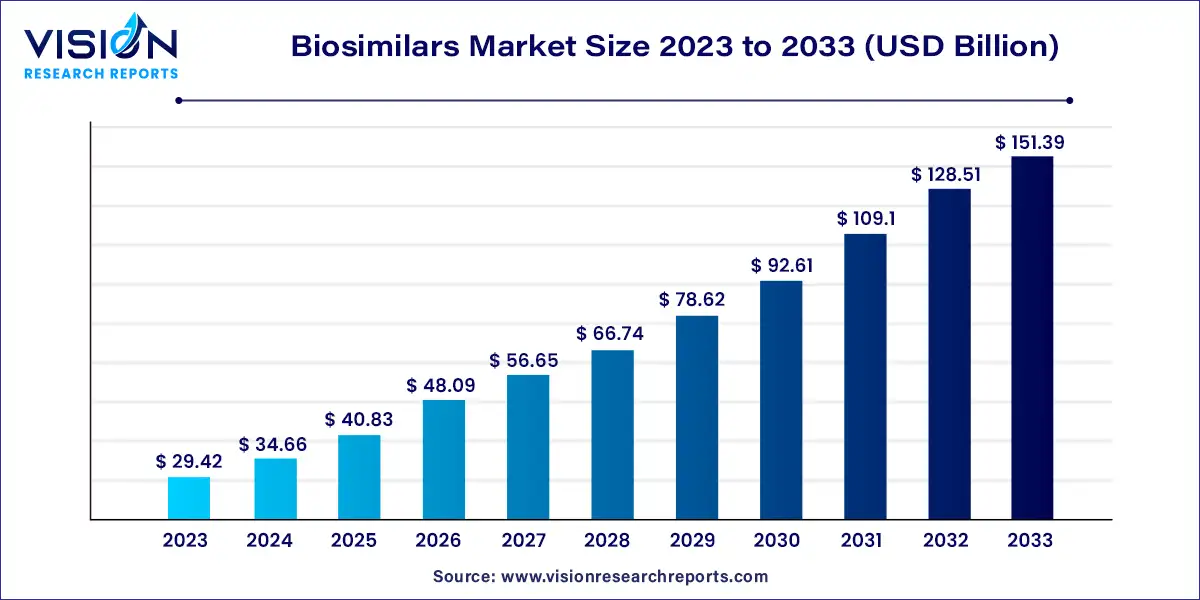

The global biosimilars market size was valued at USD 29.42 billion in 2023 and it is predicted to surpass around USD 151.39 billion by 2033 with a CAGR of 17.8% from 2024 to 2033. The biosimilars market is experiencing significant growth, driven by advancements in biotechnology and increasing healthcare needs. Biosimilars, which are highly similar to approved reference biologics, offer a cost-effective alternative and are becoming a crucial component of global healthcare strategies.

The biosimilars market is witnessing robust growth driven by the demand for cost-effective healthcare solutions, as biosimilars offer significant savings compared to their reference biologics. This cost advantage is particularly important in addressing the escalating global healthcare expenses. Additionally, the growing prevalence of chronic diseases such as cancer and diabetes fuels the need for biologic treatments, and as patents for major biologics expire, biosimilars provide a viable alternative. The supportive regulatory environment further accelerates market expansion, with regulatory agencies streamlining the approval processes for biosimilars. Advances in biotechnology and manufacturing techniques also contribute to the market's growth by enhancing the quality and production efficiency of biosimilars. Together, these factors create a favorable landscape for the continued expansion of the biosimilars market.

