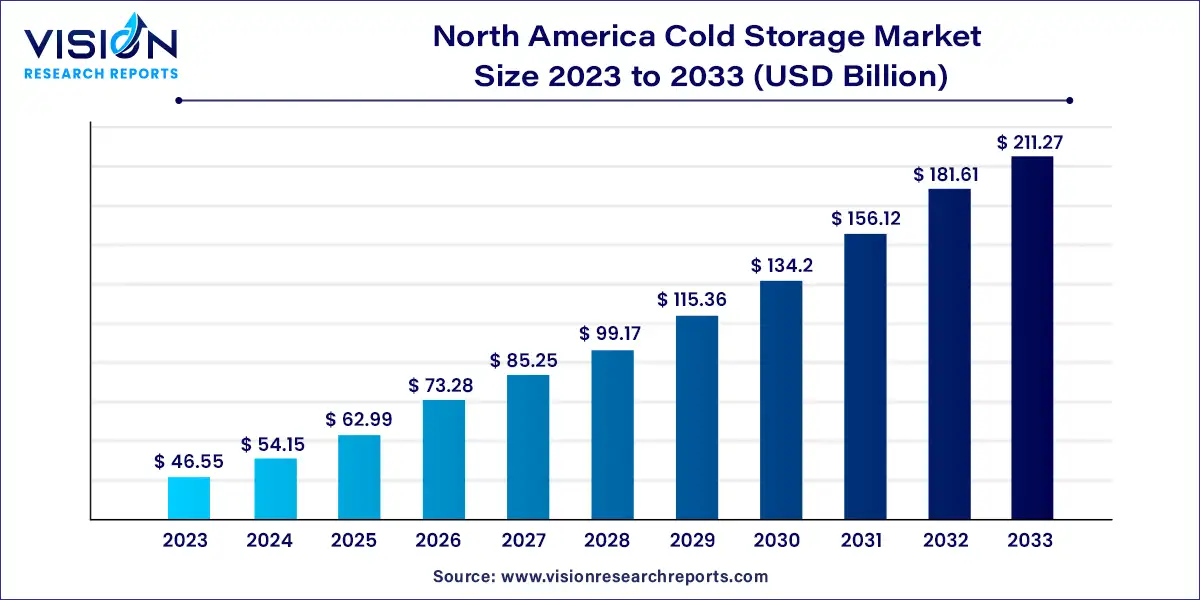

The North America cold storage market size was estimated at around USD 46.55 billion in 2023 and it is projected to hit around USD 211.27 billion by 2033, growing at a CAGR of 16.33% from 2024 to 2033.

The North America cold storage market has witnessed significant growth in recent years, driven by various factors such as the increasing demand for frozen and chilled food products, advancements in refrigeration technology, and the expansion of the food retail sector.

The growth of the North America cold storage market is propelled by various factors contributing to its expansion. One significant driver is the escalating demand for frozen and chilled food products across the region. This surge is primarily fueled by shifting consumer preferences towards convenience foods and the increasing popularity of perishable items. Moreover, continuous advancements in refrigeration technology play a pivotal role in enhancing the efficiency and reliability of cold storage facilities. Additionally, the expansion of the food retail sector, including supermarkets, hypermarkets, and online grocery platforms, further boosts the need for temperature-controlled storage infrastructure to maintain the quality and safety of perishable goods throughout the supply chain. These combined factors create a conducive environment for the sustained growth of the North America cold storage market.

The market is divided by type into facilities/services and equipment. In 2023, the facilities/services segment held the largest market share, accounting for over 93% of total revenue. It is projected to grow at a CAGR of 16.22% from 2024 to 2033. Within facilities/services, the cold storage industry is segmented into refrigerated warehouses and cold rooms. The refrigerated warehouses sub-segment includes private & semi-private and public warehouses, which offer customizable storage solutions tailored to clients’ needs, such as storage capacities, racking systems, and segregated zones for different products. These warehouses cater to various sectors, including pharmaceuticals and food & beverage, with companies worldwide investing in advancements to enhance their position in the refrigerated warehouse market.

