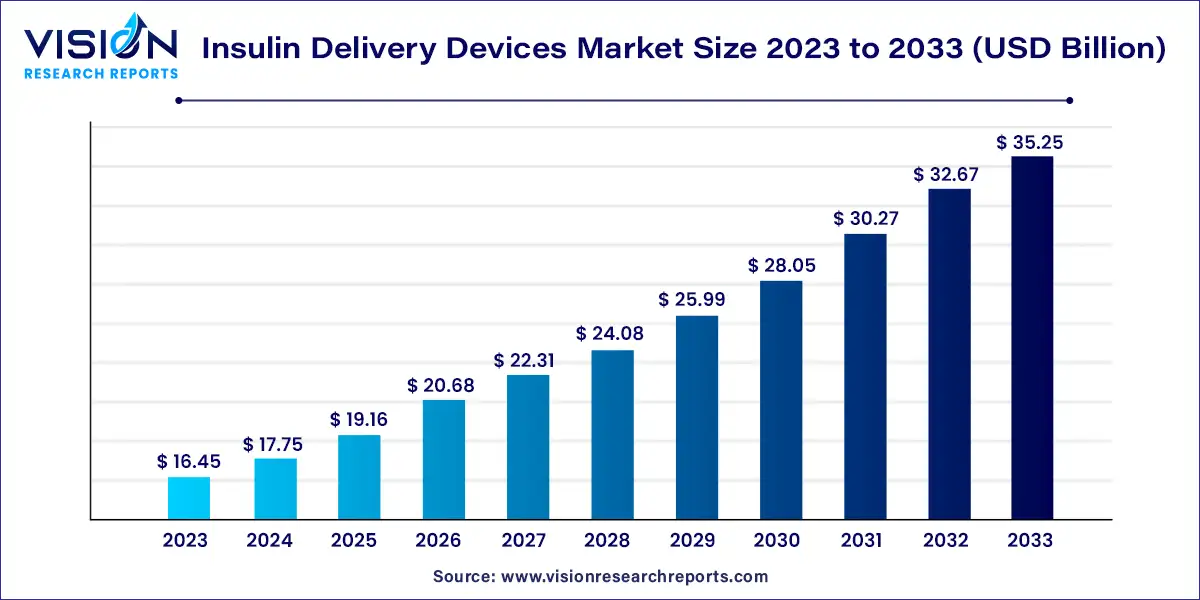

The global insulin delivery devices market size was estimated at around USD 16.45 billion in 2023 and it is projected to hit around USD 35.25 billion by 2033, growing at a CAGR of 7.92% from 2024 to 2033.

The insulin delivery devices market is a critical segment of the global healthcare industry, driven by the rising prevalence of diabetes and the increasing demand for advanced diabetes management solutions. Insulin delivery devices are essential for the administration of insulin to diabetic patients, ensuring effective blood glucose control and improving the quality of life for millions worldwide.

The insulin delivery devices market is experiencing robust growth driven by an increasing prevalence of diabetes worldwide, necessitating efficient and reliable methods for insulin administration. Technological advancements in insulin delivery devices, such as the development of smart insulin pens and more sophisticated insulin pumps, are significantly enhancing the convenience and accuracy of diabetes management. Additionally, the growing patient preference for minimally invasive and user-friendly devices over traditional methods, coupled with favorable government initiatives and reimbursement policies, is further accelerating market expansion.

