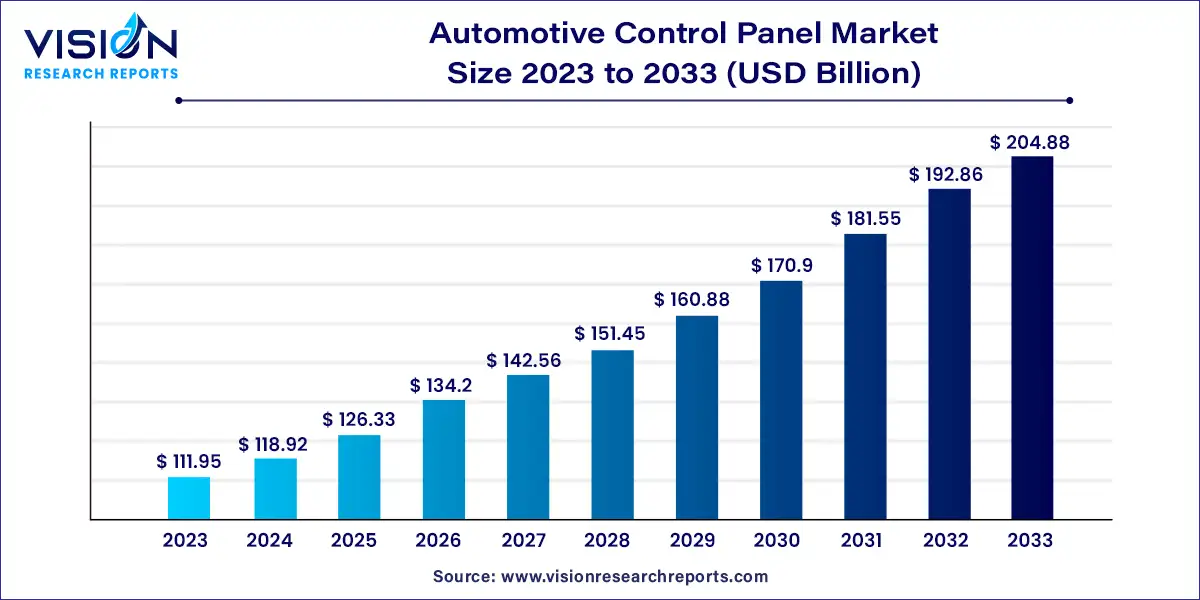

The global automotive control panel market size was estimated at around USD 111.95 billion in 2023 and it is projected to hit around USD 204.88 billion by 2033, growing at a CAGR of 6.23% from 2024 to 2033. The automotive control panel market has become increasingly vital as modern vehicles evolve into complex, tech-driven machines. These control panels are central to the operation of various vehicle systems, including climate control, infotainment, navigation, and safety features. The market is poised for significant growth, driven by advancements in automotive technology, consumer demand for enhanced driving experiences, and the ongoing shift towards electric and autonomous vehicles.

The growth of the automotive control panel market is driven by an increasing adoption of advanced driver assistance systems (ADAS) and in-car entertainment technologies has heightened the need for more sophisticated control panels. Secondly, the shift towards electric vehicles (EVs) and autonomous driving necessitates specialized interfaces, driving demand for innovative control solutions. Additionally, growing consumer expectations for enhanced connectivity, safety, and comfort within vehicles are pushing manufacturers to integrate more advanced features into control panels. Lastly, stringent government regulations focused on vehicle safety and emissions are also encouraging the development of smarter, more efficient control systems.

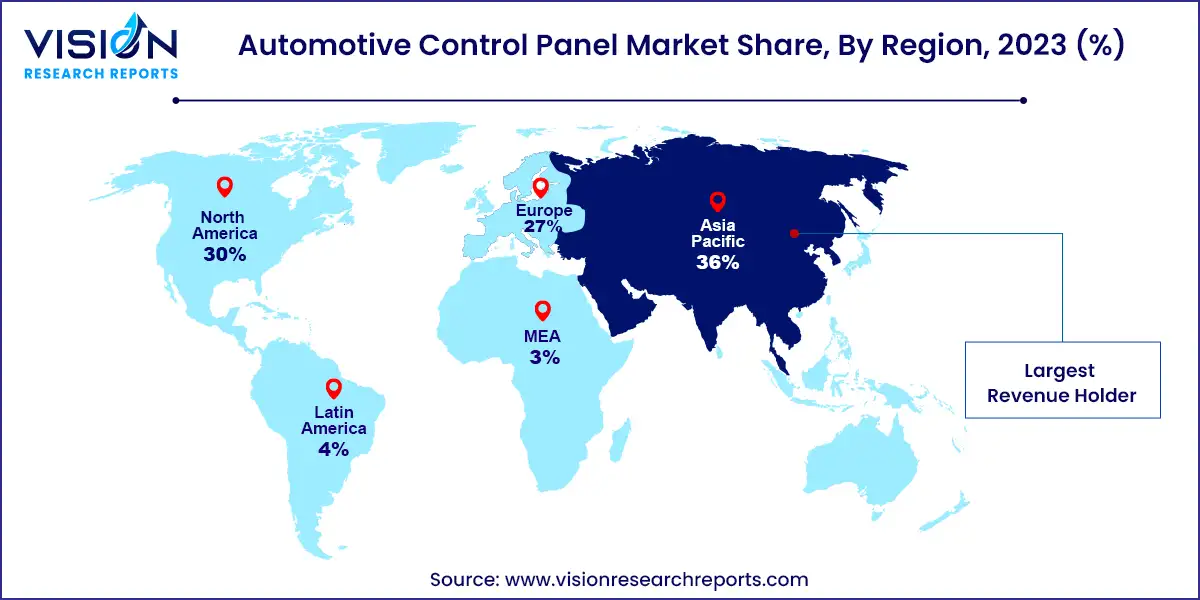

The Asia Pacific region dominated the automotive control panel market in 2023, accounting for a 36% share of global revenue. The growth in this region is driven by increasing vehicle production and the rising integration of advanced infotainment systems, touchscreens, and connectivity features in vehicles. Additionally, the growing population and improving economic conditions are boosting the demand for advanced vehicle systems, contributing to the market’s expansion.

