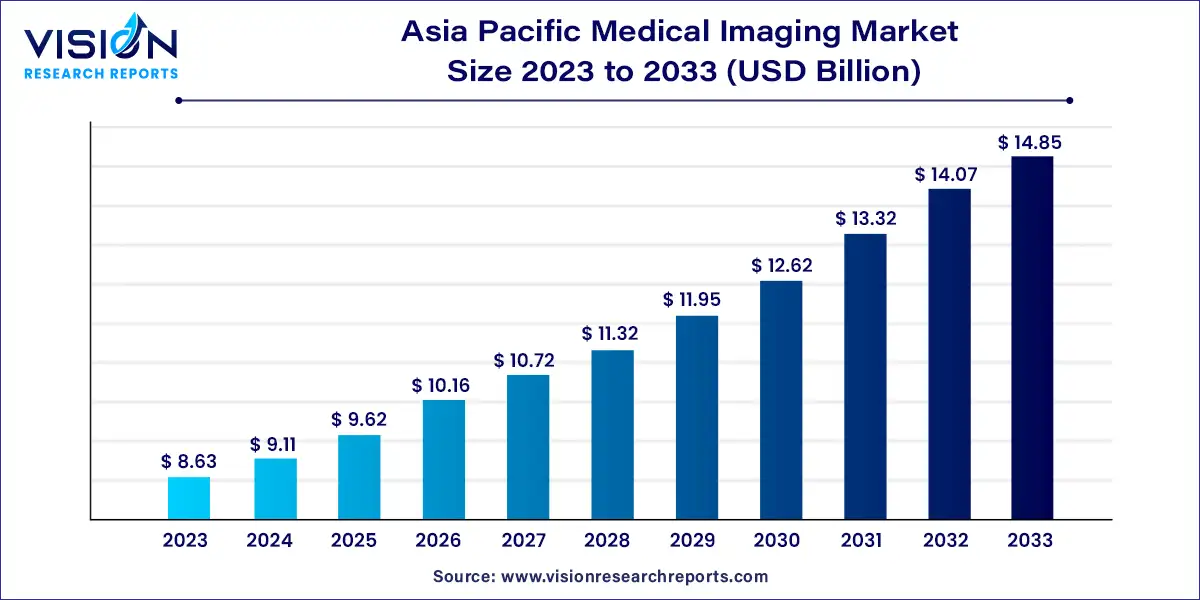

The Asia Pacific medical imaging market size was estimated at around USD 8.63 billion in 2023 and it is projected to hit around USD 14.85 billion by 2033, growing at a CAGR of 5.58% from 2024 to 2033.

The Asia Pacific region is witnessing significant growth in the medical imaging market, driven by technological advancements, increasing healthcare expenditure, and a rising prevalence of chronic diseases. Medical imaging plays a crucial role in diagnosing and monitoring various medical conditions, thereby supporting better patient outcomes and treatment decisions.

The growth of the Asia Pacific medical imaging market is fueled by the technological advancements in imaging modalities such as MRI, CT scans, ultrasound, and PET-CT have significantly enhanced diagnostic capabilities, driving increased adoption across the region. Rising healthcare expenditure, particularly in countries like China and India, is supporting the expansion of healthcare infrastructure and the integration of advanced imaging technologies. Additionally, the escalating prevalence of chronic diseases, including cardiovascular disorders and cancer, is driving the demand for medical imaging solutions for early diagnosis and treatment planning. Government initiatives aimed at improving healthcare access and quality further contribute to market growth by encouraging the adoption of advanced medical imaging systems.

In 2023, the ultrasound segment dominated with a substantial share of 33% and is poised to maintain its leadership throughout the forecast period. The segment's growth is driven by the expanding applications of ultrasound technology. Recent advancements in ultrasound transducers have opened new avenues in biomedical and cardiovascular imaging. Moreover, the development of portable ultrasound devices is expected to broaden their utility in ambulatory and emergency care settings. Integration of artificial intelligence for automated image quantification and selection is also anticipated to bolster market growth.

The CT segment is projected to experience the fastest growth during the forecast period. This growth is primarily attributed to the increasing demand for point-of-care CT devices and advancements such as high-precision CT scanners integrating artificial intelligence, machine learning, and advanced visualization systems.

Hospitals accounted for the largest share of 43% in 2023. The demand for advanced imaging modalities and the integration of imaging technologies into surgical suites are key factors driving segment growth. Teaching hospitals, in particular, have witnessed a significant rise in demand for these modalities compared to general or specialty hospitals. The establishment of new hospitals with dedicated space for imaging modalities is expected to further drive segment growth, fueled by competitive pressures and the demand for high-quality healthcare services.

The diagnostic imaging centers segment is expected to witness significant growth due to increasing awareness of chronic diseases such as cancer and neurological disorders. This has led to higher demand for CT and MRI procedures essential for diagnosis, treatment planning, and prevention of chronic illnesses. Investments in advanced technology, infrastructure improvement, and substantial funding are contributing to the segment's growth trajectory.

In 2023, the Asia Pacific medical imaging market held a share of 22%. Factors such as demographic changes, evolving disease patterns, and growth in the private healthcare sector are expected to propel market growth. The rise of private hospitals offering specialized care, including maternity and orthopedic treatments, is attributed to increasing foreign investments in the healthcare sector.

China led the Asia Pacific medical imaging market in 2023 with the largest revenue share. The country's growing number of hospitals is driving demand for medical imaging devices, which are integral to modern healthcare facilities. However, navigating China's complex and evolving regulatory environment remains a challenge for companies entering the market. Despite regulatory hurdles, China presents significant opportunities for U.S. companies aiming to expand their presence.

Japan's medical imaging market is anticipated to grow at the fastest CAGR of 5.93% during the forecast period. The country boasts well-equipped healthcare facilities with advanced imaging technologies. Increasing adoption of medical imaging devices in primary care settings and clinics is supported by the availability of affordable, novel imaging solutions and growing interest among physicians in early clinical interventions.

India, with its burgeoning demand for maternity services evidenced by the highest number of New Year’s Day births globally, is poised to drive the adoption of medical imaging devices. Manufacturers are actively expanding their operations in India, exemplified by Philips' recent investment in Maharashtra. This expansion includes facilities for MRI radio frequency coils, mobile surgery systems, and ultrasound assembly, reflecting India's growing importance in the medical imaging market.

By Product

By End-use

By Country

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Asia Pacific Medical Imaging Market

5.1. COVID-19 Landscape: Asia Pacific Medical Imaging Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Asia Pacific Medical Imaging Market, By

8.1. Asia Pacific Medical Imaging Market, by Product, 2024-2033

8.1.1. X-ray Devices

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Ultrasound

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Computed Tomography

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Magnetic Resonance Imaging

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Nuclear Imaging

8.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Asia Pacific Medical Imaging Market, By End-use

9.1. Asia Pacific Medical Imaging Market, by End-use, 2024-2033

9.1.1. Hospitals

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Diagnostic Imaging Centers

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Others

9.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Asia Pacific Medical Imaging Market, Regional Estimates and Trend Forecast

10.1. Asia Pacific

10.1.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.2. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 11. Company Profiles

11.1. GE Healthcare

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Koninklijke Philips N.V.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Siemens Healthineers

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Canon Medical Systems Corporation

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Mindray Medical International

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Esaote

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Hologic, Inc.

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Samsung Medison Co., Ltd.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Koning Corporation

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. PerkinElmer Inc.

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others