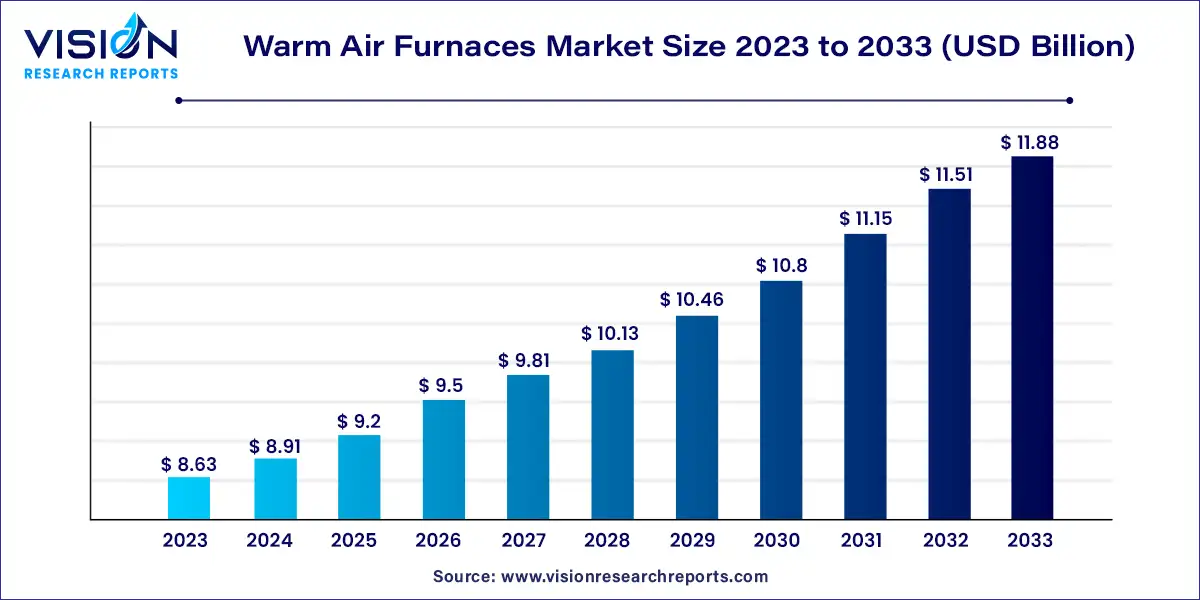

The global warm air furnaces market size was estimated at around USD 8.63 billion in 2023 and it is projected to hit around USD 11.88 billion by 2033, growing at a CAGR of 3.25% from 2024 to 2033.

The warm air furnaces market is experiencing significant growth due to several factors such as technological advancements, increasing demand for energy-efficient heating solutions, and expanding construction activities worldwide. Warm air furnaces play a crucial role in providing effective heating solutions for residential, commercial, and industrial applications, driving the market's expansion.

The growth of the warm air furnaces market is propelled by the technological advancements play a crucial role, with manufacturers continually innovating to develop more efficient and environmentally friendly heating solutions. Increasing awareness and demand for energy-efficient systems also drive market growth, as consumers and businesses seek to reduce energy costs and minimize environmental impact. Additionally, the rising pace of construction activities worldwide creates significant opportunities for warm air furnace adoption, both in new construction projects and retrofitting existing buildings. Moreover, supportive government regulations and incentives further encourage the adoption of these heating systems, fostering market growth. Overall, these factors collectively contribute to the positive trajectory of the warm air furnaces market, promising continued expansion in the foreseeable future.

