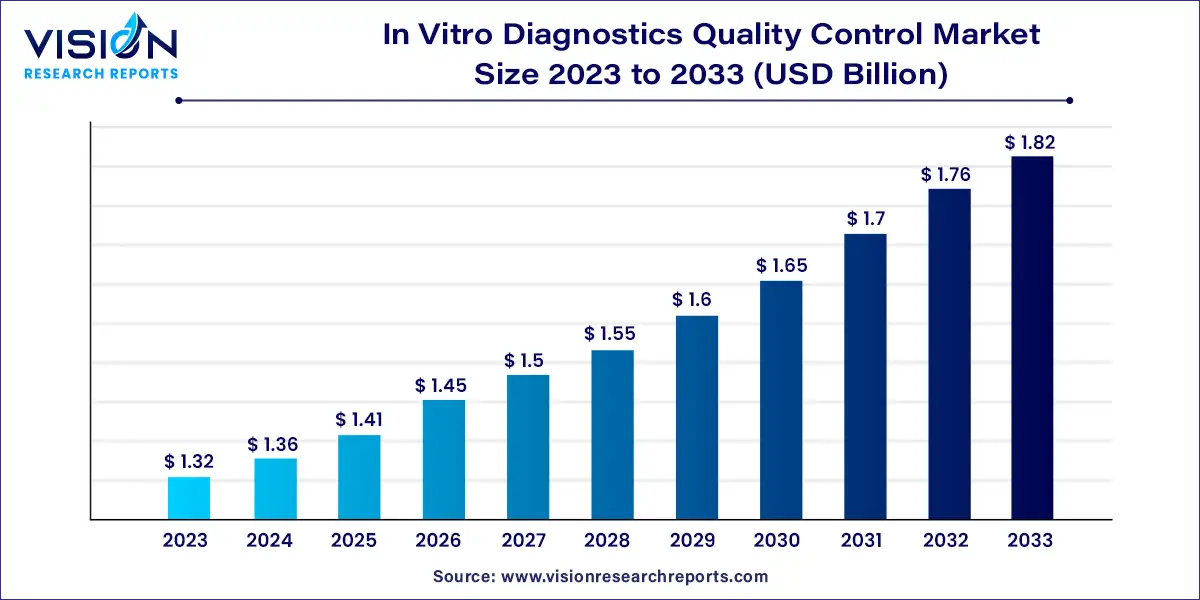

The global in vitro diagnostics quality control market size was estimated at around USD 1.32 billion in 2023 and it is projected to hit around USD 1.82 billion by 2033, growing at a CAGR of 3.25% from 2024 to 2033.

The in vitro diagnostics (IVD) quality market plays a pivotal role in ensuring the accuracy, reliability, and safety of diagnostic tests used in healthcare settings. As the demand for precise and efficient diagnostic solutions continues to rise, the importance of maintaining high standards of quality control and assurance cannot be overstated.

The growth of the in vitro diagnostics (IVD) quality market is propelled by an escalating prevalence of chronic and infectious diseases worldwide, necessitating reliable and accurate diagnostic solutions. Additionally, the aging population demographic adds to the demand for advanced diagnostic technologies, emphasizing the importance of precision in diagnosis and treatment monitoring. The increasing adoption of personalized medicine further fuels market growth, as tailored diagnostic approaches require stringent quality control measures to ensure efficacy and safety. Moreover, technological advancements, such as automation and molecular diagnostics, are revolutionizing the IVD landscape, offering innovative solutions for improved patient care.

