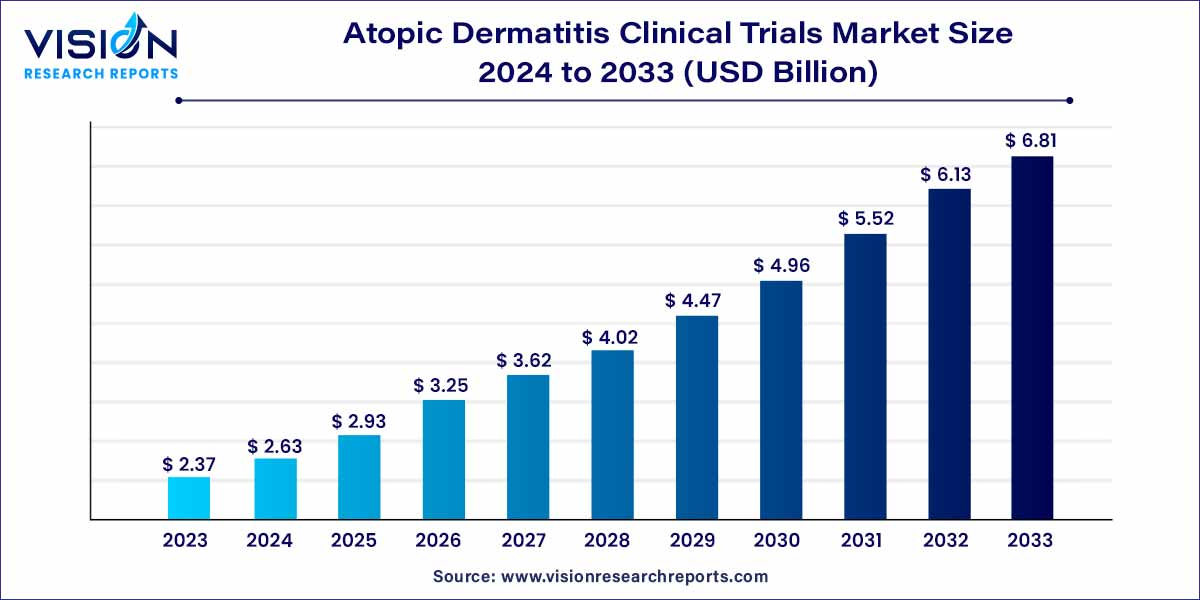

The global atopic dermatitis clinical trials market was estimated at USD 2.37 billion in 2023 and it is expected to surpass around USD 6.81 billion by 2033, poised to grow at a CAGR of 11.14% from 2024 to 2033. The atopic dermatitis clinical trials market is driven by an advancement in understanding disease pathophysiology, rising healthcare expenditure, unmet medical needs and biotechnological innovations.

Atopic Dermatitis, commonly known as eczema, affects millions of individuals worldwide, with its characteristic symptoms including itching, redness, and inflammation of the skin. The complexity of this condition has prompted intensive research efforts to discover effective treatments and therapies.

The growth of the atopic dermatitis clinical trials market is propelled by several key factors contributing to its expansion. First and foremost, the increasing prevalence of Atopic Dermatitis on a global scale has heightened the urgency for effective therapeutic solutions, stimulating heightened research and development activities. Moreover, advancements in our understanding of the intricate immunological and genetic factors underlying Atopic Dermatitis have paved the way for the exploration of targeted, precision therapies. The growing trend towards personalized medicine has further amplified interest in tailoring treatments to individual patient profiles, fostering a more nuanced and effective approach to Atopic Dermatitis management. Additionally, the robust collaborations between pharmaceutical companies, research institutions, and biotech firms have catalyzed innovation, fostering the discovery and development of novel therapeutic interventions. The emphasis on comparative effectiveness studies not only refines existing treatment protocols but also fuels competition, encouraging the introduction of improved and differentiated therapeutic options. As these factors synergize, the atopic dermatitis clinical trials market is poised for sustained growth, offering promising avenues for enhanced patient care and outcomes.

