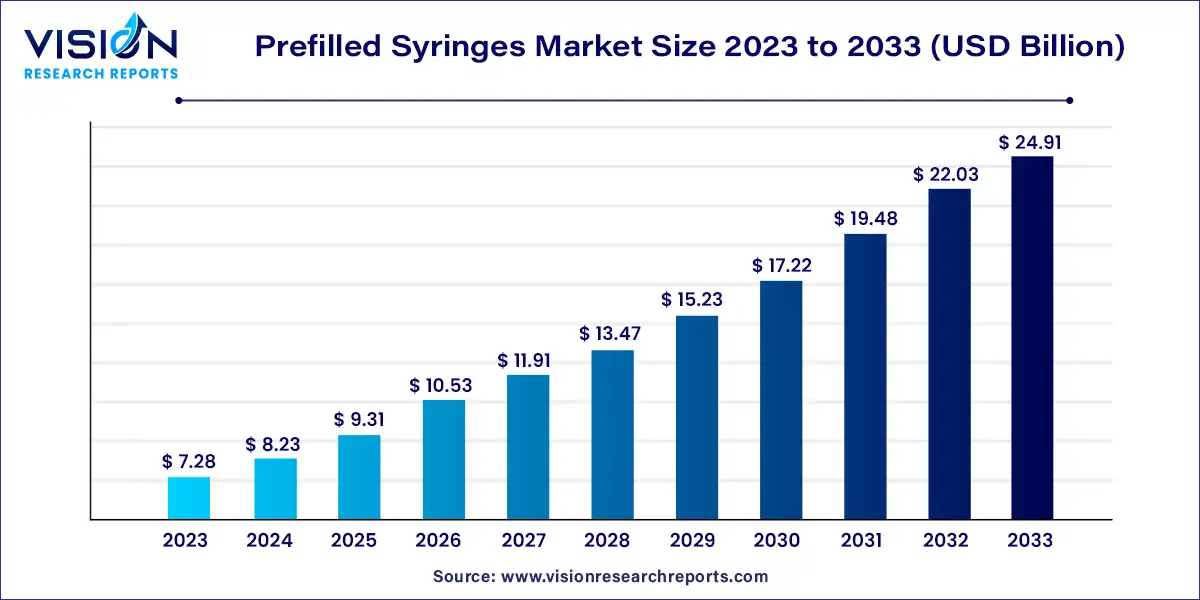

The global prefilled syringes market size was valued at USD 7.28 billion in 2023 and it is predicted to surpass around USD 24.91 billion by 2033 with a CAGR of 13.09% from 2024 to 2033. Prefilled syringes have become a crucial component in the pharmaceutical and healthcare industries, offering significant advantages in terms of ease of use, dosage accuracy, and patient compliance. This market has witnessed substantial growth due to the increasing demand for self-administration of medications, the rise in chronic diseases, and advancements in pharmaceutical technologies.

The growth of the prefilled syringes market is significantly influenced by an increasing prevalence of chronic diseases such as diabetes, rheumatoid arthritis, and multiple sclerosis has created a heightened demand for convenient and reliable drug delivery systems. Prefilled syringes facilitate easier self-administration, which enhances patient compliance and simplifies the management of these conditions. Secondly, advancements in syringe technology, including improved safety features and drug compatibility, are driving market expansion. Innovations such as integrated needle safety mechanisms and enhanced drug stability ensure more accurate dosing and minimize the risk of contamination or needle-stick injuries. Additionally, the rising adoption of biologics, which often require injectable delivery, further boosts the demand for prefilled syringes. These syringes are particularly suited for biologics due to their ability to maintain drug integrity and deliver precise dosages.