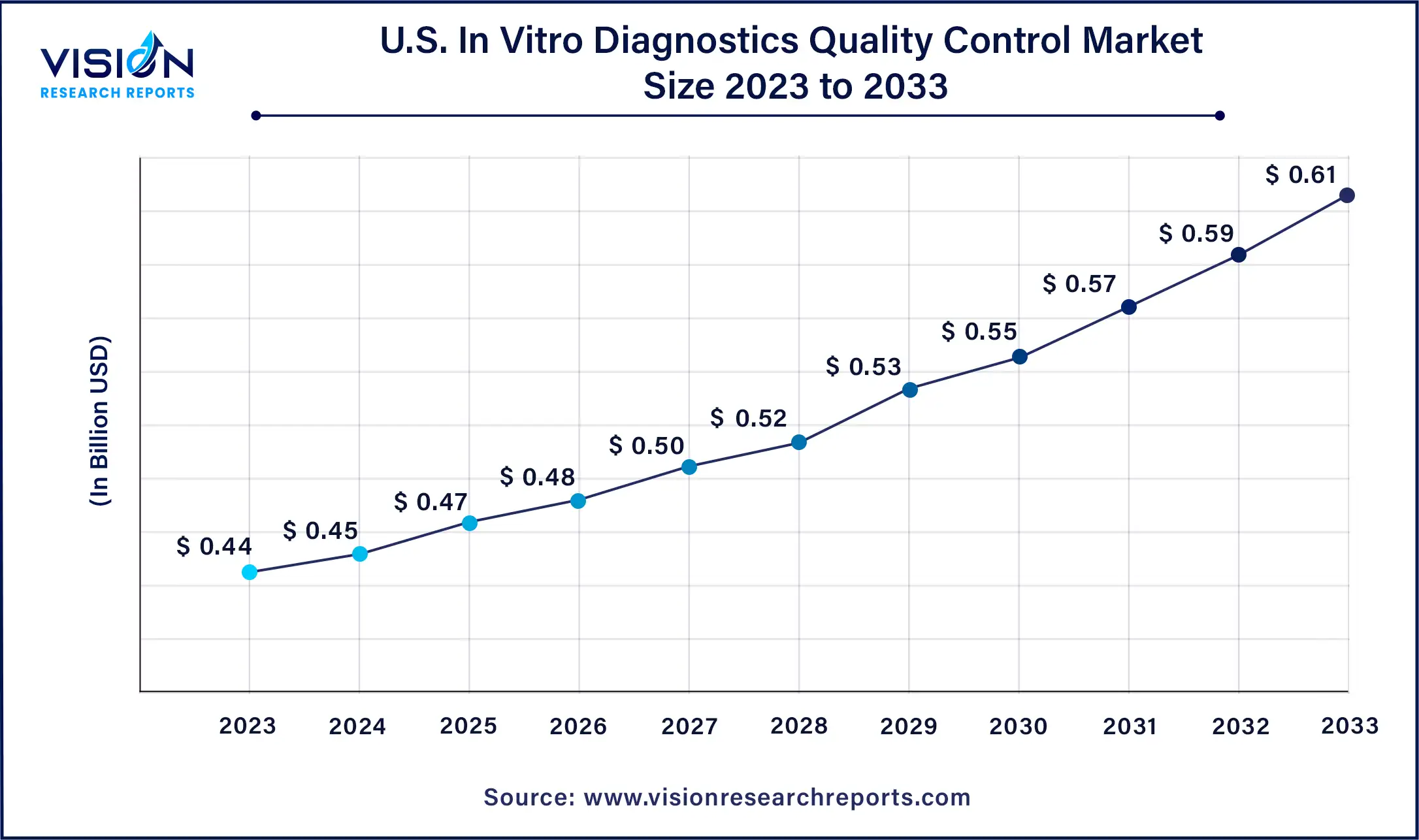

The U.S. in vitro diagnostics quality control market was estimated at USD 0.44 billion in 2023 and it is expected to surpass around USD 0.61 billion by 2033, poised to grow at a CAGR of 3.32% from 2024 to 2033.

