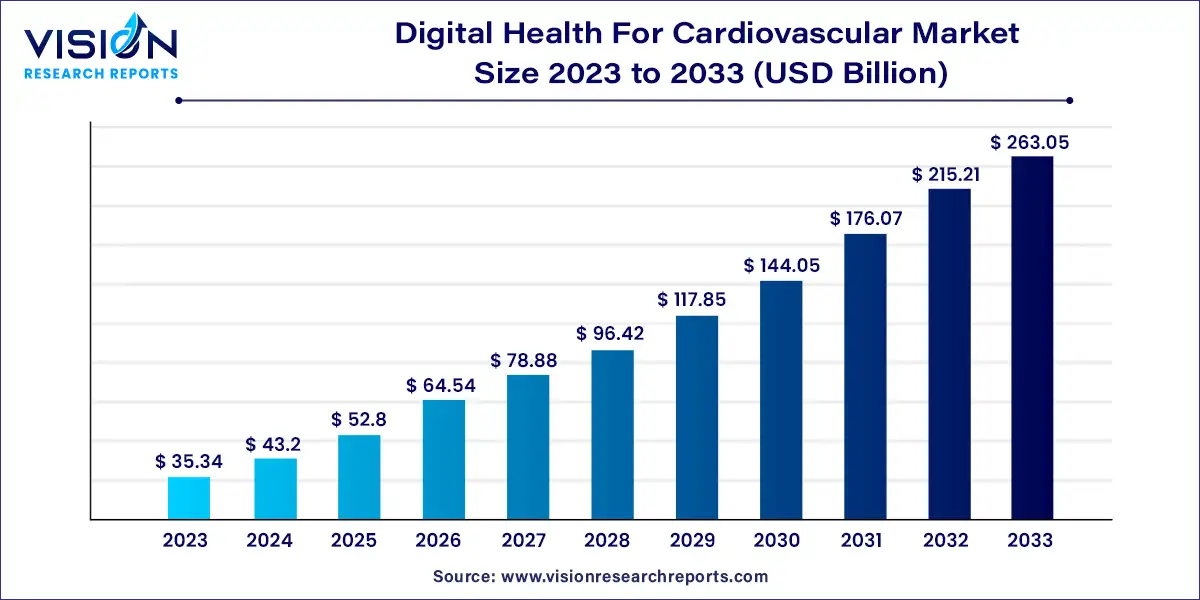

The global digital health for cardiovascular market was estimated at USD 35.34 billion in 2023 and it is expected to surpass around USD 263.05 billion by 2033, poised to grow at a CAGR of 22.23% from 2024 to 2033.

Digital health technologies have revolutionized healthcare delivery, particularly in the realm of cardiovascular health. With the increasing prevalence of cardiovascular diseases globally, the demand for innovative digital solutions to monitor, manage, and prevent these conditions is on the rise.

The growth of the digital health market in cardiovascular care is propelled by an increasing prevalence of cardiovascular diseases globally drives the demand for innovative solutions that enable early detection, continuous monitoring, and personalized management of these conditions. Secondly, advancements in sensor technology, wearable devices, and mobile health applications facilitate remote monitoring and real-time data collection, empowering patients and healthcare providers with actionable insights for better decision-making. Additionally, the rising healthcare costs and the need for more efficient and accessible healthcare delivery models incentivize the adoption of digital health solutions that offer cost-effective alternatives to traditional care settings. Furthermore, the COVID-19 pandemic has accelerated the adoption of telehealth and remote monitoring technologies, highlighting the importance of digital health in ensuring continuity of care during crises. Overall, these growth factors underscore the transformative potential of digital health in revolutionizing cardiovascular care and improving patient outcomes.

