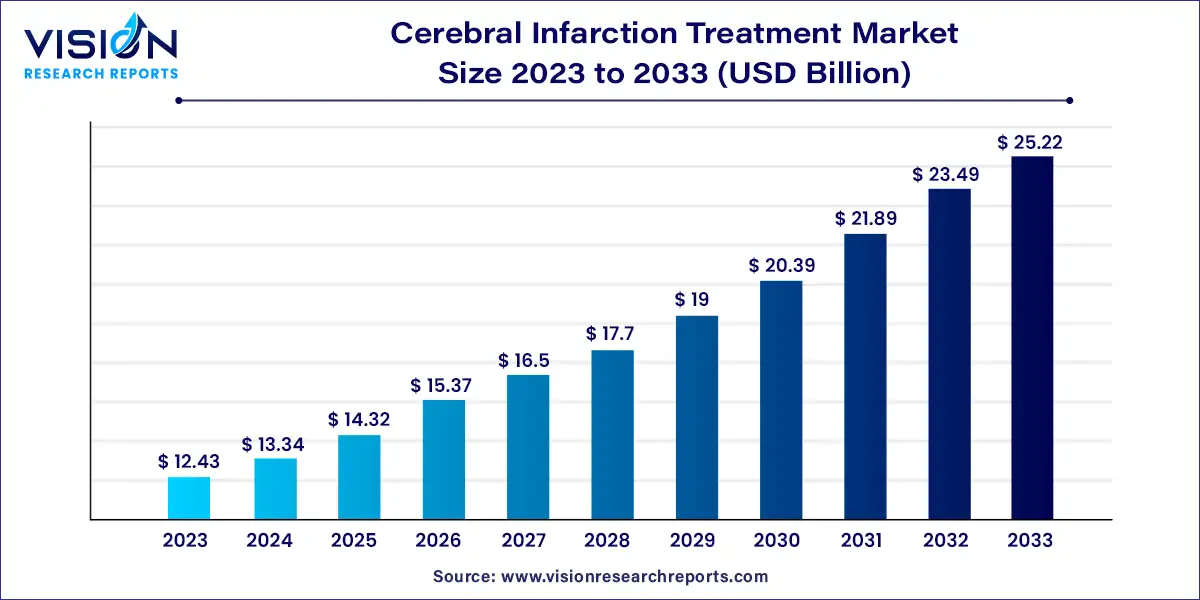

The global cerebral infarction treatment market size was estimated at around USD 12.43 billion in 2023 and it is projected to hit around USD 25.22 billion by 2033, growing at a CAGR of 7.33% from 2024 to 2033. Cerebral infarction, commonly known as a stroke, is a critical medical condition characterized by the interruption of blood flow to the brain, leading to neuronal death and loss of brain function. The treatment landscape for cerebral infarction is continually evolving, driven by advancements in medical research, technology, and an increasing understanding of stroke pathophysiology.

The growth of the cerebral infarction treatment market is driven by an advancements in medical technology and increasing awareness about cerebral infarction are improving diagnosis and treatment options. The rising incidence of stroke, fueled by aging populations and increasing prevalence of risk factors such as hypertension, diabetes, and lifestyle-related conditions, further propels market demand. Additionally, ongoing research and development of innovative therapies and drugs, including thrombolytics and mechanical thrombectomy devices, are enhancing treatment efficacy and expanding market opportunities. Moreover, supportive government initiatives and increasing healthcare expenditure are contributing to market growth by facilitating better access to advanced treatments.