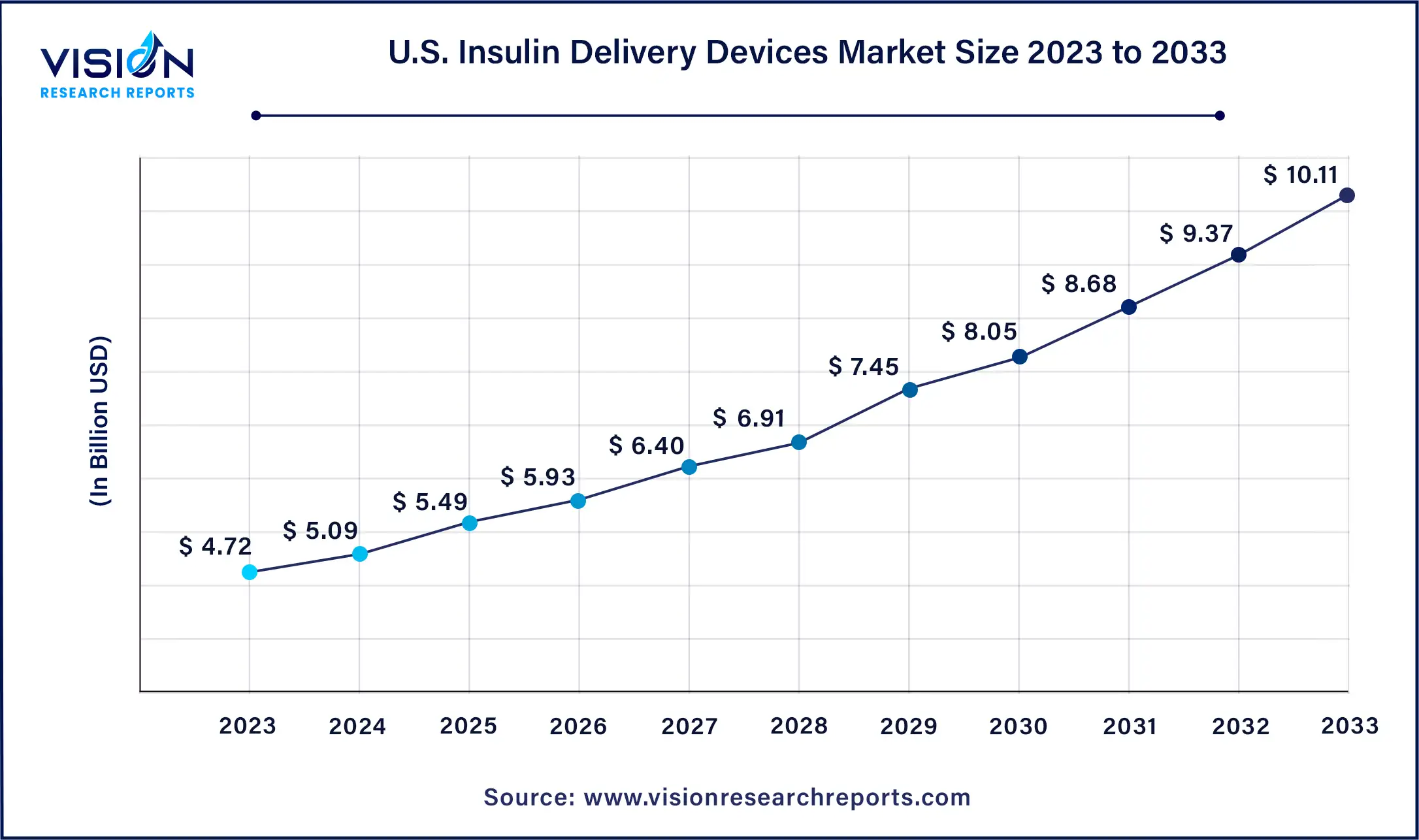

The U.S. insulin delivery devices market size was estimated at USD 4.72 billion in 2023 and it is expected to surpass around USD 10.11 billion by 2033, poised to grow at a CAGR of 7.91% from 2024 to 2033.