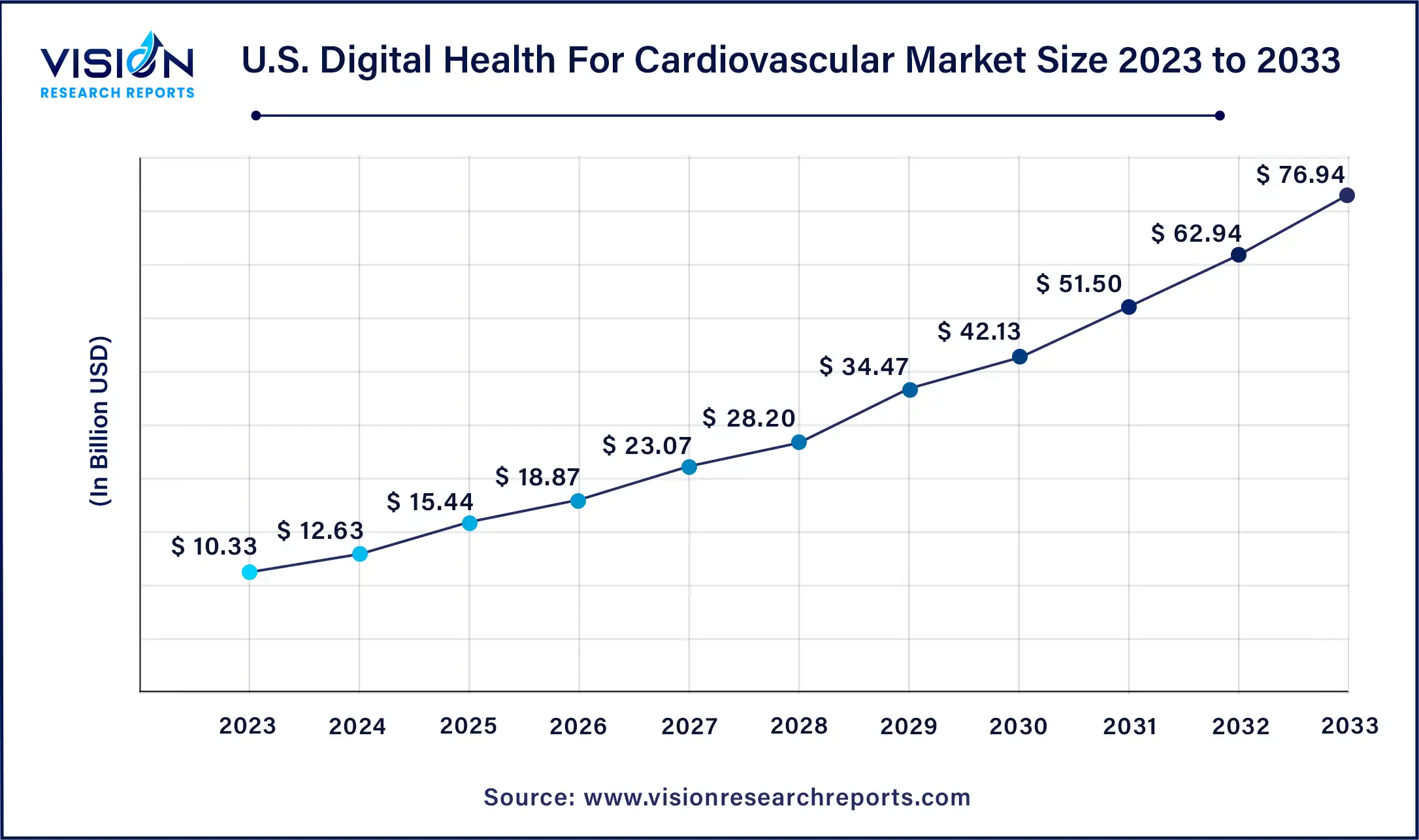

The U.S digital health for cardiovascular market size was estimated at around USD 10.33 billion in 2023 and it is projected to hit around USD 76.94 billion by 2033, growing at a CAGR of 22.23% from 2024 to 2033.

