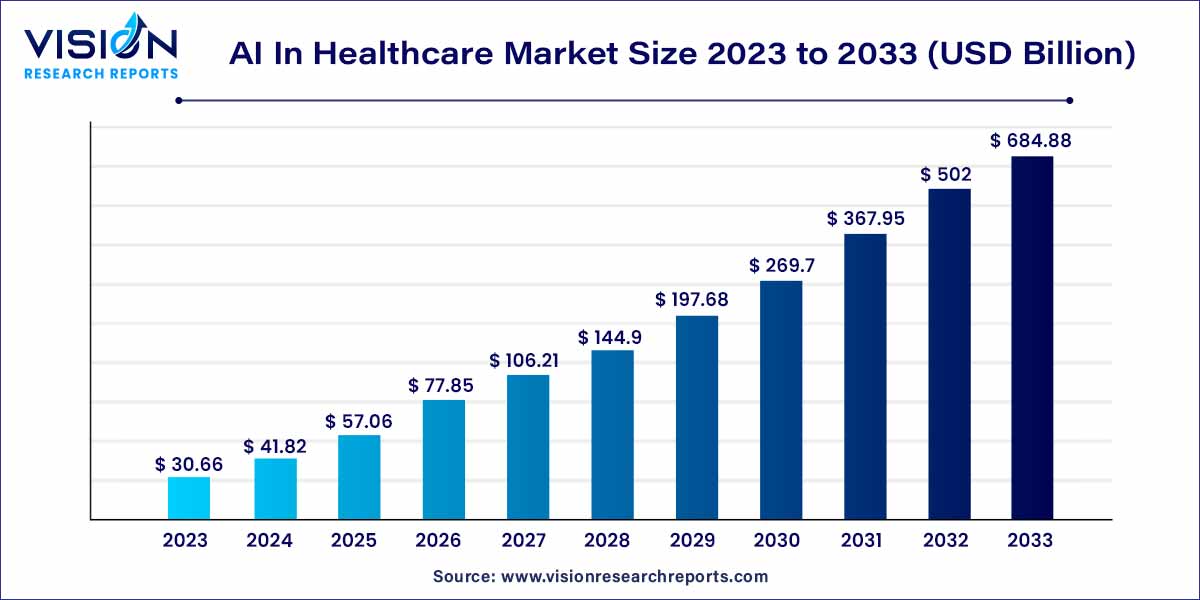

The global AI in healthcare market was surpassed at USD 30.66 billion in 2023 and is expected to hit around USD 684.88 billion by 2033, growing at a CAGR of 36.43% from 2024 to 2033. Personalized medicine, the need to lower healthcare costs, and the expansion of patient health-related digital data sets are some of the key factors propelling the industry.

The integration of Artificial Intelligence (AI) in the healthcare sector has ushered in a new era of possibilities, redefining the way medical services are delivered, managed, and optimized. This comprehensive overview explores the dynamic landscape of the AI in Healthcare market, shedding light on key components that drive its growth, applications, and the transformative impact it has on the healthcare ecosystem.

The growth of the AI in healthcare market is propelled by a convergence of influential factors that collectively contribute to its expanding trajectory. Advancements in machine learning technologies, coupled with the exponential increase in computational power, serve as catalysts for the development of sophisticated AI applications within the healthcare sector. The abundance of healthcare data, stemming from sources such as electronic health records and medical imaging, provides a rich foundation for machine learning algorithms to extract valuable insights. This convergence empowers healthcare professionals with enhanced diagnostic capabilities, personalized treatment modalities, and improved operational efficiency. The transformative impact of AI on patient care, characterized by early disease detection and tailored interventions, further fuels the market's growth. As the industry continues to harness the potential of AI, the synergy between technological innovation and healthcare needs is poised to drive sustained expansion in the AI in Healthcare market.