| Report Coverage | Details |

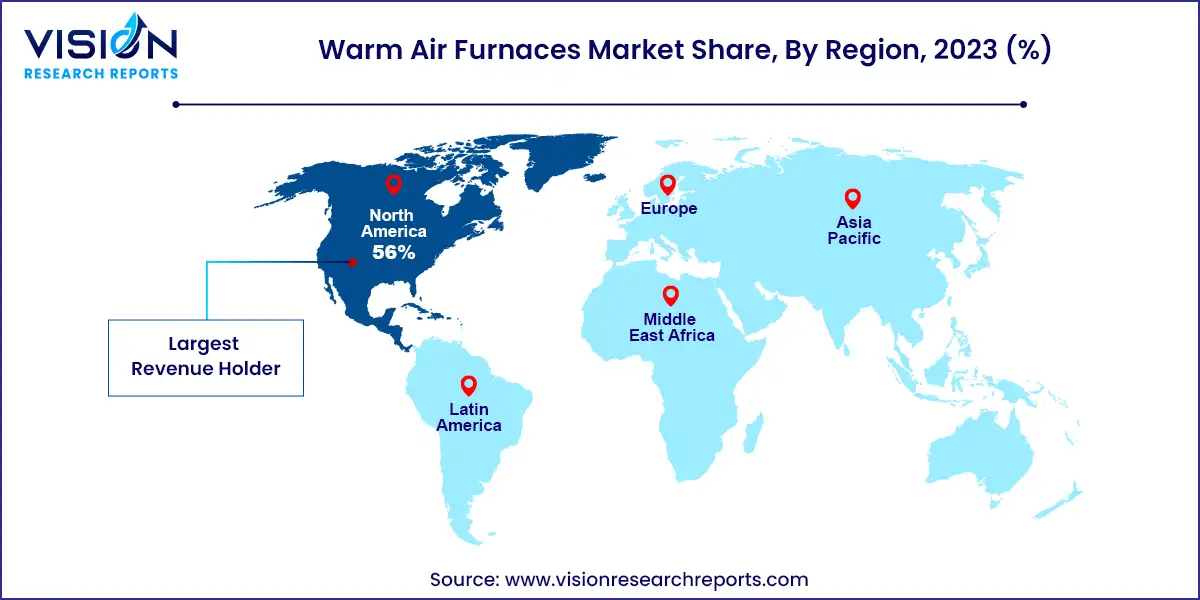

| Revenue Share of North America in 2023 | 56% |

| CAGR of Asia Pacific from 2024 to 2033 | 3.64% |

| Revenue Forecast by 2033 | USD 11.88 billion |

| Growth Rate from 2024 to 2033 | CAGR of 3.25% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The gas-warm air furnaces type segment led the market and accounted for 96% of the global revenue share in 2023. Gas-warm air furnaces are generally more efficient than electric furnaces. They can convert a higher percentage of the fuel they consume into usable heat, resulting in reduced environmental impact and lower energy costs. These can heat spaces quickly, providing almost instant warmth. This is especially crucial in colder climates, where a rapid response is necessary to maintain comfort. Further, natural gas is often cheaper than electricity, making gas furnaces a cost-effective heating option, particularly in regions with abundant natural gas supplies. These aforementioned factors are expected to drive the demand for gas-warm air furnace in the coming years.

For instance, Lennox International Inc. offers an SLP99V variable-capacity gas furnace which is the most efficient furnace as it offers an efficiency rate of up to 99%. Additionally, it comes with either a 20-year or a lifetime limited warranty. Further, Daikin warm air gas furnace provides efficient and economical heating performance. Moreover, gas-warm air furnaces are known for their reliability and durability. With proper maintenance, they can last for many years, providing consistent and dependable heating.

The oil-warm air furnace type segment is anticipated to witness a CAGR of 2.16% over the forecast period. These effectively spread warm air around a building. A thermostat allows for precise temperature control. When the oil-warm air furnaces are properly maintained, the air produced is not as dry as the air heated by electric or wood-burning systems, and it is odorless. These aforementioned factors are anticipated to propel the demand for warm air furnaces over the forecast period.

The XV80 model from Trane strikes a solid balance between performance and energy economy. Trane's XV80 is rated with an AFUE of up to 85%. Furthermore, the XV80's variable-speed blower distributes heat more uniformly and consistently throughout the area, minimizing hot and cold areas.

The commercial application segment led the market and accounted for 42% of the global revenue share in 2023. Warm air furnaces are widely used in commercial applications for heating various types of commercial buildings and spaces. Their versatility, efficiency, and relatively low installation and maintenance costs make them a popular choice for many commercial applications. For instance, warm air furnaces are often used in office buildings to provide centralized heating. They can efficiently heat large open spaces, individual offices, and conference rooms. Further, many retail stores use warm air furnace to keep their spaces warm and comfortable for customers during colder months.