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 11.14% |

| Market Revenue by 2033 | USD 6.81 billion |

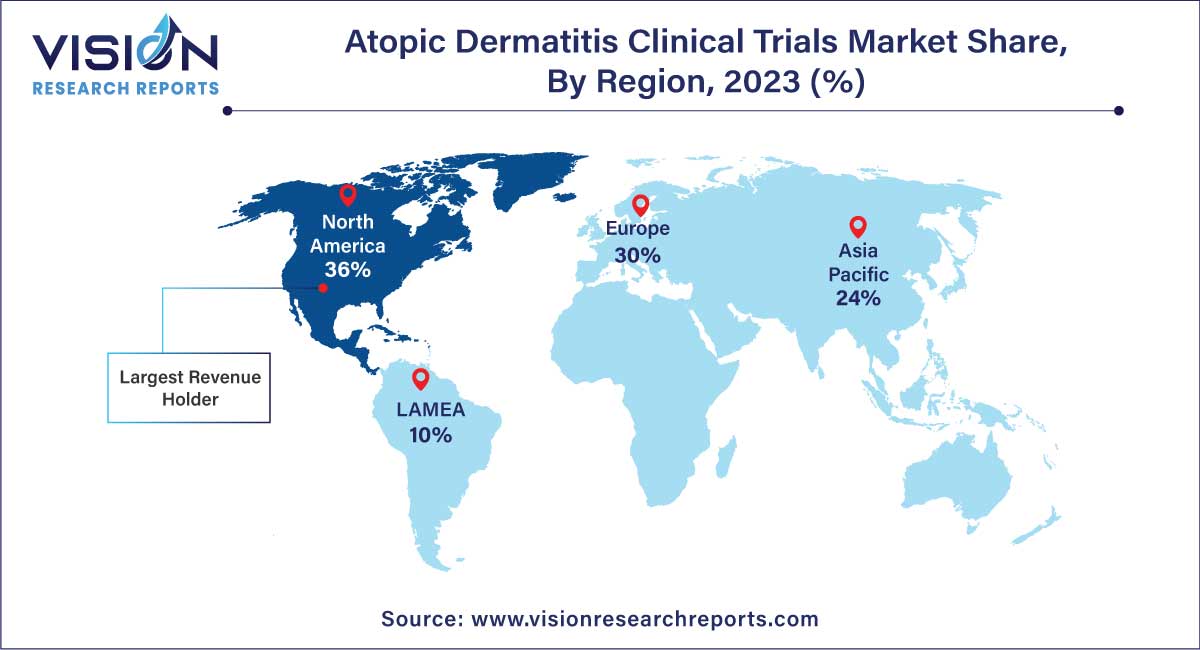

| Revenue Share of North America in 2023 | 36% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

Large molecules led the market with the highest market share of 54% in 2023. This high percentage can be attributed to increasing demand for biologics, driven by rising incidence of atopic dermatitis and skin eczema across globe. Several biopharmaceutical companies are expanding their therapeutics pipeline to treat the condition. For instance, as per an article published by Springer Nature Limited in 2022 stated that apart from obtaining regulatory approval for biologics such as anti-IL-13 inhibitor tralokinumab, IL-4Ra inhibitor dupilumab, JAK1/2 inhibitor baricitinib in Europe, there are more than 70 new compounds under development for treatment of mild to severe atopic dermatitis. Hence, increasing pipeline of products under large molecules is primary factor supporting segment’s robust shares and lucrative growth rate across the forecast period.

