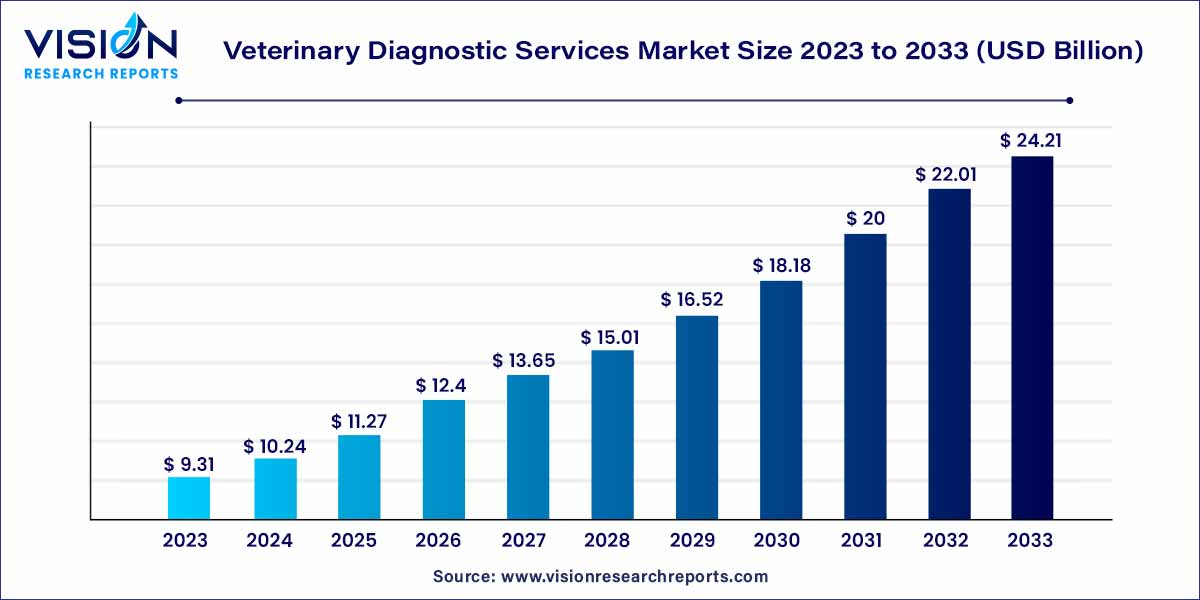

The global veterinary diagnostic services market was estimated at USD 9.31 billion in 2023 and it is expected to surpass around USD 24.21 billion by 2033, poised to grow at a CAGR of 10.03% from 2024 to 2033. The market is expanding due to several major factors, such as rising costs for animal health, an increase in the frequency of animal diseases, improvements in diagnostics, and an increasing rate of medicalization.

The veterinary diagnostic services market is a vital component of the global healthcare system for animals, encompassing a wide range of diagnostic procedures and services designed to ensure the well-being of companion animals, livestock, and other species. These services play a pivotal role in identifying, monitoring, and managing various health conditions in animals, contributing to the overall health and productivity of animal populations.

The growth of the veterinary diagnostic services market is propelled by several key factors. Firstly, the increasing prevalence of animal diseases underscores the essential role of diagnostic services in effective disease management and prevention. Technological advancements in diagnostic tools, including digital imaging, automation, and artificial intelligence, contribute significantly to enhancing the accuracy and efficiency of veterinary diagnostics. Moreover, the growing number of pets and the intensification of commercial animal farming drive the demand for these services, as pet owners and livestock producers prioritize the health and well-being of their animals.

| Report Coverage | Details |

| Market Revenue by 2033 | USD 24.21 billion |

| Growth Rate from 2024 to 2033 | CAGR of 10.03% |

| Revenue Share of North America in 2023 | 39% |

| CAGR of Asia Pacific from 2024 to 2033 | 10.04% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

In terms of test type, the in vitro diagnosis segment dominated the market with a revenue share of 87% in 2023. Veterinary in vitro diagnosis (IVD) services are used to diagnose several animal diseases and monitor the health status of animals & therapeutic procedures by analyzing samples, such as blood, tissue, urine, feces, and other biological fluids. IVD services use various methods, including sequencing technology, polymerase chain reaction, mass spectrometry, and microarray techniques, to test the sample preparation.

