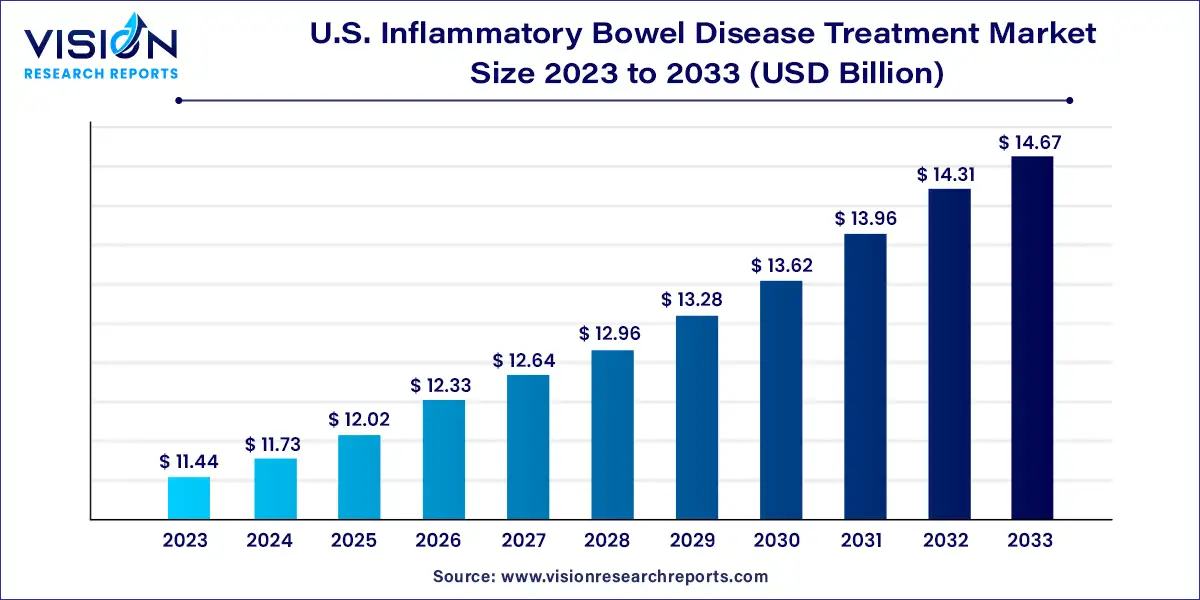

The U.S. inflammatory bowel disease treatment market size was estimated at USD 11.44 billion in 2023 and it is expected to surpass around USD 14.67 billion by 2033, poised to grow at a CAGR of 2.52% from 2024 to 2033.

Inflammatory bowel disease (IBD) remains a significant healthcare challenge in the United States, impacting millions of individuals and imposing substantial burdens on both patients and healthcare systems.

The growth of the U.S. inflammatory bowel disease (IBD) treatment market is driven by an increasing prevalence of IBD in the United States contributes to market expansion, driven by factors such as changes in lifestyle, environmental influences, and genetic predisposition. Additionally, advancements in medical research and technology play a pivotal role in driving market growth, facilitating the development of novel treatment modalities and therapeutic interventions. Furthermore, rising awareness among healthcare providers and patients about the importance of early diagnosis and effective management of IBD fosters demand for innovative treatment options. Moreover, favorable government initiatives and policies aimed at improving access to healthcare services and promoting research in gastrointestinal disorders further stimulate market growth. Overall, these growth factors collectively propel the expansion of the U.S. IBD treatment market, offering new opportunities for market players and improving outcomes for patients affected by this chronic inflammatory condition.

Crohn’s disease dominated the market in 2023 with a revenue share of 63%. Crohn's disease requires more treatment options and advancements due to its chronic inflammatory nature that affects the gastrointestinal tract, causing symptoms such as abdominal pain, diarrhea, weight loss, and fatigue. Crohn's disease often has periods of remission followed by relapses, making it difficult to manage in the long term. More effective treatments are needed to help patients maintain remission and improve their overall health. In October 2023, Eli Lilly and Company announced that mirikizumab (an investigational interleukin-23p19 antagonist) achieves safety and efficacy in treating adults with Crohn's disease. Crohn's disease has an increased prevalence due to its variability in response to treatment, limited understanding of the disease, recurrence and remission challenges, potential complications, and the impact on patients' quality of life.

The ulcerative colitis segment is anticipated to register the fastest CAGR over the forecast period. Untreated or poorly managed ulcerative colitis can lead to complications such as severe bleeding, increased risk of colon cancer, and life-threatening inflammation known as toxic megacolon. The complex and unpredictable nature of ulcerative colitis, along with the need for ongoing management to maintain quality of life and prevent complications, makes it a condition that requires more extensive treatment.

In terms of drug class, the TNF inhibitors segment held the largest market revenue share in 2023. Tumor Necrosis Factor (TNF) inhibitors are in high demand for treating inflammatory bowel diseases (IBD) due to their effectiveness in managing the symptoms and reducing inflammation. Inflammatory bowel diseases, such as Crohn's disease and ulcerative colitis, are chronic conditions characterized by inflammation in the gastrointestinal tract. This inflammation can lead to abdominal pain, diarrhea, weight loss, and other complications. The demand for TNF inhibitors in this treatment is high due to their proven efficacy in managing symptoms, inducing and maintaining remission, and improving patients' overall quality of life.

The JAK inhibitors segment is anticipated to register the fastest CAGR during the forecast period. The segment's expansion is anticipated due to the growing endorsement of innovative JAK inhibitors and potent pipeline medications. According to the Gastroenterology & Endoscopy news, in 2022, the FDA approved Rinvoq for treating ulcerative colitis. This increase in the number of regulatory approvals, in turn, leads to market growth.

The injectable segment dominated the market in 2023 in terms of revenue share. Injectable medications, such as biologics and biosimilars, are designed to target specific proteins or cells involved in the inflammatory process of inflammatory bowel disease. This targeted approach allows for more efficient and effective treatment than traditional oral or topical medications, which may have broader side effects. Injectables can provide systemic treatment; they circulate throughout the body and reach affected areas more effectively than local treatments, which may only address the symptoms at the application site.

The oral segment is projected to grow at the fastest CAGR over the forecast period. Oral medications can be easily swallowed and taken with water, making them more convenient for patients than other administration routes, such as injections or infusions. This is particularly important for long-term management of chronic conditions such as IBD. Oral medications can be combined with other treatments, such as biologics or immunosuppressants, to enhance their effectiveness in managing these diseases. This approach can help improve treatment outcomes and reduce the risk of complications. In October 2023, the U.S. FDA approved Pfizer’s VELSIPITY, an oral treatment for adults with active ulcerative colitis (UC).

The hospital pharmacies segment held the largest revenue share in 2023. The inflammatory bowel diseases, including Crohn's disease and ulcerative colitis, require a complex and tailored treatment approach. Patients often need a combination of medications, including immunosuppressants, biologics, and anti-inflammatory drugs. Hospital pharmacies have the expertise and resources to manage such intricate medication regimens.

The online pharmacies segment is expected to register the fastest CAGR during the forecast period. Online pharmacies offer a convenient way for patients to access medications without leaving their homes. This is particularly beneficial for individuals with IBD, who may experience periods of increased symptoms or flare-ups, making it difficult for them to visit a physical pharmacy.

By Type

By Drug Class

By Route of Administration

By Distribution Channel

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others