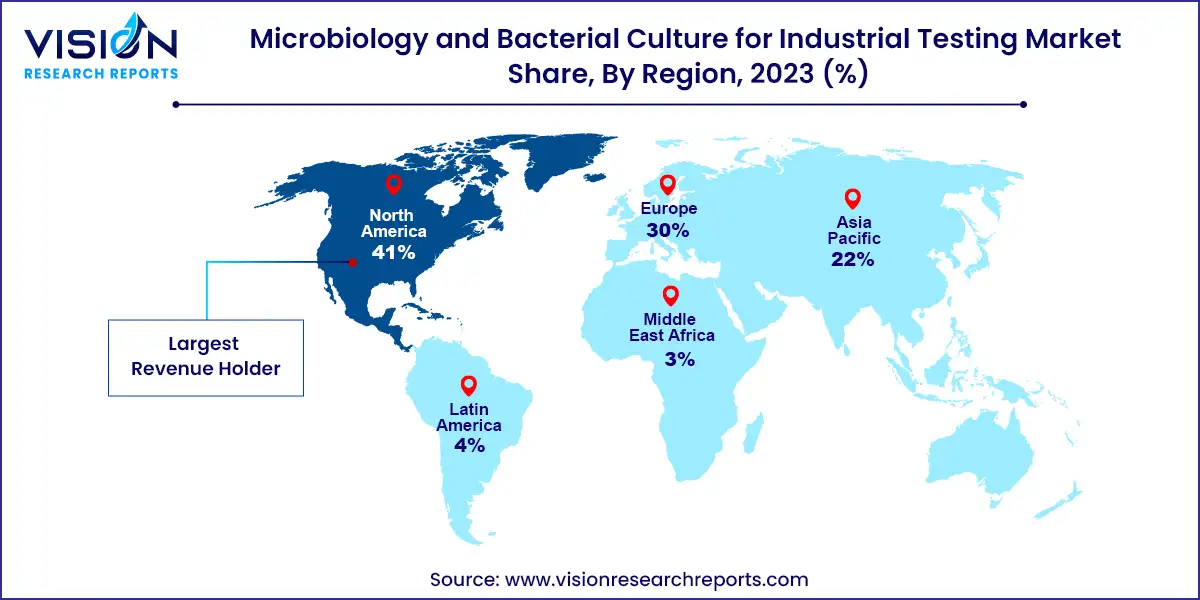

North America held the largest market share of 41% in 2023 and is expected to maintain its dominance. Key factors contributing to this growth include an increasing geriatric population, the rising prevalence of diabetes due to lifestyle changes, growing obesity rates, and high treatment costs. Major players like Abbott, Medtronic, and Dexcom, which have their operational headquarters in North America, also drive market growth.

The Asia Pacific insulin delivery devices market is projected to grow at the fastest rate, with a CAGR of 8.83% during the forecast period. This growth is primarily driven by China and Japan. China leads the market in revenue share due to the presence of major key players and the increasing prevalence of diabetes. Additionally, technological advancements in insulin delivery devices, a growing geriatric population, and rising cases of lifestyle diseases like obesity are expected to boost market growth. The International Diabetes Federation (IDF) reported that in 2021, 90 million adults (aged 20-79) in the IDF South-East Asia Region had diabetes, a number expected to rise to 152 million by 2045. Similarly, in the IDF Western Pacific Region, 206 million adults were living with diabetes in 2021, with projections reaching 260 million by 2045.

In 2023, insulin pens accounted for the largest market share of 44%. These pen-like devices offer a convenient, accurate, and less invasive method for insulin delivery, especially beneficial for individuals who need regular injections. A survey conducted by MSF and T1International across 38 countries, involving over 400 insulin users, showed that 82% of respondents preferred insulin pens over traditional syringes. The reasons for this preference included ease of use, accurate dosing, reduced pain, and lower social stigma associated with public use. These benefits enhance quality of life and adherence to treatment protocols. Within the insulin pens category, reusable insulin pens hold the largest market share. Popular reusable insulin pens include AllStar, ClikSTAR, JuniorSTAR, and TouStar by Sanofi.