| Attribute | Asia Pacific |

| Market Value | USD 40.30 Billion |

| Growth Rate | 6.25% CAGR |

| Projected Value | USD 73.75 Billion |

The automotive control panel market in North America is expected to grow moderately from 2024 to 2033. Technological advancements and rising consumer demand for high-tech features and convenience in premium vehicles are key drivers of market growth in this region. Additionally, the shift towards electric vehicles (EVs) and government initiatives promoting their adoption are further fueling demand for automotive control panels.

Europe Automotive Control Panel Market Trends

The automotive control panel market in Europe is expected to grow at a notable compound annual growth rate (CAGR) from 2024 to 2033. The rapid expansion of the automotive industry in countries like Germany, the UK, and Italy, coupled with the rising adoption of automotive vehicles, is driving market growth. Furthermore, the shift towards stricter environmental regulations and the increasing popularity of electric and hybrid vehicles are spurring the development of specialized control panels that integrate with these technologies, further fueling market growth.

In 2023, the manual control panel segment led the market, capturing a 39% share of global revenue. Despite the rising popularity of touchscreen interfaces, manual control panels that use physical buttons, knobs, and switches continue to offer several advantages. These controls are often simpler and more intuitive, particularly for essential functions like climate and audio settings. Additionally, manual control panels are generally more cost-effective to produce and maintain compared to advanced touchscreen systems. The simpler design, with fewer electronic components, results in lower manufacturing and repair costs. This cost efficiency, coupled with their ease of use, has fueled the growth of the manual control panel segment.

The touchscreen control panel segment is expected to see significant growth from 2024 to 2033. Touchscreens are rapidly replacing traditional mechanical buttons and manual control panels across various industries, with the automotive sector leading the charge in user interface innovation. Many new vehicle models now feature touchscreens that replace traditional center console components. The growing adoption of touchscreen control panels in vehicles, which offer a convenient and intuitive user experience along with quick access to information such as fuel levels and engine diagnostics, is driving the growth of this segment.

The passenger cars segment dominated the market in 2023, driven by the increasing adoption of vehicles like luxury cars, SUVs, sedans, and electric cars worldwide. The evolution of user interfaces in luxury vehicles is enhancing the driving experience by making it more intuitive, safe, and satisfying. Advanced systems like touchscreens, voice controls, and augmented reality are setting new benchmarks in automotive control panel technology for passenger cars. Additionally, multi-function control knobs or manual controls on the center console allow drivers to navigate menus and make selections without needing to touch the screen. The growing use of manual, push-button, and touchscreen control panels in passenger cars, due to their benefits, is propelling the segment’s growth.

The Light Commercial Vehicle (LCV) segment is anticipated to experience substantial growth from 2024 to 2033. Control panels in LCVs are designed with a focus on durability and functionality, making them suitable for the demanding conditions of commercial use. Given that these vehicles often operate in rugged environments and under high-mileage conditions, their control panels are built to be robust and reliable. The increasing demand for control panels with features like enhanced resistance to dust, moisture, and wear-and-tear—ensuring long-term performance and reducing maintenance costs—is driving growth in this segment.

By Type

By Application

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Automotive Control Panel Market

5.1. COVID-19 Landscape: Automotive Control Panel Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Automotive Control Panel Market, By Type

8.1. Automotive Control Panel Market, by Type, 2024-2033

8.1.1. Manual Control Panel

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Push Button Control Panel

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Touch Screen Control Panel

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Automotive Control Panel Market, By Application

9.1. Automotive Control Panel Market, by Application, 2024-2033

9.1.1. Passenger Cars

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Light Commercial Vehicle (LCV)

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Heavy Commercial Vehicle (HCV)

9.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Automotive Control Panel Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Type (2021-2033)

10.1.2. Market Revenue and Forecast, by Application (2021-2033)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Type (2021-2033)

10.1.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Type (2021-2033)

10.1.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Type (2021-2033)

10.2.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Type (2021-2033)

10.2.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Type (2021-2033)

10.2.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Type (2021-2033)

10.2.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Type (2021-2033)

10.2.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Type (2021-2033)

10.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Type (2021-2033)

10.3.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Type (2021-2033)

10.3.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Type (2021-2033)

10.3.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Type (2021-2033)

10.3.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Type (2021-2033)

10.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Type (2021-2033)

10.4.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Type (2021-2033)

10.4.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Type (2021-2033)

10.4.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Type (2021-2033)

10.4.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Type (2021-2033)

10.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Type (2021-2033)

10.5.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Type (2021-2033)

10.5.4.2. Market Revenue and Forecast, by Application (2021-2033)

Chapter 11. Company Profiles

11.1. Continental AG

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. MinebeaMitsumi Inc.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. ZF Friedrichshafen AG

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Faurecia Clarion

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. GX Group Limited

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Valeo S.A.

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Assembly Solutions Ltd

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. SIC Ltd

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. BCS Automotive Interface Solutions

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Toyota Motor Sales, U.S.A.

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others