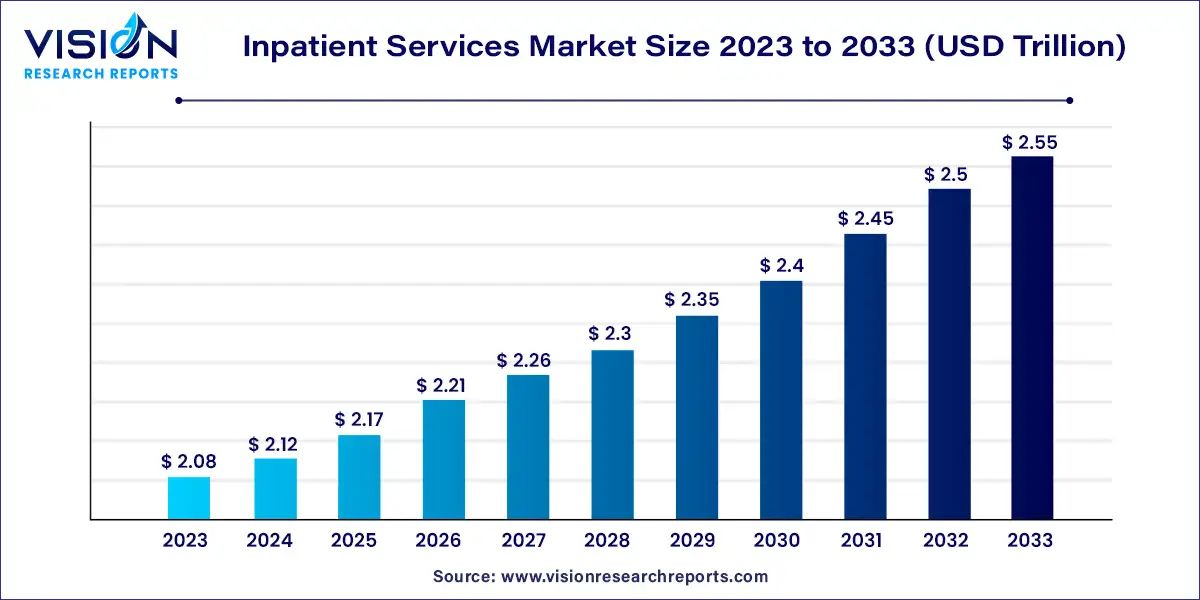

The global inpatient services market size was estimated at around USD 2.08 trillion in 2023 and it is projected to hit around USD 2.55 trillion by 2033, growing at a CAGR of 2.07% from 2024 to 2033.

The inpatient services market is a critical component of the healthcare industry, providing essential medical care for patients requiring hospitalization. This market encompasses a wide range of services, including surgery, intensive care, maternity care, and rehabilitation. As healthcare needs continue to grow and evolve, the inpatient services market plays a pivotal role in ensuring that patients receive comprehensive and continuous care during their hospital stay.

The growth of the inpatient services market is driven by an increasing prevalence of chronic diseases and conditions, such as diabetes, cardiovascular diseases, and cancer, which require extensive and prolonged medical care. Additionally, the aging global population contributes significantly to the demand for inpatient services, as older adults typically experience more complex health issues that necessitate hospitalization. Technological advancements in medical equipment and treatment methods also play a crucial role in market growth, as they enhance the quality of care and expand the range of services that hospitals can offer. Furthermore, government initiatives and healthcare policies aimed at improving access to healthcare services and expanding insurance coverage are boosting the utilization of inpatient services. Economic growth in emerging markets is another factor, leading to better healthcare infrastructure and increased healthcare spending.

