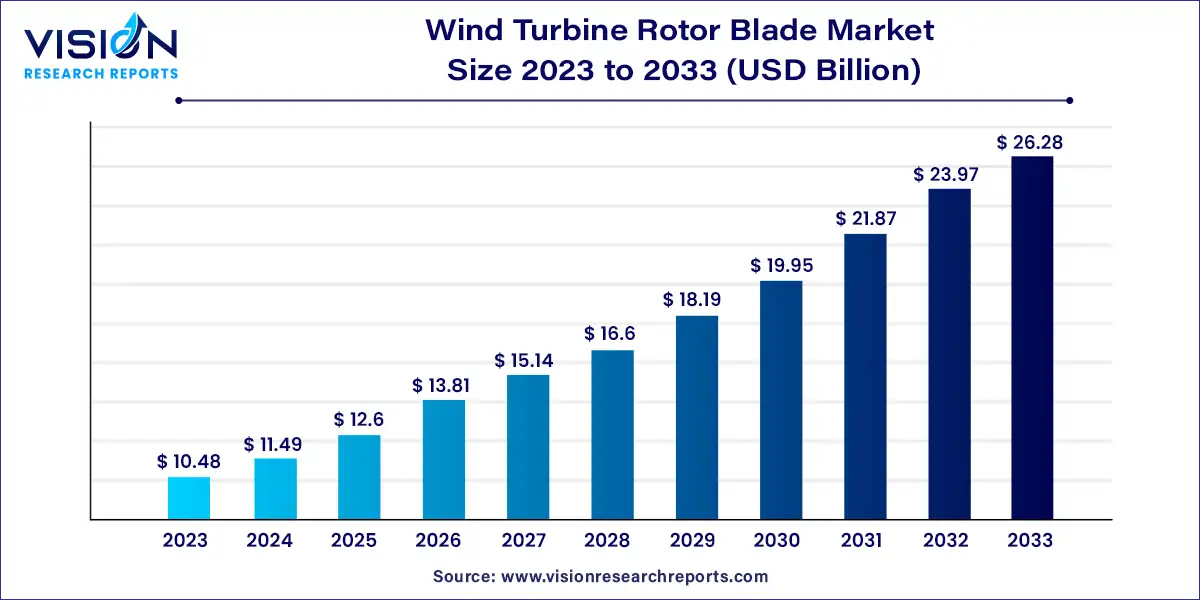

The global wind turbine rotor blade market size was surpassed at USD 10.48 billion in 2023 and is expected to hit around USD 26.28 billion by 2033, growing at a CAGR of 9.63% from 2024 to 2033.

The wind turbine rotor blade market is a pivotal segment within the renewable energy sector, crucial for harnessing wind energy efficiently. Rotor blades are essential components of wind turbines, converting wind energy into mechanical energy that drives electricity generation. As the global emphasis on sustainable energy sources grows, the demand for advanced wind turbine rotor blades has surged, influencing market dynamics significantly.

The growth of the wind turbine rotor blade market is primarily driven by the escalating global shift towards renewable energy sources. Governments and organizations are increasingly prioritizing the reduction of greenhouse gas emissions and investing in wind power as a viable alternative to fossil fuels. This push is bolstered by supportive policies, subsidies, and tax incentives that encourage the development and installation of wind turbines. Additionally, technological advancements in blade materials and design have significantly enhanced rotor blade efficiency, durability, and performance. Innovations such as longer, lighter blades made from advanced composites allow for greater energy capture and reduced operational costs. The growing awareness of environmental sustainability and the need for energy security further fuel the demand for wind turbines, thereby accelerating the growth of the rotor blade market.

