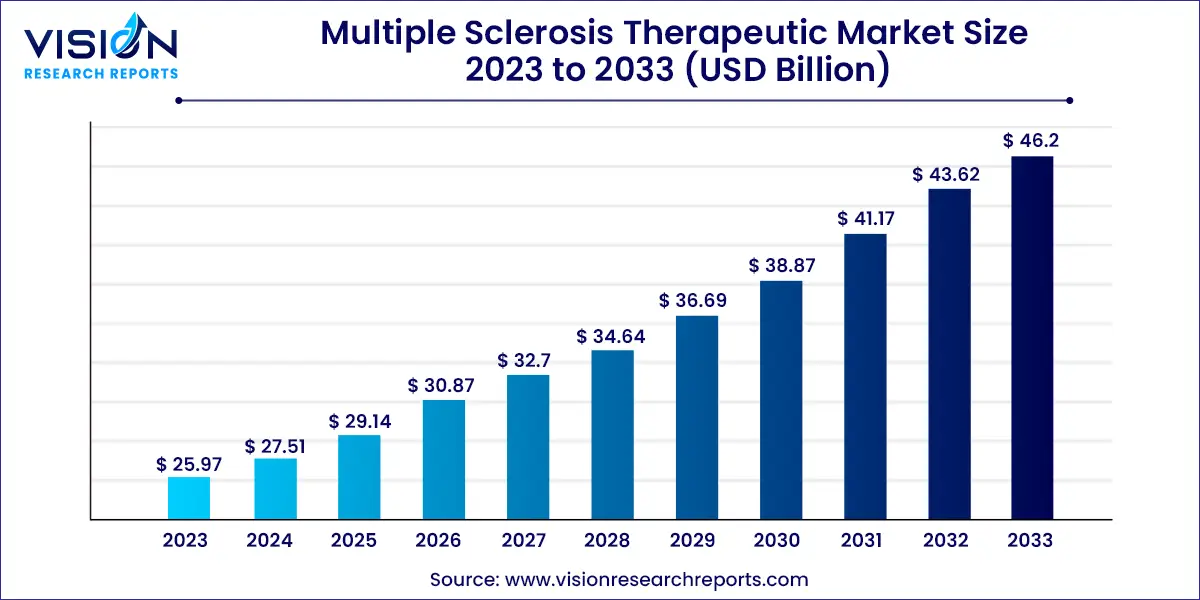

The global multiple sclerosis therapeutic market size was estimated at USD 25.97 billion in 2023 and it is expected to surpass around USD 46.2 billion by 2033, poised to grow at a CAGR of 5.93% from 2024 to 2033. The multiple sclerosis (MS) therapeutic market has been experiencing significant growth over the past few years, driven by advancements in medical research, the development of novel therapies, and an increasing prevalence of the disease. Multiple sclerosis is a chronic, inflammatory autoimmune disease that affects the central nervous system, leading to a wide range of symptoms including physical, mental, and sometimes psychiatric problems. The therapeutic landscape for MS is diverse, encompassing disease-modifying therapies (DMTs), symptomatic treatments, and emerging gene and cell-based therapies.

The growth of the multiple sclerosis (MS) therapeutic market is driven by the rising prevalence of MS globally is a significant contributor, as more patients require effective treatments. Advances in diagnostic technologies have also played a crucial role, enabling earlier and more accurate detection of the disease, which in turn drives the demand for novel therapies. The continuous evolution of research and development in the field has led to the introduction of innovative disease-modifying therapies (DMTs) and biologics, expanding the treatment options available. Additionally, increased investment in clinical trials and research, alongside growing healthcare expenditures, supports the development of new therapies and enhances market growth. The push towards personalized medicine and targeted therapies also aligns with the trend of providing more effective and individualized treatment options, further propelling the market forward.

North America led the global multiple sclerosis therapeutic market with a 39% share in 2023. The region's growth is primarily due to the rising number of MS cases and the presence of advanced healthcare infrastructure.

| Attribute | North America |

| Market Value | USD 10.12 Billion |

| Growth Rate | 5.95% CAGR |

| Projected Value | USD 18.01 Billion |

In 2023, Europe emerged as a lucrative market for multiple sclerosis therapeutics, supported by its well-established healthcare infrastructure. The UK is expected to experience rapid growth in the market due to its advanced healthcare system, which facilitates precise diagnosis and tailored treatment options. Germany also held a significant market share in 2023, thanks to proactive government recommendations and favorable healthcare policies.

The Asia-Pacific market is projected to grow swiftly in the coming years, driven by increased government initiatives, a broader range of treatment options, and lower treatment costs. China held a notable market share in 2023, with its growing pharmaceutical industry and the establishment of the China National Registry of Central Nervous System Inflammatory Demyelinating Illnesses in 2021, which aims to provide comprehensive disease management. India also held a substantial market share, influenced by its expanding healthcare infrastructure and government initiatives promoting advanced technologies.

In 2023, the immunosuppressants segment led the market with a dominant 61% share. These medications are crucial for managing multiple sclerosis by inhibiting the abnormal immune response associated with the disease. The expansion of this segment is supported by the growing approval of new products for MS. Immunosuppressants are favored for their low dosage requirements, reduced adverse effects, and high efficacy, driving their continued market growth.

The immunostimulants segment is anticipated to grow at a CAGR of 6.63% throughout the forecast period. These drugs enhance the immune system’s activity, which can be beneficial in multiple sclerosis by helping to counteract disease progression. Advances in research and technology are leading to the development of new immunostimulant therapies that target specific pathways involved in MS, offering promising new treatment options for patients.

In 2023, the injectable segment held the largest market share at 53%. This segment’s growth is attributed to the higher efficacy and convenience of injectable drugs compared to other methods of administration. Injectables are particularly effective in managing disease symptoms, contributing to their continued preference.

The oral segment, projected to grow at a CAGR of 7.03% during the forecast period, benefits from its convenience and ease of use. Oral medications eliminate the need for frequent, often painful injections, making them a preferred choice among patients seeking a more manageable treatment regimen.

In 2023, hospital pharmacies dominated the market with a 47% share. This prominence is due to the growing significance of MS and the increasing number of inpatients. Hospitals are becoming central hubs for diagnosing and treating multiple sclerosis, leading to a higher distribution of therapeutics through their pharmacies.

Retail pharmacies are expected to grow at a CAGR of 6.43% during the forecast period. This growth is driven by the convenience and accessibility of retail pharmacies, making them a preferred choice for patients needing regular medication refills.

By Drug Class

By Route of Administration

By Distribution Channel

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others