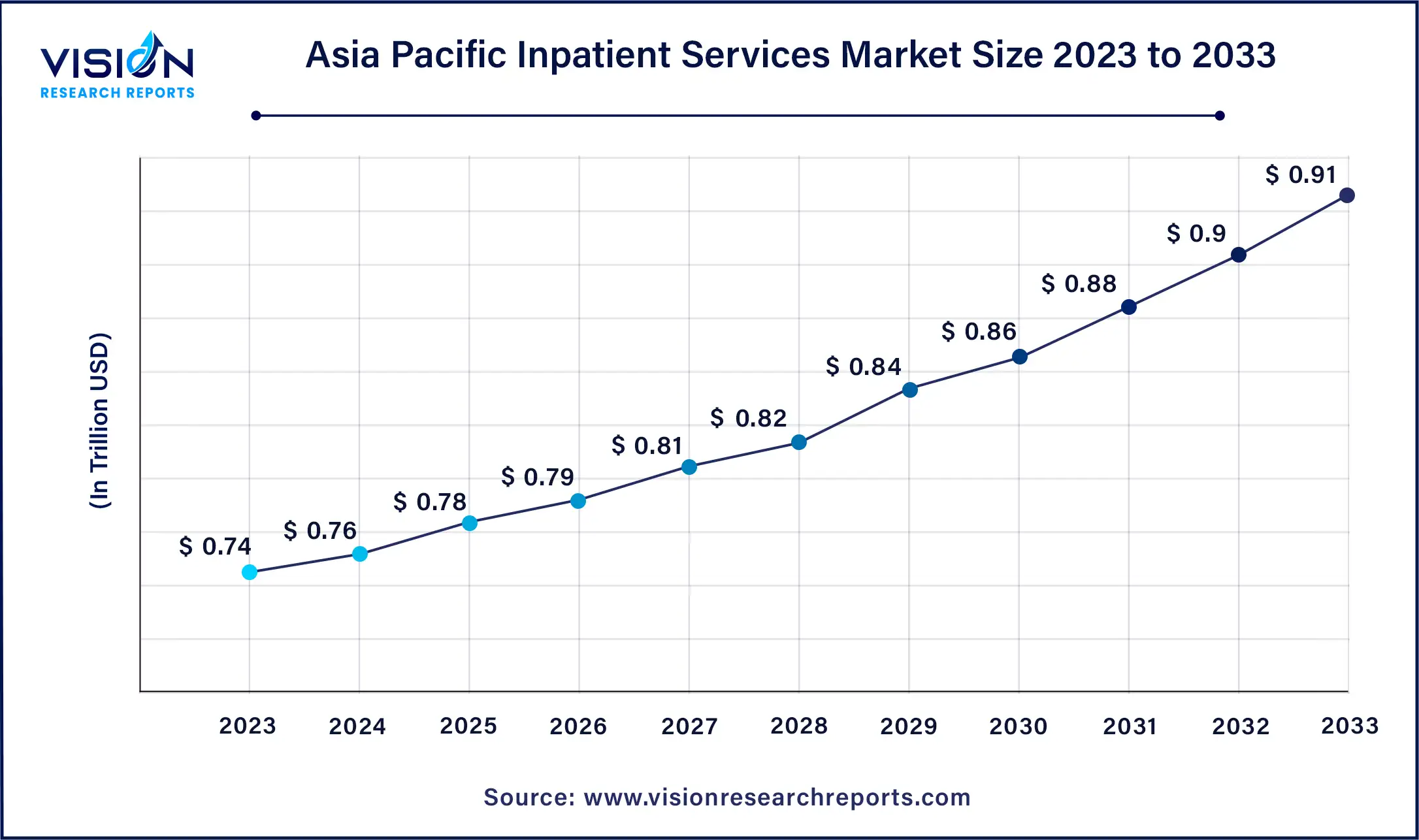

The Asia Pacific inpatient services market size was estimated at USD 0.74 trillion in 2023 and it is expected to surpass around USD 0.91 trillion by 2033, poised to grow at a CAGR of 2.08% from 2024 to 2033.

