The global cancer diagnostics market size was estimated at around USD 107.48 billion in 2023 and it is projected to hit around USD 195.77 billion by 2033, growing at a CAGR of 6.18% from 2024 to 2033. The cancer diagnostics market is witnessing robust growth owing to several factors including the rising prevalence of cancer globally, advancements in diagnostic technologies, and increasing awareness regarding early disease detection.

The cancer diagnostics market is propelled by several growth factors, including the escalating incidence of cancer worldwide, advancements in diagnostic technologies, and heightened awareness concerning early disease detection. Key players in the market are continually innovating and investing in research and development endeavors to introduce groundbreaking diagnostic solutions, thus enhancing precision and efficacy in cancer detection. Collaborations and partnerships between diagnostic companies and healthcare institutions are further augmenting market expansion and technological progression. Nonetheless, challenges such as the elevated costs associated with advanced diagnostic techniques, rigorous regulatory frameworks, and a shortage of skilled healthcare professionals remain significant hurdles to market growth.

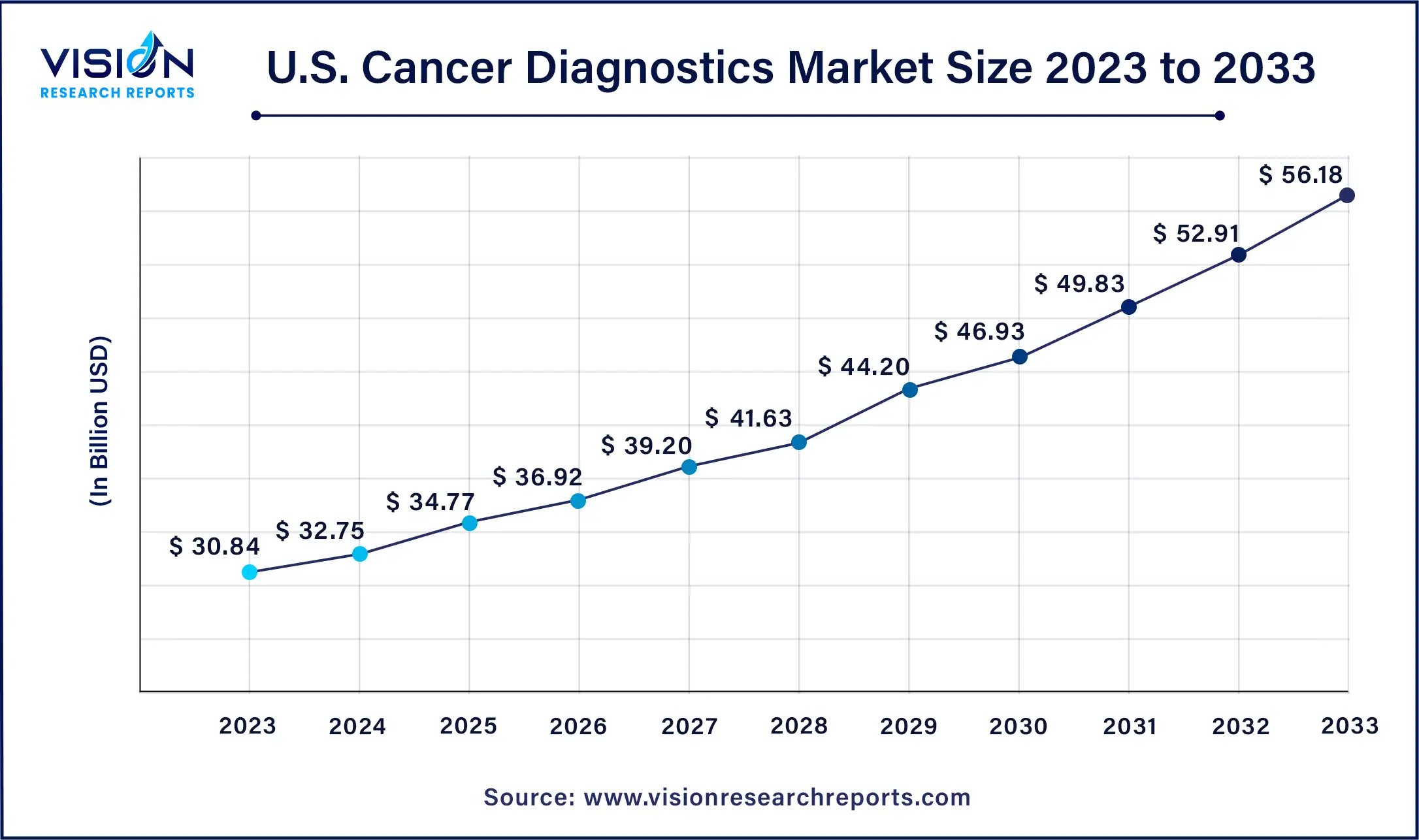

The U.S. cancer diagnostics market size was valued at USD 30.84 billion in 2023 and is expected to hit around USD 56.18 billion by 2033, at a CAGR of 6.18% from 2024 to 2033.