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 36.43% |

| Market Revenue by 2033 | USD 684.88 billion |

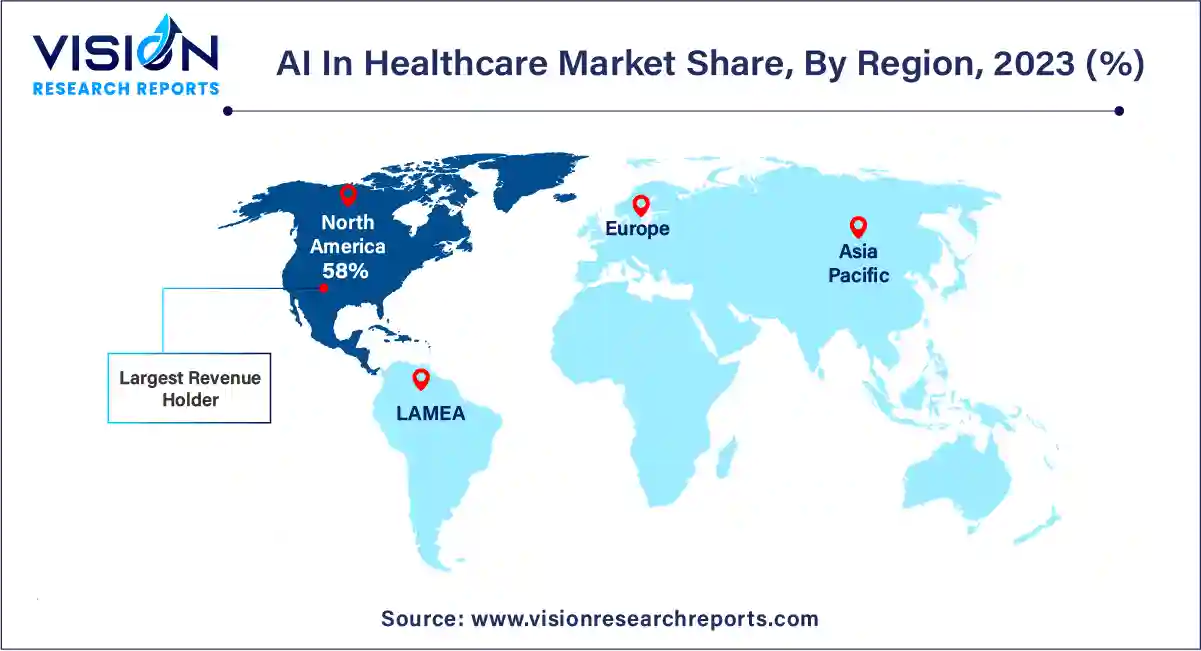

| Revenue Share of North America in 2023 | 58% |

| CAGR of Asia Pacific from 2024 to 2033 | 40.18% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The software solutions segment dominated the market with the largest revenue share of 41% in 2023 owing to the rapidly growing adoption rate of AI-based software solutions amongst healthcare providers, payers, and patients. For instance, in September 2019, GE Healthcare partnered with five Chinese local software developers namely, 12Sigma Technologies, Biomind, Shukun Technology, Yizhun Medical AI, and YITU Technology to collaboratively work on developing the Edison AI platform and support the smooth digital transformation of GE Healthcare.

The software solutions segment is anticipated to grow lucratively from 2024 to 2033. This dramatic growth rate is attributable to rising penetration of AI-based technologies in several healthcare applications such as cybersecurity, clinical trials, virtual assistants, robot-assisted surgeries, telemedicine, dosage error reduction, and fraud detection. Moreover, a growing number of strategic initiatives such as partnerships and seed investments undertaken by key players are contributing to the growth potential. Key players in this segment are IBM Corporation, NVIDIA Corporation, Intel Corporation, and Biosymetrics.

