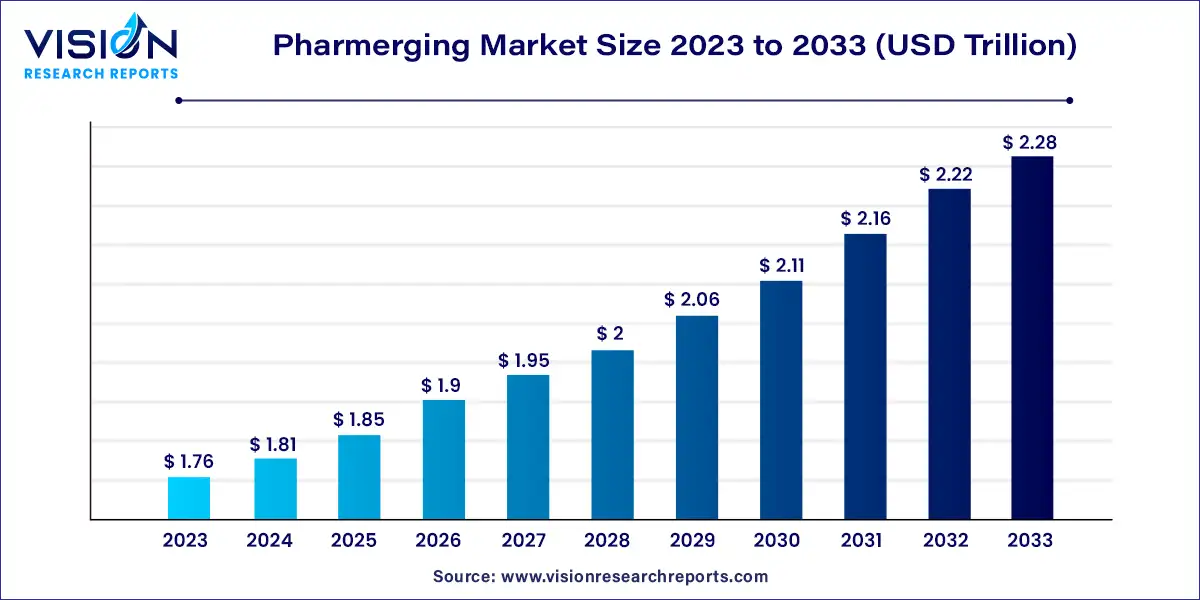

The global pharmerging market size was valued at USD 1.76 trillion in 2023 and it is predicted to surpass around USD 2.28 trillion by 2033 with a CAGR of 2.62% from 2024 to 2033. The pharmerging market represents a rapidly evolving sector within the global pharmaceutical industry, encompassing emerging markets that are witnessing significant growth in healthcare expenditure, drug consumption, and pharmaceutical innovation. This market is characterized by its potential for high returns due to expanding healthcare infrastructure, increasing prevalence of chronic diseases, and a growing middle-class population with rising disposable income.

The expansion of the pharmerging market is driven by an escalating healthcare investments in infrastructure and accessibility are pivotal, as governments and private entities in these regions prioritize improvements in medical facilities and services. This increased spending translates into better availability of pharmaceuticals and healthcare products. Second, the rising incidence of chronic diseases, such as diabetes and cardiovascular disorders, has amplified the demand for advanced medical treatments and pharmaceuticals. This trend underscores the need for more robust healthcare solutions. Additionally, the burgeoning middle class in pharmerging economies is playing a significant role, with higher disposable incomes enabling greater access to healthcare services and medications. Lastly, ongoing regulatory reforms and policy changes are facilitating smoother market entry for pharmaceutical companies, enhancing the overall business environment.

