expansion of clinical trials and research activities in gene and cell therapies further fuels market growth, as these trials increasingly rely on viral vectors and plasmid DNA for therapeutic applications. Furthermore, the increasing focus on vaccine development, particularly in response to emerging infectious diseases, has led to a higher demand for plasmid DNA-based vaccines and vector systems. Collectively, these factors contribute to the robust expansion and evolution of the viral vector and plasmid DNA manufacturing market.

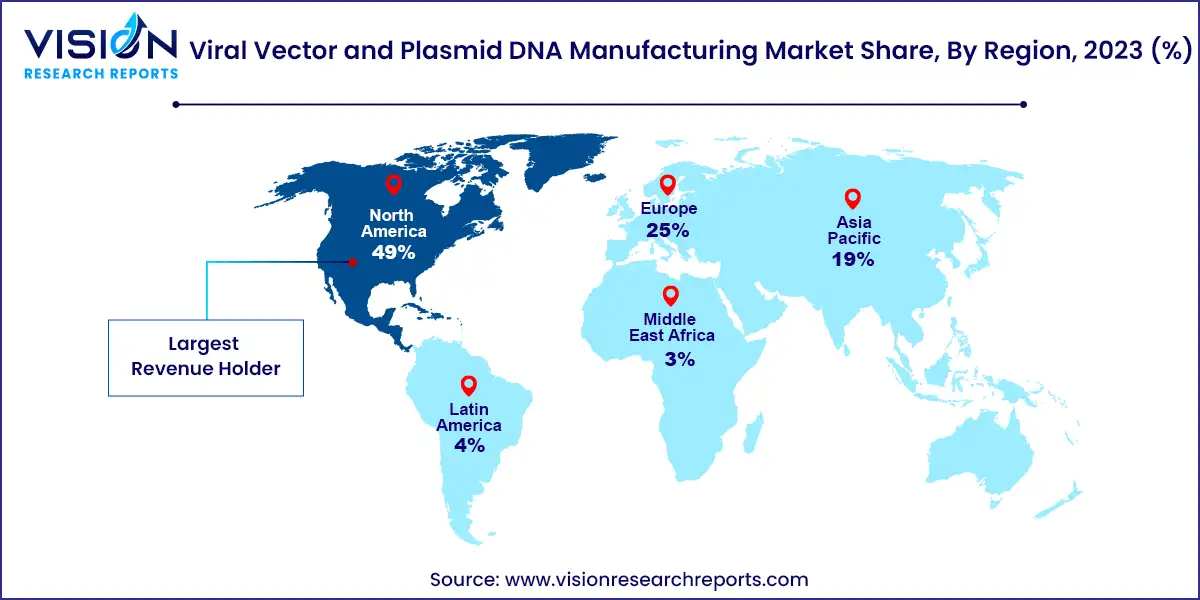

North America led the market in 2023 with a 49% share, driven by active research and development in gene and cell therapies and a high number of contract development organizations (CDOs) in the region. The U.S. holds a substantial share of this market, thanks to the presence of key players and advanced manufacturing technologies.

| Attribute | North America |

| Market Value | USD 2.62 Billion |

| Growth Rate | 20.23% CAGR |

| Projected Value | USD 16.57 Billion |

Asia Pacific is expected to be the fastest-growing region, with China at the forefront due to improvements in regulatory frameworks and vaccine development. For instance, the licensing agreement between Advaccine Biopharmaceuticals Suzhou Co., Ltd and INOVIO for the commercialization of the INO-800 COVID-19 DNA vaccine in Greater China illustrates the region’s expanding market potential. The growth in China's biopharmaceutical sector, coupled with its large patient population, is propelling the demand for viral vectors and plasmid DNA, driving the market forward.

In 2023, the adeno-associated virus (AAV) segment led the market, commanding a significant revenue share of 21%. The growing demand for AAVs is driven by their precision in gene delivery, making them highly sought after for clinical trials. Their utilization in developing orthopedic and ocular gene therapies has proven effective, with studies such as one published in August 2022 suggesting AAV-mediated gene therapy's potential in preventing acquired hearing loss. The adoption of AAVs is rapidly increasing across various therapeutic areas due to these benefits.

The lentivirus segment is anticipated to experience a notable compound annual growth rate (CAGR) during the forecast period. Advances in lentiviral vector technology, including the development of non-integrating lentiviral vectors (NILVs), are driving this growth. NILVs offer the advantage of transducing both dividing and non-dividing cells and are being explored for applications in CAR-T cell therapy and vaccine development targeting dendritic cells. Such innovations are expected to contribute significantly to market expansion.

In 2023, the downstream processing segment led the market with a dominant revenue share of 54%. This segment's prominence is due to the complex procedures required for the polishing and purification of clinical-grade products. As demand for clinical-grade viral vectors increases, manufacturers are developing more efficient downstream processes to address the challenges of traditional lab-scale manufacturing. Innovations include integrating fed-batch fermentation techniques with genetically optimized cell systems and advanced purification technologies.

The upstream processing segment is projected to grow at a significant CAGR. This segment involves the infection of cells with viruses, their cultivation, and the harvesting of the viruses. Advanced technologies like the ambr 15 microbioreactor system, which facilitates high-throughput upstream processing with automated setup and minimal labor, are expected to drive this growth. The system’s efficiency in cell culture processing and reduced need for cleaning and sterilization contribute to its appeal.

In 2023, the vaccinology segment dominated the market, capturing the largest revenue share of 23%. This growth is fueled by the increasing demand for vaccines targeting diseases such as cancer and COVID-19. Viral vectors and plasmid DNA play a crucial role in vaccine development, and the rising focus on developing new vaccines, supported by government funding, is expected to drive further growth in this segment.

The cell therapy segment is anticipated to grow at the fastest CAGR due to the rise in personalized cancer treatments. The success of Chimeric Antigen Receptor (CAR)-based therapies for cancer is expected to further stimulate this segment's growth.

The research institutes segment led the market in 2023 with the largest revenue share of 59%. Research activities aimed at improving vector production are driving this dominance. For example, in July 2021, Bluebird Bio and the Institute for NanoBiotechnology collaborated to develop new technologies for enhancing viral vector production. Such research collaborations are expected to continue fueling market growth.

The pharmaceutical and biotechnology companies segment is expected to grow significantly due to the continuous introduction of advanced therapies and an increase in gene therapy-based research programs. The rising number of biotech companies utilizing vectors for therapeutic production supports this growth trend.

In 2023, the cancer segment held the largest revenue share of 38%. The increasing incidence of cancer, projected to reach 28.4 million new cases in the next two decades, drives the demand for gene therapies to treat cancer. This rising demand for targeted therapies is expected to boost the need for viral vectors and plasmid DNA in the development of cancer treatments.

Genetic disorders are anticipated to register a significant CAGR during the forecast period. Gene therapy remains a critical application for treating genetic disorders, with more than 10% of ongoing clinical trials focused on this area. This emphasis on gene therapy for genetic disorders supports the growth of the viral vector and plasmid DNA manufacturing market.

By Vector Type

By Workflow

By Application

By End-use

By Disease

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others