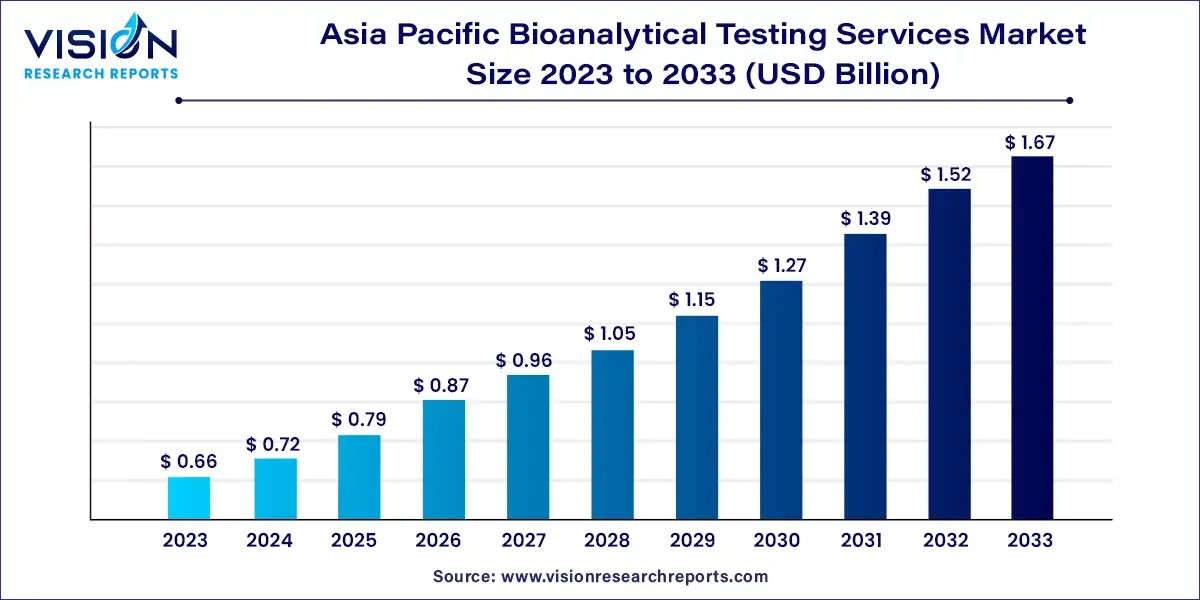

The Asia Pacific bioanalytical testing services market size was estimated at around USD 0.66 billion in 2023 and it is projected to hit around USD 1.67 billion by 2033, growing at a CAGR of 9.75% from 2024 to 2033.

The Asia Pacific bioanalytical testing services market is witnessing substantial growth, driven by the expanding pharmaceutical and biotechnology industries, increased investment in research and development, and the rising demand for specialized testing services.

The Asia Pacific bioanalytical testing services market is driven by the rapid expansion of the pharmaceutical and biotechnology industries in the region is driving demand for comprehensive bioanalytical testing to support drug development and regulatory approval processes. Secondly, increasing investments in research and development, particularly in countries like China, India, and Japan, are fueling advancements in drug discovery, thereby boosting the need for specialized testing services. Additionally, the region's growing involvement in clinical trials, supported by a diverse patient population and cost-effective operational advantages, further enhances the demand for bioanalytical testing.

The small molecule segment accounted for a dominant revenue share of 58% in 2023. This sector has seen frequent developments in recent years across the region, though countries like Malaysia and Indonesia still have significant unmet needs. The large molecule segment is expected to grow at a comparatively faster CAGR of 10.43% during the forecast period. Bioanalytical testing of large-molecule drugs can expedite the research-to-market journey in drug development.

Therapeutics in the large molecule segment have increased noticeably in recent years due to their target specificity, higher potency, and lower toxicity. Notable services in this area include assay development and validation, clinical testing, and biopharmaceutical and toxicological assays. Pharmaceutical companies are increasingly incorporating large-molecule bioanalysis into their service portfolios. They have established GLP-certified and GCLP-compliant bioanalytical laboratories that offer immunoassays for pharmacodynamics (PD), pharmacokinetics (PK), immunogenicity, and biomarkers.

The sample analysis workflow segment emerged as the largest contributor with a revenue share of 46% in 2023. This workflow is crucial to the stages of medication research and marketing, explaining its significant industry share. The growing potential of sample analysis to aid pharmacokinetic (PK) studies is a notable factor expected to drive market expansion. Within sample analysis, the hyphenated technique holds a dominant share due to its ability to address complex analytical problems. This technique combines online spectroscopic detection with separation techniques to help in the qualitative and quantitative analysis of complex compounds. Another important analytical procedure is ligand binding assays (LBAs), which quantify antibodies, proteins, DNA, biosimilars, ribonucleic acids, and other large molecules in toxicokinetic (TK), PK, immunogenicity, and pharmacodynamic (PD) studies during preclinical and clinical development.

The sample preparation segment is anticipated to register a CAGR of 10.13% from 2024 to 2033. The need for cleaner samples and the importance of minimizing matrix risks have highlighted the necessity for proper sample preparation. In this workflow, protein precipitation (PPT) is a key step used for sample cleaning and the extraction of pharmaceuticals from blood samples, such as whole blood, serum, and plasma, during the drug discovery process. Recently, advances have been made in PPT sample preparation methods used in bioanalytical testing services. These advances include the development of novel techniques to enhance the sample preparation process, integration of different sample preparation steps, and application of these advancements to biological samples. Moreover, the introduction of improved protein purification methods can enhance the quality, efficiency, and cost-effectiveness of sample preparation in the bioanalytical testing services market.

The bioavailability segment accounted for the largest revenue share in 2023. Bioavailability studies offer several notable benefits, including the evaluation of new drugs after administration and the establishment of equivalence between early and late clinical trial formulations. This technique is widely used to ensure consistency between formulations used in clinical trials and stability studies, as well as to confirm therapeutic equivalence between a pharmaceutically equivalent test drug and a generic or reference drug.

The bioequivalence segment is anticipated to expand at the fastest CAGR from 2024 to 2033. This parameter is crucial for drug makers developing generic versions of branded products. Positive developments in the biosimilar space are expected to increase the popularity of bioequivalence studies in the coming years. Additionally, the growing need for cost-effective biosimilars or generics has further boosted the adoption of bioequivalence tests.

The China bioanalytical testing services market accounted for a major share in 2023. The country has become an appealing destination for clinical trial outsourcing due to its diverse patient demographics, large population, and economical nature. This has led to domestic as well as international pharmaceutical organizations outsourcing their clinical trial processes to CROs in this economy, elevating the demand for bioanalytical testing services. Furthermore, there has been an increase in the frequency of acquisitions and expansion activities by both regional and global organizations that has served to boost market growth.

The bioanalytical testing services market in Australia is anticipated to witness the fastest growth from 2024 to 2033. Australia is highly cost-competitive for early-phase clinical trials when compared to the U.S. It operates a Clinical Trial Notification scheme, which means that the regulator delegates the trial review process to ethics committees and only needs to be notified of the outcome. This, in turn, minimizes the regulatory burden on clinical trial sponsors, enabling them to save time & money. The Australian government is also implementing reforms to reduce study start-up times, boost patient recruitment, and standardize clinical trial costs. All these factors are projected to elevate the country’s contribution to the overall market.

By Molecule

By Test

By Workflow

By Country

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others