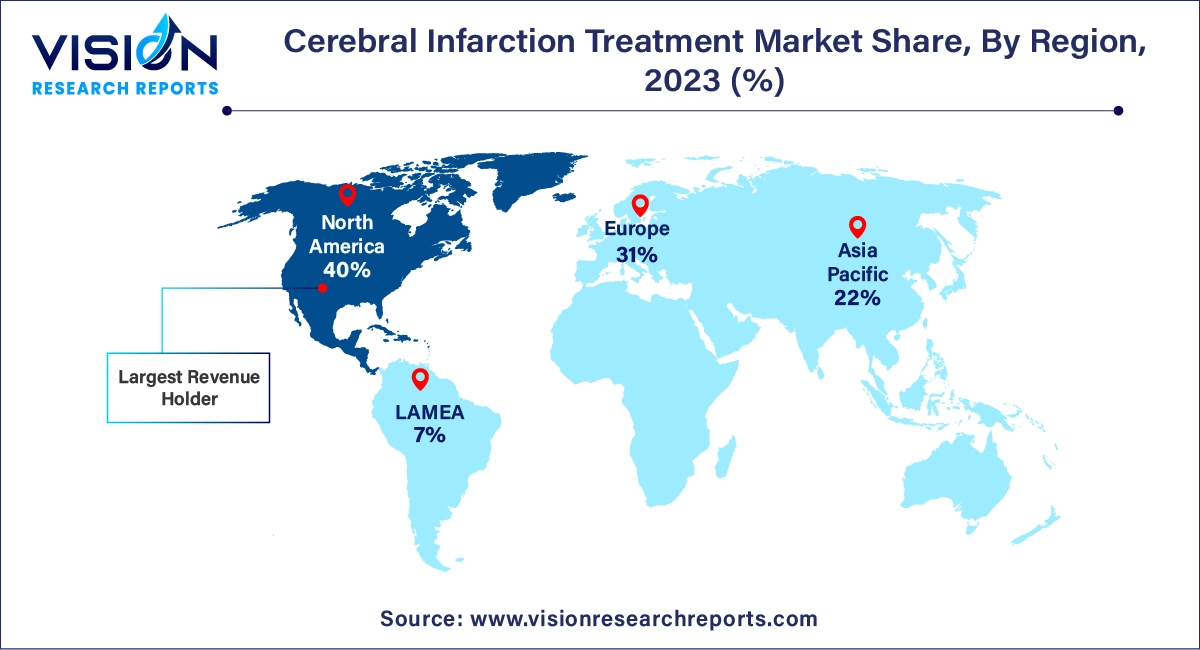

North America led the global cerebral infarction treatment market with a 40% share in 2023. This is due to its advanced healthcare infrastructure, high stroke prevalence, and substantial investments in research and development. According to a CDC report from May 2024, stroke is the fifth leading cause of death in the U.S., with approximately 795,000 cases annually. The high incidence drives demand for sophisticated treatments such as tPA and mechanical thrombectomy devices. Supportive reimbursement policies and government funding for stroke research, such as NIH grants, further bolster market growth.

| Attribute | North America |

| Market Value | USD 4.97 Billion |

| Growth Rate | 7.34% CAGR |

| Projected Value | USD 10.08 Billion |

The cerebral infarction treatment market in Europe is growing rapidly due to an aging population, increasing stroke incidence, and supportive healthcare policies. Stroke is a leading cause of disability and mortality in Europe, with over 1.1 million new cases each year. Investments in healthcare infrastructure and initiatives like the Stroke Action Plan for Europe 2018-2030 are driving market expansion. The region's emphasis on early intervention and rehabilitation is also boosting demand for advanced stroke treatments.

The Asia Pacific region is seeing rapid growth in the cerebral infarction treatment market due to rising stroke incidence, increased healthcare investments, and greater awareness about stroke prevention and treatment. Countries such as China and India are experiencing a surge in stroke cases due to aging populations and lifestyle changes. The WHO projects a significant rise in stroke-related morbidity in the region. With an estimated population of 4.7 billion, Asia faces a major health challenge with between 9.5 and 10.6 million stroke cases annually. This growing healthcare burden, coupled with uneven resource distribution, is impacting stroke care and management.

In Latin America, the cerebral infarction treatment market is expanding due to increased healthcare investments, a rising prevalence of stroke, and efforts to enhance access to advanced treatments. Stroke remains a leading cause of death and disability in the region. The Pan American Health Organization highlights the need for improved stroke care. Investments in healthcare infrastructure, especially in urban areas, and the growing presence of multinational pharmaceutical companies are improving access to innovative therapies, driving market growth.

The cerebral infarction treatment market in the Middle East and Africa is witnessing significant growth driven by rising stroke incidence, improving healthcare infrastructure, and increasing government focus on non-communicable diseases. Governments in the Middle East, particularly in countries such as Saudi Arabia and the UAE, are investing in advanced healthcare facilities and public health campaigns to address stroke prevention and treatment. In addition, international collaborations and investments in medical research are supporting market growth.

In 2023, the ischemic stroke segment dominated the cerebral infarction treatment market with a significant share of 79%. This prominence is attributed to the high prevalence of ischemic strokes, advancements in treatment technologies, and increasing awareness of early intervention strategies. As highlighted by the World Stroke Organization's 2022 Global Stroke Fact Sheet, ischemic strokes, which result from blocked blood flow to the brain, represent approximately 62% of all stroke cases worldwide and are associated with 3.3 million deaths annually. The market growth is driven by the development and adoption of advanced treatment modalities, including thrombolytic therapies and mechanical thrombectomy devices.

Conversely, the hemorrhagic stroke segment is witnessing the highest growth rate, with a compound annual growth rate (CAGR) of 8.23%. Despite being less prevalent than ischemic strokes, hemorrhagic strokes are associated with high mortality and morbidity rates. These strokes occur due to the rupture of a blood vessel in the brain, leading to bleeding in or around the brain. According to the same World Stroke Organization report, over 3.4 million new intracerebral hemorrhages are reported each year, with nearly 3 million resulting in death. The rising global incidence of hypertension—a major risk factor for hemorrhagic strokes—is contributing to the increased frequency of these strokes, particularly in low- and middle-income countries.