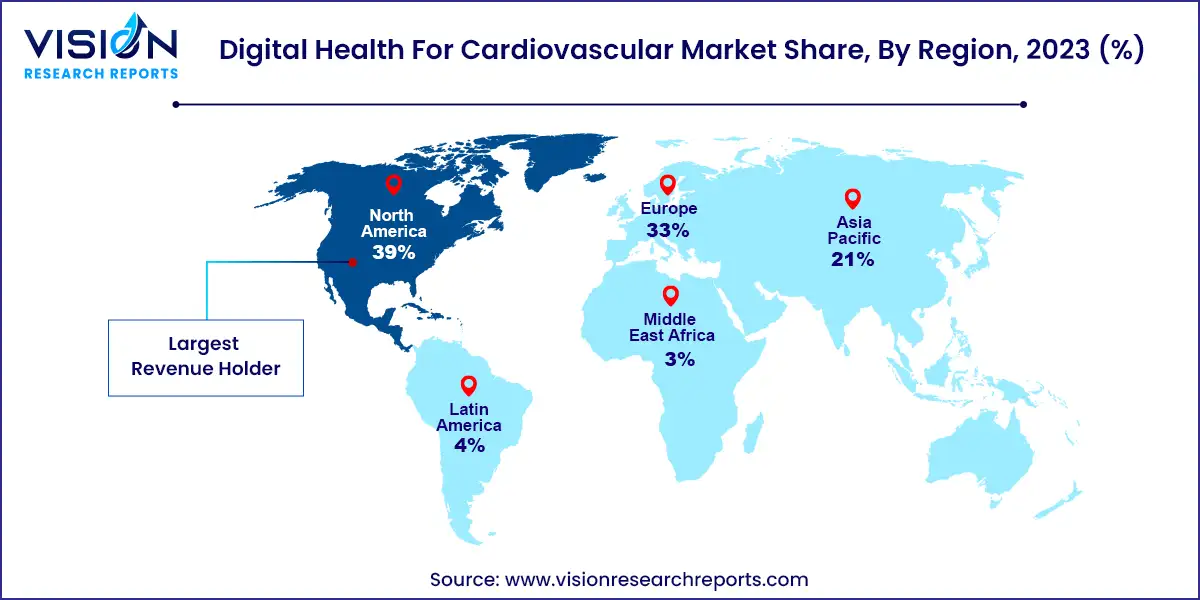

In 2023, North America emerged as the leading region in the digital health for cardiovascular market, capturing a revenue share of 39%. This dominance can be attributed to several factors, including the increasing expenditure on healthcare IT to support digital infrastructure, ongoing technological advancements, and supportive government initiatives. For example, in May 2022, the American College of Cardiology released principles endorsing digital health initiatives and disseminating the latest scientific discoveries. Additionally, the population in North America is actively embracing wearable devices for health management alongside telemedicine platforms. These integrated systems play a crucial role in improving patient outcomes and overall community health by enabling early intervention. Moreover, the proliferation of smartphone-based apps designed for health monitoring purposes in the region is driving market growth. The significant demand for cardiovascular digital solutions in home-care settings further underscores the region's contribution to the industry's growth.

The digital health for cardiovascular market in Asia Pacific is projected to experience the highest compound annual growth rate (CAGR) during the forecast period. This growth is anticipated to be fueled by the rising adoption of mHealth platforms and increased healthcare expenditure across the region. Moreover, technological advancements in healthcare, supported by enhanced government spending, are expected to further drive industry growth in Asia Pacific. The uptake of digital apps and platforms in the region has been accelerated by the active participation of key market players and the emergence of niche entrepreneurial ventures in Asia Pacific.

In 2023, the services segment dominated the market in terms of revenue share. Market participants offer services either in bundled packages or as standalone options. The increasing demand for advanced software solutions and platforms like Electronic Medical Records (EMRs) and Electronic Health Records (EHRs), coupled with the growing importance of updating and training to use these tools effectively, is propelling the growth of this segment. For example, in January 2024, Medtronic collaborated with Cardiac design labs to introduce Padma Rhythms, an electronic Loop Recorder (ELR) patch aimed at advancing ELR technology nationwide for long-term heart monitoring and diagnosis in India. Moreover, key players provide a range of pre- and post-installation services, including project planning, training, implementation, and resource allocation and optimization for project success.

The software segment is expected to achieve the highest CAGR of 23.53% during the forecast period, driven by the adoption of software systems by insurance payers, patients, healthcare providers, and healthcare facilities. This increasing adoption significantly contributes to the growth of the software segment in the cardiovascular industry. By integrating software systems, stakeholders can streamline processes, enhance communication, and improve the overall quality of care, ultimately boosting the growth of the software segment within the healthcare sector. Market players are introducing software solutions to diagnose various cardiovascular diseases. For instance, in 2021, Optum, a leading healthcare services provider, launched OptumIQ, an AI-powered platform that identifies patients at risk for chronic conditions and recommends interventions to enhance their care. Another example is Cleerly, which raised Series C funding in July 2022 to develop AI-based software for diagnosing atherosclerosis, valued at USD 192 million. These factors are expected to drive growth in the segment.

In 2023, the patient segment emerged as the dominant end-use segment, commanding the largest market share of 35%. It is projected to experience the fastest CAGR throughout the forecast period. This growth is driven by increasing demand fueled by a growing emphasis on patient-centered care and a rising number of individuals seeking more effective health management. In response to these trends, companies are revolutionizing the healthcare landscape by introducing innovative solutions such as virtual consultations and patient-care devices. For instance, BIOTRONIK’s Cardio Messenger SMART facilitates cardiac monitoring in patients by receiving information from the implanted device during sleep, enhancing mobility, enabling remote monitoring, and tracking various health parameters.

The provider segment also held a significant market share in the end-use segment, propelled by a notable surge in the adoption of innovative technologies like digital therapeutics and telemedicine. Healthcare providers are embracing digital solutions extensively and swiftly to deliver personalized treatment plans, remote consultations, and evidence-based therapies that surpass conventional care. Through the integration of digital tools, providers can offer more personalized and accessible care, ultimately leading to improved patient outcomes.

By Component

By End-use

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others