The in vivo diagnosis segment is projected to grow at the fastest CAGR of 8.43% during the forecast period. In vivo diagnostics services mainly consist of imaging technologies. Customer needs for veterinary in vivo diagnostics services have increased due to recent advancements in veterinary imaging. Demand has increased particularly for dual imaging technologies (PET/CT, PET/MR, and SPECT/CT), cross-sectional methods (MRI and CT imaging), and nuclear medicine techniques (PET and SPECT).

Based on animal type, the companion animals segment led the market with the highest revenue share of 60% in 2023. This can be attributed to increasing pet adoption during the COVID-19 pandemic and growing awareness about early disease diagnosis & health management. The adoption of companion animals, particularly dogs, is sharply rising in the U.S. According to the American Pet Products Association's National Pet Owners Survey 2021-2022, in the U.S., 69 million households (or approximately 54%) owned dogs, up from 50% of homes registered in 2018.

The production animals segment is expected to grow at the fastest CAGR of 8.28% during the forecast period, primarily owing to rising livestock productivity. Cattle, pigs, chickens, and other livestock are considered production animals. Rising zoonotic disease occurrence and a high livestock population are the main drivers of the production animal diagnostic services market.

In terms of the testing category, the clinical chemistry segment held the largest market share of 24% in 2023. The increasing volume of veterinary analytical services is the main factor driving the demand for diagnostic services for clinical pathological applications. Clinical chemistry examinations are crucial for determining the function of various animal organs, such as the liver, kidneys, and other organs. They can aid in diagnosing diseases like pancreatitis or diabetes in animals. The effectiveness of a pet’s treatment can also be tracked using these tests.

The cytopathology segment is estimated to witness the fastest CAGR of 11.05% during the forecast period. Cytopathology testing services can help identify cancerous cells or determine if a tumor is benign or malignant. It can also detect infectious microorganisms and others, such as yeast, with a unique appearance. The growing incidences of cancer in companion animals and the increased use of cytopathological cancer diagnosis services are expected to boost the segment share during the forecast period.

In terms of sector, the private sector held the largest market share in 2023 and is anticipated to grow at the fastest CAGR of nearly 7.93% over the forecast period. The private sector includes corporate reference laboratories and privately owned clinics/hospital-based laboratories. Private laboratories often focus solely on veterinary diagnostics, allowing them to develop specialized expertise.

Furthermore, rather than investing in costly equipment and personnel training, veterinary clinics & hospitals may find it more cost-effective to outsource certain diagnostic procedures to private laboratories. Private laboratories can conduct these tests on a large scale, distributing the expenses among numerous customers and making their services cheaper for individual veterinary practices. These factors drive market growth.

In terms of type, the point-of-care (POC) segment contributed the largest market share of 58% in 2023. The segment focuses on testing services offered at the POC, such as a farm, veterinary establishment, or home. Results are delivered within minutes or a few hours (much faster than sending out lab results), allowing veterinarians to provide efficient diagnoses and decide future steps (such as additional testing or treatment) within the same appointment. Overall, POC diagnostics in veterinary medicine transformed how veterinarians approach diagnosis and treatment, resulting in better patient outcomes and growing demand for such testing solutions in the market.

The laboratory-based segment expected to expand at the highest CAGR of 8.06% during the forecast period. The laboratories are owned and operated by companies or public entities. Veterinary laboratories provide a comprehensive range of diagnostic tests and services to diagnose and monitor various animal diseases & disorders.

In terms of region, North America held the largest revenue share of more than 39% in 2023. North America has seen a rise in pet ownership, with many households considering pets as family. This growing pet population has increased the demand for veterinary diagnostics services to ensure the health and well-being of these animals. In addition, pet owners are willing to spend more on their pets' healthcare, including diagnostics, surgery, and other medical services. The rise in veterinary healthcare expenditure has contributed to the growth of the market. Moreover, the presence of veterinary diagnostics laboratories in the region contributes to market growth.

On the other hand, the Asia Pacific region is expected to grow at the fastest CAGR of 10.04% from 2024 to 2033. Major reasons anticipated to propel the regional market growth are the rise in middle-class families, increasing disposable income, adopting companion animals, and the growing demand for animal proteins. Countries such as China & India are anticipated to have strong growth potential with the number of industrial facilities in the region increasing.