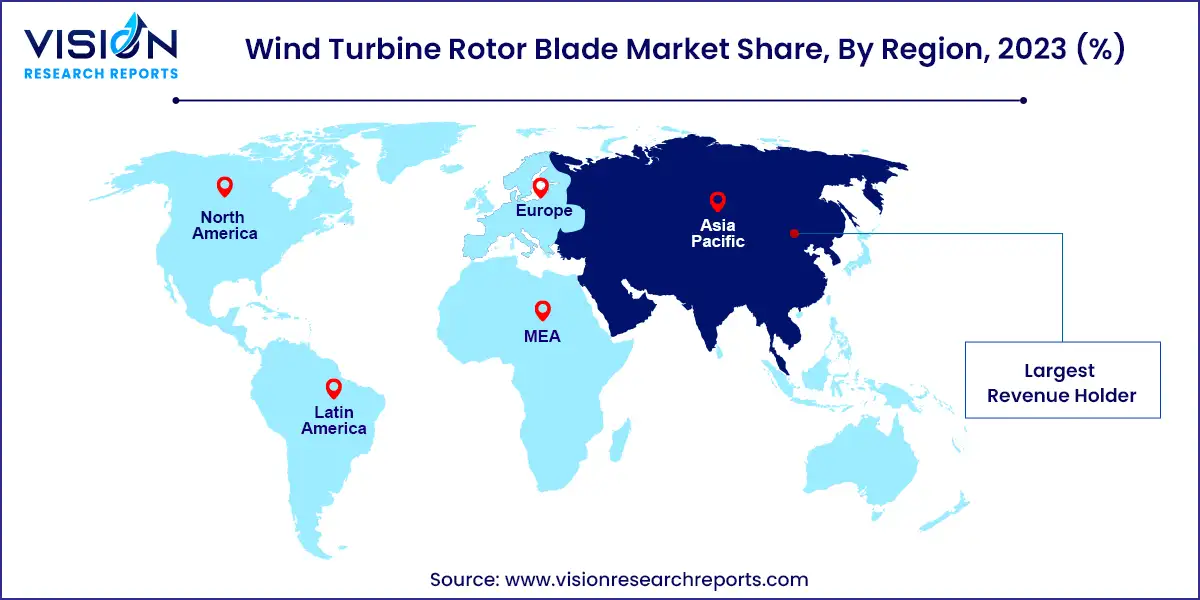

The Asia Pacific region is poised for rapid growth in the wind turbine rotor blade market, driven by the swift expansion of wind energy projects in countries such as China and India. These nations have set ambitious targets for wind energy capacity to meet the rising energy demands of their growing populations.

North America held over 25% of the revenue share in the global wind turbine rotor blade market. The market in North America is expected to grow steadily, driven by supportive government policies and initiatives aimed at diversifying the energy mix. The U.S., in particular, continues to make substantial investments in wind energy, with state-level mandates encouraging the expansion of both onshore and offshore wind farms. This commitment positions the U.S. as a key player in the global wind energy market.

U.S. Wind Turbine Rotor Blade Market Trends

U.S. manufacturers and energy producers are focusing on sustainable practices, including the recycling and reuse of old blades, to ensure a more sustainable lifecycle for wind turbines. As the industry evolves, the U.S. is expected to lead in wind energy innovation, harnessing wind power to meet growing energy demands sustainably.

Europe Wind Turbine Rotor Blade Market Trends

Europe is anticipated to grow due to significant efforts in wind energy installations and stringent carbon emission regulations. Leading countries like Germany, the UK, and Denmark are at the forefront of wind energy innovation, investing heavily in both onshore and offshore wind farms. Europe's advanced infrastructure, skilled workforce, and technological prowess in wind turbine design and manufacturing are expected to drive continued growth.

The carbon composite material segment dominated the revenue share with over 77% in 2023. Initially, the high cost of carbon composites restricted their use to premium applications. However, advancements in manufacturing processes and decreasing costs have led to their widespread adoption in new rotor blade designs. Their exceptional strength-to-weight ratio significantly improves turbine performance and longevity, thereby supporting the expansion of the wind energy sector.

Glass fiber materials play a crucial role in the development and optimization of wind turbine rotor blades, shaping the wind energy sector significantly. The benefits of glass fibers—such as their favorable strength-to-weight ratio, durability, and cost-effectiveness—enable the creation of longer, more robust blades. These attributes are essential for boosting wind turbine efficiency and energy output.

The offshore application segment accounted for over 69% of the revenue share in 2023. The onshore application segment is projected to benefit from lower installation and maintenance costs compared to offshore projects. Established infrastructure and technological advancements support onshore wind energy, making it an attractive investment in both developed and emerging economies. The affordability and proven reliability of onshore wind farms are expected to drive increased adoption.

The growth of the onshore segment is primarily due to its lower installation and maintenance costs compared to offshore wind farms. The well-established infrastructure and technology for onshore wind energy make it a dependable investment for countries across various development stages. Nations like India and China are increasingly investing in wind energy, which is anticipated to boost market growth.

By Material

By Application

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others