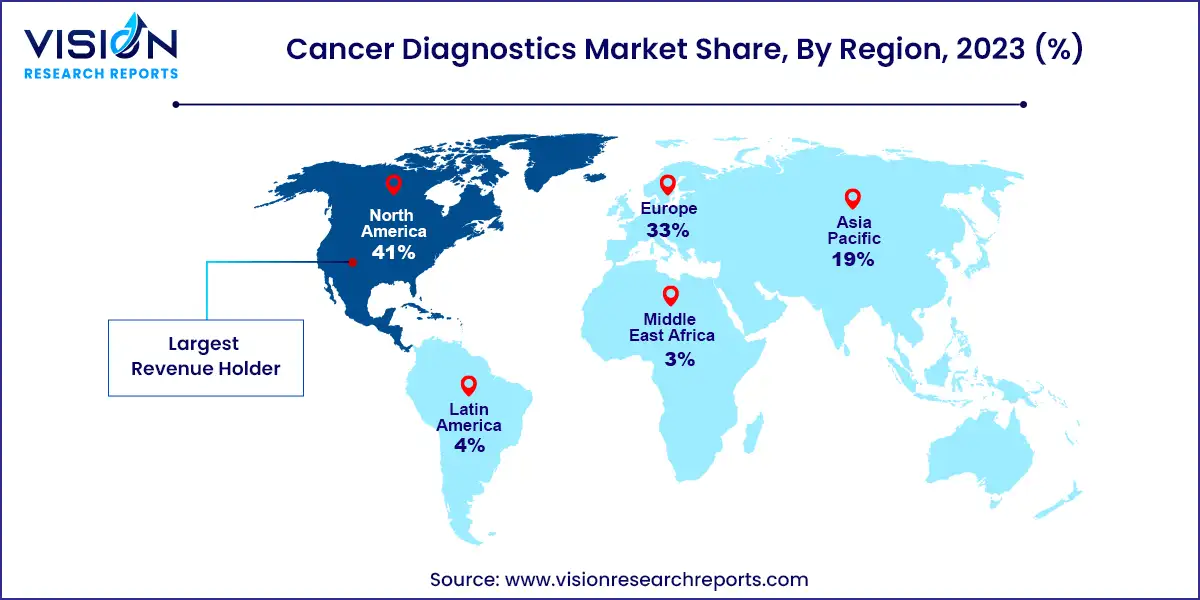

In 2023, North America emerged as the dominant force in the market, commanding a notable revenue share of 41%. The region's market dominance can be attributed to several factors, including the growing cancer burden in the United States and Canada. Additionally, there is a notable focus among medical device companies in the region on developing innovative diagnostic devices geared towards cancer detection, further propelling market growth. Product launches play a pivotal role in shaping market dynamics, exemplified by Nanostics Inc.'s announcement in July 2022 regarding the commencement of a clinical investigation for bladder cancer.

Conversely, the Asia Pacific market is poised to witness the fastest compound annual growth rate (CAGR) from 2024 to 2033, driven by various factors including increasing healthcare reforms. The region is experiencing a rise in cancer prevalence, particularly highlighted by a report published by PubMed Central in March 2022, which underscores the high incidence of cancer in China. With an estimated 4.8 million new cancer cases predicted in China by 2022, lung cancer emerges as the most prevalent type.

The consumables segment dominated the market with a share of 60% in 2023 and is poised to witness the most rapid growth throughout the forecast period. The development of advanced imaging diagnostic techniques and effective monoclonal antibody-based assays for detecting antigens and small chemicals produced by malignant cells holds significant promise for enhancing diagnostic capabilities. While monoclonal antibody (mAb) technology is still in its nascent stages, recent advancements in recombinant antigen synthesis and antibody creation techniques have substantially broadened its potential in diagnosis.

On the other hand, the instruments segment is expected to experience notable growth during the forecast period. Analytical instruments play a pivotal role in automating the diagnostic process and facilitating the convergence of samples and reagents. Kits and robots employed in pathology laboratories aid in the quantification and detection of infectious microorganisms, blood antigens, and viral load.