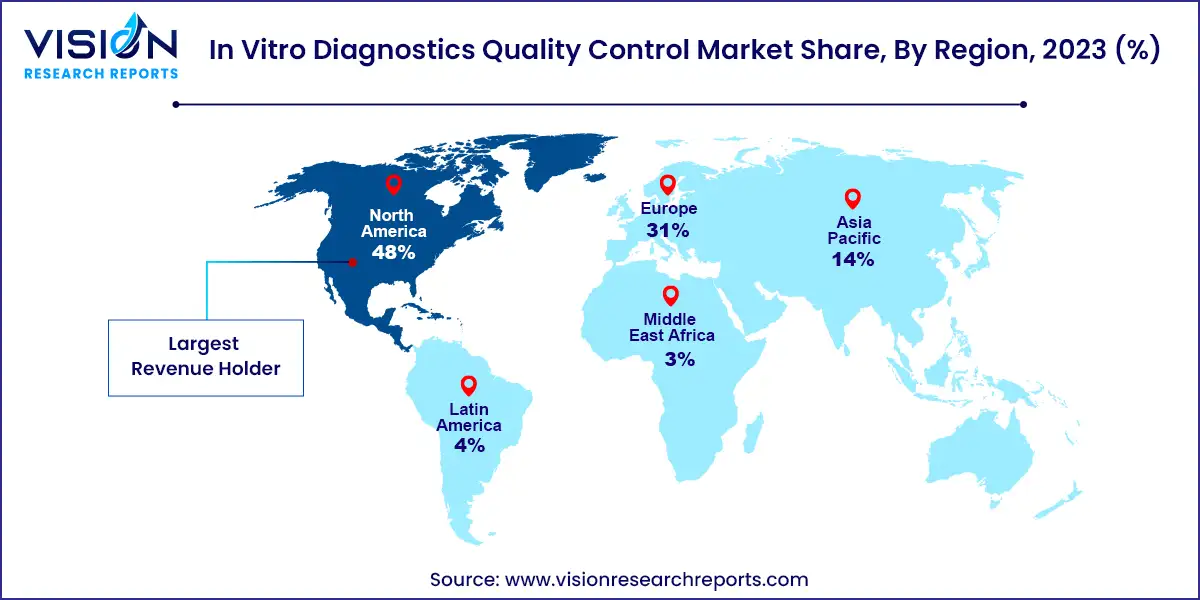

In 2023, North America dominated the in vitro diagnostics quality control market, accounting for a significant 48% share. This substantial share can be attributed to several factors, including the region's increasing healthcare expenditure, well-established healthcare system, and robust clinical diagnostics industry, particularly in the United States. These factors have generated considerable demand for both internal and external quality control solutions for clinical and research purposes. Furthermore, continuous advancements in the field of in vitro diagnostics (IVD) and the high affordability and adoption of innovative and advanced diagnostic systems and solutions further contribute to North America's attractiveness as a market globally.

Meanwhile, the Asia Pacific market is poised to experience the fastest growth during the forecast period. The region exhibits high potential for market expansion due to the rising number of companies involved in manufacturing IVDs and IVD quality control products. Additionally, there is increasing awareness of the importance of early and precise diagnosis, driving the demand for IVDs across the Asia Pacific region. Organizations such as the Asia Pacific Federation of Clinical Biochemistry and Laboratory Medicine (APFCB) play a pivotal role in promoting awareness about the use of IVDs through various committees and initiatives.

In 2023, the controls segment emerged as the dominant force in the market, commanding a share of 49%. Controls play a vital role in maintaining the integrity and reliability of diagnostic tests conducted in clinical laboratories and healthcare settings by ensuring accuracy, reliability, and consistency. The growing prevalence of chronic diseases and the increasing demand for precise diagnostic evaluations are driving the expansion of the controls market.

Meanwhile, the calibrators segment is poised to witness the fastest compound annual growth rate (CAGR) during the forecast period. Calibrators are reference materials containing known concentrations of analytes, utilized to standardize and calibrate diagnostic assays. They serve as benchmarks for establishing the correlation between the assay signal and the concentration of analytes in patient samples. Laboratories employ calibrators to calibrate their diagnostic instruments and assays, ensuring precise and reproducible measurement of analytes.