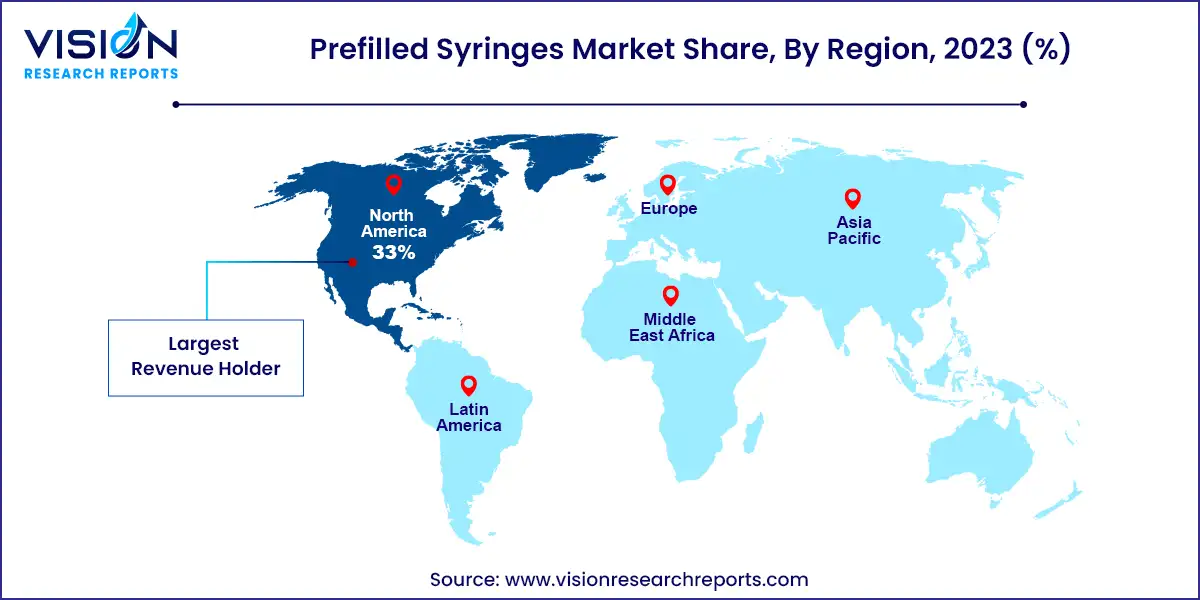

The prefilled syringes market in North America held a 33% share in 2023. The region prioritizes preventing needlestick injuries among healthcare professionals, and prefilled syringes with needle guards are increasingly used to address this concern. The CDC recommends prefilled syringes for vaccine administration due to their ability to preserve vaccine potency and save time, contributing to market growth.

| Attribute | North America |

| Market Value | USD 2.40 Billion |

| Growth Rate | 13.09% CAGR |

| Projected Value | USD 8.22 Billion |

Europe dominates the global prefilled syringes market, driven by the preference for prefilled injectable devices to reduce needle-related injuries. Government initiatives and prominent market players in the region are fostering the use of single-use medical goods, which is expected to boost market growth.

The Asia-Pacific market is set for significant expansion due to the presence of numerous FDA, TGA, and EMA-approved facilities. The region's developing economy and large, growing population, coupled with an increasing incidence of chronic conditions, are expected to drive market growth.

The Latin American prefilled syringes market is experiencing notable growth, fueled by the rising prevalence of chronic diseases like diabetes and rheumatoid arthritis. The aging population, advancements in technology, and expanding biopharmaceuticals sector are further driving demand.

The disposable segment dominated the market with a 92% share in 2023 and is projected to experience the highest growth rate over the forecast period. The increasing trend towards self-injection has heightened the need for safety, which disposable syringes address effectively. These syringes reduce the risk of cross-contamination by allowing for the immediate disposal of needles post-use. They are essential in both diagnostic and therapeutic applications for chronic diseases, which drives their growing demand. For instance, in June 2021, Hindustan Syringes and Medical Devices Ltd. partnered with Star Syringes of the UK to introduce disposable safety needles under the Disposjekt Needle brand, aimed at enhancing safety against sharps injuries.

The reusable segment also held a notable market share in 2023. Reusable syringes with disposable tips can be utilized multiple times, offering cost savings and potentially reducing infection risks when proper safety protocols are observed. For example, replacing auto-injectors with weekly reusable syringes can cut production needs by up to 200 units annually. According to the U.S. FDA, prefilled syringes with disposable tips, such as those used for dental applications, are commonly employed, with the tips discarded after each use while the dispensers are reused.

The hospitals segment led the market with a 52% share in 2023. Hospitals are favored for their accessibility and trusted reputation, making them a primary setting for fluid therapies and injections. The CDC estimates that safety measures like prefilled syringes can reduce sharps-related injuries by 60-88%, highlighting their role in enhancing hospital safety protocols.

The mail order pharmacies segment is anticipated to grow the fastest over the forecast period. These pharmacies offer the convenience of direct medication delivery to patients' homes, which is particularly beneficial for those needing regular injections with prefilled syringes. Mail order pharmacies also provide competitive medication pricing, potentially lowering overall healthcare costs, which is attractive for patients with chronic conditions requiring ongoing treatment.

The glass segment accounted for the largest share of 52% in 2023. Glass provides an effective barrier against moisture, oxygen, and light, essential for maintaining medication stability and preventing degradation. Although some plastics also offer good barrier properties, they may not be as effective as glass for certain drugs. Glass syringes also offer excellent clarity, which allows healthcare providers to easily monitor the medication inside.

The plastic segment held a significant market share in 2023 due to its cost-effectiveness compared to glass. Plastic syringes are more affordable to produce, making them accessible in various healthcare settings, especially in emerging markets. Plastic also allows for greater design flexibility, enabling the creation of innovative features like multi-chamber syringes or integrated needle guards, which enhance functionality and safety. These advantages are expected to drive the demand for plastic prefilled syringes.

The vaccines and immunizations segment held the largest share of 26% in 2023. Prefilled syringes are ideal for vaccines, which often require multiple doses over time. They eliminate the need for drawing medication from vials, reducing errors and contamination risks. Prefilled syringes are also easier for patients to use compared to traditional vials, which improves compliance and supports successful vaccination programs. They can be pre-measured and labeled, facilitating easier self-administration at home.

The oncology segment is projected to grow at the fastest rate over the forecast period. Prefilled syringes offer significant benefits for oncology patients undergoing frequent injections, such as those in chemotherapy. They provide easier transport and self-administration compared to traditional vials and syringes, improving patient comfort and independence. Technological advancements, such as multi-chamber syringes, are enhancing the delivery of combination therapies used in cancer treatments, offering greater flexibility and convenience.

By Type

By Material

By Application

By Distribution Channel

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others