Based on application, the robot assisted surgery segment held the largest revenue share of 25% in 2023 and it is anticipated to grow at the fastest CAGR of 39.25% during forecast period. The increase in the number of robot-assisted surgeries and rise in investment for the development of new AI platforms are among few key factors supporting the penetration of AI in robot-assisted surgeries. As per a study, about 1,000 robot-assisted procedures were performed worldwide in 2000, whereas in 2018, this number increased to more than 1 million. Similarly, according to a study published in JAMA Network Open, robot assisted surgeries accounted for 15.1% of all the general surgeries in 2018, up from 1.8% in 2012.

In addition, in August 2019, the Clinical Robotic Surgery Association was inaugurated in India, which focuses on providing training to young surgeons in the field of robotic surgery, which indicates the surging demand for robotic surgeries. The adoption of AI technology is expected to increase owing to lack of skilled surgeons.

North America dominated the market with largest revenue share of 58% in 2023, owing to advancements in healthcare IT infrastructure, growing care expenditures, widespread adoption of AI/ML technologies, favorable government initiatives, lucrative funding options, and presence of several key market players. Moreover, growing geriatric population, changing lifestyles, increasing prevalence of chronic disorders, growing demand for value-based care, and rising awareness levels towards the implementation of AI-based technologies are bolstering the market growth in North America.

Moreover, the Asia Pacific region is anticipated to register the fastest CAGR of 40.18% over the forecast period. This growth rate is attributable to the rapid innovations and development in the IT infrastructure and entrepreneurship ventures specializing in AI-based technologies. Increasing investments by private investors, venture capitalists, and non-profit organizations to enhance clinical outcomes, improve data analysis and data security, and reduced costs are driving the adoption rates. Favorable government initiatives supporting and promoting healthcare organizations and care providers to readily adopt AI-based technologies are some of the key factors driving the growth of the Asia Pacific market.

By Component

By Application

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on AI in Healthcare Market

5.1. COVID-19 Landscape: AI in Healthcare Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global AI in Healthcare Market, By Component

8.1. AI in Healthcare Market, by Component, 2024-2033

8.1.1. Software Solutions

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Hardware

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Services

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global AI in Healthcare Market, By Application

9.1. AI in Healthcare Market, by Application, 2024-2033

9.1.1. Robot-Assisted Surgery

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Virtual Assistants

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Administrative Workflow Assistants

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Connected Machines

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Diagnosis

9.1.5.1. Market Revenue and Forecast (2021-2033)

9.1.6. Clinical Trials

9.1.6.1. Market Revenue and Forecast (2021-2033)

9.1.7. Fraud Detection

9.1.7.1. Market Revenue and Forecast (2021-2033)

9.1.8. Cybersecurity

9.1.8.1. Market Revenue and Forecast (2021-2033)

9.1.9. Dosage Error Reduction

9.1.9.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global AI in Healthcare Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Component (2021-2033)

10.1.2. Market Revenue and Forecast, by Application (2021-2033)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Component (2021-2033)

10.1.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Component (2021-2033)

10.1.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Component (2021-2033)

10.2.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Component (2021-2033)

10.2.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Component (2021-2033)

10.2.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Component (2021-2033)

10.2.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Component (2021-2033)

10.2.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Component (2021-2033)

10.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Component (2021-2033)

10.3.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Component (2021-2033)

10.3.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Component (2021-2033)

10.3.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Component (2021-2033)

10.3.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Component (2021-2033)

10.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Component (2021-2033)

10.4.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Component (2021-2033)

10.4.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Component (2021-2033)

10.4.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Component (2021-2033)

10.4.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Component (2021-2033)

10.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Component (2021-2033)

10.5.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Component (2021-2033)

10.5.4.2. Market Revenue and Forecast, by Application (2021-2033)

Chapter 11. Company Profiles

11.1. Nuance Communications, Inc.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. IBM Corporation

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Microsoft

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. NVIDIA Corporation

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Intel Corporation

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. DeepMind Technologies Limited

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others