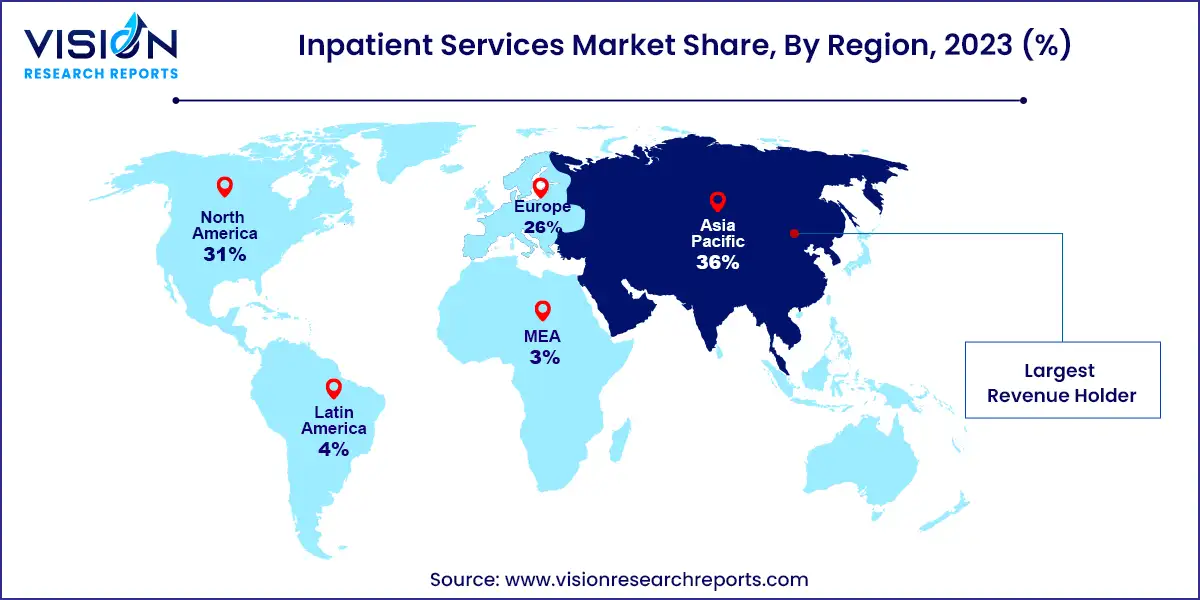

In North America, the inpatient services market is dominated by private hospitals, with major players such as HCA Healthcare, Cleveland Clinic, and Johns Hopkins holding significant market shares. These institutions have a strong presence across the region, focusing on delivering high-quality care.

In the Asia Pacific region, the inpatient services market led the global market with a 36% share in 2023. This is due to the rising prevalence of chronic diseases, a growing population, increased investment in healthcare infrastructure, and a heightened focus on curative care. Many governments in the region are investing in new health systems and hospitals to address the increasing demand for healthcare services.

In 2023, the cardiovascular disorders segment led the market, holding the largest revenue share of 19%. This dominance is due to the rising incidence of cardiovascular diseases driven by an aging population, obesity, sedentary lifestyles, and smoking. Advances in diagnostic techniques, such as vessel wall MRI, have improved the diagnosis and treatment of cardiovascular diseases like atherosclerosis. Additionally, growing awareness and public health initiatives promoting healthy lifestyles and regular screenings contribute to market growth. For example, the Minnesota Department of Health reported that over 46,000 individuals in Minnesota, U.S., were hospitalized for cardiac disorders in 2021, an increase from 2020.

Conversely, the respiratory disorder segment is expected to grow at the fastest CAGR from 2024 to 2033. This growth is attributed to the increasing prevalence of respiratory disorders such as asthma, Chronic Obstructive Pulmonary Disease (COPD), and lung cancer. As these conditions become more common, the demand for their treatment rises. Moreover, advancements in treatment options, including targeted therapies and immunotherapies, are expanding the range of treatments available for respiratory disorders, increasing demand for complex and specialized care within the industry.

In 2023, the publicly/government-owned segment held the largest revenue share of 37%. This is due to the provision of specialized medical procedures at relatively low costs and the availability of numerous patient beds for various medical conditions. Community hospitals, in particular, have a large number of patient beds and cater to a wide range of medical conditions through their specialized departments. Furthermore, the launch of new public hospitals, especially in developing countries, is expected to drive significant market growth. For instance, in April 2022, Turkey's Health Ministry opened a new hospital in Hatay, Southern Turkey, with financial aid from the EU, which is anticipated to relieve pressure on the province's health infrastructure and increase capacity to meet growing demand.

However, the for-profit privately owned segment is projected to witness the fastest CAGR from 2024 to 2033. This growth is primarily driven by a focus on specialized services and critical care, such as oncology and cardiology, typically offered by private hospitals. These hospitals are expanding their capabilities to meet urgent medical needs, thereby increasing demand for inpatient services. For instance, in January 2024, Ramsay Health Care announced the opening of a new hospital in New Epping, Australia. The hospital will open in two stages, the first in 2024 and the second in 2027, initially providing 70 inpatient beds, including six critical care units and four high-dependency units.

By Treatment

By Ownership

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others