By Test Type

By Animal Type

By Testing Category

By Sector

By Type

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Veterinary Diagnostic Services Market

5.1. COVID-19 Landscape: Veterinary Diagnostic Services Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Veterinary Diagnostic Services Market, By Test Type

8.1. Veterinary Diagnostic Services Market, by Test Type, 2024-2033

8.1.1. In Vitro Diagnosis

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. In Vivo Diagnosis

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Veterinary Diagnostic Services Market, By Animal Type

9.1. Veterinary Diagnostic Services Market, by Animal Type, 2024-2033

9.1.1. Companion Animals

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Production Animals

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Veterinary Diagnostic Services Market, By Testing Category

10.1. Veterinary Diagnostic Services Market, by Testing Category, 2024-2033

10.1.1. Clinical Chemistry

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Microbiology

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Parasitology

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Histopathology

10.1.4.1. Market Revenue and Forecast (2021-2033)

10.1.5. Cytopathology

10.1.5.1. Market Revenue and Forecast (2021-2033)

10.1.6. Hematology

10.1.6.1. Market Revenue and Forecast (2021-2033)

10.1.7. Immunology & Serology

10.1.7.1. Market Revenue and Forecast (2021-2033)

10.1.8. Imaging

10.1.8.1. Market Revenue and Forecast (2021-2033)

10.1.9. Molecular Diagnostics

10.1.9.1. Market Revenue and Forecast (2021-2033)

10.1.10. Other Categories

10.1.10.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Veterinary Diagnostic Services Market, By Sector

11.1. Veterinary Diagnostic Services Market, by Sector, 2024-2033

11.1.1. Public

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Private

11.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Global Veterinary Diagnostic Services Market, By Type

12.1. Veterinary Diagnostic Services Market, by Type, 2024-2033

12.1.1. Point-of-Care (POC)

12.1.1.1. Market Revenue and Forecast (2021-2033)

12.1.2. Laboratory-base

12.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 13. Global Veterinary Diagnostic Services Market, Regional Estimates and Trend Forecast