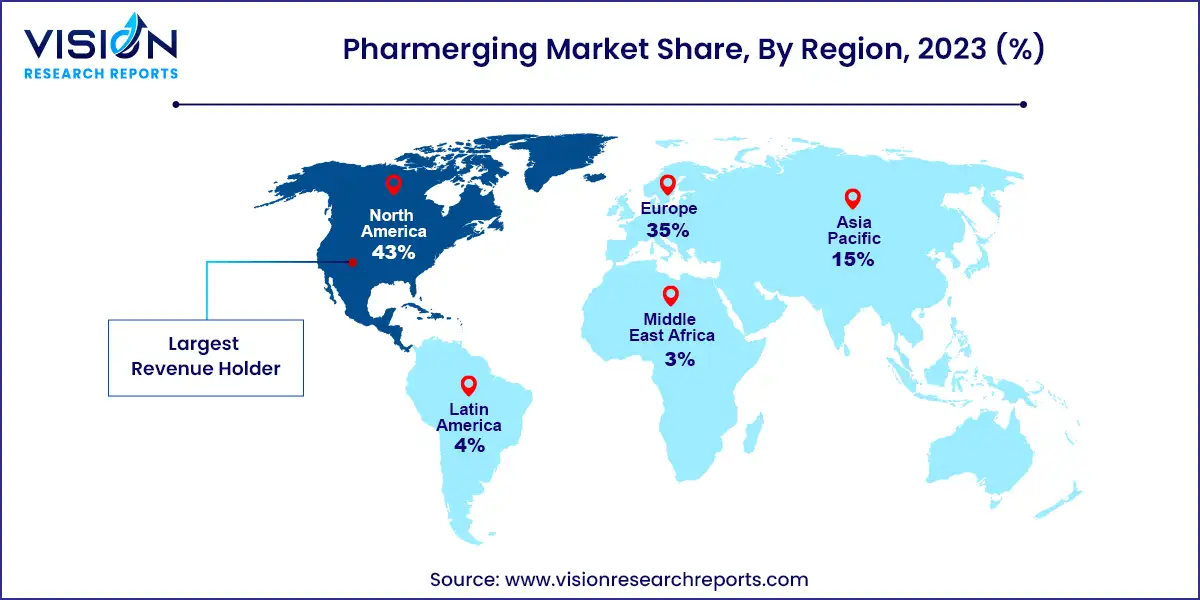

North America led the global pharmerging market with the largest revenue share of 43% in 2023. This growth is driven by increased healthcare spending and the expansion of private hospitals, which are advancing the development of the global healthcare market. The prevalence of chronic illnesses and heightened awareness of early disease detection and treatment methods further fuel market growth. The aging population in various countries, with its susceptibility to severe medical issues such as heart failure, dementia, and hypertension, is also driving demand for pharmaceuticals.

| Attribute | North America |

| Market Value | USD 0.75 Billion |

| Growth Rate | 2.63% CAGR |

| Projected Value | USD 0.98 Billion |

The pharmerging market in Europe is poised for substantial growth due to the rising prevalence of various diseases. This trend is leading to greater interest in advanced and effective treatment solutions, which is expected to drive significant market expansion in the near future.

The Asia Pacific pharmerging market is anticipated to grow at a CAGR of 4.13% over the forecast period. The region, having gained prominence in the pharmerging market, is now a focal point for the global pharmaceutical industry, driving advancements, innovation, and development in the healthcare sector.

The pharmaceutical product segment led the market, commanding a substantial revenue share of 86% in 2023. The growth in this segment is primarily driven by the increasing demand for generic prescription drugs, which are gaining traction due to their cost-effectiveness and the rise in healthcare expenditures in emerging regions. Additionally, the growing need for over-the-counter medications, generic prescriptions, and patented drugs globally is significantly contributing to this sector's expansion. The pharmaceutical industry remains a robust component of the healthcare sector in emerging economies, with the growth of the generic drug market anticipated to further boost its prominence.

Other healthcare verticals are projected to grow at a CAGR of 4.83% during the forecast period. This growth is fueled by the rising demand for diagnostic equipment, the increasing prevalence of chronic disorders, and government initiatives aimed at advancing the healthcare sector. The demand for medical imaging devices, the adoption of point-of-care treatments, and ongoing innovations by companies are also driving the market forward.

Tier-1 economies led the market, accounting for a dominant share of 61% in 2023. This growth is due to the increasing demand for affordable and innovative therapies, along with a heightened focus on medical devices for disease treatment and diagnosis. The healthcare market in Tier-1 economies, notably China, is significantly contributing to the global growth of the pharmerging market. Factors such as patent expirations, urbanization, and rising government investments in medical research are further solidifying the dominance of the Asia Pacific region, particularly China, in the pharmerging market.

Tier-2 economies are expected to grow at a CAGR of 4.33% during the forecast period. This tier includes Brazil, India, Russia, and South Africa. Brazil’s market is expanding due to its aging population, increased consumer awareness, and supportive government regulations. India’s market growth is driven by government initiatives, a substantial middle-class population, and increased healthcare spending.