Meanwhile, the equipment segment is forecasted to experience the highest CAGR of 18.12% from 2024 to 2033. This growth is driven by factors like changing food preferences, evolving lifestyles, and the rise of online food delivery services, which boost the demand for frozen food products. Cold storage equipment maintains perishable food items within specific temperature ranges, preventing spoilage and extending shelf life. The adoption of such equipment helps reduce food wastage by enabling longer storage durations, thereby contributing to the segment's growth.

The market is categorized based on temperature range into chilled (0°C to 15°C), frozen (-18°C to -25°C), and deep-frozen (below -25°C) segments. In 2023, the frozen segment (-18°C to -25°C) dominated the market, capturing over 65% of total revenue. It is projected to grow at a CAGR of 17.5% throughout the forecast period. Frozen storage offers significant advantages in preserving perishable goods such as meat, poultry, seafood, and frozen vegetables by maintaining low temperatures, thus extending shelf life and reducing spoilage and food waste. The increasing demand for frozen convenience foods like frozen dinners, pizza, and fruits is driving the growth of this segment, as consumers appreciate the convenience and extended shelf life of these products. Additionally, frozen storage is essential in the pharmaceutical industry for storing vaccines, biologics, and temperature-sensitive medications to ensure product stability and effectiveness.

On the other hand, the chilled segment (0°C to 15°C) is expected to grow at a CAGR of 14.54% throughout the forecast period. Chilled warehouses store various items such as fresh fruits and vegetables, eggs, dairy products, dry fruits, and dehydrated foods at temperatures similar to standard refrigerators. This temperature range effectively inhibits the growth of harmful bacteria on perishable food items, thereby preventing decomposition and extending shelf life. The growth of this segment is primarily driven by the need to store and preserve the shelf life of products sensitive to temperature variations.

The North America cold storage industry is segmented based on application into pharmaceuticals, food & beverages, and others. In 2023, the food & beverages segment dominated the market, accounting for a market share of 79%. Expected advancements in technology related to the storage, packaging, and processing of seafood are forecasted to contribute to the sector's growth. However, substantial growth is also anticipated in the processed food segment in the coming years, primarily driven by ongoing innovations in packaging materials. These advancements play a crucial role in extending the shelf life of food products, resulting in increased sales of processed foods in recent times.

The pharmaceuticals segment is projected to grow at a significant CAGR of 18.13% over the forecast period. The robust demand for products in this segment stems from their critical role in preserving the effectiveness and safety of pharmaceuticals, particularly vaccines. Vaccines are vital biological preparations designed to protect humans from harmful viruses and bacteria. Due to their biological nature, exposure to temperatures that are too low or too high can degrade active ingredients and compromise vaccine effectiveness. Once vaccines lose their effectiveness, they cannot be restored. Therefore, temperature-controlled facilities and equipment play a crucial role in vaccine storage and transportation, with the optimal temperature range being 2°C - 8°C. Equipment such as cold boxes, ice packs, and refrigerators are utilized for this purpose. Various market players in the cold storage sector, such as Burris Logistics and National Cold Chain Inc., offer cold storage solutions and vaccine services to meet these critical needs.

In 2023, the U.S. cold storage market reached a value of USD 36.93 billion, with expectations of a compound annual growth rate (CAGR) of 16.12% from 2024 to 2033. This growth is driven by several critical factors, including technological advancements in the packaging, processing, and storage of perishable food products and temperature-sensitive items. Additionally, stringent government regulations governing the production and supply of temperature-sensitive products have significantly benefited the market.

Cold storage facilities in Canada play a vital role in accommodating a wide range of products, such as fruits, vegetables, dairy, meat, seafood, pharmaceuticals, and other temperature-sensitive items. These facilities contribute significantly to the distribution and logistics network, ensuring the efficient and safe transportation of temperature-sensitive goods across the country. Cold storage providers offer customized solutions tailored to the unique needs of various industries, including frozen storage, chilled storage, and specialized storage for pharmaceuticals or other sensitive products.

By Type

By Temperature Range

By Application

By Country

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others