13.1. North America

13.1.1. Market Revenue and Forecast, by Test Type (2021-2033)

13.1.2. Market Revenue and Forecast, by Animal Type (2021-2033)

13.1.3. Market Revenue and Forecast, by Testing Category (2021-2033)

13.1.4. Market Revenue and Forecast, by Sector (2021-2033)

13.1.5. Market Revenue and Forecast, by Type (2021-2033)

13.1.6. U.S.

13.1.6.1. Market Revenue and Forecast, by Test Type (2021-2033)

13.1.6.2. Market Revenue and Forecast, by Animal Type (2021-2033)

13.1.6.3. Market Revenue and Forecast, by Testing Category (2021-2033)

13.1.6.4. Market Revenue and Forecast, by Sector (2021-2033)

13.1.7. Market Revenue and Forecast, by Type (2021-2033)

13.1.8. Rest of North America

13.1.8.1. Market Revenue and Forecast, by Test Type (2021-2033)

13.1.8.2. Market Revenue and Forecast, by Animal Type (2021-2033)

13.1.8.3. Market Revenue and Forecast, by Testing Category (2021-2033)

13.1.8.4. Market Revenue and Forecast, by Sector (2021-2033)

13.1.8.5. Market Revenue and Forecast, by Type (2021-2033)

13.2. Europe

13.2.1. Market Revenue and Forecast, by Test Type (2021-2033)

13.2.2. Market Revenue and Forecast, by Animal Type (2021-2033)

13.2.3. Market Revenue and Forecast, by Testing Category (2021-2033)

13.2.4. Market Revenue and Forecast, by Sector (2021-2033)

13.2.5. Market Revenue and Forecast, by Type (2021-2033)

13.2.6. UK

13.2.6.1. Market Revenue and Forecast, by Test Type (2021-2033)

13.2.6.2. Market Revenue and Forecast, by Animal Type (2021-2033)

13.2.6.3. Market Revenue and Forecast, by Testing Category (2021-2033)

13.2.7. Market Revenue and Forecast, by Sector (2021-2033)

13.2.8. Market Revenue and Forecast, by Type (2021-2033)

13.2.9. Germany

13.2.9.1. Market Revenue and Forecast, by Test Type (2021-2033)

13.2.9.2. Market Revenue and Forecast, by Animal Type (2021-2033)

13.2.9.3. Market Revenue and Forecast, by Testing Category (2021-2033)

13.2.10. Market Revenue and Forecast, by Sector (2021-2033)

13.2.11. Market Revenue and Forecast, by Type (2021-2033)

13.2.12. France

13.2.12.1. Market Revenue and Forecast, by Test Type (2021-2033)

13.2.12.2. Market Revenue and Forecast, by Animal Type (2021-2033)

13.2.12.3. Market Revenue and Forecast, by Testing Category (2021-2033)

13.2.12.4. Market Revenue and Forecast, by Sector (2021-2033)

13.2.13. Market Revenue and Forecast, by Type (2021-2033)

13.2.14. Rest of Europe

13.2.14.1. Market Revenue and Forecast, by Test Type (2021-2033)

13.2.14.2. Market Revenue and Forecast, by Animal Type (2021-2033)

13.2.14.3. Market Revenue and Forecast, by Testing Category (2021-2033)

13.2.14.4. Market Revenue and Forecast, by Sector (2021-2033)

13.2.15. Market Revenue and Forecast, by Type (2021-2033)

13.3. APAC

13.3.1. Market Revenue and Forecast, by Test Type (2021-2033)

13.3.2. Market Revenue and Forecast, by Animal Type (2021-2033)

13.3.3. Market Revenue and Forecast, by Testing Category (2021-2033)

13.3.4. Market Revenue and Forecast, by Sector (2021-2033)

13.3.5. Market Revenue and Forecast, by Type (2021-2033)

13.3.6. India

13.3.6.1. Market Revenue and Forecast, by Test Type (2021-2033)

13.3.6.2. Market Revenue and Forecast, by Animal Type (2021-2033)

13.3.6.3. Market Revenue and Forecast, by Testing Category (2021-2033)

13.3.6.4. Market Revenue and Forecast, by Sector (2021-2033)

13.3.7. Market Revenue and Forecast, by Type (2021-2033)

13.3.8. China

13.3.8.1. Market Revenue and Forecast, by Test Type (2021-2033)

13.3.8.2. Market Revenue and Forecast, by Animal Type (2021-2033)

13.3.8.3. Market Revenue and Forecast, by Testing Category (2021-2033)

13.3.8.4. Market Revenue and Forecast, by Sector (2021-2033)

13.3.9. Market Revenue and Forecast, by Type (2021-2033)

13.3.10. Japan

13.3.10.1. Market Revenue and Forecast, by Test Type (2021-2033)

13.3.10.2. Market Revenue and Forecast, by Animal Type (2021-2033)

13.3.10.3. Market Revenue and Forecast, by Testing Category (2021-2033)

13.3.10.4. Market Revenue and Forecast, by Sector (2021-2033)

13.3.10.5. Market Revenue and Forecast, by Type (2021-2033)

13.3.11. Rest of APAC

13.3.11.1. Market Revenue and Forecast, by Test Type (2021-2033)

13.3.11.2. Market Revenue and Forecast, by Animal Type (2021-2033)

13.3.11.3. Market Revenue and Forecast, by Testing Category (2021-2033)

13.3.11.4. Market Revenue and Forecast, by Sector (2021-2033)

13.3.11.5. Market Revenue and Forecast, by Type (2021-2033)