Warm air furnace offer the advantage of quick heating and the ability to integrate with ventilation and air conditioning systems, providing both heating and cooling capabilities in one system (HVAC). They can be powered by various fuels, including natural gas, oil, electricity, or propane, allowing businesses to choose the most suitable option based on their location and energy availability.

The residential application segment is anticipated to witness a CAGR of 3.55% over the forecast period. Warm air furnaces are a common heating option for residential applications. They are widely used in residential spaces to provide central heating. For instance, warm air furnaces are designed to provide heating to the entire house through a network of ducts and vents. They can efficiently distribute warm air to different rooms, ensuring consistent and comfortable temperatures throughout the home. These aforementioned factors are anticipated to propel the demand for warm air furnaces for residential applications in the coming years.

North America region dominated the market in 2023 by accounting for a share of 56% of the global revenue owing to the massive investments by various governments for the development of public infrastructure and the expansion of residential construction. Furthermore, there is rising awareness regarding energy saving across the region which is expected to augment the market demand further.

Due to the rising need for manufacturing facilities in the region's expanding economies, warm air furnace demand is expected to increase significantly throughout Central and South America. Over the projection period, this is anticipated to have a favorable effect on industrial construction, increasing market demand.

Warm air furnaces, though popular in some regions, are not as commonly used in Europe as they are in North America. In Europe, other heating systems are more prevalent due to differences in climate, energy prices, and building construction practices. For instance, Europe generally experiences milder climatic conditions compared to North America, especially in southern and western regions. As a result, the need for constant and intense heating is often lesser. Furthermore, European residential buildings often feature different construction techniques with a greater emphasis on insulation and energy efficiency. These energy-efficient building practices, along with the use of radiant heating systems, reduce the demand for warm-air furnaces.

The Asia Pacific region is expected to witness a CAGR of 3.64% over the forecast period. The warm air furnace market can vary significantly across different countries in the Asia Pacific region, and there might be some areas where warm air furnaces are more prevalent or gaining popularity. Several factors contribute to the popularity of certain heating systems over others in the region, including climate, building construction styles, energy efficiency regulations, and cultural preferences. Many countries in the region are more focused on energy efficiency and sustainable heating solutions, which has led to the popularity of warm air furnace.

By Type

By Application

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Warm Air Furnaces Market

5.1. COVID-19 Landscape: Warm Air Furnaces Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Warm Air Furnaces Market, By Type

8.1. Warm Air Furnaces Market, by Type, 2024-2033

8.1.1. Gas Warm Air Furnaces

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Oil Warm Air Furnaces

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Warm Air Furnaces Market, By Application

9.1. Warm Air Furnaces Market, by Application, 2024-2033

9.1.1. Residential

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Industrial

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Commercial

9.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Warm Air Furnaces Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Type (2021-2033)

10.1.2. Market Revenue and Forecast, by Application (2021-2033)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Type (2021-2033)

10.1.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Type (2021-2033)

10.1.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Type (2021-2033)

10.2.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Type (2021-2033)

10.2.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Type (2021-2033)

10.2.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Type (2021-2033)

10.2.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Type (2021-2033)

10.2.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Type (2021-2033)

10.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Type (2021-2033)

10.3.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Type (2021-2033)

10.3.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Type (2021-2033)

10.3.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Type (2021-2033)

10.3.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Type (2021-2033)

10.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Type (2021-2033)

10.4.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Type (2021-2033)

10.4.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Type (2021-2033)

10.4.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Type (2021-2033)

10.4.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Type (2021-2033)

10.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Type (2021-2033)

10.5.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Type (2021-2033)

10.5.4.2. Market Revenue and Forecast, by Application (2021-2033)

Chapter 11. Company Profiles

11.1. Carrier Corporation

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Mitsubishi Electric Corporation

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Emerson Electric Co.

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Ingersoll-Rand Plc

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Daikin Industries, Ltd.

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Rheem Manufacturing

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Lennox International

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Johnson Controls, Inc.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Robert Bosch GmbH

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Viessmann Group

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others