The insulin pumps segment is expected to experience the fastest growth rate during the forecast period. Insulin pumps offer a reliable and consistent method for insulin delivery, mimicking the natural function of a healthy pancreas. These compact, wearable devices provide continuous basal insulin and bolus doses to meet mealtime needs. According to a study by the American Diabetes Association in October 2023, insulin pump usage has been increasing, with notable variations based on gender, insurance coverage, and racial/ethnic backgrounds. Users of insulin pumps have shown improved A1C levels, higher adoption of Continuous Glucose Monitoring (CGM), and fewer incidents of diabetic ketoacidosis and severe hypoglycemia. The study noted a rise in insulin pump utilization from 59% in 2017 to 66% in 2021, indicating significant growth in the insulin delivery sector.

The hospitals and clinics segment is projected to achieve the fastest growth rate, with a CAGR of 8.44% during the forecast period. Hospitals are crucial in the insulin delivery industry, providing comprehensive diabetes care, including diagnosis, treatment, and management. They utilize various insulin delivery methods such as pumps, pens, syringes, and other devices to meet patients' needs. Research by the American Medical Association in February 2024 highlighted the safe use of home insulin pumps for children in non-intensive care units at a children's hospital, particularly for managing hypoglycemia and hyperglycemia. These pumps deliver insulin continuously, mimicking the natural secretion pattern of a healthy pancreas.

The home care segment captured the largest revenue share of 49% in 2023. Home care is significant in the insulin delivery industry, offering patients the convenience of managing diabetes at home. This sector includes a variety of products and services to support insulin administration, monitoring, and management outside clinical settings. Home care companies provide a range of devices, including insulin pens, syringes, pumps, and CGM systems, enabling patients to administer insulin accurately and monitor their blood glucose levels without frequent visits to healthcare facilities.

By Product

By End Use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Insulin Delivery Devices Market

5.1. COVID-19 Landscape: Insulin Delivery Devices Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Insulin Delivery Devices Market, By Product

8.1. Insulin Delivery Devices Market, by Product, 2024-2033

8.1.1. Insulin Pens

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Insulin Pumps

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Insulin Pen Needles

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Insulin Syringes

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Other Products

8.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Insulin Delivery Devices Market, By End Use

9.1. Insulin Delivery Devices Market, by End Use, 2024-2033

9.1.1. Hospitals & Clinics

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Homecare

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Other End Users

9.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Insulin Delivery Devices Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.2. Market Revenue and Forecast, by End Use (2021-2033)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.3.2. Market Revenue and Forecast, by End Use (2021-2033)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.4.2. Market Revenue and Forecast, by End Use (2021-2033)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.2. Market Revenue and Forecast, by End Use (2021-2033)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.3.2. Market Revenue and Forecast, by End Use (2021-2033)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.4.2. Market Revenue and Forecast, by End Use (2021-2033)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.5.2. Market Revenue and Forecast, by End Use (2021-2033)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.6.2. Market Revenue and Forecast, by End Use (2021-2033)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.2. Market Revenue and Forecast, by End Use (2021-2033)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.3.2. Market Revenue and Forecast, by End Use (2021-2033)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.4.2. Market Revenue and Forecast, by End Use (2021-2033)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.5.2. Market Revenue and Forecast, by End Use (2021-2033)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.6.2. Market Revenue and Forecast, by End Use (2021-2033)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.2. Market Revenue and Forecast, by End Use (2021-2033)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.3.2. Market Revenue and Forecast, by End Use (2021-2033)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.4.2. Market Revenue and Forecast, by End Use (2021-2033)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.5.2. Market Revenue and Forecast, by End Use (2021-2033)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.6.2. Market Revenue and Forecast, by End Use (2021-2033)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.5.2. Market Revenue and Forecast, by End Use (2021-2033)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.5.3.2. Market Revenue and Forecast, by End Use (2021-2033)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.5.4.2. Market Revenue and Forecast, by End Use (2021-2033)

Chapter 11. Company Profiles

11.1. Novo Nordisk A/S

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Sanofi

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Eli Lilly and Company

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Ypsomed AG

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Medtronic

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Insulet Corporation

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. B. Braun SE

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Owen Mumford Ltd.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Tandem Diabetes Care, Inc.

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. BD (Becton, Dickinson, and Company)

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others