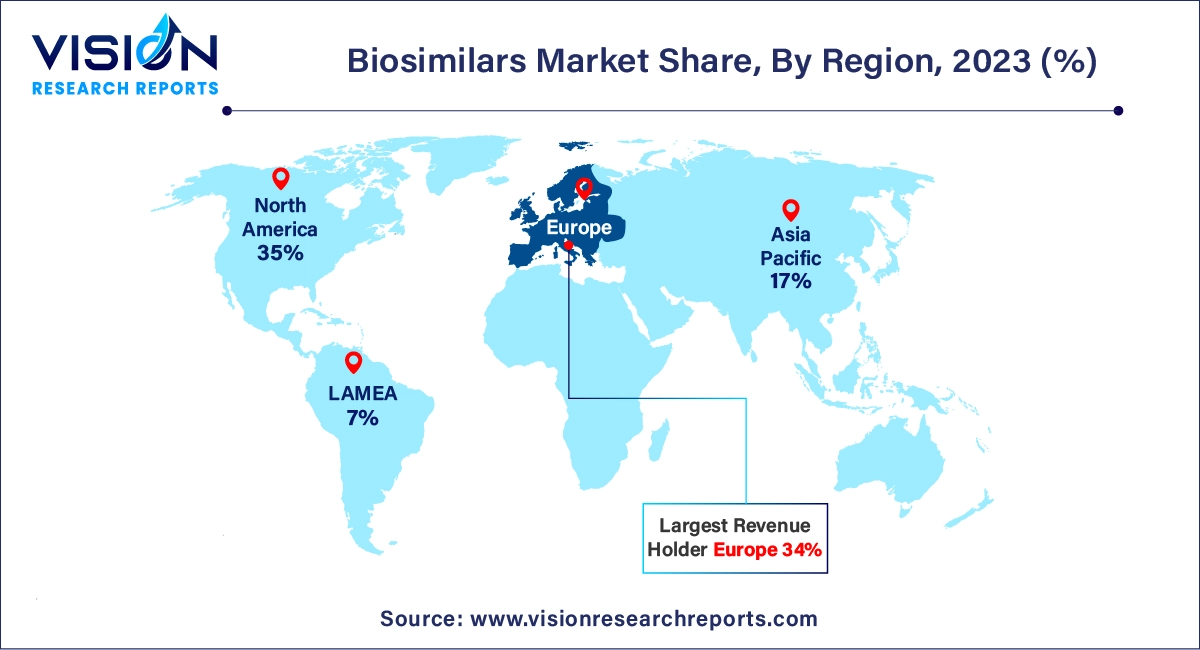

In 2023, Europe led the global market with the largest market share of 34% and is projected to maintain its leading position throughout the forecast period. This dominance is attributed to the increased adoption of biosimilars across the region and the proactive role of regulatory authorities. European regulators have implemented favorable changes to facilitate the approval of biosimilar drugs, further supporting market growth.

North America is expected to experience substantial growth during the forecast period. The growing acceptance of biosimilars and significant investments by numerous market players in research and development are anticipated to drive this growth. In 2020, the FDA approved around 20 biosimilars, including Pfizer’s Nyvepria, aimed at reducing infection rates. These developments are expected to boost the biosimilars market in North America.

In 2023, the monoclonal antibodies segment captured the largest revenue share. These antibodies are widely used for treating conditions such as cancer, rheumatoid arthritis, cardiovascular diseases, and multiple sclerosis. Their ability to target specific infected cells makes them particularly effective in cancer treatment, solidifying their position as the leading segment in the market.

The erythropoietin segment is anticipated to grow the fastest during the forecast period. Erythropoietin is crucial for stimulating red blood cell production in the bone marrow and is effective in treating anemia. The increasing incidence of kidney-related diseases is expected to drive growth in this segment.

The oncology segment was the largest revenue generator in the global biosimilars market in 2023 and is expected to continue leading throughout the forecast period. This dominance is due to the affordability of biosimilars for cancer treatment and the rising global incidence of cancer. According to the International Agency for Research on Cancer, there were approximately 19.3 million new cancer cases and 10 million cancer-related deaths globally in 2020. The prevalence of breast cancer, which accounted for 11.7% of new cases, followed by lung cancer at 11.4% and colorectal cancer at 10.0%, underscores the growing demand for biosimilars in oncology.

On the other hand, the growth hormonal deficiency segment is projected to be the fastest-growing. The increasing incidence of growth hormone deficiencies in children, with a reported 50% chance during pregnancy according to the National Organization for Rare Disorders, is expected to drive this segment’s growth.

By Product

By Application

By Manufacturer

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others