The small molecules segment is anticipated to witness a stable CAGR during the analysis timeframe. Small molecule drugs have potential to manage atopic dermatitis effectively due to their availability in several dosage forms. For instance, topical form of drugs is much easier to apply and hence has a higher demand across the patient population. Moreover, several pharmaceutical companies are investigating potential of such therapies, and so far, positive results have been witnessed across these developments. For instance, in 2022, Arcutis Biotherapeutics, Inc. announced topline positive results of phase III trials of topical roflumilast cream, a small molecule inhibitor of phosphodiesterase-4 (PDE4) in patients with atopic dermatitis. The drug is under NDA submission review and is expected to gain approval soon.

Interventional trials accounted for largest market revenue share of 72% in 2023. High segment shares are majorly due to increasing number of interventional study designs adopted in clinical trials. For instance, as per clinicaltrials.gov in 2022, approximately 60 to 70% of atopic dermatitis clinical trials are interventional studies. Interventional trials have a controlled design, often involving comparison of the intervention group (those receiving treatment) with a control group (those receiving a placebo or standard treatment). Furthermore, increasing number of clinical trials for atopic dermatitis is another considerable factor supporting segment’s growth.

Observational trials segment is anticipated to witness a lucrative growth rate across the analysis period. High growth of segment is majorly due to increasing demand for atopic dermatitis and eczema products globally. Moreover, increasing prevalence of such conditions is one of the primary factors boosting demand for effective therapeutics and augmenting segmental growth. For instance, according to Global Burden of Disease (GBD) estimates, atopic dermatitis, is a chronic skin condition and is widely prevalent and non-communicable. It holds 15th position among non-fatal diseases in terms of disability-adjusted life years, claiming top spot among all skin diseases. The primary impact is notably observed in children.

Phase II segment had the largest market share of 48% share in 2023. High segment shares are majorly due to increasing number of drugs under phase II trials. Moreover, cost of development of phase II trials is significantly high. Hence, investment across these phases is considerably more, thus supporting high segment shares. Furthermore, several pharmaceutical companies are investing huge amounts of capital in clinical development of these drugs. For instance, in October 2023, Triventi Bio secured USD 92 million in Series A funding to progress its primary antibody program, TRIV-509, into clinical development. Currently, in pre-clinical stage, TRIV-509 is anticipated to be supported by the obtained funding, sustaining operations through Phase IIa clinical trial.

Phase III segment is anticipated to witness a lucrative growth rate across the analysis period. High growth of the segment is majorly due to increasing growing number of pipeline drugs for atopic dermatitis entering phase III phase of development. Moreover, growing partnerships amongst biopharmaceutical companies to expand its clinical pipeline of drugs is another considerable factor supporting segmental growth. In addition, scientific advancements, need for better treatments, a robust developmental pipeline, regulatory requirements, patient-centric approaches, competition in pharmaceutical industry, and collaborative efforts to address the challenges associated with this prevalent skin condition are few of the important factors supporting semental growth.

North America dominated the market with the largest revenue share 36% in 2023. North America is one of the major contributors to the growth of atopic dermatitis clinical trials industry. This region is home to numerous pharmaceutical and dermatological companies, which are outsourcing part of their development activities to contract service providers, thereby contributing towards the growth of the market.

The U.S. held largest market share in North America. The U.S., has a sizable population, including a significant number of individuals affected by atopic dermatitis. Availability of a large patient pool is attractive for conducting clinical trials, especially those requiring diverse participant groups. The U.S. boasts robust research infrastructure, including well-established clinical trial sites, research institutions, and academic medical centers. This infrastructure facilitates the efficient conduct of clinical trials, making it an attractive region for sponsors and investigators, which are pertinent to gaining competitive advantages.

Asia Pacific is anticipated to witness significant growth in the market. Asia Pacific is the fastest-growing market, as many developed economies are outsourcing clinical trials to countries such as India, China, and South Korea. The evolving business model of outsourcing and R&D activities among key global companies is expected to increase clinical trial services demand in the region, owing to the cost efficiency offered by CROs in countries such as India and China. Furthermore, large & diverse patient pools, recruitment for clinical trials, established clinical infrastructure, and the availability of skilled medical practitioners are supporting market growth.