13.4. MEA

13.4.1. Market Revenue and Forecast, by Test Type (2021-2033)

13.4.2. Market Revenue and Forecast, by Animal Type (2021-2033)

13.4.3. Market Revenue and Forecast, by Testing Category (2021-2033)

13.4.4. Market Revenue and Forecast, by Sector (2021-2033)

13.4.5. Market Revenue and Forecast, by Type (2021-2033)

13.4.6. GCC

13.4.6.1. Market Revenue and Forecast, by Test Type (2021-2033)

13.4.6.2. Market Revenue and Forecast, by Animal Type (2021-2033)

13.4.6.3. Market Revenue and Forecast, by Testing Category (2021-2033)

13.4.6.4. Market Revenue and Forecast, by Sector (2021-2033)

13.4.7. Market Revenue and Forecast, by Type (2021-2033)

13.4.8. North Africa

13.4.8.1. Market Revenue and Forecast, by Test Type (2021-2033)

13.4.8.2. Market Revenue and Forecast, by Animal Type (2021-2033)

13.4.8.3. Market Revenue and Forecast, by Testing Category (2021-2033)

13.4.8.4. Market Revenue and Forecast, by Sector (2021-2033)

13.4.9. Market Revenue and Forecast, by Type (2021-2033)

13.4.10. South Africa

13.4.10.1. Market Revenue and Forecast, by Test Type (2021-2033)

13.4.10.2. Market Revenue and Forecast, by Animal Type (2021-2033)

13.4.10.3. Market Revenue and Forecast, by Testing Category (2021-2033)

13.4.10.4. Market Revenue and Forecast, by Sector (2021-2033)

13.4.10.5. Market Revenue and Forecast, by Type (2021-2033)

13.4.11. Rest of MEA

13.4.11.1. Market Revenue and Forecast, by Test Type (2021-2033)

13.4.11.2. Market Revenue and Forecast, by Animal Type (2021-2033)

13.4.11.3. Market Revenue and Forecast, by Testing Category (2021-2033)

13.4.11.4. Market Revenue and Forecast, by Sector (2021-2033)

13.4.11.5. Market Revenue and Forecast, by Type (2021-2033)

13.5. Latin America

13.5.1. Market Revenue and Forecast, by Test Type (2021-2033)

13.5.2. Market Revenue and Forecast, by Animal Type (2021-2033)

13.5.3. Market Revenue and Forecast, by Testing Category (2021-2033)

13.5.4. Market Revenue and Forecast, by Sector (2021-2033)

13.5.5. Market Revenue and Forecast, by Type (2021-2033)

13.5.6. Brazil

13.5.6.1. Market Revenue and Forecast, by Test Type (2021-2033)

13.5.6.2. Market Revenue and Forecast, by Animal Type (2021-2033)

13.5.6.3. Market Revenue and Forecast, by Testing Category (2021-2033)

13.5.6.4. Market Revenue and Forecast, by Sector (2021-2033)

13.5.7. Market Revenue and Forecast, by Type (2021-2033)

13.5.8. Rest of LATAM

13.5.8.1. Market Revenue and Forecast, by Test Type (2021-2033)

13.5.8.2. Market Revenue and Forecast, by Animal Type (2021-2033)

13.5.8.3. Market Revenue and Forecast, by Testing Category (2021-2033)

13.5.8.4. Market Revenue and Forecast, by Sector (2021-2033)

13.5.8.5. Market Revenue and Forecast, by Type (2021-2033)

Chapter 14. Company Profiles

14.1. Zoetis Services LLC

14.1.1. Company Overview

14.1.2. Product Offerings

14.1.3. Financial Performance

14.1.4. Recent Initiatives

14.2. Antech Diagnostics, Inc. (Mars, Inc.)

14.2.1. Company Overview

14.2.2. Product Offerings

14.2.3. Financial Performance

14.2.4. Recent Initiatives

14.3. IDEXX

14.3.1. Company Overview

14.3.2. Product Offerings

14.3.3. Financial Performance

14.3.4. Recent Initiatives

14.4. Neogen Corporation

14.4.1. Company Overview

14.4.2. Product Offerings

14.4.3. Financial Performance

14.4.4. Recent Initiatives

14.5. The Animal Medical Center

14.5.1. Company Overview

14.5.2. Product Offerings

14.5.3. Financial Performance

14.5.4. Recent Initiatives

14.6. Embark Veterinary, Inc.

14.6.1. Company Overview

14.6.2. Product Offerings

14.6.3. Financial Performance

14.6.4. Recent Initiatives

14.7. SYNLAB

14.7.1. Company Overview

14.7.2. Product Offerings

14.7.3. Financial Performance

14.7.4. Recent Initiatives

14.8. NationWide Laboratories

14.8.1. Company Overview

14.8.2. Product Offerings

14.8.3. Financial Performance

14.8.4. Recent Initiatives

14.9. Ellie Diagnostics

14.9.1. Company Overview

14.9.2. Product Offerings

14.9.3. Financial Performance

14.9.4. Recent Initiatives

14.10. VETERINARY HEALTHCARE COMPANY (VETHC).

14.10.1. Company Overview

14.10.2. Product Offerings

14.10.3. Financial Performance

14.10.4. Recent Initiatives

Chapter 15. Research Methodology

15.1. Primary Research

15.2. Secondary Research

15.3. Assumptions

Chapter 16. Appendix

16.1. About Us

16.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others