Infectious diseases held the largest revenue share of 31% in 2023. This segment's growth is attributed to rapid advancements in healthcare infrastructure and the rising global prevalence of infectious diseases. The increasing incidence of conditions such as malaria, tuberculosis, and HIV is driving demand for vaccines and antivirals, thus propelling the segment's expansion.

Lifestyle diseases are projected to grow at a CAGR of 3.52% during the forecast period, driven by factors such as urbanization, sedentary lifestyles, unhealthy diets, and rising obesity rates. The increasing prevalence of non-communicable diseases like cancer, cardiovascular diseases, and diabetes significantly contributes to this market's growth. Additionally, the aging population and longer life expectancy in pharmerging countries are leading to a higher incidence of age-related lifestyle diseases.

1. India: The Rise of Generic Pharmaceuticals

Background: India has become a global hub for generic pharmaceuticals, with a significant share of the global market for generic drugs. The country's pharmaceutical industry has grown rapidly due to its cost-effective production capabilities and a strong emphasis on research and development (R&D).

Case Study: Sun Pharma’s Expansion Strategy

2. China: The Growth of Innovative Drug Development

Background: China’s pharmaceutical market is growing rapidly, with increasing investment in drug development and a push towards innovation. The Chinese government has implemented policies to encourage R&D and the development of new drugs.

Case Study: Innovent Biologics’ Path to Success

By Product

By Economy

By Indication

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Product Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Pharmerging Market

5.1. COVID-19 Landscape: Pharmerging Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Pharmerging Market, By Product

8.1. Pharmerging Market, by Product, 2024-2033

8.1.1 Pharmaceutical

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Other Healthcare Verticals

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Pharmerging Market, By Economy

9.1. Pharmerging Market, by Economy, 2024-2033

9.1.1. Tier-1

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Tier-2

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Tier-3

9.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Pharmerging Market, By Indication

10.1. Pharmerging Market, by Indication, 2024-2033

10.1.1. Lifestyle Diseases

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Cancer & Autoimmune Diseases

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Infectious Diseases

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Others

10.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Pharmerging Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Product (2021-2033)

11.1.2. Market Revenue and Forecast, by Economy (2021-2033)

11.1.3. Market Revenue and Forecast, by Indication (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Economy (2021-2033)

11.1.4.3. Market Revenue and Forecast, by Indication (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Economy (2021-2033)

11.1.5.3. Market Revenue and Forecast, by Indication (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.2. Market Revenue and Forecast, by Economy (2021-2033)

11.2.3. Market Revenue and Forecast, by Indication (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Economy (2021-2033)

11.2.4.3. Market Revenue and Forecast, by Indication (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Economy (2021-2033)

11.2.5.3. Market Revenue and Forecast, by Indication (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Economy (2021-2033)

11.2.6.3. Market Revenue and Forecast, by Indication (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Economy (2021-2033)

11.2.7.3. Market Revenue and Forecast, by Indication (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.2. Market Revenue and Forecast, by Economy (2021-2033)

11.3.3. Market Revenue and Forecast, by Indication (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Economy (2021-2033)

11.3.4.3. Market Revenue and Forecast, by Indication (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Economy (2021-2033)

11.3.5.3. Market Revenue and Forecast, by Indication (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Economy (2021-2033)

11.3.6.3. Market Revenue and Forecast, by Indication (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Economy (2021-2033)

11.3.7.3. Market Revenue and Forecast, by Indication (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.2. Market Revenue and Forecast, by Economy (2021-2033)

11.4.3. Market Revenue and Forecast, by Indication (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Economy (2021-2033)

11.4.4.3. Market Revenue and Forecast, by Indication (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Economy (2021-2033)

11.4.5.3. Market Revenue and Forecast, by Indication (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Economy (2021-2033)

11.4.6.3. Market Revenue and Forecast, by Indication (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Economy (2021-2033)

11.4.7.3. Market Revenue and Forecast, by Indication (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.5.2. Market Revenue and Forecast, by Economy (2021-2033)

11.5.3. Market Revenue and Forecast, by Indication (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Economy (2021-2033)

11.5.4.3. Market Revenue and Forecast, by Indication (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Economy (2021-2033)

11.5.5.3. Market Revenue and Forecast, by Indication (2021-2033)

Chapter 12. Company Profiles

12.1. Sanofi.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Pfizer Inc.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. AstraZeneca.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. GlaxoSmithKline

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. F. Hoffmann-La Roche Ltd.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. GE Healthcare

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Eli Lilly and Company.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Medtronic

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Abbott.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Johnson and Johnson

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others