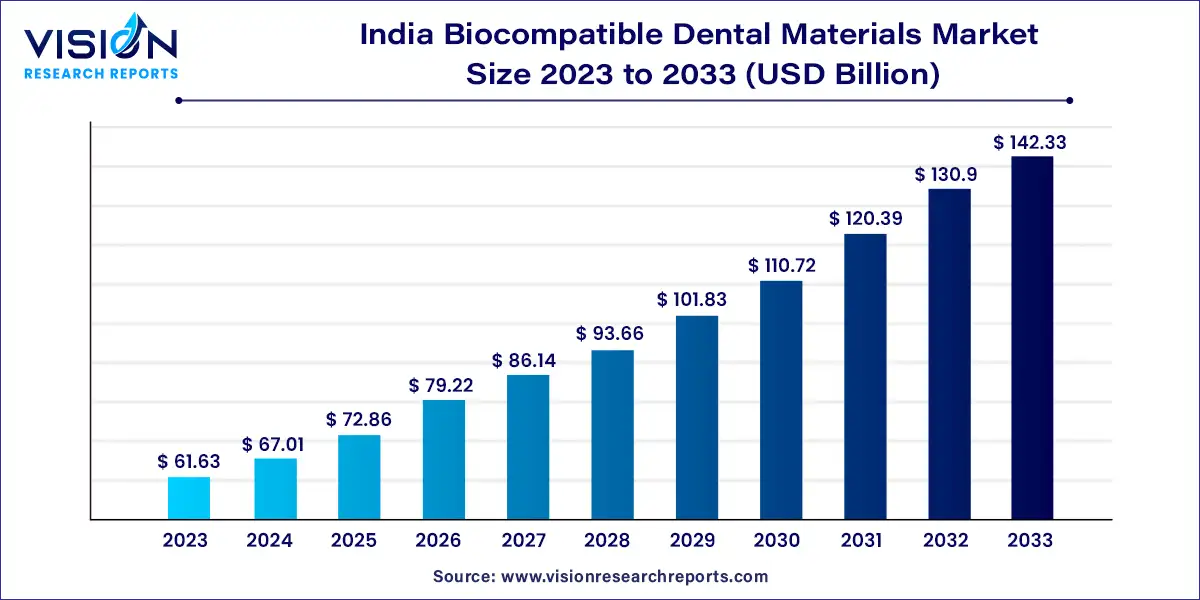

The India biocompatible dental materials market size was estimated at around USD 61.63 billion in 2023 and it is projected to hit around USD 142.33 billion by 2033, growing at a CAGR of 8.73% from 2024 to 2033.

The India biocompatible dental materials market is witnessing robust growth driven by increasing dental awareness and a rise in oral health issues among the population. These materials, which are designed to be compatible with human tissues, are gaining popularity due to their effectiveness in dental restorations and implants. Factors such as advancements in dental technology, a growing aging population, and increasing disposable incomes are propelling market demand. Additionally, the emphasis on aesthetic dentistry and the rising adoption of biocompatible materials for their superior properties, including minimal tissue reaction and enhanced durability, are further boosting the market's expansion in India.

The growth of the India biocompatible dental materials market is fueled by the rising prevalence of dental disorders and an increasing focus on oral hygiene are driving demand for advanced dental solutions. Additionally, technological advancements in dental materials, which enhance their durability and compatibility with human tissues, are boosting market growth. The growing geriatric population, who are more prone to dental issues, coupled with higher disposable incomes and improved access to dental care, further support market expansion. Moreover, the increasing popularity of cosmetic dentistry, which often utilizes biocompatible materials for superior aesthetic outcomes, is significantly contributing to the market's growth trajectory.

The ceramic biomaterials segment dominated the market with a 35% share in 2023. Medical device companies are increasingly focusing on advanced technologies due to the high prevalence of dental diseases, which is expected to drive market growth. Ceramics are widely used in dental restorations, particularly for dental inlays, bridges, and crowns. Various glass-ceramics and sintered ceramics are available today to meet the needs of patients, dentists, and dental technicians in terms of product processing and biomaterial properties.

The natural biomaterials segment is projected to grow at the fastest CAGR over the forecast period. Natural biomaterials used in dentistry include hydroxyapatite, collagen, chitosan, and various plant extracts. The choice of these materials is based on their ability to mimic the natural composition of the human body, facilitating better integration and acceptance by the patient’s tissues. Growing awareness of the environmental impact of synthetic materials has led to an increased focus on natural biomaterials. This shift is influencing patient preferences in dental treatments, driving demand for environmentally friendly and biocompatible materials.