The tissue plasminogen activators (tPA) segment held the largest revenue share of 40% in 2023. This is due to its proven effectiveness, widespread use, and essential role in treating ischemic strokes. Since its FDA approval in 1996, tPA, particularly alteplase, has been recognized as the gold standard for acute ischemic stroke management. The 2020 American Heart Association guidelines reaffirmed the importance of tPA, recommending its use for eligible patients. tPA works by dissolving blood clots, restoring blood flow to the brain, and reducing the risk of long-term disability. Its administration within 3 to 4.5 hours of stroke onset is crucial, influencing global hospital protocols and emergency response strategies.

Anticoagulants are expected to experience the highest CAGR of 9.03% during the forecast period. This growth is driven by their expanding role in stroke prevention, especially among patients with atrial fibrillation (AF). The rising prevalence of AF, a significant risk factor for ischemic strokes, is a key factor. The American Heart Association estimates that AF will affect 12.1 million people in the U.S., with numbers increasing due to an aging population. Anticoagulants reduce the risk of blood clots forming in the heart, thereby lowering the risk of stroke. Continued advancements in anticoagulant therapies further support their growing adoption.

In 2023, hospital pharmacies led the cerebral infarction treatment market with a substantial revenue share of 64%. This leadership is due to their crucial role in the acute management of stroke patients, the rising incidence of strokes, and the centralized distribution of specialized medications. Hospital pharmacies are essential for providing immediate and specialized care during the critical early stages of stroke treatment. For instance, in Australia, there were about 67,900 hospitalizations with stroke as the principal diagnosis in 2020-21, highlighting the importance of timely medication administration in stroke care.

Retail pharmacies are anticipated to achieve the highest CAGR of 9.62% in the forecast period. This growth is driven by patient preference for convenience and the expansion of accessible healthcare services through retail channels. The shift towards patient-centered care and a focus on medication adherence have led retail pharmacies to enhance their services, including medication therapy management (MTM). This model, where pharmacists provide counseling and monitor medication regimens, is increasingly important for reducing hospital readmissions and improving long-term health outcomes for stroke patients.

By Treatment

By Drug Class

By Distribution Channel

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Treatment Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Cerebral Infarction Treatment Market

5.1. COVID-19 Landscape: Cerebral Infarction Treatment Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Cerebral Infarction Treatment Market, By Treatment

8.1. Cerebral Infarction Treatment Market, by Treatment, 2024-2033

8.1.1 Ischemic Stroke

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Hemorrhagic Stroke

Chapter 9. Global Cerebral Infarction Treatment Market, By Drug Class

9.1. Cerebral Infarction Treatment Market, by Drug Class, 2024-2033

9.1.1. Tissue Plasminogen Activators (tPA)

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Anticoagulants

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Antiplatelets

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Anticonvulsants

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Others

9.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Cerebral Infarction Treatment Market, By Distribution Channel

10.1. Cerebral Infarction Treatment Market, by Distribution Channel, 2024-2033

10.1.1. Hospital Pharmacies

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Retail Pharmacies

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Other

10.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Cerebral Infarction Treatment Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Treatment (2021-2033)

11.1.2. Market Revenue and Forecast, by Drug Class (2021-2033)

11.1.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Treatment (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Drug Class (2021-2033)

11.1.4.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Treatment (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Drug Class (2021-2033)

11.1.5.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Treatment (2021-2033)

11.2.2. Market Revenue and Forecast, by Drug Class (2021-2033)

11.2.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Treatment (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Drug Class (2021-2033)

11.2.4.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Treatment (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Drug Class (2021-2033)

11.2.5.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Treatment (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Drug Class (2021-2033)

11.2.6.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Treatment (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Drug Class (2021-2033)

11.2.7.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Treatment (2021-2033)

11.3.2. Market Revenue and Forecast, by Drug Class (2021-2033)

11.3.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Treatment (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Drug Class (2021-2033)

11.3.4.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Treatment (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Drug Class (2021-2033)

11.3.5.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Treatment (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Drug Class (2021-2033)

11.3.6.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Treatment (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Drug Class (2021-2033)

11.3.7.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Treatment (2021-2033)

11.4.2. Market Revenue and Forecast, by Drug Class (2021-2033)

11.4.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Treatment (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Drug Class (2021-2033)

11.4.4.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Treatment (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Drug Class (2021-2033)

11.4.5.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Treatment (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Drug Class (2021-2033)

11.4.6.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Treatment (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Drug Class (2021-2033)

11.4.7.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Treatment (2021-2033)

11.5.2. Market Revenue and Forecast, by Drug Class (2021-2033)

11.5.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Treatment (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Drug Class (2021-2033)

11.5.4.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Treatment (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Drug Class (2021-2033)

11.5.5.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

Chapter 12. Company Profiles

12.1. Amgen Inc.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Pfizer Inc.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Novartis AG.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Amneal Pharmaceuticals LLC.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Sanofi.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Abbott Laboratories

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Johnson & Johnson.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Bristol-Myers Squibb

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others