In 2023, the in vitro diagnostics (IVD) segment emerged as the dominant force, capturing a share of 53%, primarily fueled by the heightened adoption of IVD solutions amidst the COVID-19 pandemic. The surge in testing demand underscored the pivotal role of IVD in healthcare. The market is witnessing a shift towards automated IVD systems tailored for hospitals and laboratories, offering precise, efficient, and error-free diagnosis capabilities. Notably, in March 2019, BD obtained CE-IVD certification for its automated flow cytometry system, BD FACSDuet, empowering clinical laboratories to enhance efficacy and throughput compared to manual processes.

Meanwhile, laboratory diagnostic tests (LDTs) are poised to exhibit the highest compound annual growth rate (CAGR) from 2024 to 2033. These tests serve as critical tools for swiftly integrating new information and guiding personalized therapy decisions. By enabling treatments to pivot from a generalized approach to a more tailored one based on individual genetic profiles and disease characteristics, LDTs are revolutionizing patient care. Notably, LDTs are introduced to the market without independent regulatory assessment or FDA approval, as they are generated and utilized within the same facility.

In 2023, the breast cancer segment emerged as the leader in revenue, capturing a substantial share of 17%. This dominance is poised to continue, driven by increased research and development efforts aimed at advancing screening tools for breast cancer detection. Notably, a groundbreaking research study published in Scientific Reports in September 2019 introduced a novel screening test. This test combines the expression of MMP-1 (matrix metalloproteinase-1) and miR-21 in urinary exosomes, enabling the detection of 95% of breast cancers without metastasis development.

Conversely, lung cancer is anticipated to witness the fastest compound annual growth rate (CAGR) of 7.68% from 2024 to 2033, fueled by the availability of technologically advanced diagnostic products. Oncocyte's DetermaDx, a multigene assay facilitating gene expression measurement in circulating blood cells, stands out as a non-invasive alternative for identifying lung nodules, thereby minimizing the need for invasive biopsy procedures. The industry is experiencing a surge in research and development activities aimed at pioneering novel diagnostic tests.

In 2023, the laboratories segment emerged as the dominant force in the market, commanding a significant share of 52%. This segment is poised for substantial growth over the forecast period, primarily driven by the increasing demand for testing services and the availability of resources to conduct these tests. Diagnostic laboratories are experiencing heightened reliance from hospitals for testing and evaluation purposes, thereby propelling accelerated growth. Several factors contribute to the segment's expansion, including heightened awareness about personalized medicine, advancements in technology, and a growing demand for cost-effective services. Additionally, government initiatives aimed at providing facilities such as compensation for diagnostic tests are further fueling growth. Regulatory authorities are also taking proactive steps to enhance clinical laboratory diagnostic services and streamline the diagnostic process.

Conversely, the others segment, encompassing home-based tests, is projected to exhibit the fastest compound annual growth rate (CAGR) of 7.18% from 2024 to 2033. This surge is attributed to the increased adoption of home-based and technologically advanced treatments, particularly amid the COVID-19 pandemic. Acknowledging the need for new models in the cancer community and among payers to mitigate unscheduled hospitalizations and emergency department visits, acute home-based treatment presents a promising alternative to traditional care settings. Key market players are focusing on developing home-based tests to enhance accessibility and acceptability, further driving demand within the segment.

Panel-based tests and BRCA1/2 genetic testing serve distinct yet complementary roles in assessing the inherited risk of breast and ovarian cancers. Panel-based tests offer broader coverage, detecting genetic mutations associated with a range of hereditary cancer syndromes beyond BRCA1/2, such as pheochromocytoma-paraganglioma and colon cancer. This expanded clinical value and yield make panel-based testing particularly valuable for individuals with diverse cancer risks. Moreover, patients with genetic abnormalities linked to hereditary cancer syndromes often exhibit an earlier onset of certain cancers, necessitating early detection measures. Consequently, the demand for panel tests is driven by the imperative to provide timely detection and intervention.

On the other hand, biopsy procedures are projected to witness the fastest compound annual growth rate (CAGR) from 2024 to 2033, owing to their numerous benefits, including early cancer detection and characterization. Biopsies not only facilitate the identification of cancer but also enable assessment of its aggressiveness and propensity for metastasis. This information is crucial in devising tailored treatment strategies based on the cancer's stage and behavior. Notably, product launches play a pivotal role in driving market growth.

By Product

By Type

By Application

By End-use

By Test Type

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others