By Molecule

By Study Designs

By Phase

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Molecule Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Atopic Dermatitis Clinical Trials Market

5.1. COVID-19 Landscape: Atopic Dermatitis Clinical Trials Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Atopic Dermatitis Clinical Trials Market, By Molecule

8.1. Atopic Dermatitis Clinical Trials Market, by Molecule, 2024-2033

8.1.1 Small molecules

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Large Molecules

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Atopic Dermatitis Clinical Trials Market, By Study Designs

9.1. Atopic Dermatitis Clinical Trials Market, by Study Designs, 2024-2033

9.1.1. Interventional

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Observational

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Atopic Dermatitis Clinical Trials Market, By Phase

10.1. Atopic Dermatitis Clinical Trials Market, by Phase, 2024-2033

10.1.1. Phase I

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Phase II

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Phase III

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Phase IV

10.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Atopic Dermatitis Clinical Trials Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Molecule (2021-2033)

11.1.2. Market Revenue and Forecast, by Study Designs (2021-2033)

11.1.3. Market Revenue and Forecast, by Phase (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Molecule (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Study Designs (2021-2033)

11.1.4.3. Market Revenue and Forecast, by Phase (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Molecule (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Study Designs (2021-2033)

11.1.5.3. Market Revenue and Forecast, by Phase (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Molecule (2021-2033)

11.2.2. Market Revenue and Forecast, by Study Designs (2021-2033)

11.2.3. Market Revenue and Forecast, by Phase (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Molecule (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Study Designs (2021-2033)

11.2.4.3. Market Revenue and Forecast, by Phase (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Molecule (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Study Designs (2021-2033)

11.2.5.3. Market Revenue and Forecast, by Phase (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Molecule (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Study Designs (2021-2033)

11.2.6.3. Market Revenue and Forecast, by Phase (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Molecule (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Study Designs (2021-2033)

11.2.7.3. Market Revenue and Forecast, by Phase (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Molecule (2021-2033)

11.3.2. Market Revenue and Forecast, by Study Designs (2021-2033)

11.3.3. Market Revenue and Forecast, by Phase (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Molecule (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Study Designs (2021-2033)

11.3.4.3. Market Revenue and Forecast, by Phase (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Molecule (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Study Designs (2021-2033)

11.3.5.3. Market Revenue and Forecast, by Phase (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Molecule (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Study Designs (2021-2033)

11.3.6.3. Market Revenue and Forecast, by Phase (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Molecule (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Study Designs (2021-2033)

11.3.7.3. Market Revenue and Forecast, by Phase (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Molecule (2021-2033)

11.4.2. Market Revenue and Forecast, by Study Designs (2021-2033)

11.4.3. Market Revenue and Forecast, by Phase (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Molecule (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Study Designs (2021-2033)

11.4.4.3. Market Revenue and Forecast, by Phase (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Molecule (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Study Designs (2021-2033)

11.4.5.3. Market Revenue and Forecast, by Phase (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Molecule (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Study Designs (2021-2033)

11.4.6.3. Market Revenue and Forecast, by Phase (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Molecule (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Study Designs (2021-2033)

11.4.7.3. Market Revenue and Forecast, by Phase (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Molecule (2021-2033)

11.5.2. Market Revenue and Forecast, by Study Designs (2021-2033)

11.5.3. Market Revenue and Forecast, by Phase (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Molecule (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Study Designs (2021-2033)

11.5.4.3. Market Revenue and Forecast, by Phase (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Molecule (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Study Designs (2021-2033)

11.5.5.3. Market Revenue and Forecast, by Phase (2021-2033)

Chapter 12. Company Profiles

12.1. Charles River Laboratories.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Imavita.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. REPROCELL Inc.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Oncodesign services.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. BIOCYTOGEN.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. QIMA LTD

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Novotech.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Redoxis

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Syneos Health.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Hooke Laboratories, LLC

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others