In August 2022, Frimline launched India’s first toothpaste and mouthwash designed specifically to protect and improve the oral health of expectant mothers. Dente91 Mom Toothpaste, containing Lactoferrin and Nano Hydroxyapatite, helps reduce sensitivity, fight plaque, and repair cavities. It is enriched with essential vitamins such as Vitamin B6, Folic Acid, Vitamin E, and Vitamin D3 to support women’s oral health during pregnancy. Additionally, the toothpaste is free from Fluoride, SLS, Gluten, Paraben, Peroxide, and Triclosan, ensuring safety for pregnant women and their unborn babies.

The orthodontics segment held the largest market share in 2023. Orthodontic treatments aim to create healthy, straight teeth that properly align with opposing teeth. The orthodontics market is expected to grow significantly due to factors such as the increasing prevalence of dental diseases, a growing geriatric population prone to tooth loss, and a rise in dental tourism.

A notable application of biomaterials in orthodontics is the fabrication of orthodontic appliances like braces and aligners. Traditional braces, consisting of brackets, wires, and bands, have seen improvements in biomaterials, leading to more efficient and comfortable treatment options. Biomaterials with superior strength and flexibility are selected to withstand the forces applied during orthodontic adjustments. For instance, in September 2021, Rejové Clinique and Research Center announced 'Rejove Aligners,' advanced clear aligners designed to address various oral health concerns, catering to individuals of all ages with treatment overseen by experienced orthodontists.

The implantology segment is expected to witness significant CAGR during the forecast period. The growth of implantology in India is driven by increased awareness of oral health and the benefits of dental implants, prompting a shift among patients towards seeking long-term solutions for tooth replacement.

The dental labs segment accounted for the largest market share in 2023 and is anticipated to experience lucrative growth during the forecast period. Dental laboratories use biocompatible dental materials to craft personalized dental prosthetics such as crowns, bridges, and dentures, which are then fitted into patients’ mouths by dentists. These biocompatible materials are used to create precise and durable dental prosthetics that closely resemble the patient’s natural teeth in shape, size, and color.

The dental hospitals and clinics segment is likely to grow at a significant CAGR over the forecast period. Dental healthcare facilities, including hospitals and clinics, offer a wide range of dental treatments provided by skilled and certified professionals, reducing the likelihood of complications. There is a clear preference among individuals to choose dental hospitals and clinics as their primary option for comprehensive dental care services.

By Type

By Application

By End-use

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Type Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on India Biocompatible Dental Materials Market

5.1. COVID-19 Landscape: India Biocompatible Dental Materials Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. India Biocompatible Dental Materials Market, By Type

8.1. India Biocompatible Dental Materials Market, by Type, 2024-2033

8.1.1 Metallic Biomaterials

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Ceramic Biomaterials

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Polymeric Biomaterials

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Metal-ceramic Biomaterials

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Natural Biomaterials

8.1.5.1. Market Revenue and Forecast (2021-2033)

8.1.6. Composites Biomaterials

8.1.6.1. Market Revenue and Forecast (2021-2033)

Chapter 9. India Biocompatible Dental Materials Market, By Application

9.1. India Biocompatible Dental Materials Market, by Application, 2024-2033

9.1.1. Orthodontics

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Implantology

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Prosthodontics

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Others

9.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 10. India Biocompatible Dental Materials Market, By End-use

10.1. India Biocompatible Dental Materials Market, by End-use, 2024-2033

10.1.1. Dental Hospitals and Clinics

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Dental Laboratories

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Dental Academics and Research Institutes

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Dental Product Manufacturers

10.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 11. India Biocompatible Dental Materials Market, Regional Estimates and Trend Forecast

11.1. India

11.1.1. Market Revenue and Forecast, by Type (2021-2033)

11.1.2. Market Revenue and Forecast, by Application (2021-2033)

11.1.3. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 12. Company Profiles

12.1. Institut Straumann AG.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Geistlich Pharma AG.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Zimmer Biomet.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Envista.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Dentsply Sirona.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. 3M

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. DSM.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. KURARAY CO., LTD.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Medtronic.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Henry Schein, Inc.

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others