In 2023, the quality controls segment commanded the largest share of market revenue and is expected to exhibit the fastest compound annual growth rate (CAGR) throughout the forecast period. Quality control plays a critical role in validating diagnostic tests and ensuring the reliability of results, empowering healthcare providers to make informed decisions regarding patient care. This is particularly crucial for elderly individuals, who often contend with multiple chronic conditions and necessitate precise diagnostic insights to effectively manage their health. With the global population aging and experiencing a higher prevalence of age-related chronic ailments, there is a heightened demand for diagnostic testing services.

Concurrently, the data management solutions segment is poised for substantial growth over the forecast period. These solutions facilitate seamless integration and connectivity among diverse diagnostic instruments, Laboratory Information Systems (LIS), and data management platforms. They enable interoperability between disparate systems, facilitating automated data transfer between instruments and software applications. This integration and connectivity streamline workflow processes, diminish manual data entry errors, and enhance operational efficiency within diagnostic laboratories.

In 2023, the immunochemistry segment dominated the market in terms of revenue share. Immunochemistry assays are renowned for their high sensitivity and specificity, making them ideal for accurately measuring analytes present in low concentrations. This precision is pivotal for diagnostic decision-making and patient management. Continuous advancements in immunochemistry technologies have spurred the emergence of automated and high-throughput immunoassay platforms.

Conversely, the clinical chemistry segment is poised to witness the swiftest compound annual growth rate (CAGR) during the forecast period. Clinical chemistry entails the analysis of biochemical components found in bodily fluids such as blood, serum, plasma, and urine. It encompasses the measurement of various analytes, including glucose, electrolytes, enzymes, proteins, lipids, hormones, and drugs. In February 2024, Beckman Coulter unveiled its new DxC 500 AU chemistry analyzer at the Medlab Middle East event in Dubai.

In 2023, the third-party controls segment emerged as the leader in terms of market revenue share. Third-party controls play a pivotal role in standardizing diagnostic testing procedures across diverse laboratories and testing platforms. Since these controls are manufactured independently of specific diagnostic systems, they serve as universal references, ensuring consistent performance across various testing environments. By offering a standardized reference point, third-party controls facilitate the harmonization of diagnostic testing procedures across laboratories and testing platforms.

Conversely, the OEM controls segment is poised to witness the most rapid compound annual growth rate (CAGR) during the forecast period. OEM controls are tailored to the specifications and performance characteristics of specific diagnostic instruments or testing systems. The latest advancements in OEM control automation prioritize customization, flexibility, and the integration of high-volume solutions. These advancements enhance efficiency, flexibility, and integration within laboratory and diagnostic systems. For example, an article from Control Design in April 2023 emphasized the importance of OEMs aligning with factories' control architectures. This alignment ensures that the automation and control systems designed and built by OEMs are compatible with existing infrastructure and factory requirements.

In 2023, the home care segment emerged as the leader in terms of market revenue share. Home care involves the practice of point-of-care testing (POCT), where diagnostic tests are conducted outside traditional laboratory settings, often in patients' homes or community settings. POCT devices enable individuals to conduct tests themselves or with minimal assistance, providing rapid results for immediate decision-making.

Conversely, the hospital segment is poised to witness the fastest compound annual growth rate (CAGR) during the forecast period. Hospitals implement stringent quality assurance measures to ensure the accuracy and reliability of diagnostic test results. This includes adherence to standardized protocols, regular proficiency testing, and continuous monitoring of equipment and procedures. Hospitals are at the forefront of advancements in diagnostics to enhance patient care. A study published by NCBI in October 2022 emphasized the transformative impact of integrating sensors in hospital-based care on diagnostic medicine.

By Product

By Type

By Application

By Manufacturer Type

By End-use

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others